Global Robotic Medical Imaging Market Trends

- Telemedicine and remote imaging: Integration of robotic medical imaging with telemedicine has gained momentum, thus enabling remote access to imaging data and consultations. This trend facilitates remote diagnostics, expert consultations, and real-time monitoring, especially in underserved or remote areas, thereby improving healthcare accessibility and patient outcomes. For example, the U.S. Bureau of Labor Statistics reported, that in 2021, 32% of rural Americans did not have reliable broadband internet access, which impacts their ability to utilize telehealth solutions. However, robotic imaging systems with integrated telemedicine functions can still perform scans remotely and send the images to radiologists for interpretation through existing connectivity methods. As a result of these benefits, experts anticipate strong growth in the tele-robotic medical imaging segment in the near future. According to projections by the Healthcare Information and Management Systems Society, the U.S. telehealth market is expected to grow over 40% annually between 2018-2025. A large portion of this growth will be driven by robotic solutions that support remote care delivery through imaging. Leading manufacturers are heavily investing in technologies that combine robotic, AI, and telemedicine capabilities. This convergence of innovations will change how healthcare is accessed globally, supporting both patients and providers through digital connected care.

- Personalized medicine and precision imaging: There is a growing trend toward personalized medicine, where robotic medical imaging plays a crucial role. Tailoring treatments based on individual patient data, including genetic information and precise imaging diagnostics, is becoming increasingly prevalent. This trend emphasizes the importance of customizing healthcare solutions for better patient outcomes. According to the data provided by the American Association for Clinical Chemistry, between 2020-2025, over 80% of U.S. hospitals adopted new precision imaging machines to support their personalized healthcare programs. Simultaneously, prestigious cancer institutes like MD Anderson Cancer Center have reported correlations between acquiring cutting-edge whole-body robotic Positron emission tomography (PET)/ Computed Tomography (CT) scanners and improved survival rates for several complex cancer cases that is benefited from customized treatments that are planned by using advanced images. This clearly displays how precision imaging is translating to better patient outcomes and driving expanded uptake of new robotic technology.

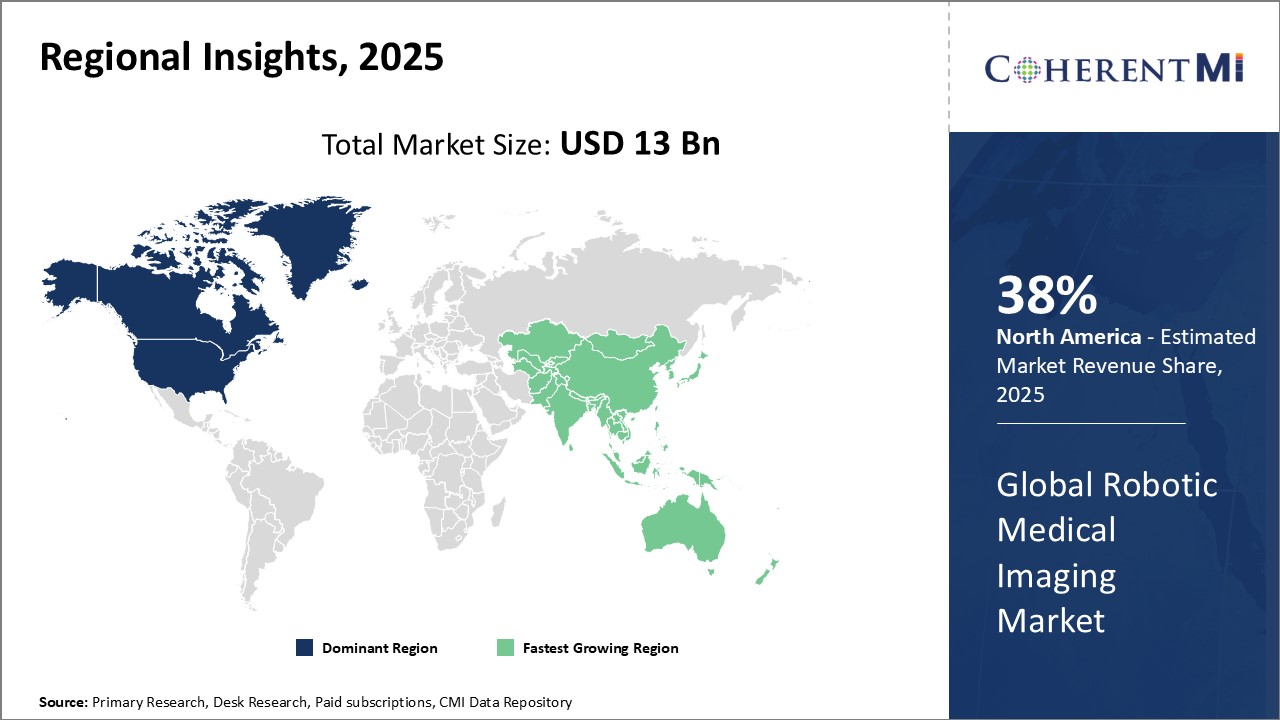

Global Robotic Medical Imaging Market Regional Insights:

- North America is expected to be the largest market for robotic medical imaging market during the forecast period, accounting for over 38% of the market share in 2025. The market growth in North America is due to the high adoption of advanced robotic surgical systems, increasing number of product approvals, and rising patient preference for minimally invasive surgeries in the region.

- The Europe market is expected to be the second-largest market for robotic medical imaging market, accounting for over 27% of the market share in 2025. The market growth of the market in Europe is due to the rising cases of chronic disorders, presence of major companies, and increasing funding for medical robotics research in the region.

- The Asia Pacific market is expected to be the fastest-growing market for robotic medical imaging market, with a CAGR of over 19% during the forecast period. The market growth in Asia Pacific is due to the improving healthcare infrastructure, rising disposable incomes, and growing awareness about advanced surgical treatments in the region.