Global Sacroiliac Joint Fusion Market Trends

- Increasing adoption of minimally invasive procedures: Patients and surgeons today demonstrate a strong preference for minimally invasive techniques for most spine procedures including SI joint fusion. The incisions required are extremely small, usually 2 cm or less. This reduces intraoperative bleeding, postoperative pain, and quicker recovery compared to open surgery. Robotic navigation further enhances the safety and precision of these procedures. Minimally invasive surgery (MIS) techniques are fast becoming the standard of care, fueling innovations in specialized implants and instrument sets.

- Growing number of ambulatory surgical procedures: Complex spine procedures like SI joint fusion which traditionally required hospitalization are increasingly being performed in outpatient ambulatory centers. This allows for same-day discharges, lowering costs and risks of hospital-acquired infections. Device manufacturers are aligning portfolios and distribution channels to tap into the steady rise in outpatient spine surgery volumes, especially across developed regions.

- Increasing industry consolidation through M&As: The sacroiliac joint fusion market is witnessing a wave of consolidations as large medical device players acquire smaller developers of novel implants and navigation technologies. Acquisitions provide access to innovative products while also removing competition. For instance, Stryker's 2021 acquisition of Vocera Communications a medtech company strengthened the digital and Artificial Intelligence (AI) capabilities for its pain management solutions.

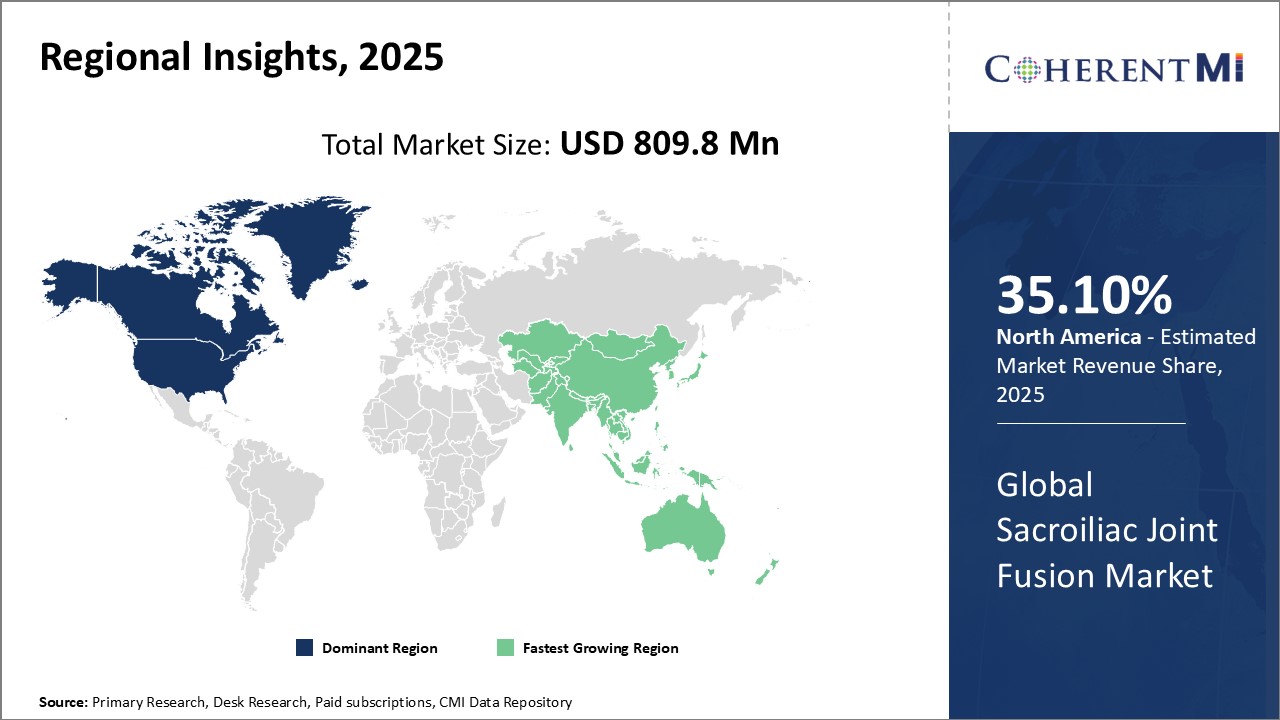

Global Sacroiliac Joint Fusion Market Regional Insights:

- North America is expected to be the largest market for sacroiliac joint fusion during the forecast period, which accounted for over 35.1% of the market share in 2025. The growth of the market in North America is attributed to the high incidence of lower back pain, favorable reimbursement policies, and continuous product approvals by regulatory authority. For instance, on March 29, 2025, CoreLink, LLC, a leading designer and manufacturer of innovative spinal implant systems, received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its Siber Ti Sacroiliac Joint Fusion System.

- Europe is expected to be the second-largest market for sacroiliac joint fusion, which accounted for over 26% of the market share in 2025. The growth of the market in Europe is attributed to the rising geriatric population and investments in healthcare infrastructure.

- Asia Pacific is expected to be the fastest-growing market for sacroiliac joint fusion, which is anticipated to grow at a CAGR of over 12% during the forecast period. The growth of the market in Asia Pacific is attributed to the improving healthcare expenditure and growing awareness about SI joint fusion procedures.