The herpes labialis market is estimated to be valued at USD 2.76 Bn in 2025 and is expected to reach USD 3.99 Bn by 2032, growing at a compound annual growth rate (CAGR) of 5.4% from 2025 to 2032. Demand for advanced treatment options and antiviral drugs for cold sores is expected to increase significantly. Rising awareness regarding available treatment options and increasing spending on oral health are some key factors expected to drive market growth.

Market Size in USD Bn

CAGR5.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.4% |

| Market Concentration | High |

| Major Players | GlaxoSmithKline plc, Novartis International AG, Pfizer Inc., Abbott Laboratories, Teva Pharmaceutical Industries Ltd. and Among Others |

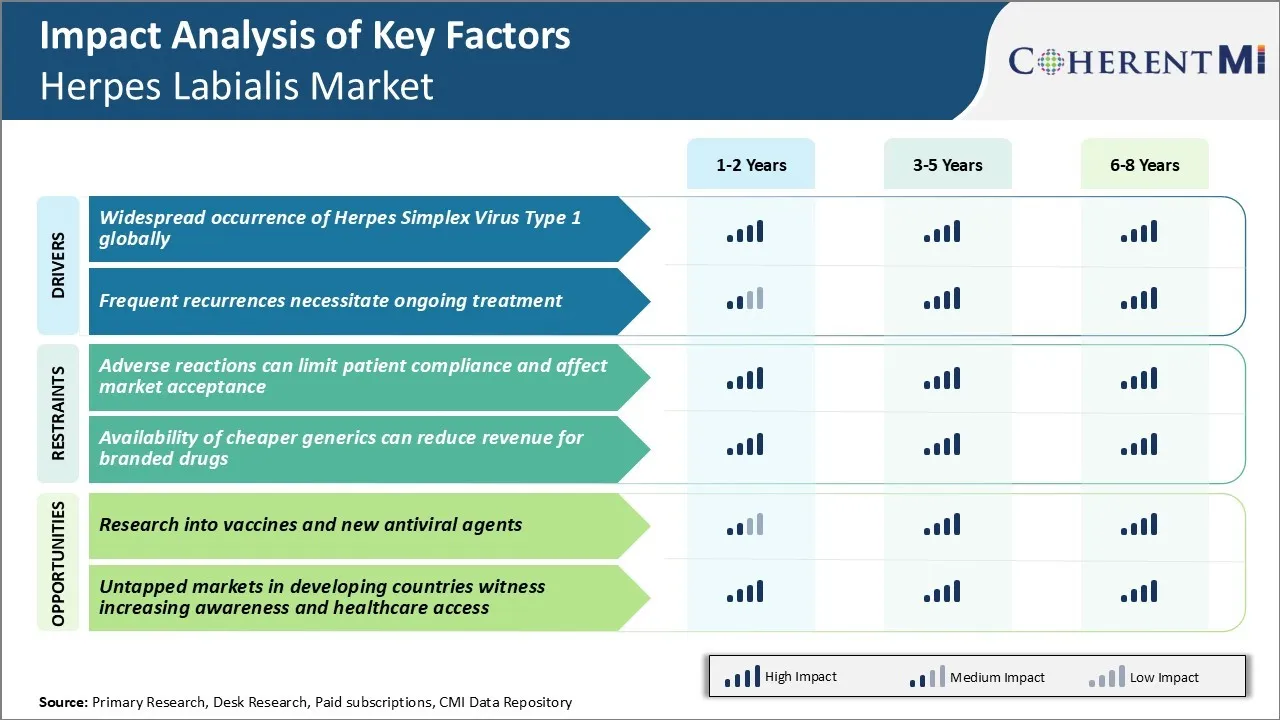

Market Driver - Widespread Occurrence of Herpes Simplex Virus Type 1 Globally

Herpes simplex virus type 1 is among the most prevalent viruses globally. As per estimates, over 3.7 billion people under the age of 50 carry this virus. The widespread occurrence of HSV-1 makes it one of the most frequent causes of infectious diseases. Countries like the United States report that over 50% of the population is affected by this virus by adulthood.

Available statistics indicate that approximately 400,000 people in the US get a new HSV-1 infection every year. With growing populations and increasing globalization, containing the spread becomes challenging. Moreover, the virus has the ability to remain dormant in nerve tissues for life after the initial infection. This stealthy behavior further exacerbates the public health challenge.

The high global footprint of HSV-1 makes it unlikely that complete control over transmission can be established anytime soon, if at all. For individuals experiencing visible signs of the disease, treating outbreaks assumes significance. Pharmaceutical interventions play a crucial role here by providing symptomatic relief. They work to shorten the duration and intensity of lesions, thus preventing complications and restoring normalcy.

As societies learn to adapt to the virus's omnipresence, demand for such therapies seems poised to remain steady for the foreseeable future.

Market Driver – Frequent Recurrences Necessitate Ongoing Treatment

HSV-1 has the tendency to reactivate intermittently after the primary infection subsides. While periods of dormancy may extend from months to years, triggers like sun exposure, fever, stress, and compromised immunity can spark recurrences. During such episodes, the virus travels down nerve fibers to affected areas like the lips, causing debilitating sores.

Recurrences tend to be particularly common during initial years after acquisition of the virus. As immune responses enhance with time, their frequency may decline but not fully cease. Women and individuals under higher stress are also reported to experience more frequent outbreaks on average. Even in later life stages, external or internal provocations continue reawakening the virus periodically.

Frequent as well as unpredictable recurrences imply the need for continuous disease management versus time-bound treatment of isolated episodes. Pharmaceutical options play a big role here by suppressing clinical manifestation as well as reducing contagiousness during symptomatic periods. Adherence to daily suppressive regimens minimizes recurrence risk by maintaining antiviral serum levels. As HSV-1 keeps affecting millions on an involuntary repetitive basis, demand for suppressive cures stays steady. Accessible solutions have long-term value for individuals as well as public health goals.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Adverse Reactions Can Limit Patient Compliance and Affect Market Acceptance

One of the major challenges faced in the herpes labialis market is the adverse reactions associated with the existing treatment options which can negatively impact patient compliance and the overall market potential. Currently, oral antivirals are the primary treatment prescribed for herpes labialis episodes.

However, these drugs often cause mild to moderate side effects such as nausea, vomiting, headache and fatigue in many patients. These adverse reactions contribute to poor treatment adherence among patients. Non-compliance to the prescribed antiviral regimens can reduce the effectiveness of the treatment and increase the risk of recurrence of lesions.

The occurrence of adverse reactions also negatively impacts the patient experience and satisfaction with the available treatment options. This gives rise to a perception that the existing therapies are unsafe and inconvenient to use. As a result, many patients tend to prefer non-prescription options or alternative therapies to avoid the risks of side effects from antiviral drugs. This non-adherence and lower uptake of prescription medications pose challenges for pharmaceutical companies to maximize revenues from this market.

Market Opportunity - Research into Vaccines and New Antiviral Agents

One of the major opportunities in the herpes labialis market lies in continued research into development of vaccines and new classes of antiviral agents. There is currently no vaccine available against HSV-1 infection which is the primary cause of recurrent oral herpes outbreaks.

Significant efforts are ongoing to develop a therapeutic vaccine which can boost the body's immune system to control the viral latency and frequency of reactivations over the long term. Success in vaccines can potentially alter the treatment landscape and paradigm completely by offering long lasting protection against the virus. Several pharmaceutical companies are also actively investigating novel antiviral compounds targeting different stages of the viral life cycle compared to existing drugs.

Newer agents with improved efficacy, safety profiles and convenient dosage forms can help address the current limitations and increase treatment uptake. This presents a multi-billion-dollar commercial opportunity for the first company to receive regulatory approvals for effective and well-tolerated prophylactic or therapeutic options for herpes labialis.

Herpes labialis, commonly known as cold sores, is generally treated based on the stage of infection. In the prodrome stage, characterized by tingling or itching sensation, antiviral drugs are prescribed to prevent onset of lesions. Acyclovir (Zovirax) and valacyclovir (Valtrex) are often recommended oral medications at this stage.

Once lesions appear in the lesion formation stage, topical antivirals are preferred. Prescribers commonly suggest penciclovir cream (Denavir) or docosanol cream (Abreva) to be applied at first signs of lesions. For more severe cases, oral antivirals like famciclovir (Famvir) pills are prescribed.

As lesions ulcerate in the ulcerative stage, pain becomes the dominant symptom. Topical anesthetics containing lidocaine like Lidaline gel help provide relief. Once lesions start healing in the crusting stage, moisturizing creams like Eucerin help expedite the process.

Recurrent infections require long-term suppressive therapy. Valacyclovir is a preferred choice due to its favorable efficacy and safety profile. Additionally, stress management and avoiding triggers can help control frequency of outbreaks.

Price of medication also influences prescribers, with generics of oral antivirals like acyclovir preferred over brands for cost-conscious patients. Overall, treatment approach is tailored based on individual factors like severity and recurrence rate.

Herpes labialis, commonly known as cold sores, has four stages - prodrome, erythema, vesicle, and crusting. The prodrome stage involves tingling or itching sensation around the lips.

Erythema occurs next with redness and swelling of the affected area. Small fluid-filled blisters or vesicles then form, which is the third stage. In the final crusting stage, the blisters burst and form scabs that eventually dry out and fall off.

For the prodrome stage, topical antiviral creams containing drugs like acyclovir or penciclovir are generally prescribed. Starting the medication at this early stage can help suppress viral replication and shorten duration of the outbreak.

Once visible lesions appear in the erythema and vesicle stages, oral antiviral medications like valacyclovir provide effective treatment.

For severe or frequent recurring outbreaks, oral antiviral suppressive therapy with acyclovir or valacyclovir is recommended. Suppressive doses are taken daily to reduce recurrence rate. This offers maximum suppression of viral shedding and helps prevent future outbreaks.

In immunosuppressed patients or severe infections, intravenous antiviral drugs like acyclovir may be administered for faster relief.

Focus on innovative drug development:

A major strategy adopted by leading pharmaceutical companies like GSK and Teva has been to invest heavily in R&D to develop novel and innovative drug therapies for herpes labialis (cold sores). For example, in 2014 GSK launched Abreva (docosanol), the first FDA approved topical cream designed to specifically treat cold sores. Abreva works by interrupting the viral envelope, preventing the virus from infecting healthy cells.

Target undiscovered consumer segments:

Another strategy adopted by emerging companies like Squarex and Fisiopharma has been to identify and target consumer segments that were previously overlooked by major players. For example, Squarex developed Lipovar in 2008, a herpes treatment aimed specifically at teenagers and young adults.

Leverage e-commerce and DTC marketing:

As herpes labialis is a highly stigmatized condition, companies that have adopted a strong direct-to-consumer approach through effective e-commerce and digital marketing strategies have seen rewards. For example, when Teva launched Acyclovir cold sore cream in 2012 with an accompanying DTC campaign targeting those "in the know" about cold sores, it drove a big spike in online sales. The discreet messaging and convenience of online purchasing helped remove barriers for consumers and grow market share for Teva.

To learn more about this report, Download Free Sample Copy

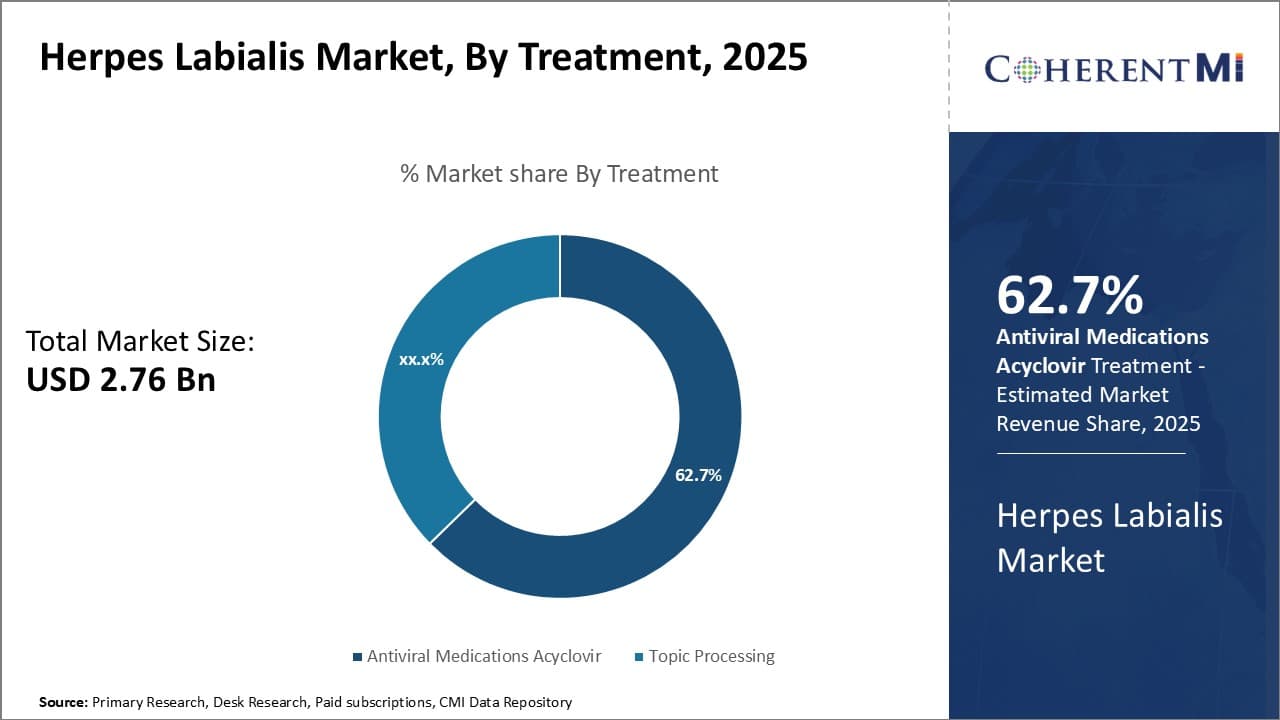

Insights, By Treatment: Patient Compliance Drives Antiviral Medications Domination

To learn more about this report, Download Free Sample Copy

Insights, By Treatment: Patient Compliance Drives Antiviral Medications Domination

In terms of treatment, antiviral medications are estimated to account for 62.7% revenue share of the market in 2025, owning to higher patient compliance with oral antiviral drugs. Antiviral medications like Acyclovir, Valacyclovir, and Famciclovir offer convenient once or twice daily oral dosing compared to topical creams which need to be applied multiple times a day.

The oral route of administration ensures better adherence to the prescribed treatment duration compared to frequent application of topical drugs. This leads to more effective control of herpes labialis outbreaks and recurrence through adequate drug levels in the body.

Among antiviral medications, Acyclovir has been the mainstay of oral therapy due to its good safety and efficacy profile. However, its short half-life requiring frequent dosing poses compliance issues for some patients. Newer antivirals like Valacyclovir and Famciclovir offer several advantages through their prodrug formulations that enhance bioavailability and allow once daily dosing. This leads to simpler dosing schedules and higher patient satisfaction, driving their uptake.

While topical drugs offer localized treatment with minimal systemic exposure, their hassle of multiple applications per day poses adherence challenges impacting treatment effectiveness. Therefore, the oral route of Antiviral Medications ensures better management of herpes outbreaks through compliance, accounting for its large market share.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

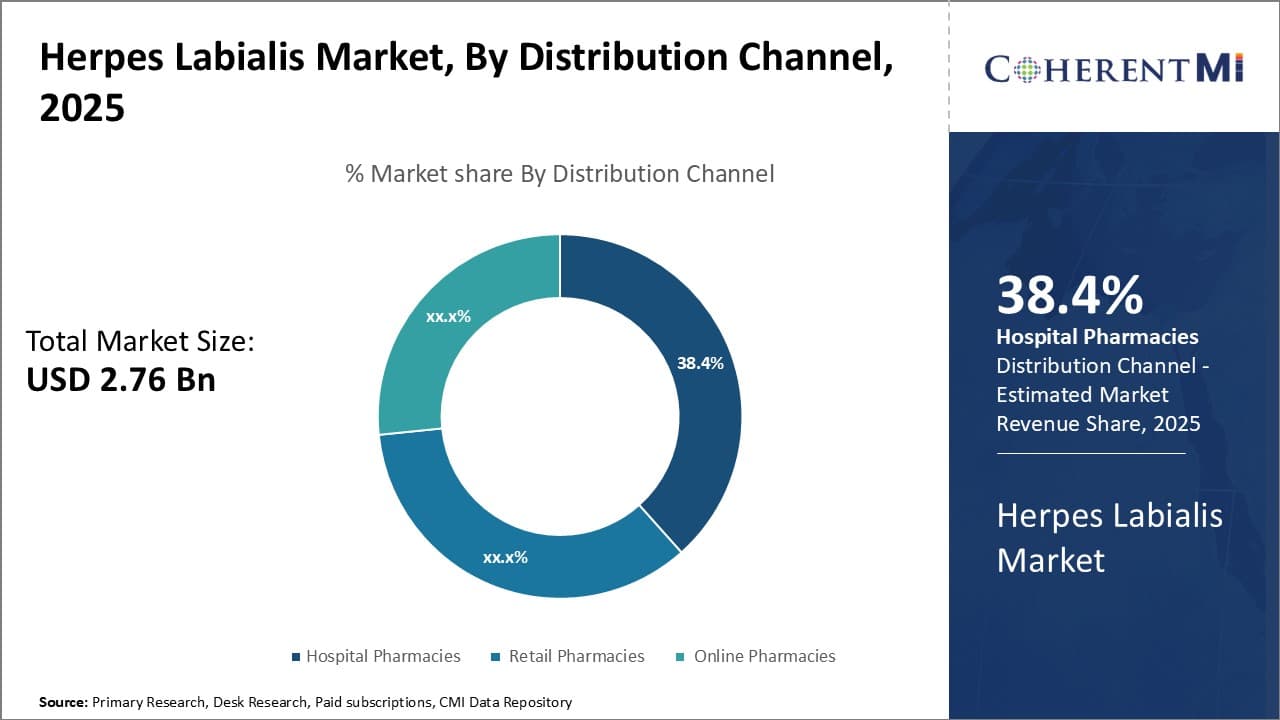

Insights, By Distribution Channel: Accessibility Augments Hospital Pharmacies Dominance

In terms of distribution channel, hospital pharmacies are projected to hold 38.4% share of the market in 2025, owing to greater accessibility for patients. Hospital pharmacies offer convenience of getting herpes labialis medications during medical consultations or hospital admissions whenever outbreaks occur. This is beneficial especially for severe or recurrent cases requiring medical management and close monitoring.

Although more expensive than other channels, hospital pharmacies provide assured drug availability at any time without requiring foresight of ordering medicines in advance. Certain antiviral drugs may also be available only through hospital pharmacies depending on regional regulations.

While retail pharmacies offer lower costs and over-the-counter access without prescriptions, their dependence on walk-in patients limits round-the-clock access compared to 24/7 hospital settings. Online pharmacies provide convenience of home delivery but require foresight of ordering medicines in advance. This poses issues during unexpected outbreaks when same-day medical access and treatment are priority.

Additionally, internet connectivity and delivery logistics remain inconsistent globally compared to ubiquitous physical retail shops. Therefore, the round-the-clock accessibility of symptomatic treatment drives hospital pharmacies as the prominent distribution channel for herpes labialis management.

Insights, By Application: Differing Immune States Augment Patient Segmentation

In terms of application, immunocompromised patients account for faster growing market share due to their vulnerability. Immunocompromised patients undergoing transplantation, cancer chemotherapy or living with HIV/AIDS have weaker immune defenses placing them at elevated risk of more frequent and severe herpes outbreaks.

While immunocompetent patients can manage intermittent usual outbreaks with short term self-care, immunocompromised cases usually require long-term antiviral prophylaxis or episodic therapy under close medical supervision. Disease progression also needs monitoring for early identification of complications like eczema herpeticum, which though rare can be devastating.

This constant medical intervention necessitates reliable long-term provision of antiviral supplies and management of adherence. Additionally, certain drugs may only be indicatedsafe for use under specialist guidance in immunocompromised groups. Therefore, the differences in herpes presentation and treatment approach based on varying immune competence levels segments the market into distinct groups with diverging needs - driving greater focus on the higher care requirements of immunocompromised patients.

The major players operating in the herpes labialis market include GlaxoSmithKline plc, Novartis International AG, Pfizer Inc., Abbott Laboratories, and Teva Pharmaceutical Industries Ltd.

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Herpes Labialis Market is segmented By Treatment (Antiviral Medications (Acyclovir, Valacyclovir, Fa...

Herpes Labialis Market

How big is the herpes labialis market?

The herpes labialis market is estimated to be valued at USD 2.76 Bn in 2025 and is expected to reach USD 3.99 Bn by 2032.

What are the key factors hampering the growth of the herpes labialis market?

The adverse reactions can limit patient compliance and affect market acceptance. Furthermore, availability of cheaper generics can reduce revenue for branded drugs. These are the major factors hampering the growth of the herpes labialis market.

What are the major factors driving the herpes labialis market growth?

The widespread occurrence of herpes simplex virus type 1 globally and frequent recurrences, which necessitate ongoing treatment, are the major factors driving the herpes labialis market.

Which is the leading treatment in the herpes labialis market?

The leading treatment segment is antiviral medications.

Which are the major players operating in the herpes labialis market?

GlaxoSmithKline plc, Novartis International AG, Pfizer Inc., Abbott Laboratories, and Teva Pharmaceutical Industries Ltd. are the major players.

What will be the CAGR of the herpes labialis market?

The CAGR of the herpes labialis market is projected to be 5.4% from 2025-2032.