Hidradenitis Suppurativa Market Size - Analysis

The hidradenitis suppurativa market is estimated to be valued at USD 883.0 Mn in 2025 and is expected to reach USD 1570.4 Mn by 2032, growing at a compound annual growth rate (CAGR) of 10.3% from 2025 to 2032. With increasing awareness about the disease and its treatment options, more patients are seeking medical help. Furthermore, recent pipeline drugs and combination therapies are expected to drive the market during the forecast period.

Market Size in USD Mn

CAGR10.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 10.3% |

| Market Concentration | Medium |

| Major Players | AbbVie Inc., Pfizer Inc., Novartis International AG, UCB Pharma, Eli Lilly and Company and Among Others |

please let us know !

Hidradenitis Suppurativa Market Trends

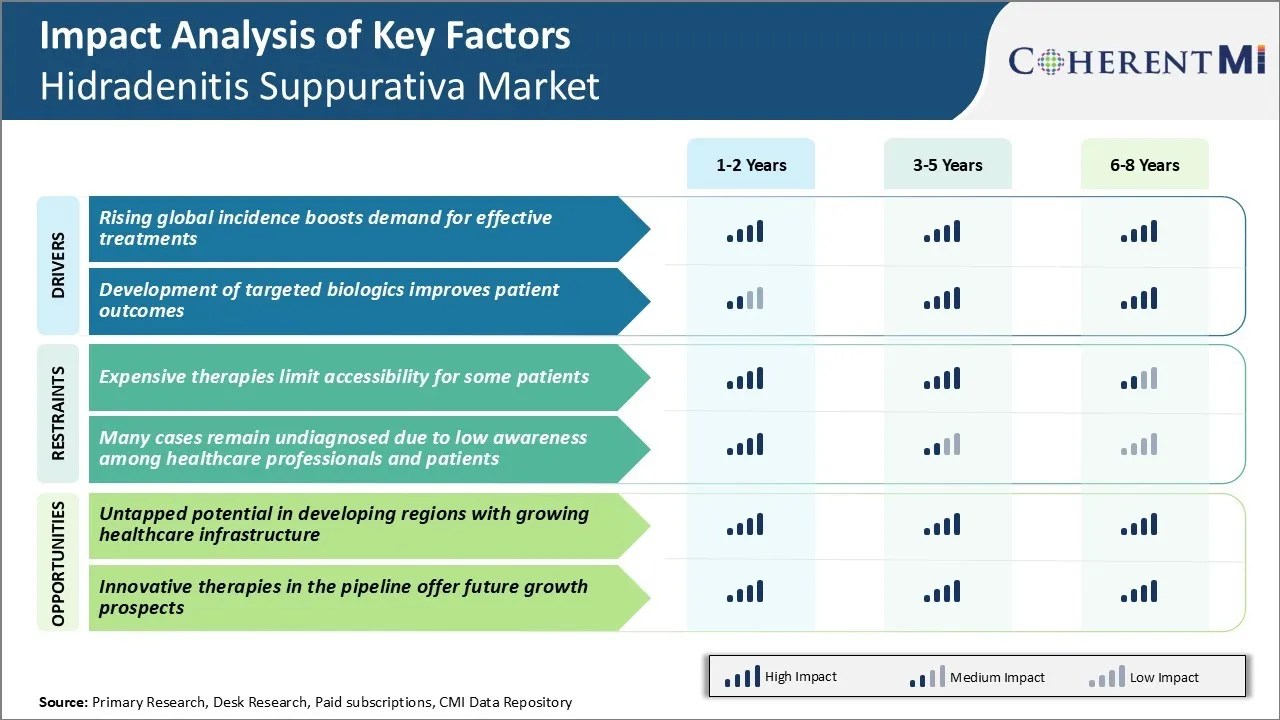

Market Driver - Rising Global Incidence Boosts Demand for Effective Treatments

The worldwide incidence of hidradenitis suppurativa has been steadily increasing over the past few decades. According to dermatologists, about 1-4% of the general population suffers from some form of hidradenitis suppurativa. But only a fraction of them have so far received an accurate diagnosis and treatment. With lifestyle changes making people prone to obesity and smokers at higher risk, the occurrence of HS is bound to increase manifold in the coming years.

Access to better screening and diagnostic techniques will facilitate identification of a greater number of positive cases. As greater clinical awareness translates to earlier interventions, patients can get timely management which can help control progression of the disease. At the same time, insurance coverage for HS therapies is also broadening in many countries.

All these factors cumulatively point towards a growing demand for effective treatment options that can alleviate symptoms and improve quality of life. Pharmaceutical companies and drug developers are responding to this need by committing more investments into innovative research projects. This rising global incidence of HS will continue serving as a major driver for the market in the foreseeable future.

Market Driver - Development of Targeted Biologics Improves Patient Outcomes

Treatment of hidradenitis suppurativa has been a huge challenge for long owing to limited understanding of its pathogenic causes. With no targeted therapies approved earlier, a large proportion experienced frequent disease flare-ups, tunneling and scarring over time. Their physical, mental and social well-being took a significant toll as a result of the inadequately managed chronic disease condition.

Advent of anti-TNF alpha treatments like adalimumab, infliximab and biosimilars has produced groundbreaking results. In several clinical trials, majority of patients achieved clinically meaningful response, remission and improvements in quality of life when administered these targeted biologics. Their novel mechanism of calming overactive immune cells has translated to long-term disease control and symptom relief for both mild and severe HS cases.

Encouraged by this success, pharmaceutical companies continue investing in novel biologic agents with improved pharmacological properties, dosing schedules and safety profiles. A few promising pipeline candidates hold potential to emerge as best-in-class treatments. With available treatment options now addressing the root immunological causes, patient outcomes are looking brighter than ever before. This shift towards highly effective, targeted biologics will certainly revamp the management approach and market developments going forward.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Expensive Therapies Limit Accessibility for Some Patients

A key challenge faced in the hidradenitis suppurativa market is the high cost of existing treatment options limiting their accessibility for some patients. Hidradenitis Suppurativa is a chronic skin condition that causes painful lumps under the skin. While there are some approved biologic therapies available that have demonstrated effectiveness in managing symptoms, they come with a heavy price tag.

For example, the two leading biologics have average yearly drug costs exceeding $30,000. This steep financial burden poses significant difficulties for many patients without comprehensive health insurance. As Hidradenitis Suppurativa mainly affects patients during their prime working years, lack of insurance coverage is a widespread issue. High deductible plans are also inadequate to cover ongoing biologic prescriptions over the long-term.

The out-of-pocket costs consequently become prohibitive for some lower-income individuals with the disease. This pricing barrier prevents important patient populations from gaining access to therapies that could improve their quality of life by reducing symptoms.

Market Opportunity - Untapped Potential in Developing Regions with Growing Healthcare Infrastructure

One significant opportunity for growth in the hidradenitis suppurativa market is the untapped potential present in developing regions where healthcare infrastructure and access to treatments are improving. While Hidradenitis Suppurativa occurs globally, awareness and diagnosis rates remain low in many emerging markets. This represents a substantial unmet need as better access to care enables more at-risk patient populations to be identified and start appropriate medical management.

As the middle class expands in nations such as China, Brazil, India and others, the ability of private healthcare sectors to provide newly affordable treatments is growing rapidly. This uptick in resources coincides with an expected increase in hidradenitis suppurativa cases secondary to rising obesity and changing lifestyles within developing regions.

First-mover pharmaceutical companies and providers focused on partnering with local clinicians, educators and insurers stand to benefit as these nascent yet large markets mature. Greater penetration into the developing world signifies important long-term revenue opportunities for players addressing the significant unmet need.

Prescribers preferences of Hidradenitis Suppurativa Market

Hidradenitis suppurativa (HS) is generally treated through a step-wise approach depending on the severity and stage of the disease. For mild HS (stage 1), prescribers typically recommend topical treatments like clindamycin 1% gel (Cleocin T). If topicals are ineffective, oral antibiotics such as doxycycline 100 mg (Doxycycline Hyclate) may be prescribed.

For moderate HS (stage 2), first-line systemic therapies include oral antibiotics along with supplemental procedures like intralesional corticosteroid injections to reduce inflamed nodules and abscesses. Commonly used antibiotics are tetracycline 500 mg (Sumycin), minocycline 100 mg (Minocin), and erythromycin 500 mg (Ery-Tab).

Severe HS (stage 3) often requires biologics alone or combined with immunosuppressants. Popular biologic choices are adalimumab 40 mg injections (Humira), which inhibits TNF-alpha, and ustekinumab 45/90 mg injections (Stelara), a monoclonal antibody targeting IL-12 and IL-23. Immunosuppressants like azathioprine 50-150 mg (Imuran) are frequently prescribed alongside biologics to maximize effectiveness.

Prescribers also consider factors like insurance coverage, cost, safety/side effects, patient adherence, and prior response to treatments when deciding preferred courses of action. Overall, treatment plans are tailored based on each case's unique disease burden and severity to achieve remission and prevent recurrence or progression of HS.

Treatment Option Analysis of Hidradenitis Suppurativa Market

Hidradenitis suppurativa (HS) has four main stages - mild (stage I), moderate (stage II), severe (stage III), and extensive (stage IV) - based on the number and size of lesions. Treatment is tailored based on the stage of disease.

For mild HS (stage I), topical treatments like clindamycin solution applied to lesions are usually first-line. If topicals are ineffective, oral antibiotics like doxycycline may be tried.

For moderate HS (stage II), oral antibiotics are considered first-line due to larger lesion size and number. Common choices include tetracycline-class drugs (doxycycline/minocycline), macrolides (erythromycin), or trimethoprim-sulfamethoxazole. If antibiotics are ineffective, hormone therapies like oral contraceptives or spironolactone may provide relief from their anti-androgenic properties.

For severe HS (stage III), stronger options like retinoids (isotretinoin), biologics targeting TNF-alpha (adalimumab, infliximab), or IL-12/IL-23 (ustekinumab) may be used. These systemics are better able to control deep nodules and abscesses characteristic of later stage disease.

For extensive HS (stage IV), aggressive treatments are warranted due to physical and psychological burden of numerous large lesions. Line options may include above biologics, combinations like retinoids with biologics, or last resort measures like surgery to remove diseased skin areas.

Key winning strategies adopted by key players of Hidradenitis Suppurativa Market

Johnson & Johnson has been able to gain a significant market share in the HS treatment market through its focus on drug innovation and pipeline development. In 2017, J&J received FDA approval for SIMPONI ARIA, a new biologic treatment for moderate-to-severe HS. This was the first approved therapy specifically for HS. By being first to market with an HS-indicated drug, J&J gained an early monopoly and was able to capture a large patient population right from launch. The drug saw strong uptake and sales, generating over $100 million in revenue by 2019.

AbbVie followed a similar strategy with the 2019 approval and launch of its HS drug HUMIRA. As the top-selling drug globally already approved for other indications, AbbVie was able to leverage HUMIRA's brand equity and promote it aggressively for HS. Within a year of approval, HUMIRA captured over 25% of the HS biologics market in the US, rivaling SIMPONI ARIA's share. AbbVie's strong sales network and reimbursement expertise helped drive rapid uptake.

Smaller players like InflaRx have partnered with large pharmaceutical companies for late-stage development and commercialization. InflaRx's pinipolimab showed promise in Phase 2 for HS. It out-licensed global rights to the drug to Pfizer in 2020.

Segmental Analysis of Hidradenitis Suppurativa Market

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

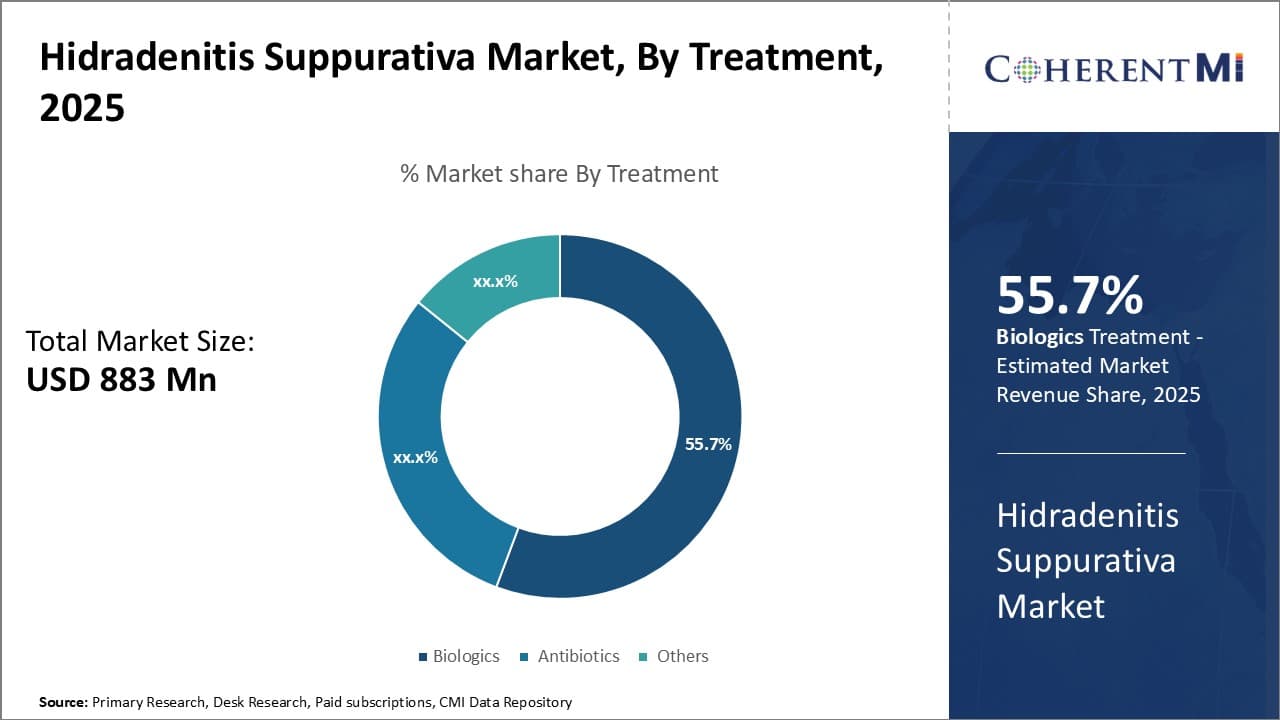

Insights, By Treatment: Biologics Promise Increased Efficacy and Targeted Approach

In terms of treatment, biologics are estimated to account for 55.7% share of the market in 2025, owning to their higher efficacy and targeted approach in treating hidradenitis suppurativa. Biologics such as tumor necrosis factor inhibitors directly help in modulating the immune response that causes inflammation and symptoms in hidradenitis suppurativa patients.

By targeting specific steps in the immune pathway rather than broadly suppressing it, biologics offer superior control over disease symptoms with minimal side effects. The targeted nature of biologics ensures they provide long-lasting remission for patients by mitigating the root cause of the condition.

Additionally, biologics often demonstrate results within a short period of time, offering quicker symptom relief to patients facing severe pain and infections from hidradenitis suppurativa. Their high success rates in improving disease severity scores and quality of life has made biologics the preferred line of treatment for moderate to severe cases of hidradenitis suppurativa.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

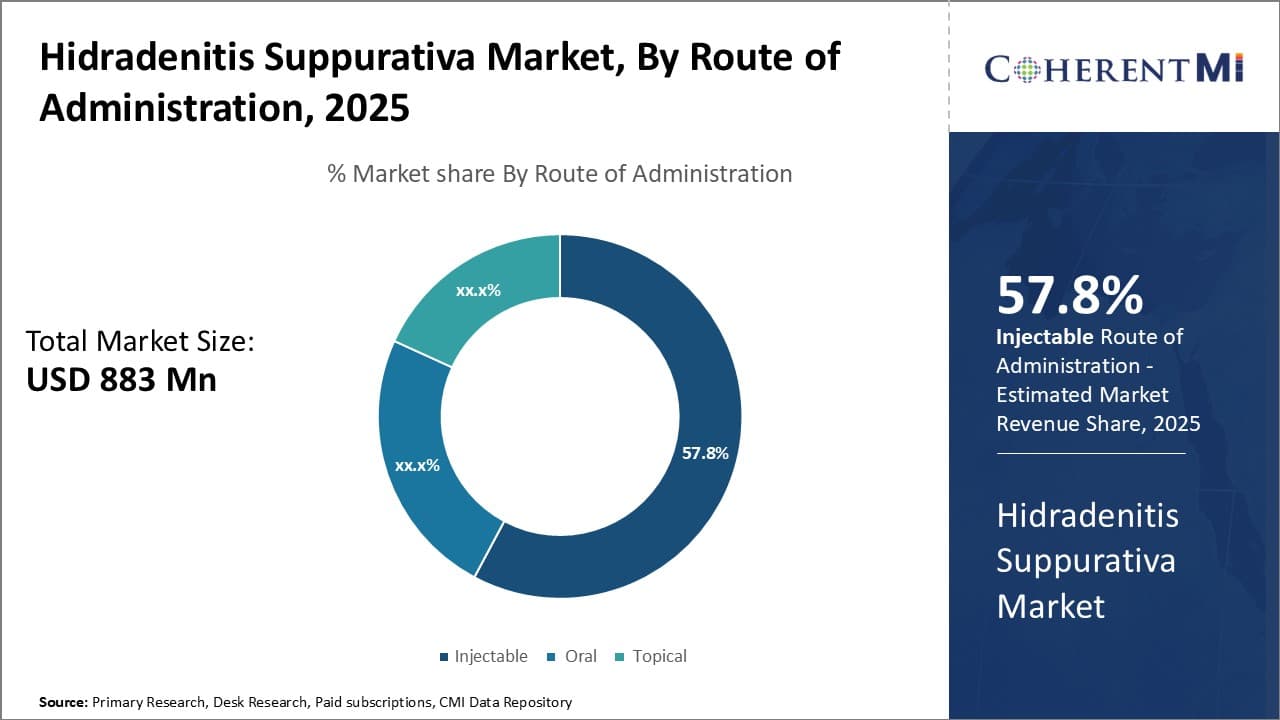

Insights, By Route of Administration: Direct Administration and Higher Adherence

In terms of route of administration, injectable route of administration is expected to hold 57.8% share of the market in 2025, owing to the direct administration and higher adherence to treatment. Injectable biologics and other drugs allow for direct entry into the bloodstream, ensuring higher bioavailability and more consistent drug levels for effective therapy. This translates to better management of hidradenitis suppurativa symptoms and lower chances of disease flares.

Additionally, injectable medications require administration by a healthcare professional, improving treatment adherence over long-term oral or topical options which can be incorrectly self-administered. Direct supervision of injectable drug intake results in timelier dosing and ensured completion of treatment course, reducing the risk of relapse or partial response. The accountable nature of injectable administration contributes to superior clinical outcomes, driving their increased adoption over other drug delivery methods.

Insights, By Distribution Channel: Specialized Management and Multidisciplinary Care

In terms of distribution channel, hospital pharmacies contribute the highest share of the market owing to their ability to offer specialized management and multidisciplinary care. Hidradenitis suppurativa is a complex condition often requiring coordinated treatment from dermatologists, surgeons, and other specialists.

Hospital pharmacies allow for streamlined access to the entire medical team and integrated care centered around the patient's needs. They ensure appropriate medication management alongside surgical procedures or other therapies. Hospitals also have effective monitoring systems to track treatment responses and catch potential complications early.

Access to round-the-clock care facilities in hospitals contribute to better stabilization of disease flares or management of post-procedural requirements. Their holistic healthcare infrastructure makes hospital pharmacies particularly suitable for severe hidradenitis suppurativa cases requiring inpatient or multifaceted treatment approaches.

Additional Insights of Hidradenitis Suppurativa Market

- The total diagnosed cases in the US were around 877,600 in 2023.

- Biologics have shifted the treatment landscape, with new options targeting cytokines like IL-17 and JAK pathways.

- Hidradenitis suppurativa is more common in females in the US and EU but affects more males in Japan.

- The age group 30-39 years has the highest prevalence of the disease in the US.

Competitive overview of Hidradenitis Suppurativa Market

The major players operating in the hidradenitis suppurativa market include AbbVie Inc., Pfizer Inc., Novartis International AG, UCB Pharma, and Eli Lilly and Company.

Hidradenitis Suppurativa Market Leaders

- AbbVie Inc.

- Pfizer Inc.

- Novartis International AG

- UCB Pharma

- Eli Lilly and Company

Recent Developments in Hidradenitis Suppurativa Market

- In April 2024, UCB Biopharma’s BIMZELX was approved in Europe for moderate-to-severe hidradenitis suppurativa, with an FDA review underway. If approved, Bimekizumab could become a valuable addition to HS treatment options, potentially impacting the current therapeutic landscape and offering patients a new mechanism of action.

- In April 2023, Boehringer Ingelheim’s Bimzelx was approved in Europe for moderate-to-severe hidradenitis suppurativa. The approval of Bimzelx in Europe introduces a biosimilar option to Humira, potentially increasing competition and providing more treatment options for patients with hidradenitis suppurativa.

Hidradenitis Suppurativa Market Segmentation

- By Treatment

- Biologics

- Tumor Necrosis Factor (TNF) Inhibitors

- Interleukin Inhibitors

- Antibiotics

- Oral Antibiotics

- Topical Antibiotics

- Hormonal Therapy

- Others

- Immunosuppressive Agents

- Retinoids

- Biologics

- By Route of Administration

- Injectable

- Oral

- Topical

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.