The hypercholesterolemia market is estimated to be valued at USD 2.73 Bn in 2025 and is expected to reach USD 3.74 Bn by 2032, growing at a compound annual growth rate (CAGR) of 4.6% from 2025 to 2032. Growing cardiovascular diseases and related conditions are major factors driving the hypercholesterolemia market. Additionally, rising obese and geriatric population further propels the demand for cholesterol-lowering therapies.

Market Size in USD Bn

CAGR4.6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 4.6% |

| Market Concentration | High |

| Major Players | Amgen Inc., Pfizer Inc., Roche Holding AG, Novartis International AG, Sanofi S.A. and Among Others |

Market Driver - Rising Awareness of Hypercholesterolemia and Increased Diagnostic Efforts

As people become more educated and aware about their health and medical conditions, there has been a notable rise in awareness of hypercholesterolemia in recent years. Individuals are taking a more proactive approach towards managing cardiovascular risk factors and getting their cholesterol levels checked on a regular basis.

Several diagnostic tests are now available to detect high cholesterol, making it more convenient for people to get screened. With awareness on the rise and more screening opportunities present, a larger number of cases are being formally diagnosed which is expanding the patient pool that can benefit from hypercholesterolemia treatment.

The healthcare industry too has stepped up efforts to routinely check cholesterol levels, especially in high-risk populations. Various diagnostic guidelines now recommend measuring lipid profiles periodically for all adults as part of regular health checkups.

New screening protocols have also been introduced targeting specific demographic groups based on factors like age, medical history and family history. As public health initiatives promote the message that high cholesterol needs to be actively managed to reduce cardiovascular risk, more patients will continue coming forward to get screened and seek out treatment options.

Market Driver - Continuous Innovation in Lipid-Lowering Therapies, Particularly PCSK9 Inhibitors

Continuous research and development efforts from drug manufacturers have led to the approval of several new lipid-lowering drug classes and agents with superior efficacy and tolerability profiles.

One of the most promising classes to emerge is PCSK9 inhibitors which directly target the PCSK9 protein to significantly lower LDL-C levels. Currently approved PCSK9 inhibitors such as evolocumab and alirocumab have demonstrated an ability to reduce LDL-C by 50-60% on top of statin therapy, offering hope to patients with very high baseline cholesterol.

PCSK9 inhibitors opened new possibilities for treating patient groups that were previously difficult to manage such as those with genetic conditions predisposing very high cholesterol. They can be effective alternatives for statin intolerant patients and provide additional options to consider before starting last-resort therapies like lomitapide.

Ongoing research focused on optimizing the dosage regimen, exploring new delivery methods and evaluating their cost-effectiveness under different treatment algorithms. If successful, these efforts could help address current limitations and expand the eligible patient population even further. The launch of PCSK9 inhibitors represented a major milestone that transformed treatment approaches for hypercholesterolemia.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High Treatment Costs Limit Access for Patients in Certain Regions

High treatment costs limit access for patients in certain regions. The high costs associated with lipid-lowering therapies like PCSK9 inhibitors pose a challenge for patients in regions with low healthcare budgets and lack of medical insurance.Patients in these areas often struggle to afford costly medications even when clinically indicated. This leads to poor treatment adherence and control of LDL-cholesterol levels. The situation is compounded in developing nations where a large population deals with cardiovascular risks but has minimal access to specialized care and premium drugs. While generic statins have helped lower costs to some extent over the past years, innovative new therapies with impressive efficacy often have price tags that are simply unreachable for many patients. Unless measures are taken to make treatments more affordable through subsidies, price negotiation or faster entry of lower-cost biosimilars, a significant section of high-risk patients globally may continue to remain underdiagnosed or undertreated.

Market Opportunity - Introduction of Less Frequent Injectable Therapies

Current PCSK9 inhibitor therapies require bi-weekly or monthly injections which can be an inconvenience leading to non-compliance over the long term. A therapy that could be administered once every 6 months can make treatment more compatible with patient lifestyles and busy schedules. This can help improve adherence to lipid-lowering regimens. The potential for half-yearly dosing with Lerodalcibep addresses one of the key limitations of existing PCSK9 inhibitors. If proven effective in ongoing late-stage trials, it may capture a portion of the hypercholesterolemia market currently satisfied with oral drugs alone as well as attract those patients who find frequent injections impractical. This opens up new opportunities for growth and also helps maximize patient and population health outcomes through better management of high cholesterol levels over the long-run.

Hypercholesterolemia treatment follows guidelines that recommend starting lifestyle modifications like diet and exercise for all patients. Prescribers typically consider drug therapy for those with LDL-C levels above 100 mg/dL or 130 mg/dL for those with risk factors.

For mild-to-moderate cases, statins are considered first-line therapy due to their efficacy and safety profile. Atorvastatin (Lipitor) and Rosuvastatin (Crestor) are commonly prescribed as they can lower LDL-C by 50% or more. For patients intolerant to statins or those needing additional LDL-C reduction, ezetimibe (Zetia) may be added.

When lifestyle changes and statin/statin plus ezetimibe therapy do not control LDL-C sufficiently, prescribers consider switching to more potent PCSK9 inhibitors. Alirocumab (Praluent) and evolocumab (Repatha), administered via autoinjector, can reduce LDL-C by 60% on average either as monotherapy or when added to other lipid lowering therapies.

For those with very high baseline LDL-C (>190 mg/dL) or cardiovascular disease, prescribers may initiate treatment with PCSK9 inhibitors along with statins. Safety and tolerability of the various treatment options also factor into prescribers' decisions. Additionally, out-of-pocket costs, availability of generics or patient assistance programs could sway prescriber preferences depending on the patient's circumstances.

Hypercholesterolemia has various stages of disease progression. Initial stage or mild hypercholesterolemia is characterized by LDL cholesterol levels between 130-159 mg/dL. Lifestyle modifications focused on diet and exercise are recommended as first line of treatment.

Moderate hypercholesterolemia with LDL levels between 160-189 mg/dL may require addition of statin therapy. Statins like Atorvastatin, Rosuvastatin and Simvastatin are commonly prescribed either as monotherapy or in combinations. These drugs work by inhibiting HMG-CoA reductase and reducing liver cholesterol production. They are effective in lowering LDL levels by 30-60% and first preference due to well-established safety and efficacy data.

Severe hypercholesterolemia with LDL greater than 190 mg/dL needs aggressive therapeutic intervention. Maximally tolerant statin doses may not suffice. Addition of Ezetimibe, a cholesterol absorption inhibitor, to ongoing statin therapy forms an attractive dual lipid lowering approach. The Ezetimibe+Atorvastatin combined formulation (Eg. Ezetrol) delivers consistent LDL reductions of 55-65%, making it the mainstay of treatment at this stage.

For patients intolerant to statins, alternative options include bile acid sequestrants like Colesevelam and PCSK9 inhibitors like Alirocumab and Evolocumab. While efficacious, these newer therapies are typically reserved for advanced stages due to higher costs.

One of the major strategies adopted was developing PCSK9 inhibitors which target PCSK9 - a protein that reduces the liver's ability to remove LDL cholesterol from the bloodstream. In 2015, Amgen launched Repatha (evolocumab) becoming the first PCSK9 inhibitor approved by the FDA for treatment of Hypercholesterolemia. Clinical trials showed Repatha reduced LDL cholesterol by 60% on average when added to statin therapy. This novel mechanism of action and superior efficacy levels compared to statins helped Amgen capture a significant market share.

Another player, Regeneron Pharmaceuticals adopted a bundling strategy by partnering with Sanofi to co-develop and market Praluent (alirocumab), a PCSK9 inhibitor. Post FDA approval in 2015, Regeneron relied on Sanofi's large salesforce to aggressively promote Praluent to clinicians. This collaborative commercial strategy helped them compete with Amgen and garner 15% US market share for PCSK9 inhibitors by 2018.

Players are also focusing on oral alternatives to injections. In 2019, Esperion Therapeutics gained FDA approval for Nexcelom (bempedoic acid) - the first non-statin, oral therapy for Hypercholesterolemia. Nexcelom works by inhibiting ATP-citrate lyase and reduces cholesterol production in the liver. The convenience of an oral therapy gave Esperion an edge over injectables.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

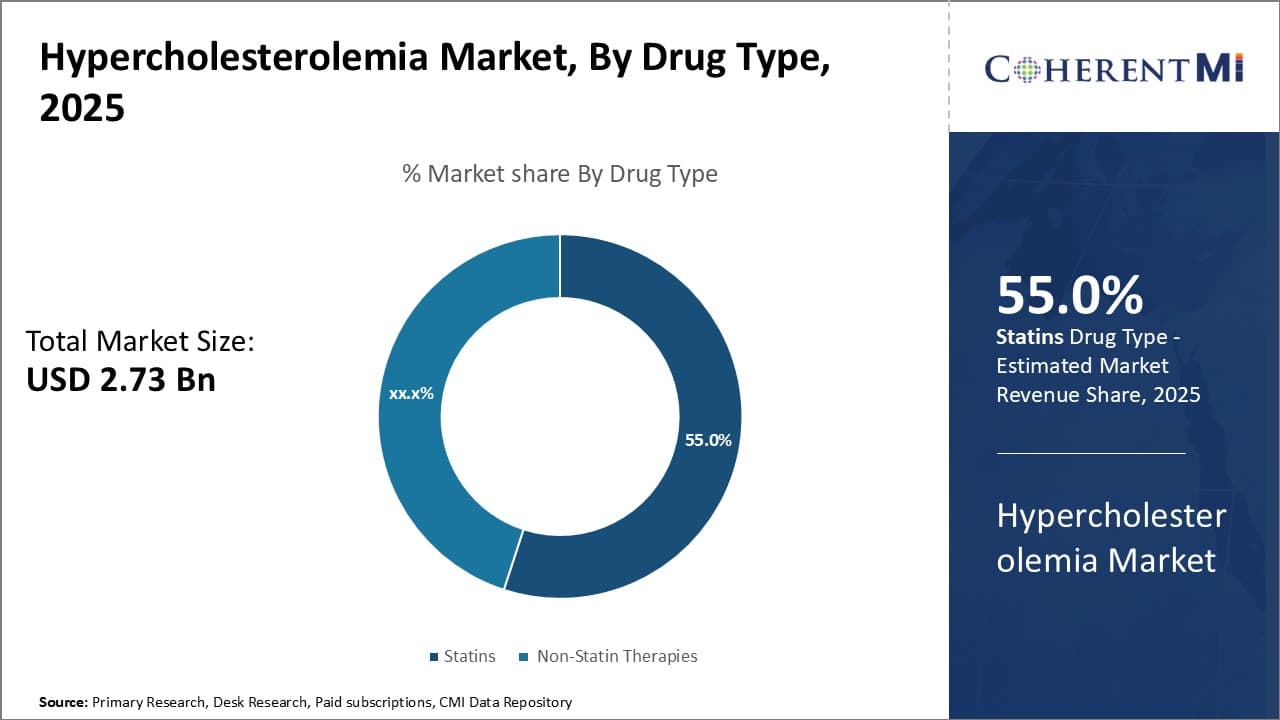

Insights, By Drug Type: Cost-effectiveness drives Statins dominance

In terms of drug type, statins are expected to account for 55% share of the hypercholesterolemia market in 2025, owing to its cost-effectiveness compared to other alternatives. Statins are the first line of treatment for hypercholesterolemia as they are highly effective in reducing LDL or "bad" cholesterol levels. Atorvastatin and simvastatin, the two commonly prescribed statins, are available as inexpensive generic drugs. Their long-term use has been proven to significantly lower the risks of cardiovascular events like heart attacks and strokes.

Due to their generic status, statins offer good value for money compared to expensive branded non-statin therapies or injectable PCSK9 inhibitors. This cost advantage, coupled with the extensive clinical evidence demonstrating statins' benefits, has made them the therapy of choice for the majority of patients with high cholesterol. Their widespread use across all healthcare settings, from hospitals to retail pharmacies, has enabled statins to dominate the hypercholesterolemia drug market by attributable share.

To learn more about this report, Download Free Sample Copy

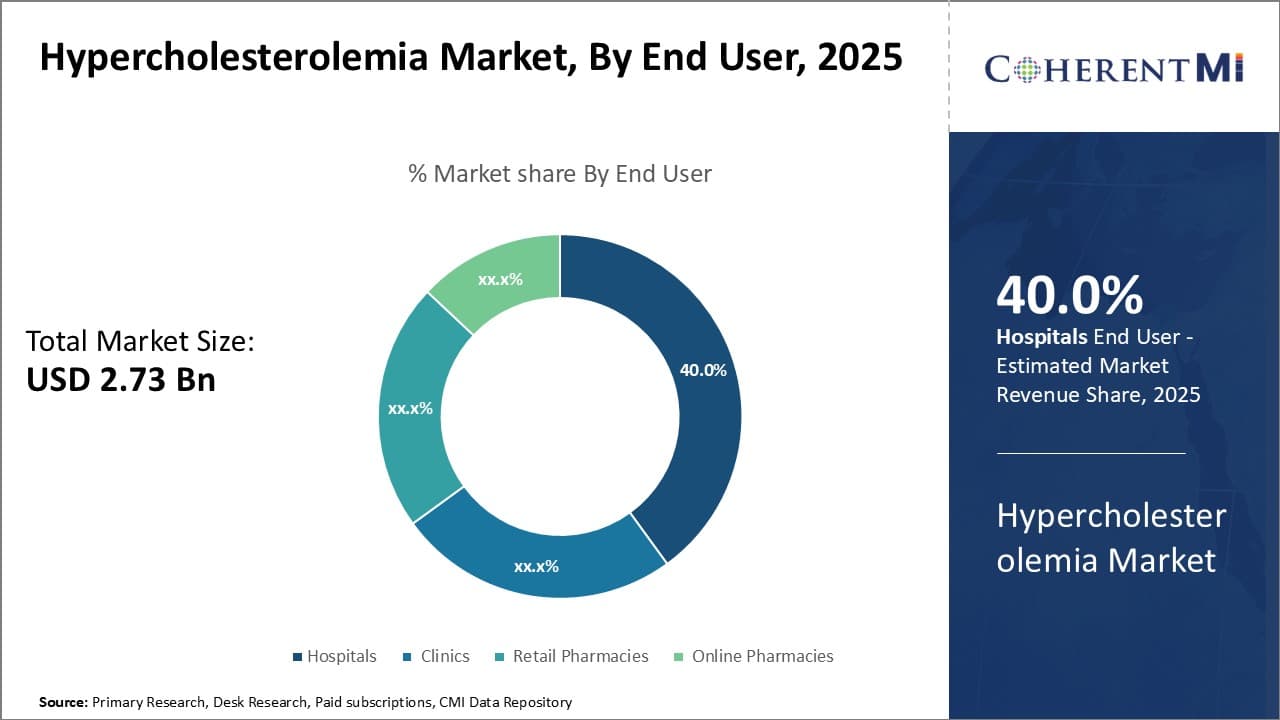

Insights, By End User: Convenience Drives Hospitals Prominence

To learn more about this report, Download Free Sample Copy

Insights, By End User: Convenience Drives Hospitals Prominence

In terms of end user, hospitals are estimated to account for 40% share of the hypercholesterolemia market in 2025, owing to the convenience it offers patients. People experiencing hypercholesterolemia-related health issues like chest pain or fatigue often visit hospitals first for evaluation and treatment.

The institution-based care provides seamless access to cardiologists, dieticians as well as laboratory tests needed to accurately diagnose and manage high cholesterol. It also addresses challenges faced by certain patients like the elderly or those from rural areas in regularly visiting standalone clinics or pharmacies. The "one-stop-shop" convenience of comprehensive care, from diagnostics to long-term drug management, appeals to a significant customer segment.

Additionally, hospitals help improve medication adherence through direct observed therapy particularly for newly-prescribed or high-risk patients. This integrated approach has enabled hospitals to maintain the largest share in the end-user market.

Insights, By Distribution Channel: Security Fosters Online Dominance

In terms of distribution channel, online sales contribute the highest share driven by the perception of security it offers customers. People buying medicines for health conditions like hypercholesterolemia are wary of privacy and safety when purchasing online.

Leading e-pharmacies have hence invested heavily in fortifying their website security and ensuring discreet, encrypted transactions. This instills confidence in customers entering their personal and insurance details digitally. The online platform also provides multilayer authentication for placing and receiving orders. Consumers appreciate not having to visit pharmacies physically during the ongoing pandemic. They also value the convenience of online tracking, notifications and doorstep delivery.

Furthermore, e-pharmacies leverage technologies like artificial intelligence to offer personalized suggestions, chatbot assistance and contextual rewards for loyal customers. These experiences have made online channels the most appealing distribution avenue, thereby contributing their fastest growing share.

The major players operating in the hypercholesterolemia market include Amgen Inc., Pfizer Inc., Roche Holding AG, Novartis International AG, and Sanofi S.A.

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Hypercholesterolemia Market is segmented By Drug Type (Statins, Atorvastatin, Simvastatin, Non-Stati...

Hypercholesterolemia Market

How big is the hypercholesterolemia market?

The hypercholesterolemia market is estimated to be valued at USD 2.73 Bn in 2025 and is expected to reach USD 3.74 Bn by 2032.

What are the key factors hampering the growth of the hypercholesterolemia market?

The high treatment costs limit access for patients in certain regions and challenges in patient adherence to long-term therapy, particularly for injectable treatments, are the major factors hampering the growth of the hypercholesterolemia market.

What are the major factors driving the hypercholesterolemia market growth?

Rising awareness of hypercholesterolemia and increased diagnostic efforts and continuous innovation in lipid-lowering therapies, particularly PCSK9 inhibitors are the major factors driving the hypercholesterolemia market.

Which is the leading drug type in the hypercholesterolemia market?

The leading drug type segment is statins.

Which are the major players operating in the hypercholesterolemia market?

Amgen Inc., Pfizer Inc., Roche Holding AG, Novartis International AG, and Sanofi S.A. are the major players.

What will be the CAGR of the hypercholesterolemia market?

The CAGR of the hypercholesterolemia market is projected to be 4.6% from 2025-2032.