The immune thrombocytopenia treatment market is estimated to be valued at USD 3.65 Bn in 2025 and is expected to reach USD 4.08 Bn by 2032, growing at a compound annual growth rate (CAGR) of 1.6% from 2025 to 2032. The market is expected to witness steady growth during the forecast period due to the increasing prevalence of autoimmune disorders and growing therapeutic applications of novel drug candidates.

Market Size in USD Bn

CAGR1.6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 1.6% |

| Market Concentration | High |

| Major Players | UCB Biopharma, Sanofi, Principia Biopharma, Argenx, Millennium Pharmaceuticals and Among Others |

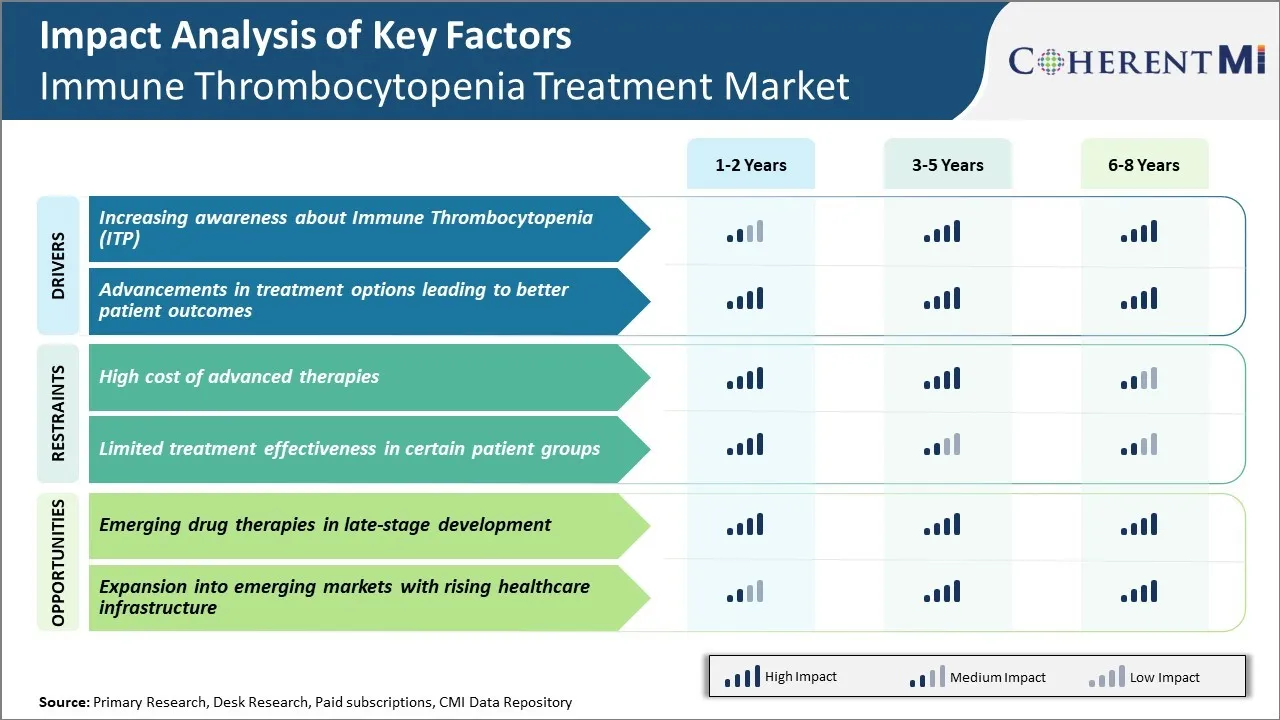

Market Driver - Increasing Awareness about Immune Thrombocytopenia (ITP)

Immune thrombocytopenia, commonly known as ITP, is an autoimmune disorder which has largely remained unknown to general public for long. However, over the past decade there has been a significant rise in efforts from healthcare organizations, patient advocacy groups and pharma companies to spread awareness about this disorder.

More individuals are now familiar with ITP as a condition where body's immune system mistakenly destroys its own platelets leading to easy or excessive bruising and bleeding. Campaigns stressing on non-specific symptoms like petechiae, purpura or excessive menstrual bleeding have helped in faster diagnosis of cases which would have otherwise gone long unnoticed.

Advocacy groups representing ITP patients have been particularly vocal on digital platforms to amplify correct medical information while countering myths and misconceptions around the condition. Their efforts in collaborating with disease experts have addressed several knowledge gaps around ITP for general practitioners as well as hematologists.

The combined impact of such awareness initiatives is visible in growing number of ITP diagnoses. Many support groups today boast strong online presence and engaged member base showing rising engagement levels from patients. Overall higher awareness on this long-overlooked disorder holds promise for timely management of cases and higher demand for effective therapeutic options.

Market Driver - Advancements in Treatment Options Leading to Better Patient Outcomes

Continual medical research especially over last decade has unlocked several advantages for patients. Advance option like thrombopoietin receptor agonists have emerged as first line treatment replacing corticosteroids in many cases. These biologics mimic body's own thrombopoietin hormone to stimulate platelet production with minimal side effects. Some patients now have therapy tailored as per their individual condition and severity through personalised regimen.

New treatment paradigms focus on sustainability of remission and avoiding relapses versus just increasing platelet counts. Options like immunomodulators previously limited to refractory cases are increasingly used upfront in combination or sequence regimens. This has shown better chances of long-term remission for several patients without requirement of frequent steroid bursts.

Technological advancements have enabled close monitoring of disease through advanced blood tests and imaging methods. This supports timely dose adjustments and adds precision in evaluating treatment success. Collaborations between researchers has expanded understanding on pathophysiological factors behind varied ITP cases. Tailored therapies targeting specific defective pathways are in pipeline. Overall, such improvements challenge status of ITP as a chronic condition managed long term. Growing options inspire confidence of patients in pursuing improved quality of life through optimal clinical control of their disease.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High Cost of Advanced Therapies

One of the major challenges currently faced by the Immune Thrombocytopenia treatment market is the high cost of advanced therapies. Immune Thrombocytopenia (ITP) is a disease characterized by a decrease in the number of platelets in blood. The existing treatment options for ITP include corticosteroids, intravenous immunoglobulin (IVIG), anti-D immunoglobulin and splenectomy. However, these therapies are not always effective and some patients experience adverse effects or relapse after treatment. Recent years have seen promising late-stage drug candidates entering clinical trials. However, these new therapies such as eltrombopag and romiplostim are associated with high acquisition and administration costs, making them unaffordable for many patients.

On average, the yearly cost of treatment with these newer targeted therapies is estimated to be over USD 100,000 per patient in the US. The high financial burden on patients acts as a significant limiting factor for the adoption of these advanced therapies. This cost challenge needs to be addressed through initiatives like patient assistance programs, affordability studies and healthcare reforms to ensure maximum access to life-saving treatment options and further growth of the ITP therapeutics market.

Market Opportunity - Emerging Drug Therapies in Late-Stage Development

One of the major opportunities for the Immune Thrombocytopenia treatment market lies in the emerging drug therapies that are currently in late-stage development. Several pharmaceutical companies are developing novel drug candidates that target different pathways involved in the pathogenesis of ITP. For example, Kezar Life Sciences is developing KZR-616, a first-in-class immunoproteasome inhibitor that received Fast Track designation from the FDA in 2020.

Also, rigid Biosciences is developing Rigel-109, a potent and selective BTK inhibitor that is currently in Phase 2/3 clinical trials for treatment of chronic ITP. If successfully approved, these new molecular entities will provide efficacious and targeted treatment options to patients suffering from ITP. Their novel mechanisms of action hold promise to sustain remissions for longer duration and minimize relapse while demonstrating improved safety profiles over existing therapies.

This late-stage pipeline is expected to drive significant revenue growth for drug manufacturers and expansion of the overall ITP therapeutics market in the coming years.

ITP is typically treated with corticosteroids in initial cases presenting with moderate to severe thrombocytopenia and symptoms of bleeding. Prescribers commonly initiate treatment with prednisone or prednisolone at dosages between 1-2 mg/kg per day. If there is an inadequate response or intolerance to corticosteroids after 4 weeks, the second line of treatment involves use of immunosuppressants such as eltrombopag (Promacta), a thrombopoietin receptor agonist, or rituximab (Rituxan), a monoclonal antibody.

For patients still exhibiting low platelet counts or having relapsed disease after corticosteroid and immunosuppressant treatments, splenectomy has traditionally been the standard third line intervention due to the spleen's role in platelet destruction. However, newer medications like fostamatinib (Tavalisse), a spleen tyrosine kinase inhibitor, are increasingly being prescribed off-label in this latter stage as they allow for splenectomy avoidance.

Crucial factors influencing prescribers' medication choices include the disease severity, effectiveness and safety profiles of the drugs, patient preferences, and insurance coverage limitations. Off-label treatments are more likely to be prescribed if standard options provide inadequate control or intolerable side effects. Close patient monitoring is also important during ITP treatment to properly evaluate responses and adjust courses of therapy accordingly.

Immune Thrombocytopenia has different treatment options based on the severity of thrombocytopenia and bleeding symptoms. For newly diagnosed mild ITP (platelet count >30,000/mcL) with no bleeding, initial treatment involves observation with no immediate therapy.

For moderate ITP (platelet count <30,000/mcL) or those with bleeding, first-line treatment includes corticosteroids like prednisone. Corticosteroids work to reduce the body's immune response against platelets. They are effective in around two-thirds of patients but side effects with long term use limit their use.

If corticosteroids fail or cannot be used long term, the next line of treatment involves immunosuppressants. Common options include antibodies against CD20 on B-cells like rituximab. By depleting B-cells, rituximab reduces autoantibody production against platelets. Another option is the spleen tyrosine kinase inhibitor eltrombopag (Promacta). It works by stimulating megakaryocyte maturation and platelet production. Both rituximab and eltrombopag are effective therapies that can sustain a platelet response in over 60% of recurring ITP patients.

For severe ITP with very low platelet counts (<10,000/mcL), treatments aim to rapidly increase platelet counts to prevent life-threatening bleeding. Options used include intravenous immunoglobulin, anti-D immunoglobulin (if Rh positive), and corticosteroids.

Product Innovation: One of the most successful strategies adopted by companies has been continuous investment and focus on R&D to develop novel and innovative treatment options. For example, Amgen received FDA approval for Nplate (romiplostim) in 2008, which was the first FDA-approved TPO receptor agonist for ITP treatment. This was a major breakthrough and helped Amgen gain significant market share initially.

Clinical Trial Excellence: Conducting large clinical trials and demonstrating superior efficacy data has provided competitive advantages. For instance, when Pfizer conducted two phase 3 clinical trials on fostamatinib in 2013-2015 involving 150 patients, it showed significant increases in platelet counts and reduced bleeding. This helped fostamatinib gain FDA approval in 2018 and market dominance over previously approved options.

Portfolio Expansion: Companies have expanded through strategic in-licensing and M&A deals. For example, Rigel Pharmaceuticals in-licensed fostamatinib rights from AstraZeneca in 2010. This supplemented Rigel's portfolio and enabled commercialization through its existing hematology sales network. Similarly, Bristol-Myers Squibb acquired Celgene Corp in 2019 for $74 billion, gaining access to Celgene's approved ITP drugs including Inrebic and Otezla. Such portfolio expansions strengthen market presence.

To learn more about this report, Download Free Sample Copy

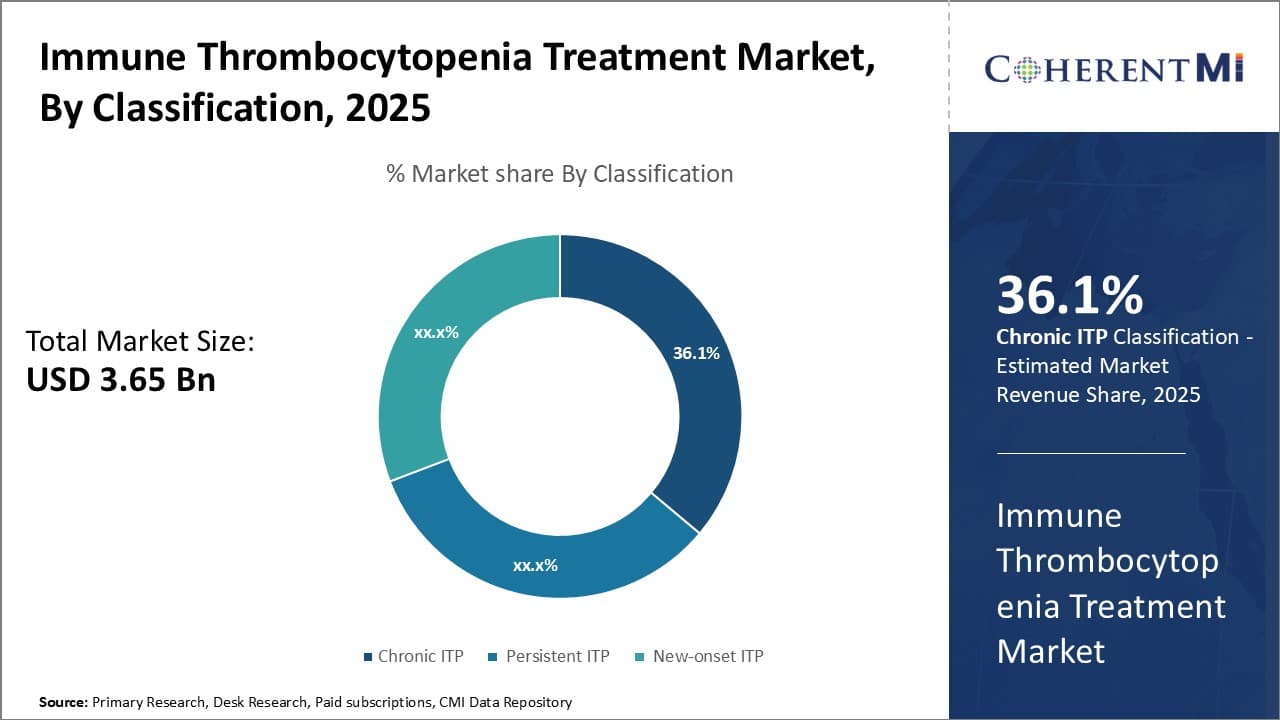

Insights, By Classification: Chronic ITP Contributes the Highest Market Share owning to its Persistent Nature

To learn more about this report, Download Free Sample Copy

Insights, By Classification: Chronic ITP Contributes the Highest Market Share owning to its Persistent Nature

Chronic ITP, as the name suggests, refers to cases where a patient's platelet counts remain low for over twelve months. This steady low platelet count poses a constant threat of bruising and bleeding. Unlike cases of new-onset or persistent ITP which may see remission, chronic ITP represents a long-term medical need.

The enduring symptoms of chronic ITP drive continued treatment seeking behavior. Patients must carefully monitor their platelet counts and seek medical intervention at the first signs of further decline. This helps prevent dangerous hemorrhaging but necessitates long-term management. Drug therapies for chronic ITP also differ from acute cases, focusing on maintenance of stable counts rather than just crisis response. Some options like corticosteroids are unsuitable for prolonged use, so alternative treatments gain importance.

The consistency of low platelet counts in chronic ITP also heightens risks like life-threatening internal bleeding. This makes treatment adherence critically important to avert medical emergencies. Close monitoring by physicians further solidifies chronic ITP as an ongoing healthcare issue rather than a temporary condition. Even after interventions like splenectomy, lifelong follow ups may be needed. The sustainability of care demands created by chronic ITP has made it the dominant force propelling the overall market.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

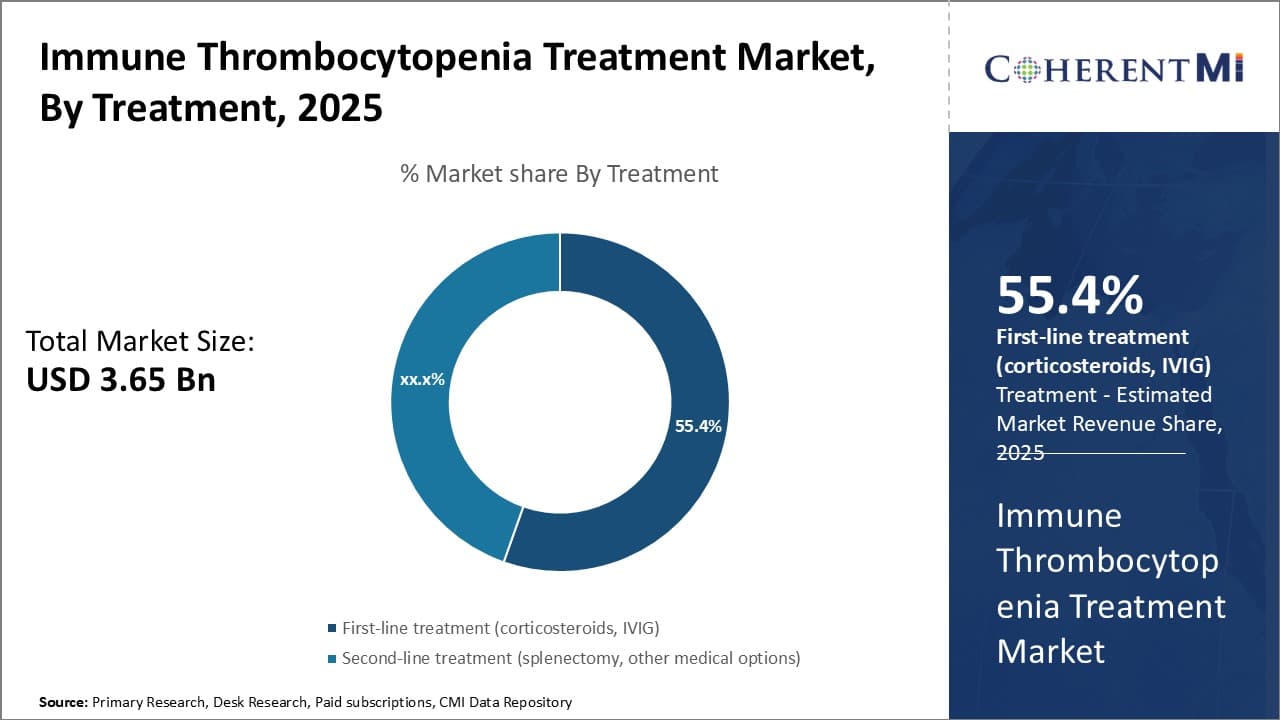

Insights, By Treatment: First-line Treatment Segment Drivers Gains Attention from Market Players

In terms of treatment, first-line treatments such as corticosteroids and intravenous immune globulin (IVIg) dominate the market due to their primacy in standard clinical guidelines. They are recommended as the first resort for newly diagnosed as well as relapsed cases of ITP. Though not universally effective, corticosteroids and IVIG provide rapid increases in platelet counts during acute phases of the disease. Their ability to deliver timely responses to plummeting counts is invaluable for averting hemorrhagic crises.

Additionally, corticosteroids and IVIG are well-established therapies with proven safety profiles. Generations of clinical use have defined their role as frontend medications to stabilize platelet numbers before considering other options. Their first-mover advantage leads to higher familiarity among physicians and patients alike. This first-line credibility solidifies corticosteroids and IVIG as go-to solutions, especially for frontline reassurance during diagnosis.

Even after other treatments enter practice, first-line alternatives often continue as backbone therapies. They may be deployed intermittently to head off relapses or combined with other drugs for synergistic effect. Such flexibility sustains their importance throughout diverse ITP treatment journeys. Overall, the initial trust and broad role afforded to corticosteroids and IVIG have made first-line treatments the pillar of this therapeutic sector.

The major players operating in the Immune Thrombocytopenia Treatment Market include UCB Biopharma, Sanofi, Principia Biopharma, Argenx, Millennium Pharmaceuticals, Takeda, Biotest, and GC Pharma.

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Immune Thrombocytopenia Treatment Market is segemented By Classification (Chronic ITP, Persistent IT...

Immune Thrombocytopenia Treatment Market

How big is the immune thrombocytopenia treatment market?

The immune thrombocytopenia treatment market is estimated to be valued at USD 3.65 Bn in 2025 and is expected to reach USD 4.08 Bn by 2032.

What are the key factors hampering the growth of the immune thrombocytopenia treatment market?

The high cost of advanced therapies and limited treatment effectiveness in certain patient groups are the major factor hampering the growth of the immune thrombocytopenia treatment market.

What are the major factors driving the immune thrombocytopenia treatment market growth?

The increasing awareness about immune thrombocytopenia and advancements in treatment options leading to better patient outcomes are the major factor driving the immune thrombocytopenia treatment market.

Which is the leading Classification in the immune thrombocytopenia treatment market?

The leading classification segment is Chronic ITP.

Which are the major players operating in the immune thrombocytopenia treatment market?

UCB Biopharma, Sanofi, Principia Biopharma, Argenx, Millennium Pharmaceuticals, Takeda, Biotest, and GC Pharma are the major players.

What will be the CAGR of the immune thrombocytopenia treatment market?

The CAGR of the immune thrombocytopenia treatment market is projected to be 1.6% from 2025-2032.