India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market Size - Analysis

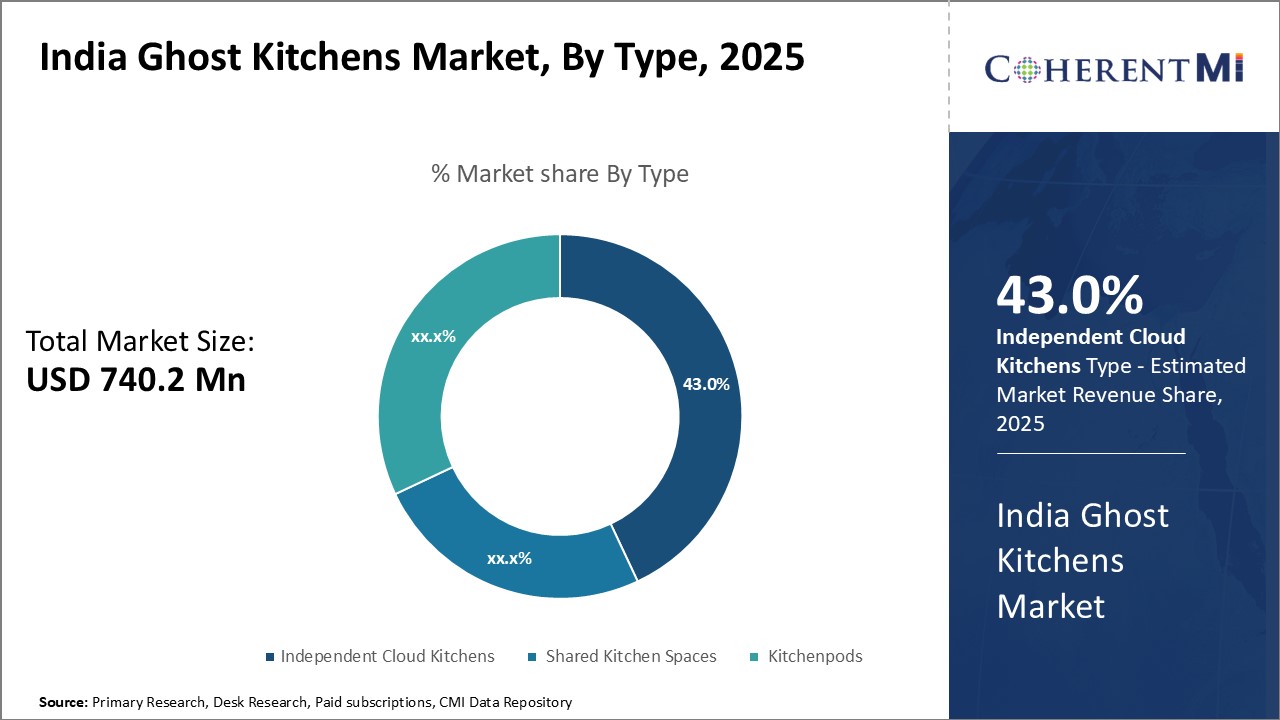

The India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market is segmented by business model type, kitchen type, by food type, by ordering method, and cities. By type, the market is segmented into Independent Cloud Kitchens, Shared Kitchen Spaces, and Kitchen Pods. Independent Cloud Kitchens is the largest segment, accounting for over 40% of the total market revenue in 2025. The Independent Cloud Kitchens segment is growing rapidly due to expansion of cloud kitchen chains.

- Rising Internet and Smartphone Penetration: According to Internet and Mobile Association of India, the country currently has 759 active internet users in the year 2025. Out of the total active users 399 million users were from rural India and 360 million for urban India landscape. The rapid growth in internet and smartphone penetration is a major driver for the India dark kitchens market. This is significantly increasing the adoption of online food delivery apps and driving demand for dark kitchens. Food delivery apps like Swiggy and Zomato have gained immense popularity. The easy availability of online delivery apps coupled with cheap mobile data tariffs is propelling the uptake of dark kitchens in India.

- Changing Consumer Preferences and Busy Lifestyles: India has a rising middle class population and large working professionals demographic. Their busy work schedules and changing preferences are fueling the demand for cloud kitchen market. Consumers want convenience, variety and quality without having to visit restaurants. Dark kitchens can fulfill all these requirements by offering quick delivery of hygienic and fresh food. Nuclear families and single households are also dependent on order-in delivery. Dark kitchens allow them to order home-cooked style meals at their convenience.

- Cost Benefits and Scalability for Restaurants: Dark kitchens eliminate the infrastructural costs associated with dine-in restaurants. They provide cost savings in terms of rentals, electricity, and staffing and inventory management. Restaurants can scale up operations, expand into new locations and add more delivery-only brands from the same kitchen at low costs. Dark kitchens also allow optimal utilization of kitchen resources by aggregating demand. Even during non-peak hours, the kitchens can be used for prep work. This gives significant cost advantages compared to standalone restaurants.

- Supportive Government Policies and Initiatives: The Indian government's Digital India initiative is aimed at increasing digital penetration and encouraging tech-based business models. Government think tank Niti Aayog has released guidelines supporting the growth of cloud kitchens. Many states like Meghalaya are offering subsidies and incentives to restaurants adopting dark kitchens. The policies are focused on enabling the digital growth of the food services sector. This is expected to provide an impetus to dark kitchens penetration across tier I and tier II cities.

Market Size in USD Mn

CAGR15.8%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 15.8% |

| Larget Market | India |

| Market Concentration | High |

| Major Players | Rebel Foods, Swiggy, Zomato, FreshMenu, Box8 and Among Others |

please let us know !

India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market Trends

- Focus on Health-Conscious Offerings and Dietary Preferences: Consumers are increasingly focusing on healthier food options and transparency when ordering food online. To tap this sentiment, dark kitchen players are adding calories and nutritional information for all items. Brands like EatFit and Hello Tempayy solely cater to health-conscious consumers. Dark kitchens are also customizing their menus to meet different dietary preferences like vegan, gluten-free, keto etc. This creates market opportunities in the niche healthy and dietary meals segment.

- Focus on Sustainable and Eco-Friendly Practices: Sustainable practices like minimal use of plastic, energy-efficient equipment and water conservation are being adopted by dark kitchens. Some chains like LeanMeal even use electric vehicles for last-mile delivery. To reduce food wastage, unsold food is donated to NGOs working with the underprivileged. Such initiatives help dark kitchens reduce their carbon footprint and promote eco-friendly messaging to attract consumers. Moreover, many cloud kitches across India such as The Chhaunk, PotPot -Yum Yum, and PotPot -Yum Yum are using ecofriendly and low cost packing which alaos affects the price of the food.

- Expansion into Tier 2 and 3 Cities: There is a large untapped market opportunity for dark kitchens in tier 2 and 3 cities of India. Food delivery apps like Swiggy are expanding deep into small towns and cities to access this new target segment. The lower rent and labor costs in small towns also make it profitable to launch cloud kitchens there. Dark kitchens can cater to the latent demand from consumers in these cities who have limited access to quality restaurants. Sit-down restaurant brands can also leverage dark kitchens to grow their reach into smaller towns for added revenue streams.

- Leveraging Social Media and Digital Marketing: Dark kitchens can leverage social media platforms like Instagram and Facebook to engage with customers and promote their brands. Targeted digital marketing across search, display, social media etc. allows them to onboard new customers within a limited delivery radius. Hyperlocal advertising helps generate locality-specific demand. Social media also provides an opportunity to go viral with unique food offerings. Dark kitchen brands can build traction and loyalty using influencer marketing on digital and social channels.

- New Delhi NCR is amongst the major metropolitan city of country with a diverse food culture, ranging from regional cuisines to global cuisines. The city is home to numerous cloud kitchen startups such as Madam Curry, Pitara Kitchen, The Fit Food and The Pizza People.

- Delhi Government announced plans to introduce cloud kitchen policy which aims at streamlining the licensing procedure for the cloud kitchen market by implementing a single window system through a digital platform. The plan is poised to give a boost to the cloud kitchen landscape in New Delhi area.

- Consumers in the city are increasingly focusing on healthier food options and transparency when ordering food online. To tap this sentiment, dark kitchen players are adding calories and nutritional information for all items. Brands like EatFit and Hello Tempayy solely cater to health-conscious consumers. Dark kitchens are also customizing their menus to meet different dietary preferences like vegan, gluten-free, keto etc. This creates market opportunities in the niche healthy and dietary meals segment.

Segmental Analysis of India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market

Competitive overview of India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market

Rebel Foods, Swiggy, Zomato, FreshMenu, Box8, EatFit, Faasos, Holachef, Biryani By Kilo, Licious, Foodpanda, InnerChef, UberEats, Oven Story, Hoi Foods, Eatonomist, Happy Eats, Box C, Curefoods Brands.

India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market Leaders

- Rebel Foods

- Swiggy

- Zomato

- FreshMenu

- Box8

India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market - Competitive Rivalry

India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market

During the pandemic the Indian food landscape saw a significant shift towards online food ordering, the pre pandemic consumer behaviors of ordering in or take away was further accelerated owing to the pandemic induced restriction. These restriction carved out the niche of cloud /ghost / dark kitchen during the pandemic. Many food aggregators and restaurant entered the space owing to low entry barrier and low capital investment. Cloud Kitchen market saw market players with chains operating country wide to a specific geographic based kitchens providing plethora of food ranging from health to gourmet food.

However, the market also faces certain restraints. One of the key challenges is the issue of lack of hygiene and regulations to maintain a standard kitchen quality. Currently, there are no hygiene and food safety guidelines mandated specifically for dark kitchens in India. The lack of regulation also prevents their growth across regions. Consumer’s perception about the hygiene standards at some small dark kitchens also negatively impacts market growth. The need is for unified hygiene and licensing regulation to support the nascent market segment.

Nevertheless, there is a large untapped market opportunity for dark kitchens in tier 2 and 3 cities of India. Food delivery apps like Swiggy are expanding deep into small towns and cities to access this new target segment. The lower rent and labor costs in small towns also make it profitable to launch cloud kitchens there. Dark kitchens can cater to the latent demand from consumers in these cities who have limited access to quality restaurants. Sit-down restaurant brands can also leverage dark kitchens to grow their reach into smaller towns for added revenue streams.

- In September 2023, Sodexo launched its first off-site tech-enabled cloud kitchen in Hyderabad. The kitchen has the capacity to make about 25, 000 meals per day which can delivered through temperature-controlled vehicles. The company’s major target customer base is the Pharmaceutical, BSFI, and ed-tech segment. The company further laid its plan to expand its operations to cities such as Pune and Bangalore along with a plan to derive 10% of its food revenue from off-site kitchens by 2025.

- In June 2023, Salad Days – a cloud kitchen delivery platform, announced its plans to expand its operations beyond Bangalore, Karnataka, by opening to three new clouds kitchens.

- In September 2022, Rebel Foods launched its virtual restaurant brand Firangi Bake specializing in flavored breads and bakes. This expands its portfolio into the bakery segment.

India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market Segmentation

- By Type

-

- Independent Cloud Kitchens

- Shared Kitchen Spaces

- Kitchen Pods

- By Product Type

-

- Fast Food

- Bakery Items

- Beverages

- Desserts

- Salads & Wraps

- Biryani & Rice Bowls

- Others (Pizzas, Burgers, Rolls)

- By Nature

-

- Franchised

- Standalone

- By Ordering Method

-

- Online Channels

- Offline Channels

- Hybrid Model

- By Cities

-

- Mumbai

- Delhi NCR

- Bengaluru

- Hyderabad

- Pune

- Chennai

- Others (Kolkata, Ahmedabad, etc)

Would you like to explore the option of buying individual sections of this report?

Monica Shevgan has 9+ years of experience in market research and business consulting driving client-centric product delivery of the Information and Communication Technology (ICT) team, enhancing client experiences, and shaping business strategy for optimal outcomes. Passionate about client success.

Frequently Asked Questions :

How big is the India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market?

The India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market is estimated to be valued at USD 740.21 in 2025 and is expected to reach USD 2066.90 Million by 2032.

What are the major factors driving the India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market growth?

Rising internet penetration, increasing demand for online food delivery, busy work schedules, convenience and easy availability of food, cost benefits for restaurants, innovative food offerings.

Which is the leading component segment in the India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market?

Independent/standalone cloud kitchens lead the India dark kitchens market owing to low infrastructure costs and easy scalability.

Which are the major players operating in the India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market?

Rebel Foods, Swiggy, Zomato, FreshMenu, Box8, EatFit, Faasos, Holachef, Biryani By Kilo, Licious, Foodpanda, InnerChef, UberEats, Oven Story, Hoi Foods, Eatonomist, Happy Eats, Box C, Curefoods Brands.

Which region will lead the India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market?

Asia Pacific is expected to lead the India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market.

What will be the CAGR of India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market?

The CAGR of India Dark Kitchens/Ghost Kitchens/Cloud Kitchens Market is expected to be around 38% from 2025-2032.