U.S. Fast Fashion Market Size - Analysis

The sector thrives on rapid product turnover, responding swiftly to changing consumer preferences. Fast fashion brands often leverage efficient supply chain management and global production networks to bring new styles to market at an accelerated pace. This approach has resonated with consumers seeking affordable and stylish clothing options.

Fast fashion refers to inexpensive, quickly-produced, on-trend clothing. It allows consumers to purchase the latest fashion trends at an affordable price. Fast fashion brands utilize their supply chain agility to get new styles in stores as quickly as possible. The fast turnaround enables more frequent updates to inventory and new collections. This satisfies consumer demand for something fresh and new.

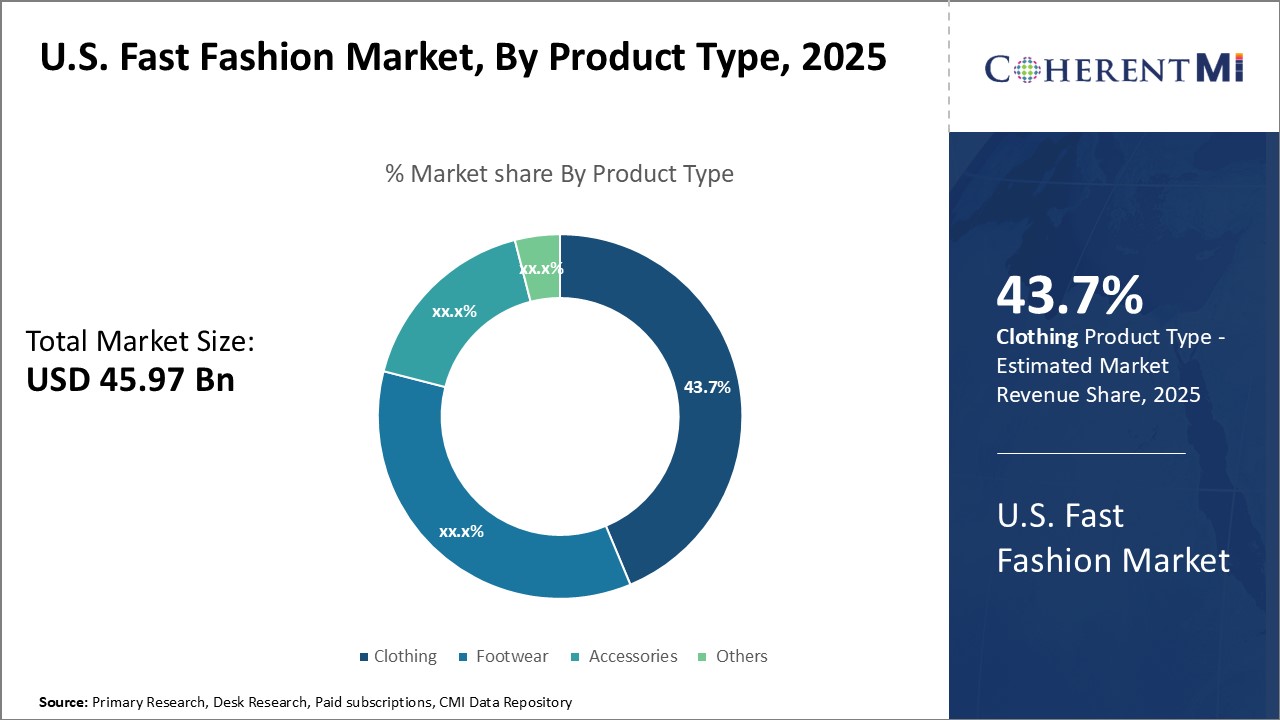

The U.S. Fast Fashion Market is segmented by product type, end-user, price range, and distribution channel. By product type, the clothing segment accounts for the largest share due to high demand for latest apparel designs and styles.

Market Size in USD Bn

CAGR5.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.7% |

| Larget Market | U.S. |

| Market Concentration | High |

| Major Players | River Island, Mango, Bershka, Missguided, New Look and Among Others |

please let us know !

U.S. Fast Fashion Market Trends

- Growing inclination towards sustainable fashion: Consumers, especially Gen Z and millennials are increasingly preferring sustainable clothing produced via ethical means. Top fast fashion brands are responding by launching eco-friendly lines made from organic fabrics, recycled textiles etc. H&M has a Conscious Collection of sustainable fashion. Zara’s Join Life Collection offers items made from eco-friendly fabrics. Adoption of sustainability helps address ecological concerns around fast fashion.

- Increasing usage of blockchain, AI and big data: Fast fashion retailers are leveraging technologies like blockchain, AI and big data to enhance supply chain transparency, forecast demand, track inventory and reduce waste. Zara is testing use of blockchain to track clothing origins. H&M uses AI for demand planning and price optimization. Tools like RFID tags, IoT sensors and machine learning enable data-driven decision making to react faster to trends. Technology integration makes supply chains smarter.

- Rising adoption of omni-channel shopping experiences: Retailers are providing seamless omni-channel experiences via integration of physical stores, ecommerce, mobile apps and social commerce. Customers expect flexible switching between channels. Features like click and collect, in-store returns of online purchases, virtual try-ons are gaining popularity. Providing personalized engagement and services across channels is crucial for customer satisfaction and retention.

- Increased focus on ethical labor practices: There is increasing focus on establishing ethical labor practices in fast fashion supply chains via better wages, working conditions and social compliance. Fashion retailers are being more transparent about their manufacturing processes. Technologies like blockchain allow tracing social compliance at each production stage. Adoption of ethical practices enables building trust and credibility among socially-aware consumers.

Segmental Analysis of U.S. Fast Fashion Market

Competitive overview of U.S. Fast Fashion Market

River Island, Mango, Bershka, Missguided, New Look, Fashion Nova, Shein, Romwe, PrettyLittleThing, Nasty Gal, Miss Pap, Boohoo, ASOS, H&M, Zara, Forever21, UNIQLO, Topshop, C&A, Primark

U.S. Fast Fashion Market Leaders

- River Island

- Mango

- Bershka

- Missguided

- New Look

U.S. Fast Fashion Market - Competitive Rivalry

U.S. Fast Fashion Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in U.S. Fast Fashion Market

- In March 2022, H&M launched a new sustainable denim line made from recycled and organic cotton called the Innovation Denim Collection. The line features distressed jeans, shorts, and jackets for women and men.

- In January 2021, Forever21 launched a new activewear line called Forever 21 Active. The collection includes leggings, bras, jackets and more in a variety of colors and prints.

- In April 2020, Zara launched an online only jewelry line called Zara Atelier filled with dramatic statement earrings, necklaces, and rings.

- In September 2021, UNIQLO partnered with tennis star Roger Federer to produce a new line of RF-branded sportswear including polo shirts and jackets.

- In June 2020, fast fashion e-tailer Boohoo acquired the British high street brands Oasis and Warehouse for £5.25 million expanding its portfolio.

U.S. Fast Fashion Market Segmentation

- By Product Type:

-

- Clothing, Footwear

- Accessories

- Others

- By End User:

-

- Men

- Women

- Unisex

- Kids

- By Price Range:

-

- Low

- Medium

- High

- By Distribution Channel:

-

- Online

- Company Outlets

- Multi-brand Stores

- Others

Would you like to explore the option of buying individual sections of this report?

Ankur Rai is a Research Consultant with over 5 years of experience in handling consulting and syndicated reports across diverse sectors. He manages consulting and market research projects centered on go-to-market strategy, opportunity analysis, competitive landscape, and market size estimation and forecasting. He also advises clients on identifying and targeting absolute opportunities to penetrate untapped markets.

Frequently Asked Questions :

How big is the U.S. Fast Fashion Market?

The U.S. Fast Fashion Market is estimated to be valued at USD 46.0 in 2025 and is expected to reach USD 67.8 Billion by 2032.

What are the major factors driving the U.S. Fast Fashion Market growth?

Increased online shopping adoption, rising disposable incomes, Desire for latest fashion trends, Growing youth population, Popularity of social media, Celebrity endorsements are the major factors driving the U.S. Fast Fashion Market

Which is the leading end user segment in the U.S. Fast Fashion Market?

The leading end user segment in the U.S. Fast Fashion Market is men which account for the major share.

Which are the major players operating in the U.S. Fast Fashion Market?

Major players in the U.S. Fast Fashion Market are River Island, Mango, Bershka, Missguided, New Look, Fashion Nova, Shein, Romwe, PrettyLittleThing, Nasty Gal, Miss Pap, Boohoo, ASOS, H&M, Zara, Forever21, UNIQLO, Topshop, C&A, Primark

What will be the CAGR of U.S. Fast Fashion Market?

The CAGR of the U.S. Fast Fashion Market is expected to be 5.7% from 2025 to 2032.

What are the drivers of the U.S. Fast Fashion Market?

Key drivers are rising online shopping, growing middle class, demand for latest trends, affordability, and celebrity/social media influence.