Industrial Bulk Packaging Market Trends

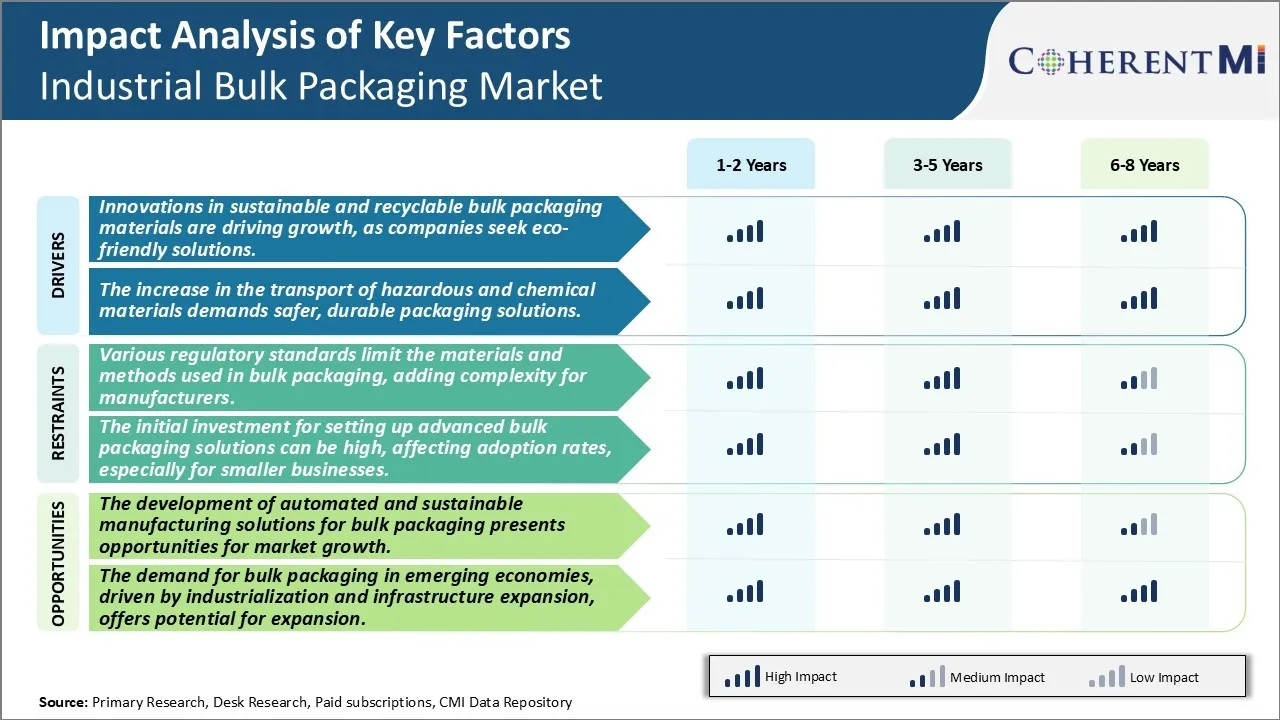

Market Driver - Innovations in Sustainable and Recyclable Bulk Packaging Materials are Driving Growth, as Companies Seek Eco-Friendly Solutions

With increase in environmental concerns globally, companies are constantly pushing boundaries to develop sustainable packaging solutions for transporting goods in bulk. There is a strong push towards reducing plastic waste and investing in renewable resources. Biodegradable packaging made from agricultural residues like bagasse, wheat straw and husk have shown promise. Such materials can be processed similar to plastics but are gentler on the environment. Given the push for sustainability goals and net zero commitments, many consumer brands and industrial manufacturers are actively seeking packaging supplies that have lower carbon footprint over the product life cycle.

Innovators are experimenting with novel material formulations derived from agricultural by-products and food processing residue. For example, one startup has developed bags for bulk transport of seeds, fertilizers etc. using fully biodegradable films made from corn starch and cassava. As these break down without harming soil quality or releasing greenhouse gases, they are gaining popularity among farm sector buyers. Likewise, researchers are working on composite mixes of recycled paper pulp and polylactic acid derived from sugarcane or corn. Such materials provide adequate strength for shipping large volumes while ensuring recyclability. Supported by government incentives and green procurement policies, adoption of renewable packaging alternatives is growing across industries like food processing, mining, construction etc.

Another notable shift is towards reusable and refillable systems that utilize standardized containers. Major automotive part makers have launched pooling programs where sturdy IBCs or bulk bags are leased and extensively used before retirement. By reducing single-use packaging, these programs help lower material consumption and disposal costs. Technological advances like smart sensors and IoT devices are enhancing traceability of reusable totes in transit. This boosts their reuse potential before repairs or replacement. Overall, innovations providing eco-packaging solutions tailored to quantity demands of key industrial segments are fueling growth in the bulk packaging market.

Market Driver - The Increase in The Transport of Hazardous and Chemical Materials Demands Safer, Durable Packaging Solutions

With growing complexities in global supply chains, long distance shipments of hazardous materials have become commonplace. From chemicals and industrial gases to nuclear waste and minerals, a range of dangerous goods require specialized packaging to maintain safety standards. However, existing containment solutions have limitations regarding strength, leak resistance and damage tolerance under extreme conditions. Recognizing the stringent performance needs, packaging innovators are developing advanced material formulations and designs optimized for hazardous cargo transport.

One notable technology gaining ground is high-barrier multilayer plastics incorporating nanoclay particles. When nanoclays are interleaved between polymer sheets, their uneven edges and high aspect ratio act as absorption sites for contaminants while reinforcing structural integrity. Manufacturers are utilizing such nanocomposite formulations to produce IBCs, drums and bulk bags exhibiting high impermeability to liquids and gases even after impacts or cuts. Similarly, composites of specialty fibers like aramid, ultra-high molecular weight polyethylene and glass woven with epoxy resins result in packaging with unmatched puncture and cut resistance even in presence of aggressive chemicals.

Adoption of strong but lightweight composite structures has also enabled the use of reusable bulk containers for multiple shipment cycles. Advanced condition monitoring allows detecting even minute defects so that repairs can be scheduled well in advance. Telematics solutions provide real-time tracking of containers along with environmental data on exposure to temperature fluctuations, pressure changes and vibrations. This helps assess maintenance needs and validate conformance to transportation regulations over extended usage periods. As hazardous cargo transportation becomes more complex globally, demand for super-durable and smart packaging will continue to intensify in the coming years.

Market Challenge - Various Regulatory Standards Limit the Materials and Methods Used in Bulk Packaging, Adding Complexity for Manufacturers

Various regulatory standards limit the materials and methods used in bulk packaging, adding complexity for manufacturers. Different jurisdictions impose different restrictions on acceptable materials for dry and liquid products, as well as barrier requirements and closure specifications designed to ensure safety and product integrity during transport. Complying with these standards involves significant research and testing for packaging designers to ensure their solutions meet all applicable rules. Additionally, standards are constantly evolving as new research highlights different environmental or health impacts. This forces manufacturers to continually monitor changes and update their product designs proactively to maintain compliance. The scale of the bulk packaging industry means even minor adjustments can involve lengthy requalification procedures across supply chains. Such regulatory hurdles increase business costs for stakeholders and make it harder to expand into new markets or rapidly commercialize innovative packaging technologies. However, protecting public safety and the environment remains important, placing regulatory authorities in a difficult position of balancing these priorities with commercial interests.

Market Opportunity - Automated Manufacturing Creates an Opportunity for Market Growth

The development of automated and sustainable manufacturing solutions for bulk packaging presents opportunities for market growth. Adapting production lines with robotics and digital fabrication equipment allows standardized components to be mass-produced more efficiently. This leads to lower unit costs while maintaining stringent quality control. Automation further supports customization at scale through flexible modular design and on-demand printing/assembly techniques. Digitally managing fabrication data also enables easier regulatory compliance reporting. Meanwhile, the use of recycled/recyclable materials in automated manufacturing supports trends toward Circular Economy business models and packaging ecologically fit for a low-carbon future. Developing cost-effective and scalable automation serves bulk packaging producers, product brand owners, and other supply chain actors through competitive pricing, fast design iteration, and sustainability benefits. It positions the industry for continued long-term growth addressing demands across numerous markets like chemicals, food and agriculture which rely on solutions for efficient bulk transport and storage in line with environmental protection goals.