Industrial Valves Market Trends

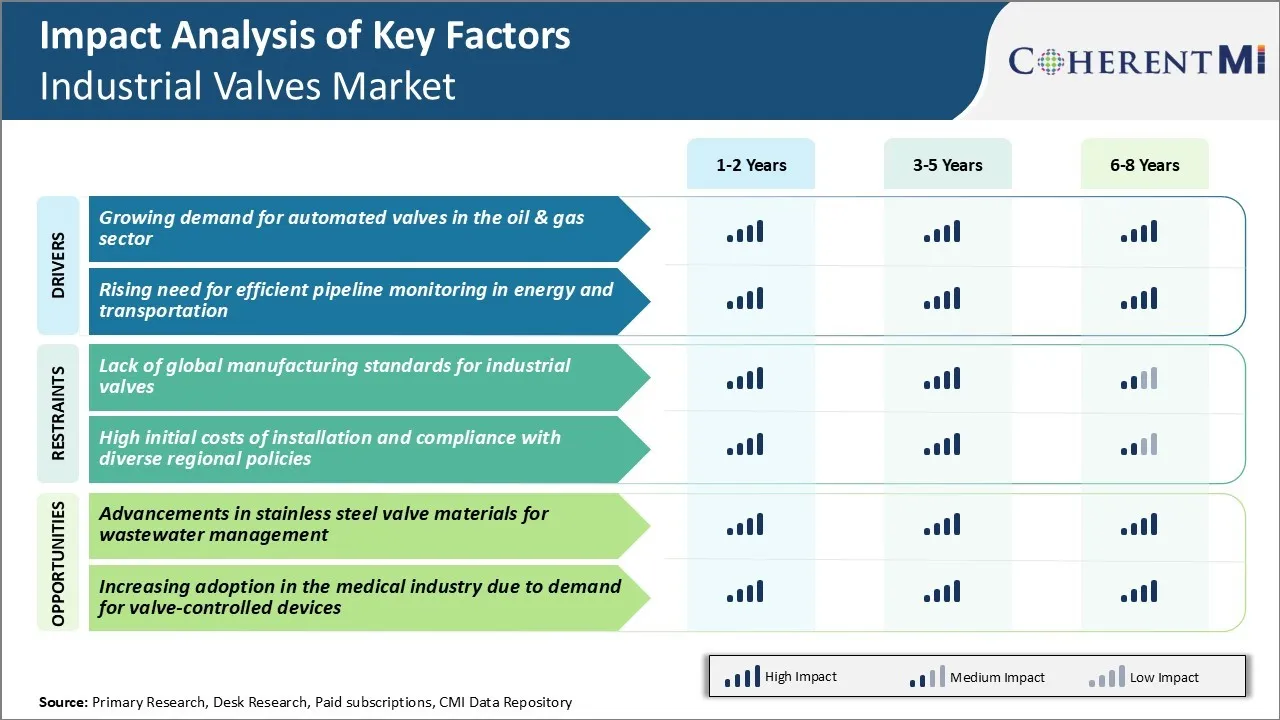

Market Driver - Growing Demand for Automated Valves in the Oil & Gas Sector

The oil and gas industry has been increasingly adopting automated valves in their production processes to enhance operational efficiency. With advances in valve actuation and control technologies, oil and gas companies are able to remotely monitor and operate their industrial valve infrastructure from centralized control rooms.

A major benefit of automated industrial valves is that they increase uptime of production equipment. The valves are programmed to open and close autonomously based on predefined setpoints without any delay. Oil and gas operators are realizing higher returns on investment through better utilization of expensive refining and pipeline assets with automated valve technology.

Rising adoption of digital transformation initiatives across the sector is another key factor driving increased demand. Players in the industrial valves market are increasingly leveraging IoT, analytics, and artificial intelligence to remotely monitor and diagnostic the performance of field equipment. This will shape new trends in the market in the coming years.

Market Driver - Rising Need for Efficient Pipeline Monitoring in Energy and Transportation

With growing pipeline networks transporting oil, gas and other critical fluids, the need for stringent monitoring of pipeline infrastructure has risen significantly. Undetected leakages or pressure variations can disrupt supplies and also lead to safety and environmental hazards.

‘Intelligent valves' can continuously track parameters like flow, pressure, temperature, and detect any anomalies. They autonomously alert control rooms in case pre-set thresholds are exceeded. This allows prompt isolation of pipeline sections for repairs or maintenance before small faults escalate into major damage. Industrial valves are also programmed to close automatically in an emergency shutdown scenario like a large rupture.

Adoption of such smart valves is growing across various pipeline applications. For natural gas distribution, utilities are deploying them within their networks to accurately meter and curtail gas supplies during high demand periods or emergencies. This ensures continuity of supply to high-priority consumer segments like power plants. Overall, efficient pipeline monitoring through automated control valves is enabling higher network reliability in diverse energy transportation infrastructure.

Market Challenge - Lack of Global Manufacturing Standards for Industrial Valves

The industrial valves market faces significant challenges due to a lack of global manufacturing standards. While there are some regional standards organizations, such as the American Petroleum Institute in North America, there is no single comprehensive set of standards that are adopted worldwide. This leads to inconsistencies in specifications between geographic regions.

Industrial valves market players must tailor their products to meet the requirements of each individual market, raising costs and complexity compared to a unified standard. It also causes compatibility issues when facilities seek to procure valves from global suppliers or integrate valves into multinational systems. The lack of standardized dimensions, materials, testing protocols and markings increases the risk of performance, reliability and safety issues over the lifetime of the valves. The

The development of a set of universal valve standards could help address these challenges by simplifying certification, improving product interchangeability and creating a more seamless global marketplace. However, gaining industry consensus on standardized requirements continues to be an obstacle due to diverging regional practices and vested interests.

Market Opportunity - Advancements in Stainless Steel Valve Materials for Wastewater Management

Significant opportunities exist for industrial valve suppliers in the wastewater management industry driven by advancements in stainless steel materials. Treated wastewater is increasingly being reused for industrial processes and agricultural irrigation due to growing water scarcity. This is accelerating demand for corrosion-resistant valves capable of handling higher concentrations of chemicals, salts, and bacteria in reclaimed water applications.

Leading industrial valve manufacturers have developed innovative stainless steel alloys with improved chromium-nickel compositions that provide unmatched resistance to corrosion, pressure, temperature, and abrasion. When combined with premium surface finishes, tight tolerances and automated passivation treatments, these new stainless materials enable valves to achieve significantly longer lifespans of 15-20 years even under highly demanding operating conditions.

Looking ahead, continued materials innovation is expected to further expand the suitability of stainless valves into newer application areas in the industrial valves market.