産業車両市場 サイズ - 分析

グローバル・インダストリアル・カー・マーケットは、 米ドル 41.7 ベン に 2024 そして到達する予定 米ドル 65.6 によって 2031、混合の年次成長率で育つ (CAGR) 2024年~2031年

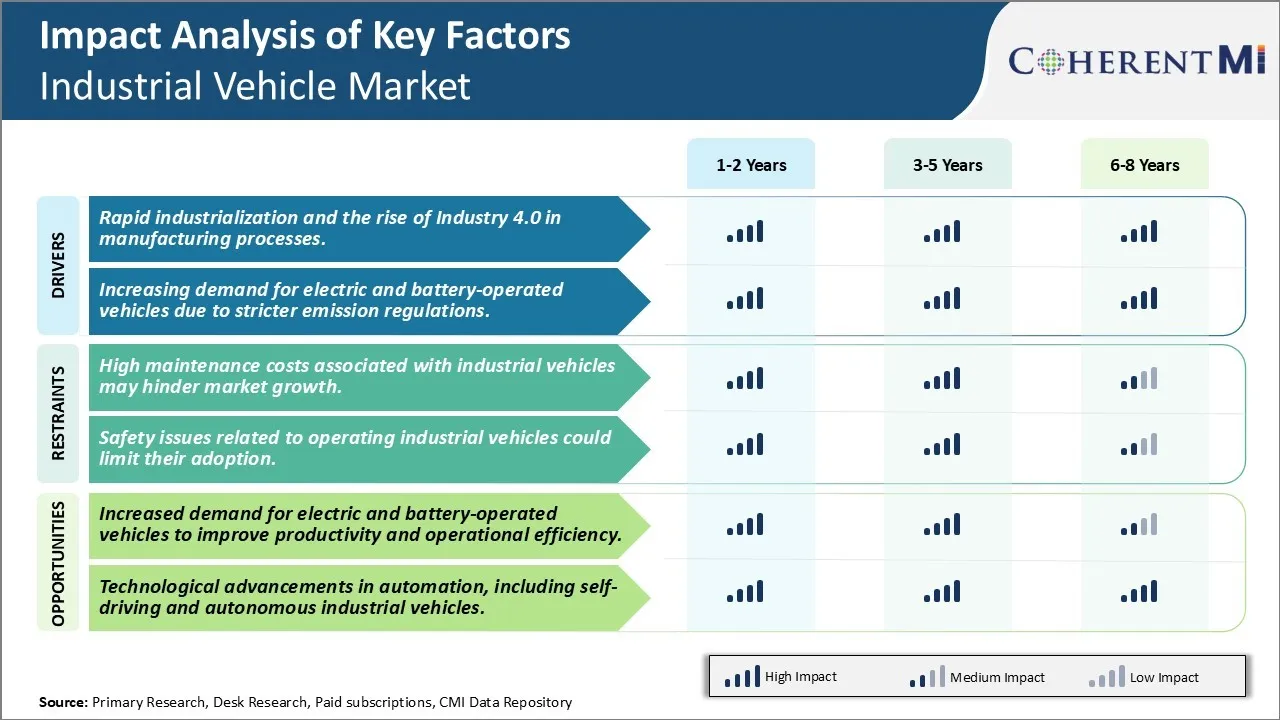

産業車両市場は、過去数年間に前向きな成長傾向を目撃してきました。 業界全体の材料処理のための急速な産業化および成長の必要性のような要因は産業車のための要求を高めました。 また、製造および倉庫設備の自動化を増加させ、自動ガイド車および牽引トラクターの使用を増強しました。 eコマースや自動車業界を成長させることで、今後数年で産業車両の需要が高まります。 しかし、高い初期投資は市場成長を妨げる可能性がある。 全体的に、産業用車両市場は、車両の自動化と接続における技術の進歩と有利な機会を提供することが期待されます。

市場規模(米ドル) Bn

CAGR4.8%

| 調査期間 | 2025-2032 |

| 推定の基準年 | 2024 |

| CAGR | 4.8% |

| 市場集中度 | High |

| 主要プレーヤー | 安徽ヘリ株式会社, クラウン機器株式会社, ハンチャフォークリフト, ハイスターエール素材の取扱い, ユンヘインリッチAG その他 |

お知らせください!

産業車両市場 トレンド

市場ドライバ - 厳格な排出規制による電気および電池式車両の需要の増加

環境意識の高まりに伴い、産業車両や商用車向けの厳しい排出規範を導入しています。 規制機関は、屋内生産施設、倉庫、物流公園内で使用される燃料ベースの車両から有毒な排出量を治すことに特に焦点を合わせています。 主に内部燃焼エンジンからの排気には、炭酸ガス、酸化窒素、粒子状物質などの有害ガスが含まれているためです。 このような排出に対する継続的な暴露は、深刻な健康リスクをポーズします。

排出規制を締めるのを見ると、産業車両メーカーはより環境に優しい代替品を開発しています。 すべての電気および雑種の電気自動車は従来の使用されたディーゼルかガソリン車への実行可能な取り替えとして見られます。 燃料エンジンを電動モーターに交換することで、閉場空間内のゼロテールパイプ排出を保証します。 内部燃焼エンジンを発生させる騒音に対してもサイレント操作が優先されます。

バッテリー技術は急速に進んでおり、電気自動車が1回の充電でより長い運転範囲を達成するのに役立ちます。 新しい世代の電動トラックおよびフォークリフトで利用される高度のリチウム イオン電池はガソリン カウンターパートに匹敵する強力な性能を提供します。 さらに、高速充電インフラとの互換性は、古いバッテリーバージョンに関連する限られた運転範囲の問題に対処します。 実際の産業用途向けに、電気自動車の実用性を向上します。

製造業者間の環境の感度を高めて、グリーンフリートのアップグレードプログラムに傾斜させます。 電動車両は、カーボンフットプリントを削減し、操業コストを削減し、燃料やメンテナンスを長期的に節約できます。 電気商用車のための補助金やインセンティブの可用性を高めることで、その採用はさらに加速されます。 電池式の産業輸送のオーガーのための好みは電気自動車の企業のためによく、肯定的に関連した市場成長に影響を与えます。 排出規範の順守に関する厳格な法則は、今後この技術のシフトを継続します。

市場機会 - 生産性と運用効率を向上させるために、電気およびバッテリー駆動車に対する需要の増加

電気自動車やバッテリー駆動の産業用車両に成長する市場機会があります。 増加するエネルギーコスト、厳しい排出規範、生産性および効率性検討などの要因によって駆動される多くの会社は、倉庫および物流業務のための電気自動車を積極的に探しています。 電動産業用車両には、汚染物質を排出しないため、より環境にやさしい利点があります。 パワーを要求する電気が長い操業のディーゼルより安いので、それらはまたより多くのエネルギー効率です。 最も重要なのは、電気自動車は、労働力の生産性を向上させます。 静かな操作で、騒音制限なしで複数のシフトで集中的に使用できます。 自動関数は手動レバーを取り替え、より容易で、より速い操作を可能にします。 艦隊のマネージャーは密接に電池の状態を監視し、要求をリモートで満たすことができます。 全体的に、電気車はディーゼルまたはガスの変形上の最大20%の高い生産性を持っています。 輸送コストと労務コストにプラスの影響力が向上しました。 連続技術により、早期電気自動車の性能制限がなくなりました。 製造業者が範囲の不安の問題に対処し、電池の価格をさらに引き出すことができれば、産業電気自動車の市場は今後数年で指数関数的な成長のためにpoised。

主要プレーヤーが採用した主な勝利戦略 産業車両市場

革新および新製品の開発に焦点を合わせて下さい: トヨタ、キオングループ、Jungheinrichなどの企業は、常に進化する顧客ニーズに応えるために新製品を革新し導入することで、大きな成功を収めています。 例えば、2018年のトヨタでは、オペレータの訓練を容易にするためにTugの二重制御車を開始しました。 この革新的な製品は、トヨタが新しい顧客をキャプチャし、そのリーダーシップポジションを強化するのを助けました。

市場拡大のための戦略的買収: 大手のプレイヤーは、戦略的買収による市場シェアと能力を拡大します。 2019年、Kion Groupがデマティックを買収し、物流オートメーションソリューションポートフォリオを強化 この買収により、多様な業界を横断する顧客に対して、自動ガイド付き車両システムとソフトウェアを統合し提供できるようになりました。 Kion は、フォークリフトを超えてオートメーションの新しい成長領域を拡大するのを助けました。

強いアフター・マーケットの焦点およびサービス サポート: アフターマーケットの収益は、トップとボトムラインに大きく貢献します。 三菱ロジネクストのような企業は、ディーラーネットワークやサービス/メンテナンス契約に大きく投資し、強力なアフターマーケットサポートを保証します。 2020年度は、三菱のアフターマーケット売上が4.2%を上回るパンデミックにおいても優れたサービスサポートに成長しました。 アフターマーケットの焦点は、顧客の粘着と再発収益を達成しました。

カスタマイズされたプロダクトおよびデジタル解決: プレーヤーのtailorプロダクト、また特定の企業および適用必要性にカスタマイズされたデジタル/IoTの解決を提供して下さい。 Jungheinrichの倉庫管理ソフトウェアおよびデータ分析により、小売大手DHLが生産性を30%向上させることができました。 そのようなカスタマイズ、デジタル対応の製品は、業界を横断する大艦隊の顧客を獲得するのに役立ちます。

上記の例では、継続的なイノベーション、戦略的M&A、強力なアフターマーケットの焦点とカスタマイズされたデジタルソリューションが、産業車両のリーダーが競争優位性を獲得し、過去5年間で市場成長を上回るのに役立ちます。 データバックインスタンスは、重要な勝ち戦略の実質的な影響を示しています。

セグメント分析 産業車両市場

Insights、Autonomyのレベル、non/Semi-autoのドライバー セグメントは機能性 オートメーション

Autonomy のレベルでは、非半自動セグメントは、2024 年に 64.2% の貢献を期待しています。オペレータは、非常に自動化されたバリアントよりも中核産業業務のための機能的な車両を好むからです。 なし/ 半自動運転車は精密な運行を要求する工場環境の信頼性そして安全の貨物を扱うように造られます。 シンプルな設計は、屋内/専用ルートで不要な自動運転機能上の商品やスタッフを輸送するための機能性を優先します。 また、非自動運転車は、自動変異体と比較して、規制や安全検証を少なくします。 パイロットレス車は、リモートコントロールのための機会を提供していますが、ほとんどの産業用アプリケーションは、オンボードのオペレータに依存して、監督と柔軟性を提供します。 なし/ セミオートノマイズ車なので、工場敷地内では、技術的に複雑なオートノマイズバリアントと比較して、繰り返し、スケジュールされた輸送ニーズのためにより有効になります。

追加の洞察 産業車両市場

産業用車両市場は、産業化、業界4.0の上昇、および自動化の増加により、安定した成長を遂げています。 現在、中国、日本、インドなどの国で急激な産業成長を遂げるアジア・パシフィックは、現在最大の市場です。 北米は、主に産業オートメーションの技術的進歩とサプライチェーン管理の精度を必要とする電子商取引の拡大のために重要な成長を目撃する予定です。 フォークリフト、リフトトラック、電気自動車などの産業車両は、倉庫、製造工場、物流ハブで広く使用され、効率性を向上させます。 市場はより低い排出およびよりよいエネルギー効率による電池作動させた車のための増加された要求によって更に運転されます。 これらの車両は、特に排出制御規制が厳しい地域で牽引されています。 全体的には、技術の発展と産業オートメーションの向上による継続的な成長が見込まれる。

競合の概要 産業車両市場

産業車両市場における主要なプレーヤーは、Anhui Heli Co. Ltd.、Crown Equipment Corporation、Hangchaフォークリフト、Hyster-Yale材料処理、Jungheinrich AG、Kion Group AG、トヨタ産業株式会社、ドオサン株式会社、三菱重工業、株式会社、ヒュンダイ建設機器、Polaris Inc.、SSI SCHAEFER、Ros Electric Vehicles、Daifuku、Taylor-Dunnなどがあります。

産業車両市場 リーダー

- 安徽ヘリ株式会社

- クラウン機器株式会社

- ハンチャフォークリフト

- ハイスターエール素材の取扱い

- ユンヘインリッチAG

産業車両市場 - 競合関係

産業車両市場

(大手プレーヤーが支配)

(多くのプレーヤーが参入し、競争が激しい。)

最近の動向 産業車両市場

- 2024年3月、カルマー(Cargotecの一部)は、オーストラリアのIntermodal Terminal Companyに6つの電動リーチスタッカーと2つの電動空のコンテナハンドラを提供し、メルボルンのSomerton Intermodalターミナルをサポートしています。

- 2023年9月、ハングチャは、リチウムE-Trucksの使用による材料処理のブレークスルーを表す小スペースで例外的な操縦性を提供する3ピボットXCモデルを発表しました。

産業車両市場 セグメンテーション

- ドライブタイプ別

- インフォメーション

- 電池操作

- ガス供給

- Autonomyのレベルによって

- ノン・セミオートノムース

- オートモーティブ

- 用途別

- 製造業

- ウォーハスイング

- 貨物・物流

- その他

購入オプションを検討しますか?このレポートの個々のセクション?

Gautam Mahajan は、市場調査とコンサルティングで 5 年以上の経験を持つリサーチ コンサルタントです。市場エンジニアリング、市場動向、競合状況、技術開発の分析に優れています。一次調査と二次調査の両方、およびさまざまな分野にわたる戦略コンサルティングを専門としています。

よくある質問 :

産業用車両市場はどれくらいの大きさですか?

グローバル・インダストリアル・車両市場は、USD 41.7で評価される 2024年のBnはUSD 65.6に達すると予想される によって 2031.

産業用車両市場のCATGとは?

2024年~2031年にかけて、産業車両市場のCAGRが4.6%となる見込みです。

産業用車両市場成長の大きな要因は何ですか?

製造業プロセスにおける業界 4.0 の急速な産業化と、厳しい排出規制による電気および電池式車両の需要の増加は、産業車両市場を牽引する主要な要因です。

産業車両市場の成長を妨げる重要な要因は何ですか?

産業用車両に関連する高いメンテナンスコストは、産業車両に関連する市場成長と安全の問題を妨げる可能性があるため、その採用を制限することは、産業車両市場の成長を妨げる主要な要因です。

産業用車両市場におけるドライブの種類は?

ICE は主導型セグメントです。

産業車両市場における主要な選手は?

安徽ヘリ株式会社、クラウン機器株式会社、ハングチャフォークリフト、ハイスターエールマテリアルハンドリング、Jungheinrich AG、Kion Group AG、トヨタインダストリーズ株式会社、ドオサン株式会社、三菱重工株式会社、ヒュンダイ建設機械、ポラリス株式会社、SSI SCHAEFER、Ros Electric Vehicles、大福、テイラーダンは主要選手です。