Inflammatory Pain Therapeutic Market Size - Analysis

The inflammatory pain therapeutic market is estimated to be valued at USD 5.05 billion in 2025 and is expected to reach USD 7.59 billion by 2032, growing at a compound annual growth rate (CAGR) of 6.00% from 2025 to 2032.

There has been consistent rise in use of prescription drugs to manage inflammatory pain indicating growth in awareness and healthcare spending, which is driving the market growth.

Market Size in USD Bn

CAGR6.00%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.00% |

| Market Concentration | High |

| Major Players | Pfizer Inc., Roche Holding AG, Novartis AG, Johnson & Johnson, Merck & Co., Inc. and Among Others |

please let us know !

Inflammatory Pain Therapeutic Market Trends

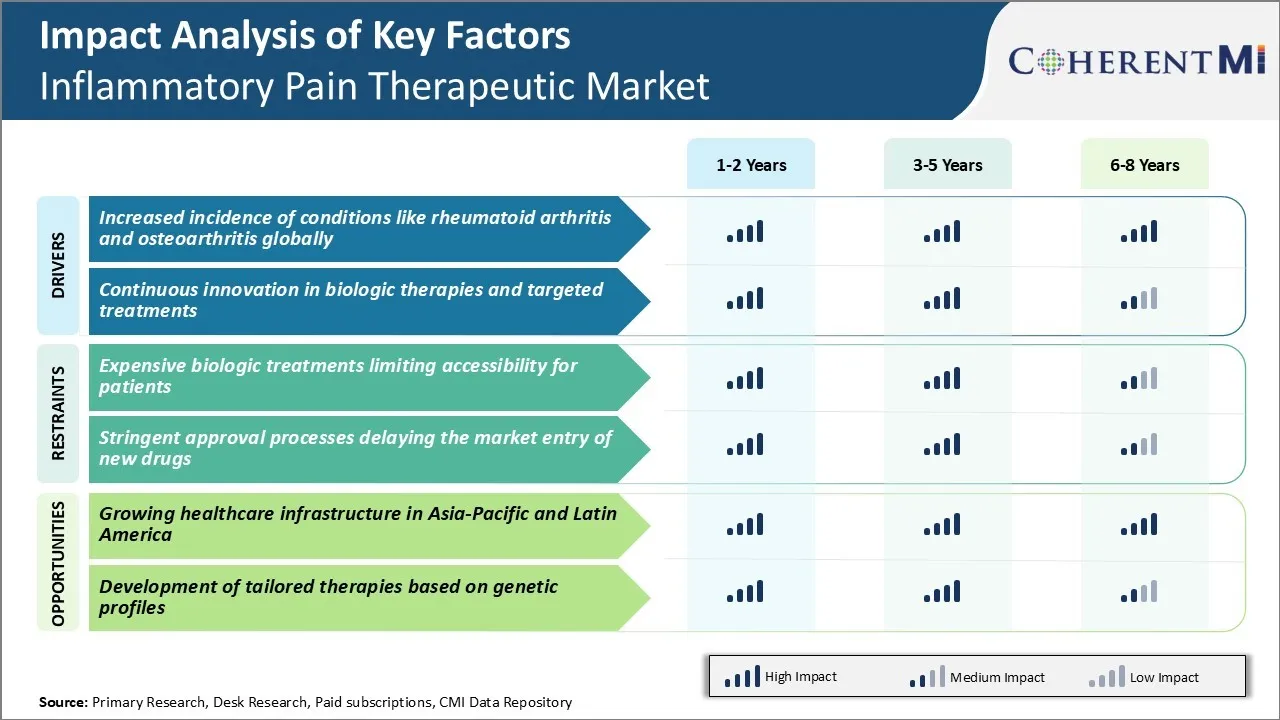

Market Driver - Increased Incidence of Conditions Like Rheumatoid Arthritis and Osteoarthritis Globally

According to the estimates, osteoarthritis currently affects over 300 million people globally and is expected to become the fourth leading cause of disability by 2050. The risks are increasing mainly due to the growing geriatric population who are more vulnerable to degenerative joint changes with age.

Similarly, around 1% of the worldwide population or roughly 58 million people live with rheumatoid arthritis presently. It impacts women nearly three times as frequently as men. While predominantly a disease of the elderly, incidence is even rising among younger age-groups in recent decades. Industrially developed nations too have witnessed a small but significant climb in diagnosis rates which could relate to environmental factors playing a role alongside genetic components.

With joint conditions gaining prevalence, the need for improved pain relief medications also grows stronger. Conventional medicines like paracetamol or NSAIDS may provide some relief but often come with side-effects after prolonged usage. This has driven research into newer therapeutics classes targeting specific inflammatory pathways in the body. A rising diagnosis pool implies greater utilization of advanced treatment lines as well for managing persistent symptoms associated with osteoarthritis and rheumatoid arthritis.

Market Driver - Continuous Innovation in Biologic Therapies and Targeted Treatments

Another major aspect supporting growth in the inflammatory pain therapeutics field is continuous innovation around newer biologic agents and targeting specific pathophysiology. After initial success with TNF inhibitors in rheumatoid arthritis, the focus has expanded to developing sophisticated therapies acting via alternative mechanisms of action.

Scientists today have a deeper understanding of how specific inflammatory cytokines and molecules contribute to the onset and progression of conditions like osteoarthritis and rheumatoid arthritis. Drugs blocking interleukins like IL-6 and IL-1β are a few examples. Similarly, cell-signaling pathways like JAK/STAT and MAPK are being increasingly studied as prospective targets with promising early results observed.

Advancement in protein engineering and immunogenicity enhancing technologies as well have opened up new opportunities. Better production techniques help manufacture biologics of higher purity, stability and safety. Delivery methods are designed for maximum comfort of self-administration through modes like pre-filled pens and patch pumps.

Combination therapies leveraging biologics with Janus kinase inhibitors, biosimilars or other classes are another developing concept. Such synergies hold hope of achieving superior outcomes through complementary mechanisms with lower doses. An enriched product pipeline therefore exists, ranging from improved generations of existing blockbuster drugs to entirely new modalities like gene therapies.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Expensive Biologic Treatments Limiting Accessibility for Patients

One of the key challenges faced by the inflammatory pain therapeutic market is the high cost of biologic treatments which limits their accessibility to a large number of patients who need them. Biologics such as tumor necrosis factor (TNF) inhibitors have revolutionized the treatment of chronic inflammatory conditions like rheumatoid arthritis.

However, the development and manufacturing costs associated with biologics makes them much more expensive than traditional small-molecule drugs. The average annual cost of biologic treatment ranges anywhere between $20,000 to $50,000 per patient. This heavy financial burden makes biologics unaffordable for many patients, especially those who are underinsured or uninsured.

The high costs of biologics also put strain on public and private healthcare budgets. Unless more affordable biosimilar and subsequent entry biologics enter the inflammatory pain therapeutic market to increase treatment options and drive down prices, a huge patient population will continue to remain deprived of this important class of drugs due to economic constraints.

To improve accessibility, pharmaceutical companies need to focus on the development of more cost-effective biologics and payment models that make treatment affordable for one and all.

Opportunity: Growing Healthcare Infrastructure in Asia-Pacific and Latin America

The inflammatory pain therapeutic market has strong growth opportunities in emerging regions due to rising healthcare infrastructure and expenditure in these parts of the world. Asia-Pacific and Latin America are two regions that have witnessed accelerated economic development in the last few decades.

As incomes rise, governments in these regions have started allocating greater portions of their budgets towards improving public healthcare services. Major investments have been made to build new hospitals and clinics, train medical professionals, and expand health insurance coverage to reach more people. This expanding healthcare infrastructure has increased patients' access to modern medicines and treatments for various chronic conditions.

As awareness about inflammatory diseases like rheumatoid arthritis grows and more people get incorporated into the formal healthcare system, the demand for innovative pain medications like biologics is expected to surge rapidly across Asia-Pacific and Latin American countries. The potential of the inflammatory pain therapeutic market presented by these emerging pharma hubs makes them lucrative regions for global drug manufacturers to focus their business expansion strategies on.

Increased commercial activities will further propel the development of healthcare services in these parts of the world, benefiting patients.

Prescribers preferences of Inflammatory Pain Therapeutic Market

Inflammatory pain is usually treated via a step-care approach. For mild cases, prescribers typically recommend over-the-counter NSAIDs like ibuprofen (Advil) or naproxen (Aleve) as the first-line treatment. However, if severe pain persists, providers will often switch patients to prescription-strength NSAIDs such as diclofenac (Voltaren) or meloxicam (Mobic).

For moderate to severe inflammatory pain, prescribers commonly prescribe weak opioids plus NSAIDs as the second-line treatment. Tramadol (Ultram) is a frequently recommended option that provides pain relief without as high of an addiction risk as other opioids. Some prescribers also add topical NSAIDs like diclofenac gel (Voltaren) for localized joint pain.

If pain still isn't well managed, prescribers may choose disease-modifying anti-rheumatic drugs (DMARDs) as the third-line treatment. Methotrexate is commonly prescribed due to its dual anti-inflammatory and immune-modulating effects. For those with inadequate responses, biologic DMARDs may be prescribed, such as tumor necrosis factor (TNF) inhibitors like etanercept (Enbrel) or infliximab (Remicade).

Prescriber preferences are also influenced by patients' other conditions, insurance coverage, relative cost and side effect profiles of the different medications available at each line of treatment. This step-care framework aims to balance efficacy and safety based on the individual patient's disease severity and risk factors.

Treatment Option Analysis of Inflammatory Pain Therapeutic Market

Inflammatory pain can range from mild to severe depending on the stage of the disease. Treatment options vary based on the severity and progression.

In the early mild stages, over-the-counter medications like ibuprofen (Advil) and naproxen (Aleve) may help reduce inflammation and pain. For moderate symptoms, prescription-strength NSAIDs (nonsteroidal anti-inflammatory drugs) are commonly used. Celecoxib (Celebrex) and diclofenac (Voltaren) are common oral NSAID options that target pain and swelling. Topical NSAIDs applied to the skin can also provide relief.

For those experiencing more severe, persistent inflammatory pain, additional treatment is needed. DMARDs (disease-modifying antirheumatic drugs) are frequently prescribed. Methotrexate is a first-line DMARD that suppresses the immune system response causing pain and damage. Hydroxychloroquine (Plaquenil) is also used early on.

If symptoms are not adequately controlled, biologics may be introduced. These injectable or infusible drugs like etanercept (Enbrel), adalimumab (Humira), and tocilizumab (Actemra) specifically target inflammation pathways. While more expensive than other options, biologics can achieve remission for many by blocking TNF-alpha or IL-6 receptor activity.

Later stage disease may lead to joint damage requiring surgical remedies. Cortisone injections directly into painful areas provide short-term relief. As a last resort, joint replacement can resolve end-stage joint destruction.

Key winning strategies adopted by key players of Inflammatory Pain Therapeutic Market

Focus on innovative product development - Developing innovative and novel drugs has been a crucial strategy for companies to gain an edge in this market. For example, in 2019, Eli Lilly received FDA approval for its new drug Olumiant (baricitinib), which is the first FDA-approved treatment for adults with moderate to severe atopic dermatitis.

Acquisitions and partnerships - Companies are focusing on acquiring and partnering with other players having complementary pipelines and technologies. For instance, in 2020, Pfizer acquired Arena Pharmaceuticals to gain access to its pipeline of innovative potential therapies for inflammatory intestinal diseases. This strengthened Pfizer's GI portfolio.

Geographic expansion - Leading players have adopted strategies to expand their commercial footprint in high-growth emerging markets like Asia Pacific and Latin America. For instance, in 2019 Abbott Laboratories received approval to market Humira in China, expanding access for patients with immune-mediated inflammatory diseases. This helped Abbott gain a foothold in one of the largest pharmaceutical markets.

Focus on real-world evidence generation - Companies are generating extensive real-world evidence on the effectiveness and safety profiles of their drugs. For example, Pfizer generated RWE on Xeljanz through its CORRONA registry, which helped reinforce its efficacy and safety in approved indications and aided approvals in new areas like ulcerative colitis.

Segmental Analysis of Inflammatory Pain Therapeutic Market

To learn more about this report, Download Free Sample Copy

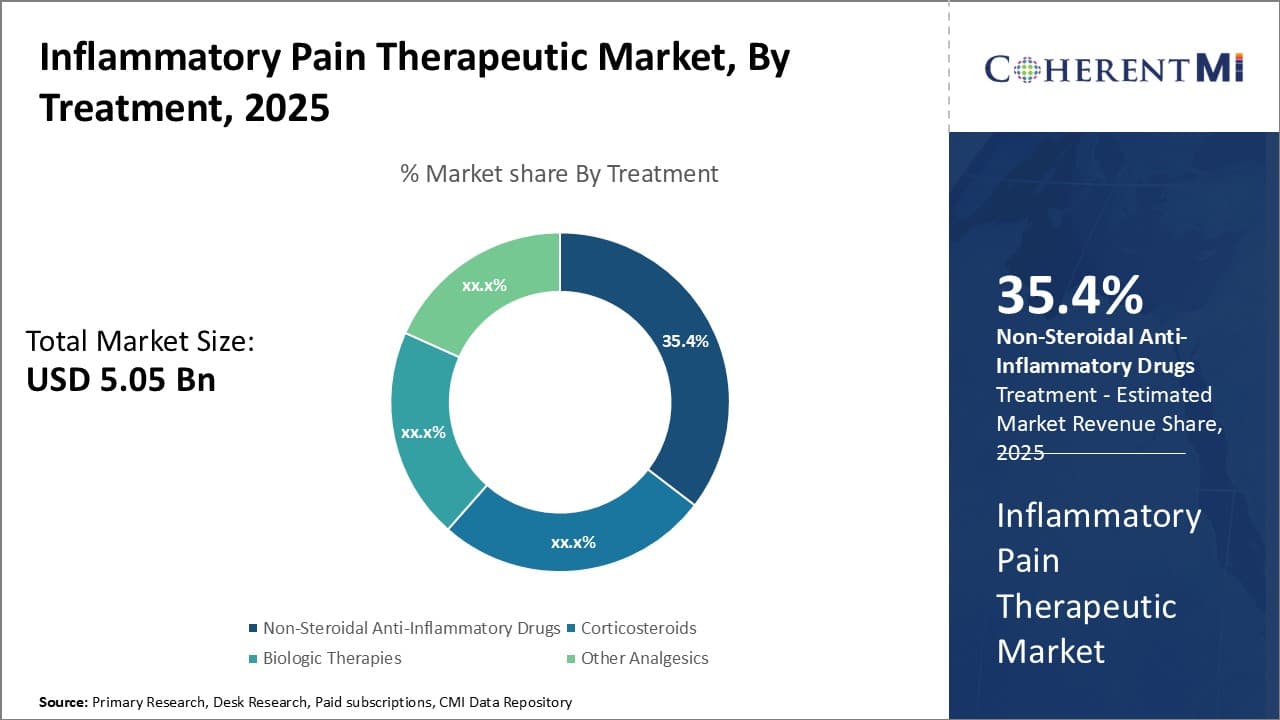

Insights, By Treatment: Pain Management Options Drive Growth of NSAIDs Segment

To learn more about this report, Download Free Sample Copy

Insights, By Treatment: Pain Management Options Drive Growth of NSAIDs Segment

In terms of treatment, Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) contributes the highest share of the inflammatory pain therapeutic market owning to their widespread adoption as a front-line therapy for pain management. NSAIDs are widely prescribed drugs used to treat various inflammatory and degenerative conditions.

The ability of NSAIDs to provide relief from mild-to-moderate pain with an acceptable safety profile makes them an accessible and low-cost option for managing conditions like arthritis, musculoskeletal disorders and postoperative pain. NSAIDs work by blockingcyclooxygenase (COX) enzymes and inhibiting prostaglandin production, thereby reducing inflammation and associated pain.

The market is dominated by generic versions of various NSAIDs which are affordable for a majority of patients. Other factors boosting the uptake of NSAIDs include increasing awareness about the importance of prompt pain management, growing geriatric population vulnerable to arthritis, promotional activities by pharmaceutical companies marketing NSAIDs, and rising emphasis on self-care. This makes NSAIDs an integral part of the standard treatment regimens in inflammatory conditions.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

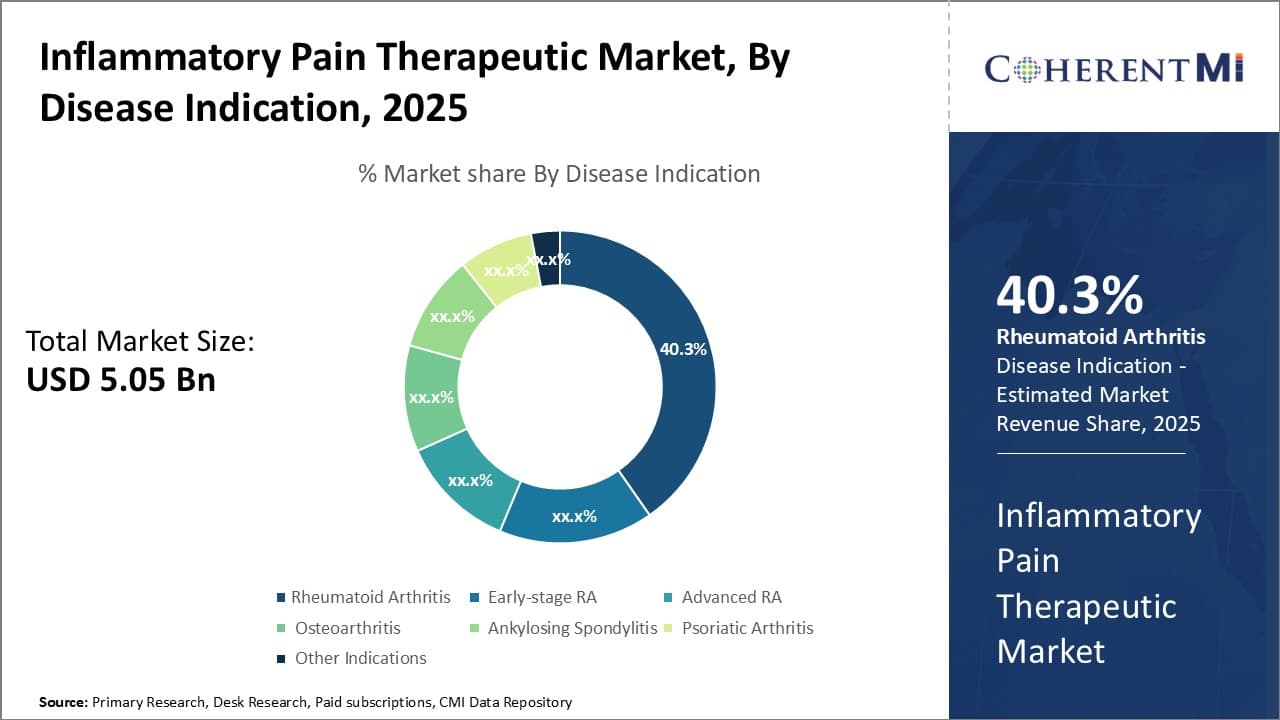

Insights, By Disease Indication: Rheumatoid Arthritis Suffers Drive Strong Demand for Targeted Therapies

In terms of disease indication, rheumatoid arthritis contributes the highest share of the inflammatory pain therapeutic market owing to the large patient pool and need for effective long-term treatment options. Rheumatoid arthritis is a chronic systemic inflammatory condition involving persistent symmetrical joint swelling and pain.

The advanced stages of RA involve structural damage to joints leading to deformity and disability if left untreated. The disease disproportionately impacts women and debilitates patients in their most productive years. This makes RA a major healthcare burden globally. The high unmet need in RA management is driving research into novel targeted therapies that can modify disease progression, induce remission and help preserve joint function in the long run.

Biological disease-modifying anti-rheumatic drugs have emerged as an important treatment paradigm that supplement existing therapies. TNF inhibitors, in particular, have transformed the RA treatment landscape offering better efficacy over methotrexate alone. Improved patient outcomes associated with targeted RA drugs and patient assistance programs are responsible for their increasing uptake over conventional NSAIDs and corticosteroids.

Insights, By End User: Hospitals Remain Cornerstone of Inflammatory Pain Care Delivery

In terms of by end user, hospitals contribute the highest share of the inflammatory pain therapeutic market owing to their central role in the management of inflammatory pain conditions. Most patients receive initial diagnosis and treatment in hospitals owing to the availability of specialists, advanced diagnostic facilities and multi-disciplinary care delivery under one roof.

For complex conditions with unclear etiology or treatment resistance, in-patient management also becomes necessary. In addition, hospitals perform a bulk of surgical interventions related to inflammatory disorders like joint replacement surgeries for arthritis.

Use of biologics which require administration via infusion or injection is also more feasible and safer in the controlled hospital environment. Well-equipped hospitals deliver coordinated care by rheumatologists, orthopedic surgeons, physical therapists, nurses and social workers which is difficult to match on an outpatient basis.

Strong hospital networks aid in streamlined management over the long course of these chronic illnesses through various healthcare settings. Their large size also makes hospitals key targets for promotion and availability of latest treatment agents.

Additional Insights of Inflammatory Pain Therapeutic Market

- Prevalence Rates: Approximately 15 million individuals worldwide are affected by chronic inflammatory pain conditions.

- Economic Impact: The global inflammatory pain market contributes an estimated $20 billion annually to the healthcare economy, considering direct and indirect costs.

- Treatment Adherence: Studies indicate that 60% of patients discontinue NSAID therapy within six months due to adverse effects.

Competitive overview of Inflammatory Pain Therapeutic Market

The major players operating in the Inflammatory Pain Therapeutic Market include Pfizer Inc., Roche Holding AG, Novartis AG, Johnson & Johnson, Merck & Co., Inc., GlaxoSmithKline plc, Sanofi S.A., Eli Lilly and Company, Bayer AG, and AbbVie Inc.

Inflammatory Pain Therapeutic Market Leaders

- Pfizer Inc.

- Roche Holding AG

- Novartis AG

- Johnson & Johnson

- Merck & Co., Inc.

Recent Developments in Inflammatory Pain Therapeutic Market

- In January 2024, Pfizer Inc. launched a new biologic therapy targeting specific inflammatory pathways, aiming to improve efficacy and reduce side effects. This development is expected to enhance patient outcomes and expand Pfizer's market presence. Notably, Pfizer has ongoing efforts around Janus kinase (JAK) inhibitors, which target immune-mediated conditions by blocking inflammatory signaling pathways.

- In June 2023, Roche Holding AG acquired a leading biotech firm specializing in novel anti-inflammatory compounds, strengthening its portfolio and research capabilities in the inflammatory pain sector. Also, in October 2023, Roche acquired Telavant for $7.1 billion, gaining rights to develop RVT-3101, a novel treatment for inflammatory bowel disease.

Inflammatory Pain Therapeutic Market Segmentation

- By Treatment

- Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)

- COX-2 Inhibitors

- Non-selective NSAIDs

- Corticosteroids

- Oral Corticosteroids

- Injectable Corticosteroids

- Biologic Therapies

- TNF Inhibitors

- Interleukin Inhibitors

- Other Analgesics

- Opioids

- Antidepressants

- Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)

- By Disease Indication

- Rheumatoid Arthritis

- Early-stage RA

- Advanced RA

- Osteoarthritis

- Knee OA

- Hip OA

- Ankylosing Spondylitis

- Early-stage AS

- Advanced AS

- Psoriatic Arthritis

- Other Indications

- By End User

- Hospitals

- Clinics

- Diagnostic Centers

- Research Institutes

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.