Influenza A Infections Market Size - Analysis

The influenza A infections market is estimated to be valued at USD 744.2 Mn in 2025 and is expected to reach USD 909.1 Mn by 2032, growing at a compound annual growth rate (CAGR) of 2.9% from 2025 to 2032. Widespread initiatives by governments and private organizations to increase vaccination rates along with rising awareness about preventive healthcare have contributed to the market growth.

Market Size in USD Mn

CAGR2.9%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 2.9% |

| Market Concentration | Medium |

| Major Players | Cidara Therapeutics, SAb Biotherapeutics, FluGen, Moderna, Vir Biotechnology and Among Others |

please let us know !

Influenza A Infections Market Trends

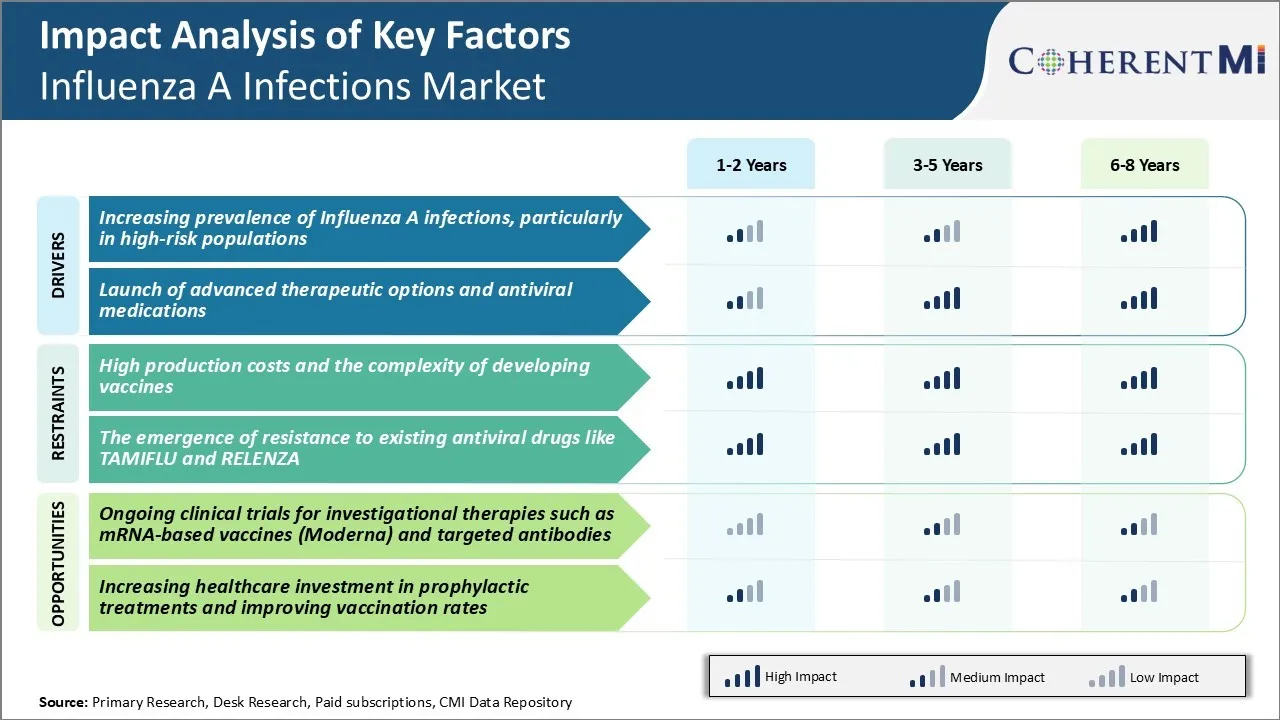

Market Driver - Increasing Prevalence of Influenza A Infections, Particularly in High-risk Populations

As per CDC statistics, the hospitalization rate due to influenza is nearly six times higher in adults aged 65 years and above in comparison to young healthy adults. Furthermore, individuals with chronic pulmonary disorders or cardiac illnesses have over twenty times greater likelihood of developing severe pneumonia if infected with these respiratory pathogens. Likewise, the underdeveloped immune system in infants and toddlers places them at an elevated risk of influenza-related complications.

During the most recent flu seasons, health authorities have reported above-average influenza activity levels along with rising hospitalization and mortality figures associated with these viral illnesses. The evolving epidemiological patterns indicate that the threat posed by these contagious respiratory viruses is no longer seasonal but rather perpetual.

Moreover, the emergence and worldwide spread of antiviral resistance in certain influenza virus strains adds an additional layer of complexity to disease management. Considering these interrelated factors, it is reasonable to expect that the target patient groups will continue experiencing disproportionately higher influenza disease burden in the coming years unless effective control measures are implemented.

Market Driver - Launch of Advanced Therapeutic Options and Antiviral Medications

In addition to optimizing existing antiviral classes, developers have also explored wholly novel antiviral targets such as endonuclease and cap-dependent endonuclease inhibitors that may offer broader spectrum activity against multiple influenza strains. Another active area of research involves host-targeting agents focusing on processes like virus attachment, fusion and immune modulation using novel monoclonal antibody platforms or host directed small molecules. Advanced formulations involving nanoparticle-based drug delivery carriers are further improving dosage convenience and therapeutic compliance for antiviral medications especially in pediatric populations.

On the vaccine front, technologies for rapid development and production of updated seasonal vaccine strains are accelerating the timeliness of protective strategies. Investigational programs on universal influenza vaccines capable of inducing durable immunity against diverse strains also hold promise to transform the current preventive landscape in the future. Collectively, the sizable R&D investments and ensuing approvals of these expanded treatment avenues are expected to bring about notable enhancements in clinical outcomes and quality of care for patients impacted by influenza A virus infections worldwide.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High production costs and the complexity of developing vaccines

One of the major challenges faced by players in the influenza A infections market is the high production costs associated with developing effective vaccines. Vaccine manufacturing is an intricate and expensive process that involves growing virus strains in fertile hen eggs or cell cultures. This is followed by inactivation, purification and formulation of the antigen. Ensuring consistency and scalability further adds to the costs.

Additionally, the influenza virus is constantly mutating, necessitating annual updates to the vaccine composition. Developing vaccines targeting multiple strains simultaneously increases R&D investments substantially. Manufacturers must also conduct extensive clinical trials to establish safety, immunogenicity and efficacy. All these factors contribute to the high resource requirements for vaccine innovation.

Many companies, especially smaller players, find it difficult to justify the investments without guaranteed demand and profitability. This poses a major barrier to expanding vaccine access and achieving higher vaccination rates globally.

Market Opportunities - Ongoing Clinical Trials for Investigational Therapies

The influenza A infections market sees promising opportunities from recent advancements in vaccine production technologies. Several companies are investing in novel platforms that can accelerate development and lower costs. For instance, Moderna is evaluating an mRNA-based universal influenza vaccine in clinical trials. mRNA vaccines have the potential to provide multi-strain protection with a more streamlined manufacturing process compared to egg- or cell-based methods.

Other therapies under investigation include recombinant vaccines and therapeutic antibodies targeting specific viral proteins. Targeted antibodies may enable treatment of high-risk patients even after symptoms emerge. Several players are also exploring the feasibility of pan-influenza vaccines conferring long-term immunity against all influenza strains.

If successful, such investigational therapies could capture a large market share and shift treatment paradigms. They offer opportunities for continued patent protection and high profit margins. Ongoing clinical research in this domain is expected to drive significant growth within the influenza A infections market over the forecast period.

Prescribers preferences of Influenza A Infections Market

Influenza A infections are generally treated in a stepwise manner based on symptom severity and progression. For patients presenting with mild symptoms such as fever, cough and muscle aches, over-the-counter medications like Tylenol (paracetamol) and Robitussin (dextromethorphan) are usually recommended for relief of fever and cough. If symptoms persist or worsen after a few days, prescribers may recommend antiviral medications like Tamiflu (oseltamivir) or Relenza (zanamivir). These are most effective when started within 48 hours of symptom onset.

For patients developing moderate to severe symptoms including shortness of breath, chest discomfort or worsening cough, prescribers typically prescribe stronger antivirals in the form of Tamiflu or Relenza along with supportive medications. Elderly patients and those with underlying health conditions are more likely to receive antivirals early in treatment. If symptoms continue to deteriorate even after antiviral use, prescription of adjunct medications such as steroids or antibiotics may be considered. In severe cases requiring hospitalization, intravenous antivirals and other drugs aimed at managing symptoms are administered under strict medical supervision.

Key factors influencing prescribers' choice include patient age, co-morbid conditions, symptom severity, and disease stage or progression over time.

Treatment Option Analysis of Influenza A Infections Market

Influenza A infections can be categorized into three stages - early, middle, and late stage.

In the early stage, when symptoms first appear such as fever, cough, sore throat, body aches, etc., over-the-counter medications are usually the first line of treatment. Pain relievers and fever reducers like acetaminophen (Tylenol) or ibuprofen (Advil) can help alleviate symptoms. Plenty of rest and intake of fluids is also recommended.

If symptoms persist or worsen after a few days, the infection has progressed to the middle stage. At this point, antiviral medications prescribed by a doctor can shorten the duration and severity of the illness if taken within 48 hours of symptom onset. Oseltamivir (Tamiflu) is commonly prescribed as it is effective against most influenza A strains. It comes as an oral capsule and is typically prescribed for 5 days.

For patients at high risk of complications, antiviral treatment is recommended even after 48 hours. However, if symptoms last for more than 10 days or worsen, it indicates the infection has entered the late stage. This stage can lead to dangerous secondary infections like pneumonia. In such cases, hospitalization and intravenous antiviral therapy along with supplemental oxygen and bronchodilators may become necessary.

Key winning strategies adopted by key players of Influenza A Infections Market

GlaxoSmithKline's shingles vaccine strategy:

In 2017, GSK launched Shingrix, an adjuvanted recombinant zoster vaccine to protect adults aged 50 years and older against shingles (herpes zoster). Shingrix was shown to be over 90% effective in clinical trials, significantly higher than the first-generation zoster vaccine Zostavax. This breakthrough vaccine has been a huge commercial success for GSK, generating over $1.8 billion in sales in 2021 alone.

Sanofi's vaccine portfolio strategy:

Sanofi has built a broad vaccines portfolio covering influenza, meningitis, polio and more. In influenza specifically, it developed quadrivalent vaccines from 2003 onward to protect against 4 flu strains compared to traditional trivalent vaccines. This gave it a strong strategic advantage during the 2009 H1N1 pandemic. More recently in 2018-19 flu season, Sanofi's high-dose influenza vaccine Fluzone High-Dose, which elicits a stronger immune response in elderly, captured over 25% of the US high-dose influenza market within a few months of approval.

Novavax's antigen design strategy:

Novavax developed an influenza vaccine based on recombinant nano particle technology and demonstrated superior efficacy. Specifically, for H1N1 influenza, previous vaccines were based on the egg-adapted viral strain which drifted from the original pandemic strain decreasing their effectiveness.

Segmental Analysis of Influenza A Infections Market

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

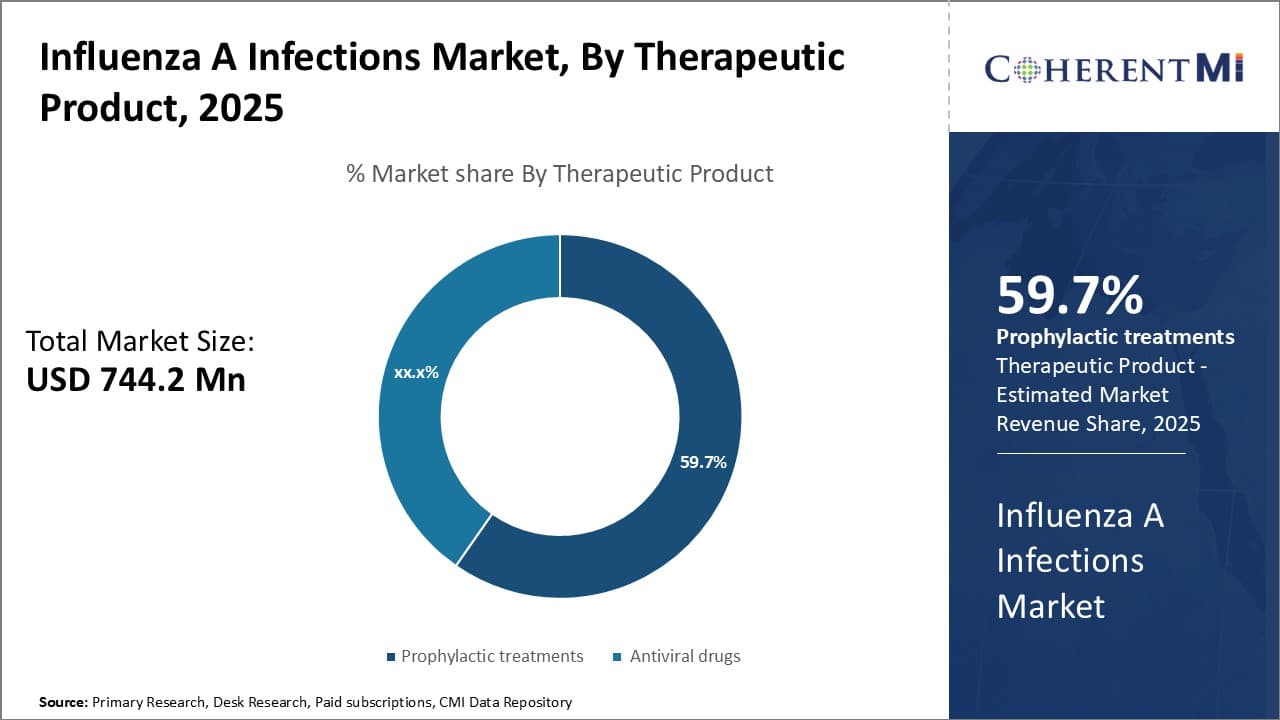

Insights, By Therapeutic Product: Efficacy Driving Adoption of Prophylactic Treatments (CD388, VIR-2482)

In terms of therapeutic product, prophylactic treatments (CD388, VIR-2482) are expected to hold 59.7% share of the influenza A infections market in 2025, owing to their superior efficacy in preventing influenza virus infection compared to existing antiviral drugs. CD388 and VIR-2482 work by activating interferon responses, thereby establishing an antiviral state in cells before virus exposure. This pre-exposure activation of antiviral defenses helps eliminate the virus at the entry points itself and prevents it from multiplying and causing illness.

Conventional antiviral drugs like Tamiflu work after virus entry and aim to stop replication. However, their efficacy depends on being administered timely. In contrast, prophylactic treatments initiate the body's defenses beforehand to block virus entry, making them a preferable prevention option especially for high-risk groups like the elderly.

Another factor fueling the segment's growth is the fact that antibodies induced by these drugs recognize conserved viral proteins that are less prone to mutate compared to those targeted by vaccines. This lowers the risk of resistance developing against prophylactic treatments over time.

To learn more about this report, Download Free Sample Copy

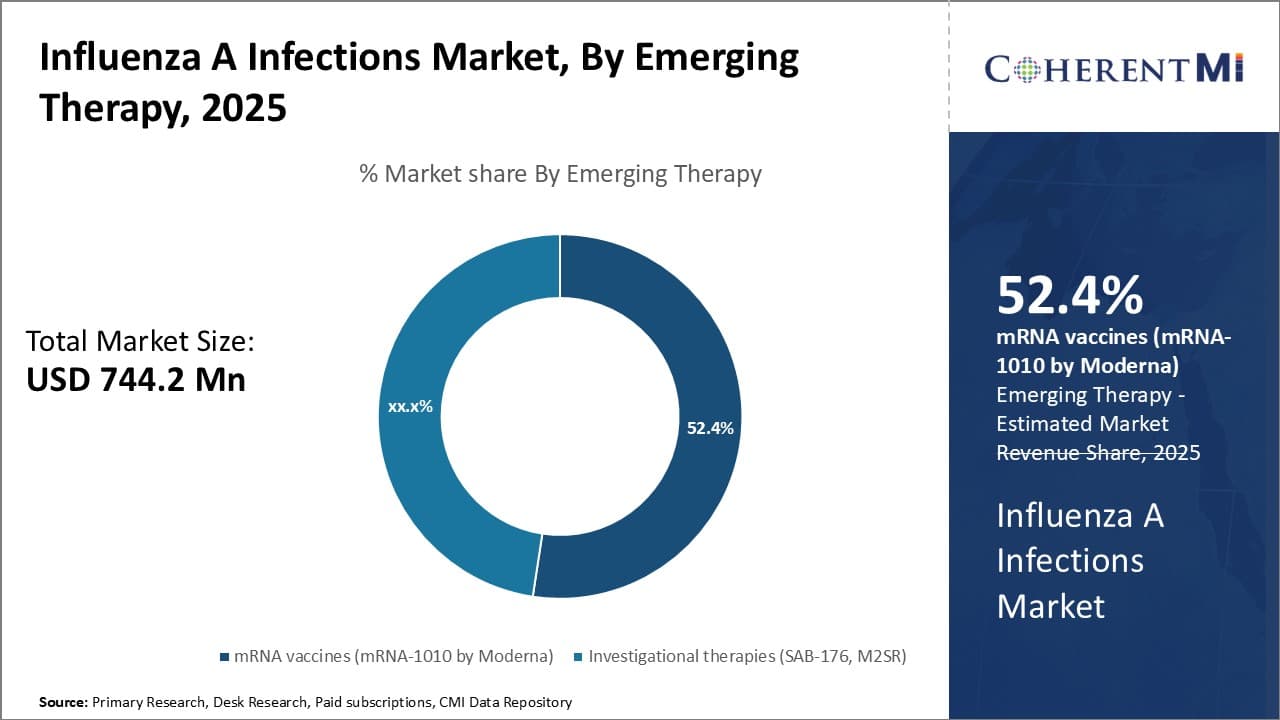

Insights, By Emerging Therapy: mRNA Vaccines (mRNA-1010) Leveraging Technological Advancements

To learn more about this report, Download Free Sample Copy

Insights, By Emerging Therapy: mRNA Vaccines (mRNA-1010) Leveraging Technological Advancements

In terms of emerging therapy, mRNA vaccines (mRNA-1010 by Moderna) are projected to account for 52.4% share of the influenza A infections market in 2025, leveraging its technological edge over conventional and investigational options. mRNA-1010 is the first mRNA vaccine to enter clinical trials for influenza prevention. Unlike conventional vaccines that rely on inactivated or weakened viral components, mRNA vaccines don't use any part of the live virus.

Instead, they carry genetic instructions that prompt the body's own cells to produce viral proteins to develop an immune response. This allows for faster development than egg-based vaccine production and circumvents the need to anticipate which viral strains will predominate months in advance.

mRNA vaccines also can be redesigned comparatively quicker than alternatives if a virus mutates, bolstering their efficacy over multiple flu seasons. Their ability to trigger both antibody- and T-cell mediated immune responses also makes them more likely to induce durable, cross-protective immunity against drifted viral strains than other options in development.

Insights, By Vaccine: Targeting High Risk Groups Driving High-Dose Vaccines Uptake

In terms of vaccine, high-dose vaccines (Fluzone) contribute the highest share of the influenza A infections market driven by their ability to better protect older adults. People aged 65 years and older have weaker immune responses to standard-dose flu shots due to immunosenescence. High-dose Fluzone contains four times as much of the relevant antigen content to generate a stronger immune response for this vulnerable group.

Clinical trials show it provides significantly better protection from influenza compared to standard vaccines in the elderly population. The stronger antibodies elicited help offset waning immunity often seen in this age group, thereby upholding protective effects over the course of the influenza season. High-dose Fluzone has also been found to reduce flu-related hospitalizations in older Americans, a key concern among this risk group.

The cost-effectiveness and superior outcomes achieved lend a competitive advantage to the high-dose vaccine segment compared to alternatives like intranasal formulations targeting this substantial market demographic of aging influenza patients.

Additional Insights of Influenza A Infections Market

- In the United States, approximately 42,580 cases of Influenza A were recorded in 2021, with a steady increase projected during the forecast period.

- Seasonal influenza continues to impose significant health and economic burdens, with annual outbreaks resulting in increased hospitalizations and mortality rates, particularly among high-risk groups like the elderly.

- Influenza A is a predominant cause of acute respiratory distress syndrome (ARDS), particularly in adults with underlying risk factors such as obesity, pregnancy, and lack of vaccination.

- Current treatment guidelines emphasize rapid diagnosis and initiation of antiviral therapy within 48 hours of symptom onset to maximize treatment efficacy.

- Therapy Uptake: Among the therapies, Fluzone generated the highest revenue, with sales reaching USD 1.164 billion in 2021.

Competitive overview of Influenza A Infections Market

The major players operating in the influenza A infections market include Cidara Therapeutics, SAb Biotherapeutics, FluGen, Moderna, Vir Biotechnology, and Vaxart.

Influenza A Infections Market Leaders

- Cidara Therapeutics

- SAb Biotherapeutics

- FluGen

- Moderna

- Vir Biotechnology

Recent Developments in Influenza A Infections Market

- In June 2024, Moderna announced the successful completion of its Phase 3 trials for mRNA-1010, a vaccine candidate targeting seasonal influenza strains, particularly Influenza A. The results showed promising efficacy, especially against the A/H1N1 and A/H3N2 strains, which are responsible for the majority of severe influenza cases in adults. This development could significantly improve vaccine availability and effectiveness, particularly for high-risk populations such as the elderly.

- In July 2023, Vir Biotechnology and GSK continued their collaboration on VIR-2482, an investigational monoclonal antibody designed to prevent influenza A. This antibody is particularly aimed at protecting older adults, a group at higher risk of flu-related complications. VIR-2482 targets the hemagglutinin protein of influenza A and has shown broad coverage of all major influenza A strains since the 1918 pandemic.

- In November 2022, SAb Biotherapeutics presented positive Phase II trial results for SAB-176, their investigational treatment targeting both influenza A and B. The data demonstrated broad efficacy in neutralizing multiple strains of these viruses, which is particularly promising for high-risk patients. SAB-176, a fully-human polyclonal antibody developed using the company’s DiversitAb™ platform, showed significant reduction in viral load and clinical symptoms compared to placebo. This therapeutic has been designed to provide protection against rapidly mutating influenza viruses, offering a potential advancement for treating severe flu cases in vulnerable populations.

- In June 2022, Moderna entered Phase III trials for mRNA-1010, a quadrivalent vaccine for seasonal influenza, positioning itself as a future leader in the influenza vaccine market. This vaccine targets four strains of influenza (A/H1N1, A/H3N2, B/Yamagata, and B/Victoria) based on World Health Organization (WHO) recommendations. The trial aims to assess the safety and immunogenicity of mRNA-1010 compared to a licensed seasonal influenza vaccine. This program is part of Moderna's broader effort to develop a portfolio of respiratory vaccines.

- In September 2021, Cidara Therapeutics announced promising clinical data for their drug CD388, which showed significant potential for long-acting protection against Influenza A. CD388 is a part of Cidara's Cloudbreak® platform, leveraging a novel drug-Fc conjugate (DFC) designed to provide universal, long-lasting protection from influenza. The data from early trials demonstrated reduced viral replication and lower infection rates in participants who received CD388 compared to placebo. This development could mark a significant advancement in flu prevention, offering season-long protection and potentially transforming the landscape of influenza prevention.

Influenza A Infections Market Segmentation

- By Therapeutic Product

- Prophylactic treatments (CD388, VIR-2482)

- Antiviral drugs (TAMIFLU, RELENZA, RAPIVAB, XOFLUZA)

- By Emerging Therapy

- mRNA vaccines (mRNA-1010 by Moderna)

- Investigational therapies (SAB-176, M2SR)

- By Vaccine

- High-dose vaccines (Fluzone)

- Intranasal vaccines (FluMist)

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.