The kidney transplant rejection market is estimated to be valued at USD 1.63 Bn in 2025 and is expected to reach USD 2.94 Bn by 2032, growing at a compound annual growth rate (CAGR) of 8.8% from 2025 to 2032. Factors such as the increasing prevalence of renal diseases, rising geriatric population, and growing awareness about organ transplantation are fueling the demand for effective rejection treatments.

Market Size in USD Bn

CAGR8.8%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.8% |

| Market Concentration | Medium |

| Major Players | Eledon Pharmaceuticals, Sangamo Therapeutics, AlloVir, CSL Behring, Hansa Biopharma and Among Others |

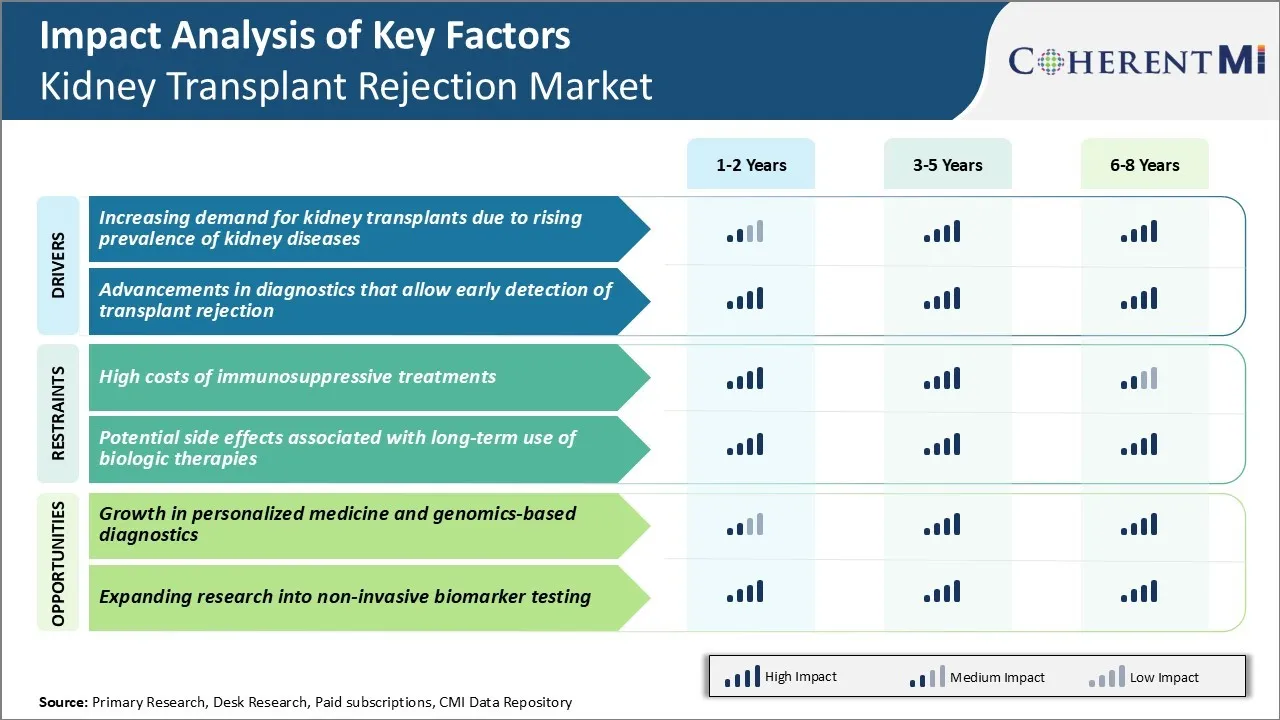

Market Driver - Increasing Demand for Kidney Transplants due to Rising Prevalence of Kidney Diseases

As per estimates by medical experts, there has been nearly 20% rise in new cases of end stage renal diseases over the past decade alone. In recent years, kidney transplant has emerged as the most viable option offering patients a better quality of life.

However, the demand for kidney transplants far exceeds the available organ supply. According to data, nearly 100,000 people are currently waiting for a kidney transplant in the United States alone whereas only around 20,000 transplants are performed annually.

Furthermore, not all waiting patients receive a transplant due to medical ineligibility or passing away while waiting. Such scenarios have fueled the demand for alternative organ sources and living donors.

While deceased donor programs still account for a major chunk of transplants, the share of transplants from living donors is on the rise. This is mainly because living donor transplants offer advantages like better organ quality, immediate availability and good post-transplant outcomes. Healthcare providers and institutions are also investing greater efforts towards public education and incentives to promote living donations. If the supply demand gap continues to widen further, it will consistently drive the growth in this market.

Market Driver – Advancements in Diagnostics Allow Early Detection of Rejection

Monitoring transplant recipients for signs of rejection is crucial in improving long term outcomes. However, traditional biopsy-based methods are invasive, slow and cannot detect subclinical rejection in initial stages. Biomarkers such as donor-specific cell-free DNA have shown promise in predicting rejection episodes much before clinical symptoms appear. Gene expression tools analyze genes activated during rejection to provide valuable insights.

Furthermore, improvements in modalities like ultrasound, magnetic resonance imaging (MRI) and positron emission tomography (PET) scanning allow for detailed examination of transplanted organs without the risks of biopsy. Integrating these modern diagnostics with established approaches can augment surveillance capability. It enables clinicians to preemptively treat asymptomatic rejections and modify immunosuppressive regimens.

Early therapy results in better outcomes like improved graft function and survival rates. It can potentially reduce hospitalization requirements and lower healthcare costs associated with treating advanced rejection. As validation studies establish their clinical efficacy, incorporation of novel diagnostics in routine follow-up protocols is gaining momentum. This is positively impacting the demand for diagnostic assays, imaging services as well as resources for data analysis.

Overall, continued progress in surveillance methods for timely and accurate diagnosis of rejection presents opportunities for market participants.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High Costs of Immunosuppressive Treatments

The costs associated with immunosuppressive treatments for kidney transplant patients pose a significant challenge for the kidney transplant rejection market. Lifelong immunosuppressive medications are required post-transplant to prevent organ rejection. However, these medications such as tacrolimus, mycophenolate mofetil and corticosteroids are extremely expensive, with annual drug costs often exceeding $25,000 per patient. This financial burden dissuades many patients from undergoing a kidney transplant procedure.

With growing rates of end-stage renal disease globally, there is significant demand for kidney transplants but high treatment costs limit the number of transplants performed. Manufacturers of immunosuppressive drugs must explore strategies to make these critical therapies more affordable and accessible.

This could include developing low-cost generic versions of branded medications or payments schemes where the costs are shouldered by governments and insurers. Addressing the challenges posed by immunosuppressive drug prices is crucial to enable more patients to benefit from kidney transplantation.

Market Opportunity - Growth in Personalized Medicine and Genomics-based Diagnostics

The growing fields of personalized medicine and genomics-based diagnostics present substantial opportunities for growth within the kidney transplant rejection market. Current immunosuppressive regimens employ a 'one-size-fits-all' approach. However, emerging technologies allow for more individualized therapies that consider each patient's unique genetic profile and disease characteristics.

Genetic testing can help identify patients at high risk of transplantation complications or drug side effects. This enables preemptive modification of immunosuppression protocols. Similarly, non-invasive molecular diagnostics based on genomic profiling of donor organ biopsies may facilitate early detection of transplant rejection.

Personalized medicine approaches have potential to improve long-term outcomes while reducing costs by minimizing toxicity and graft loss. The kidney transplant rejection market is likely to witness significant investment in research and development of genomics-based tests, biomarkers and precision immunotherapies tailored for personalized transplant management protocols.

Kidney transplant rejection is typically treated through a sequential approach based on the severity and stage of rejection. Treatment begins with induction therapy right after transplantation to prevent early rejection episodes. Calcineurin inhibitors (CNIs) like cyclosporine (Cycloset, Gengraf) and tacrolimus (Prograf) are commonly prescribed as the backbone of maintenance therapy.

For mild acute rejection, steroid therapy is the first line of treatment. Methylprednisolone (Solu-Medrol) is often intravenously administered to reduce inflammation. If steroids alone prove ineffective, antithymocyte globulin (ATG; Thymoglobulin) may be added. For moderate rejection, repeated steroid doses are tried. However, if persistent, antilymphocyte antibodies like basiliximab (Simulect) or daclizumab (Zenapax) are prescribed in combination with steroids.

Severe acute rejection may require more aggressive immunotherapy using alemtuzumab (Campath). For steroid-resistant acute rejection, a T-cell-depleting agent like ATG is favored by most specialists over alemtuzumab due to lower risk of opportunistic infections. Belatacept (Nulojix), a selective T-cell costimulation blocker, has emerged as an alternative to CNIs for chronic allograft nephropathy to reduce long-term nephrotoxicity.

The stage of rejection, individual patient risk factors like race and HLA mismatches, and side effect profiles of the different immunosuppressants available are key considerations that influence prescribers in selecting the most appropriate treatment regimen.

Kidney transplant rejection can be classified into three stages based on severity - acute, chronic, and late rejection. Acute rejection occurs within the first six months post-transplant and is the most common form.

The first-line treatment for acute kidney transplant rejection involves the use of corticosteroids, which are powerful anti-inflammatory and immunosuppressant drugs. Methylprednisolone is the corticosteroid of choice, administered intravenously at a high dose of 500-1000 mg for 3 days. This helps suppress the immune system and reduce inflammation in order to reverse the rejection.

If corticosteroids are ineffective, the second-line treatment involves the use of antithymocyte globulin (ATG). ATG contains antibodies that attack and destroy T cells to provide stronger immunosuppression. Brands such as Thymoglobulin are commonly used. ATG is given intravenously for 5-10 days along with corticosteroids.

For cases where rejection persists after the above options, third-line therapies involving monoclonal antibody drugs are used. drugs like Basiliximab (Simulect) and Daclizumab (Zenapax) which prevent T-cell activation are preferred. Alternatively, Muromonab-CD3 (Orthoclone OKT3) which attacks activated T-cells can also be given for 2 weeks along with corticosteroids. This strong triple immunosuppressive regime is effective in reversing severe rejection in most cases.

Immunosuppressant drugs have been the mainstay of prevention and treatment of kidney transplant rejection. Companies like Astellas Pharma, Novartis, and Roche have dominated the market with their immunosuppressant drug portfolios.

Astellas Pharma's Prograf (tacrolimus) was one of the first immunosuppressant drugs approved for prevention of kidney transplant rejection in the 1990s. Prograf works by inhibiting the body's immune system from attacking and destroying the transplanted organ. It was a major breakthrough at the time as previous drugs like cyclosporine had more side effects. Prograf became the global standard of care and continues to be prescribed in over 90% of kidney transplants worldwide. This helped Astellas capture a significant market share that it retains to date.

In the 2000s, Novartis launched CellCept (mycophenolate mofetil), a newer generation immunosuppressant that provided better efficacy with fewer side effects than previous drugs. Novartis utilized aggressive marketing campaigns highlighting CellCept's clinical trial data that showed significantly lower rejection rates compared to older therapies. This helped Novartis gain rapid adoption from physicians and the drug became the standard of care along with tacrolimus. By 2010, CellCept sales exceeded $1 billion annually, demonstrating the success of Novartis' marketing strategy in conquering a large portion of the market.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

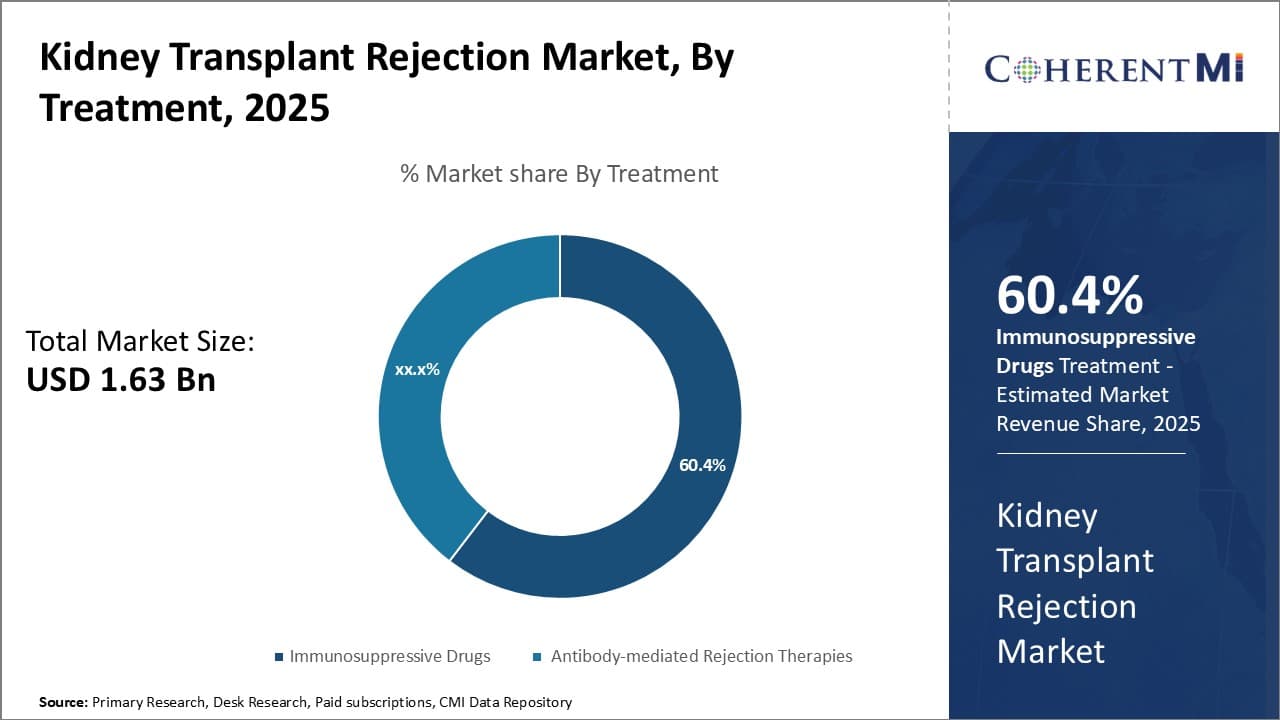

Insights, By Treatment: Growing Incidence of Organ Transplant Procedures

In terms of treatment, immunosuppressive drugs segment is expected hold 60.4% share of the market in 2025, owing to the rising number of organ transplant procedures globally. Immunosuppressive drugs play a crucial role in preventing rejection after organ transplantation by suppressing the body's immune system from attacking the transplanted organ. As these drugs are taken on a lifelong basis post-transplant, their demand increases significantly with each transplant procedure performed.

Moreover, advancements in immunosuppressive drug formulations, with less severe side effects, improved pharmacokinetics and better efficacy, are encouraging more patients to opt for organ transplantation. This in turn is fueling the sales of immunosuppressive drugs. Additionally, factors such as increasing preference for minimally invasive procedures, rise in healthcare expenditure in developing nations and growing awareness about organ donation are contributing to the growth of the global organ transplant market.

All these factors, collectively, are driving the demand for immunosuppressive drugs and thereby placing this segment at the forefront of the kidney transplant rejection market.

To learn more about this report, Download Free Sample Copy

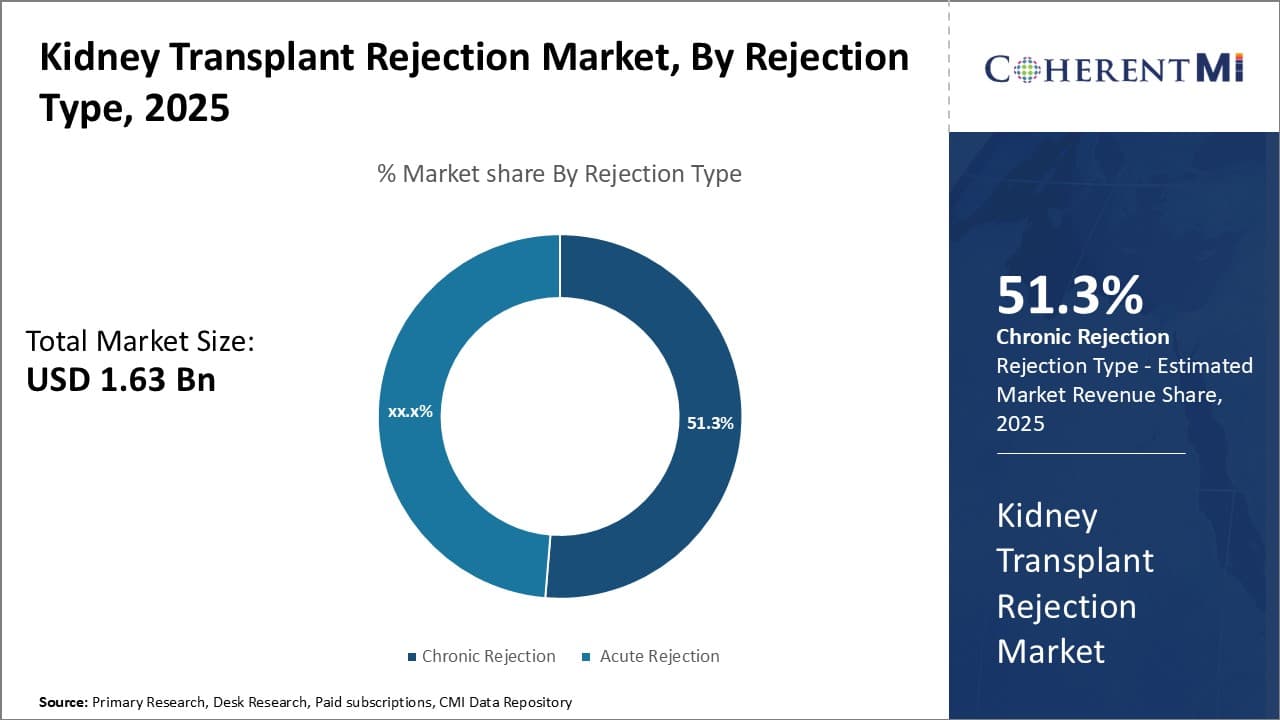

Insights, By Rejection Type: Chronic Rejection Dominates due to Difficulty in Early Detection

To learn more about this report, Download Free Sample Copy

Insights, By Rejection Type: Chronic Rejection Dominates due to Difficulty in Early Detection

In terms of rejection type, chronic rejection segment is projected to hold 51.3% share of the market in 2025, owing to issues associated with timely diagnosis. Chronic rejection is difficult to detect in its early stages as symptoms often develop gradually and mimic other medical conditions. This makes it challenging for physicians to differentiate chronic rejection from other diseases based on clinical signs alone.

Moreover, currently available diagnostic techniques lack sufficient sensitivity and specificity for early detection of chronic rejection. These factors delay therapeutic intervention in chronic rejection cases, resulting in progressive damage to the kidney allograft over time. While acute rejection can be treated effectively if diagnosed promptly, escaping acute therapy frequently leads to chronic rejection.

With advancement in diagnosis still underway, chronic rejection continues to pose a major threat to long-term graft survival and function. This subsequently boosts its prevalence in the kidney transplant rejection market.

Insights, By Diagnostic Approach: Biomarker-based Diagnosis Dominates the Market Owing to Advantages

In terms of diagnostic approach, biomarker-based diagnostics segment contributes the highest share of the market owing to various advantages over alternatives. Some key biomarkers studied for diagnosis of kidney transplant rejection include serum creatinine, urinary enzymes, cell-surface antigens and cytotoxic cells. Biomarker-based tests allow for minimally-invasive liquid biopsies and offer objective, quantitative results.

Additionally, biomarkers can detect subclinical rejection activity not evident on biopsy and serial biomarker monitoring helps predict future allograft injury risk. Unlike genomics-based tests requiring specialized infrastructure, biomarker tests are quick and cost-effective.

Moreover, identification of novel biomarkers through ongoing research can further boost test specificity and sensitivity. Altogether, the non-invasive nature, speed, reproducibility and ongoing enhancements of biomarker-based diagnostics have positioned this segment as the current market leader for kidney transplant rejection diagnosis over genomics-based approaches.

The major players operating in the kidney transplant rejection market include Eledon Pharmaceuticals, Sangamo Therapeutics, AlloVir, CSL Behring, Hansa Biopharma, Veloxis Pharmaceuticals, Novartis, and Transplant Genomics.

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Kidney Transplant Rejection Market is segmented By Treatment (Immunosuppressive Drugs, Antibody-medi...

Kidney Transplant Rejection Market

How big is the kidney transplant rejection market?

The kidney transplant rejection market is estimated to be valued at USD 1.63 Bn in 2025 and is expected to reach USD 2.94 Bn by 2032.

What are the key factors hampering the growth of the kidney transplant rejection market?

High costs of immunosuppressive treatments and potential side effects associated with long-term use of biologic therapies are the major factors hampering the growth of the kidney transplant rejection market.

What are the major factors driving the kidney transplant rejection market growth?

Increasing demand for kidney transplants due to rising prevalence of kidney diseases and advancements in diagnostics that allow early detection of transplant rejection are the major factors driving the kidney transplant rejection market.

Which is the leading treatment in the kidney transplant rejection market?

The leading treatment segment is immunosuppressive drugs.

Which are the major players operating in the kidney transplant rejection market?

Eledon Pharmaceuticals, Sangamo Therapeutics, AlloVir, CSL Behring, Hansa Biopharma, Veloxis Pharmaceuticals, Novartis, and Transplant Genomics are the major players.

What will be the CAGR of the kidney transplant rejection market?

The CAGR of the kidney transplant rejection market is projected to be 8.8% from 2025-2032.