The Global liver cirrhosis market is estimated to be valued at USD 1.49 Billion in 2025 and is expected to reach USD 2.15 Billion by 2032, growing at a compound annual growth rate (CAGR) of 5.4% from 2025 to 2032. The increasing prevalence of liver diseases and rising alcohol consumption globally are major factors contributing to the growth of liver cirrhosis cases.

Key factors such as the rising geriatric population, growing awareness about liver cirrhosis treatment and management, new product approvals, and improving healthcare infrastructure in developing nations are expected to contribute to the market growth during the forecast period. However, the high cost of treatment and lack of effective diagnosis and treatment in developing countries are some challenges restraining the market growth.

Market Size in USD Bn

CAGR5.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.4% |

| Market Concentration | High |

| Major Players | Madrigal Pharmaceuticals, Inc., Galectin Therapeutics Inc., Grifols Therapeutics LLC, CymaBay Therapeutics, Akero Therapeutics, Inc. and Among Others |

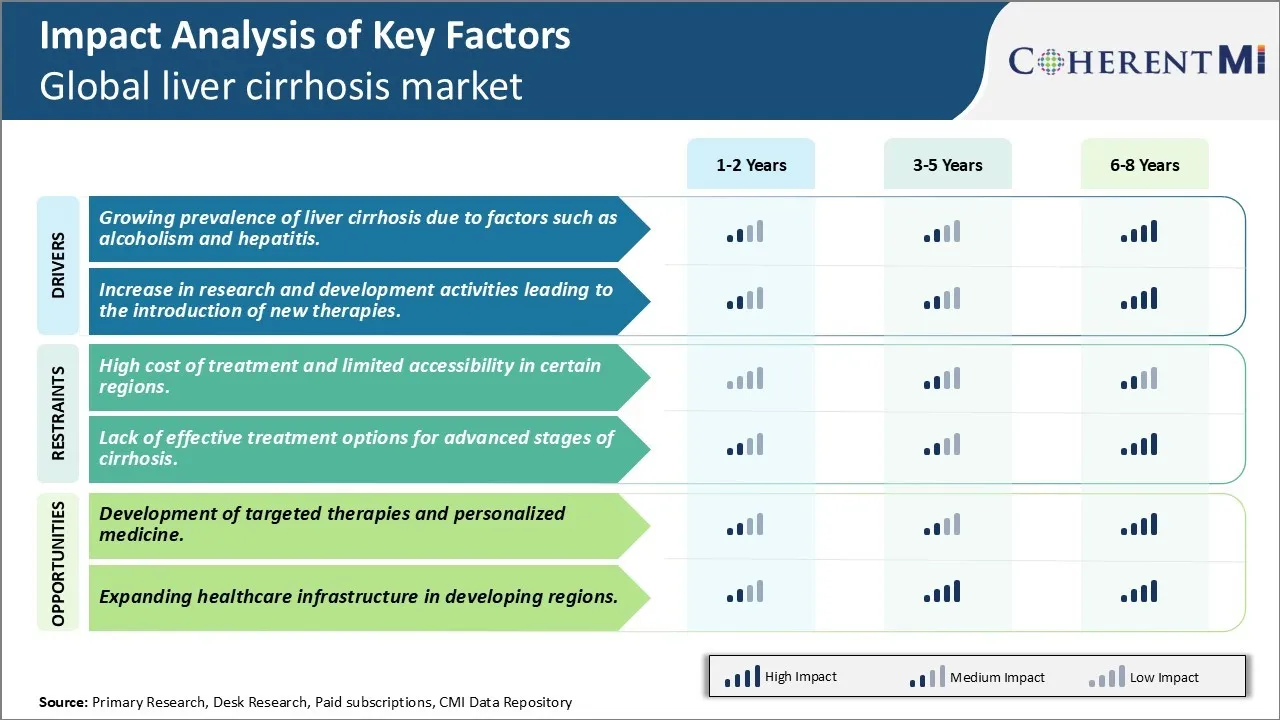

Market Driver - Growing prevalence of liver cirrhosis due to factors such as alcoholism and hepatitis.

One of the key factors driving growth in the global liver cirrhosis market is the growing prevalence of the disease due to conditions such as alcoholism and viral hepatitis infections. Liver cirrhosis has been on the rise steadily over the past few decades due to increasing consumption of alcohol worldwide. Excessive consumption of alcohol over a long period of time can result in damage to liver cells and progression to advanced fibrosis and scarring of the liver or cirrhosis. This is one of the leading causes of liver cirrhosis globally, especially in developed Western nations. According to reports, an estimated 30% of cirrhosis cases in Europe and the United States are attributable to alcoholism. The steady rise in alcoholism cases being witnessed across both developed and developing countries is thus fueling the prevalence of alcohol-induced liver cirrhosis over time.

Similarly, viral hepatitis infections especially by hepatitis B (HBV) and hepatitis C (HCV) viruses are significant risk factors for cirrhosis development. An estimated 35 million to 150 million people worldwide are chronically infected with HCV, out of which 15-30% ultimately develop liver cirrhosis if not treated. Though vaccination programs have reduced HBV prevalence over the decades, HBV still remains endemic in many parts of Asia Pacific and Africa. This translates into large pools of populations at risk of developing chronic liver diseases including cirrhosis in the long run. The growing economic burden of viral hepatitis in terms of both human suffering and healthcare expenditures is thus supporting robust growth opportunities for players in the liver cirrhosis market.

Overall, the lack of awareness, challenges in diagnosis, and poor healthcare access in developing nations have meant that the number of people suffering from alcoholism and hepatitis continues to remain high globally. Unless effective preventive measures and treatment options are rolled out widely, this will sustain a consistent rise in prevalence of end-stage liver conditions such as cirrhosis over the forthcoming years, fuelling steady demand for drugs, devices and other therapeutics.

Increase in research and development activities leading to introduction of new therapies

Another key factor driving growth in the liver cirrhosis market is the substantial rise in investments toward research and development activities focused on this disease area over the past decade. This has successfully accelerated the introduction of innovative new drug molecules, medical devices and therapies that have enhanced treatment outcomes for cirrhosis patients.

Drug development programs have led to the approval and commercialization of several new generation anti-fibrotic molecules that directly target the underlying scarring process in cirrhosis. These include experimental anti-TGFβ compounds and proteases inhibitors among others that have delivered promising results in reducing progression to overt cirrhosis in clinical trials. Increased understanding of the molecular pathways involved in fibrosis regression has also facilitated the design of more targeted therapeutics. Medical technologies have advanced as well, with introduction of novel non-invasive devices for liver fibrosis assessment as well as improved transplantation techniques and post-surgery care protocols.

Additionally, the cell and gene therapy landscape related to liver diseases is rapidly evolving. Promising clinical trials have evaluated regenerative potential of stem cells, gene silencing strategies and gene therapy viruses towards reversing cirrhosis-induced damage. Though still preliminary, these novel regenerative modalities hold great future potential for curing end-stage liver conditions in the post. Overall, intense R&D activity in both pharmaceutical and device arenas have revitalized product pipelines, boosted approvals, and reshaped clinical practices, driving continual upgrades across the liver cirrhosis therapeutics space.

Looking forward, researchers and industry players are working collaboratively on newer molecular candidates and combination regimens targeting multiple fibrotic pathways simultaneously. Advances in AI, 3D tissue modelling and individualized medicine also promise more personalized therapies. Greater emphasis on R&D will thus remain crucial to sustain the

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High cost of treatment and limited accessibility in certain regions.

One of the major challenges currently faced by the global liver cirrhosis market is the high cost of treatment coupled with limited accessibility of advanced treatment options in certain parts of the world. Treating liver cirrhosis poses a huge financial burden especially in developing countries where healthcare budget and insurance coverage for such diseases is limited. The average annual cost of treatment varies significantly depending on the stage and severity of the disease, but can easily run into tens of thousands of dollars per patient. Even developed countries face challenges in providing universal insurance coverage and treatment access for such costly long term conditions. Furthermore, advanced treatment modalities such as liver transplantation are still not widely available in remote and underdeveloped regions due to lack of required infrastructure and trained medical professionals. This treatment gap is further exacerbated in low income populations within developing countries. Unless new and more affordable treatment alternatives are developed, high treatment costs will continue restricting timely and optimal management of liver cirrhosis globally.

Market Opportunity: Development of targeted therapies and personalized medicine

One of the major opportunities in the global liver cirrhosis market lies in the development of targeted therapies and personalized medicine approaches. Current standard of care relies on broad mechanisms to reduce liver inflammation and progression of scarring, but future therapies could target specific molecular pathways driving individual cases. This offers the possibility of developing tailored treatment protocols based on unique patient and disease characteristics such as genotype, stage of disease, co-morbidities etc. Several targeted drugs focusing on key mechanisms such as TGF-beta inhibition are under research. Emerging areas such as RNA therapeutics, gene therapy and regenerative medicine hold promise for delivering curative alternatives. With advances in biomarker discovery, non-invasive diagnostics and big data analytics, liver diseases can increasingly be managed through a personalized precision medicine approach. This could help optimize treatment response while limiting safety risks and costs through individualized protocols.

Liver cirrhosis treatment is a multi-stage process dependent on the progression of the disease. Initial management for compensated cirrhosis involves treating any underlying conditions like hepatitis and lifestyle interventions. Prescribers typically recommend anti-viral drugs like Epclusa or Harvoni for hepatitis C and entecavir or Baraclude for hepatitis B.

As cirrhosis advances to a decompensated stage with portal hypertension, prescribers focus on reducing complications. For variceal bleeding, non-selective beta-blockers such as Propranolol or Carvedilol are first-line to lower portal pressure alongside endoscopic variceal ligation. For ascites and hydrothorax, diuretics including Aldactone and Lasix are prescribed. If diuretics are ineffective, paracentesis or TIPSS may be considered.

For patients with decompensated cirrhosis and organ dysfunction, transfusions, albumin and antibiotics are given alongside nutritional supplements to prevent further deterioration. If preservation or transplantation is possible, anti-rejection drugs like tacrolimus and mycophenolate are initiated. Otherwise, palliative care is prioritized.

Prescribers also factor MELD/Child-Pugh scores, availability of local treatments and patient affordability when choosing therapies. Brand reputation, formulation and multi-disciplinary evidence influence prescribers most at the decompensated stages given complexities. Close monitoring is critical at this advanced stage to catch declining health in a timely manner.

Liver cirrhosis has various stages from compensated to decompensated based on the level of liver damage and symptoms. The treatment depends on the stage of the disease.

In the early compensated stage, lifestyle changes like abstaining from alcohol and a healthy diet are recommended. Medications to treat the underlying cause like antivirals for hepatitis B/C are given. Supplements containing S-adenosylmethionine (SAMe) are also used to reduce liver inflammation and damage.

As the disease progresses to decompensated stages with complications, medication becomes the primary line of treatment. For portal hypertension and esophageal varices, non-selective beta-blockers like propranolol or carvedilol are prescribed. They help reduce variceal bleeding risks. Antibiotics are administered to prevent spontaneous bacterial peritonitis due to low albumin levels.

Diuretics like furosemide and spironolactone help manage fluid retention and ascites. Lactulose is used to reduce elevated ammonia levels in the blood to prevent hepatic encephalopathy. Lastly, vitamin K is given to patients with severe coagulation abnormalities.

For end-stage or advanced cirrhosis, liver transplantation remains the only curative treatment. However, due to donor organ shortage and high costs, transjugular intrahepatic portosystemic shunt procedure is often performed to relieve portal hypertension symptoms and improve quality of life as a bridge to transplant.

Focus on development of novel therapeutics:One of the major strategies adopted by big pharmaceutical players like Gilead Sciences, Bristol-Myers Squibb, and Johnson & Johnson has been investing heavily in R&D to develop novel therapeutics for treating liver cirrhosis. For example, in 2019 Gilead received FDA approval for Selonsertib, the first-and-only therapy in development for non-alcoholic steatohepatitis (NASH) cirrhosis. In clinical trials, Selonsertib demonstrated improvement in liver fibrosis without worsening NASH. This novel drug has given Gilead a significant edge over competitors in the NASH cirrhosis segment.

Target emerging economies:Emerging markets like India, China, Brazil offer immense growth opportunities for liver cirrhosis drugs given the increasing prevalence. Players like Abbott Laboratories and Merck have focused on these regions by launching affordable generic versions of patented drugs or developing fixed-dose combinations suitable for local needs and budgets. This helped them gain sizable shares in high growth Asian and Latin American markets. For example, Abbott's generic ENTECAVIR became the top selling drug in China's liver disease segment.

Acquisitions and partnerships: Given the huge R&D investments required, companies pursue inorganic growth through M&A and partnerships. Bristol-Myers Squibb's $74 billion acquisition of Celgene in 2019 gave it access to Celgene's promising NASH drug candidate Cemdisiran currently in phase 3 trials. Gilead partnered with Arena Pharmaceuticals in 2017 to develop new fibrotic NASH therapies. Such deals strengthen product pipelines and market position.

To learn more about this report, Download Free Sample Copy

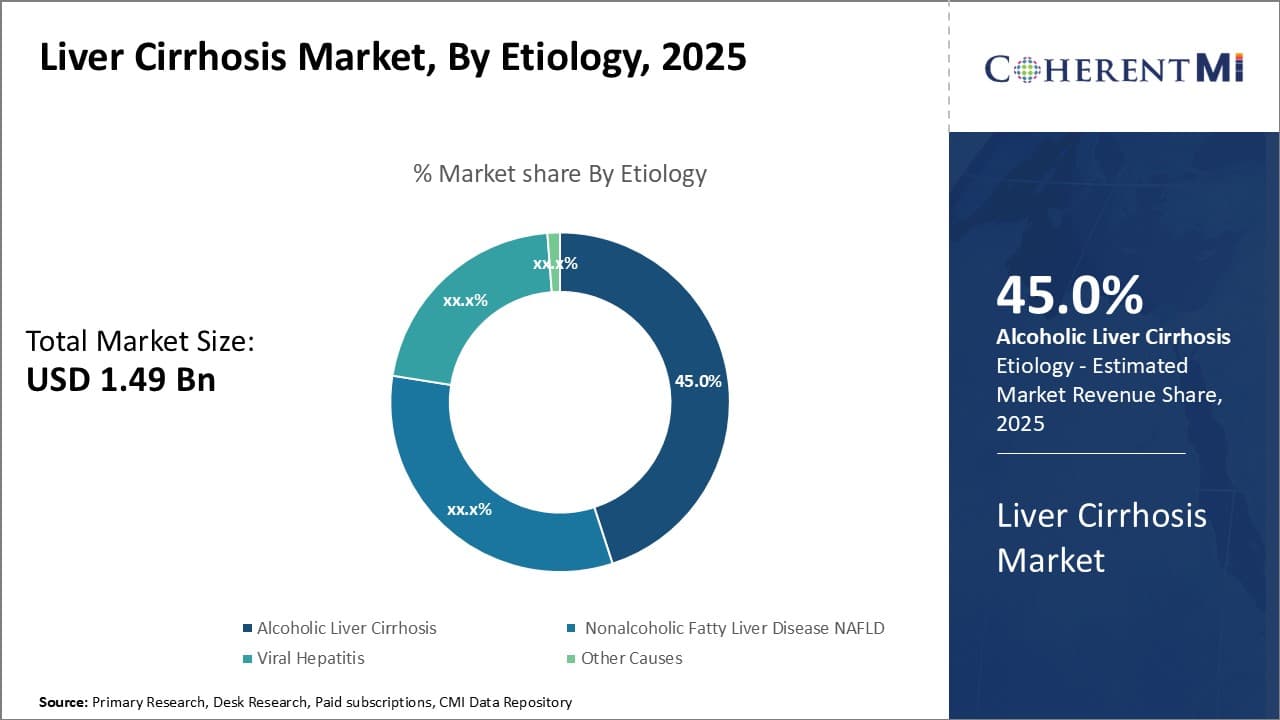

By Etiology - Excessive alcohol intake exacerbates liver damage

To learn more about this report, Download Free Sample Copy

By Etiology - Excessive alcohol intake exacerbates liver damage

In terms of By Etiology, Alcoholic Liver Cirrhosis contributes the highest share of the market with 45% in 2025 owing to widespread harmful use of alcohol globally. Long-term excessive alcohol consumption can overwhelm the liver's ability to regenerate and heal itself. Over many years, chronic alcohol abuse causes fat and scar tissue to build up, resulting in the death of liver cells and their replacement with scar tissue. This process ultimately leads to cirrhosis as the liver becomes irreversibly damaged and loses its ability to function properly.

The social acceptability and cultural traditions associated with alcohol have contributed to high rates of harmful use. In many regions, drinking is an inherent part of social and business functions. Peer pressure norms make declining drinks difficult without appearing abnormal. Easy availability and low pricing have also increased consumption rates over time. Stress and mental health issues can trigger dangerous coping mechanisms like binge drinking. Regulations on advertising and promotion are often lax.

Certain alcohol compounds are particularly toxic to the liver. Hard liquors deliver higher concentrations of alcohol compared to beer and wine. Binge drinking episodes severely stress the liver over short intervals. Genetic risk factors also influence individual susceptibility since some people develop cirrhosis even with moderate intake levels. Co-infection with hepatitis viruses multiplicatively enhances liver injury from alcohol.

Successful public health interventions will require tackling the social, cultural and commercial drivers exacerbating harmful use patterns. Taxation, regulation of physical availability and marketing could help discourage non-essential drinking. Improved screening and early diagnosis can motivate behavioral change in at-risk groups. Novel medical therapies may offer future treatment options to address the need from this largely preventable disease segment.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

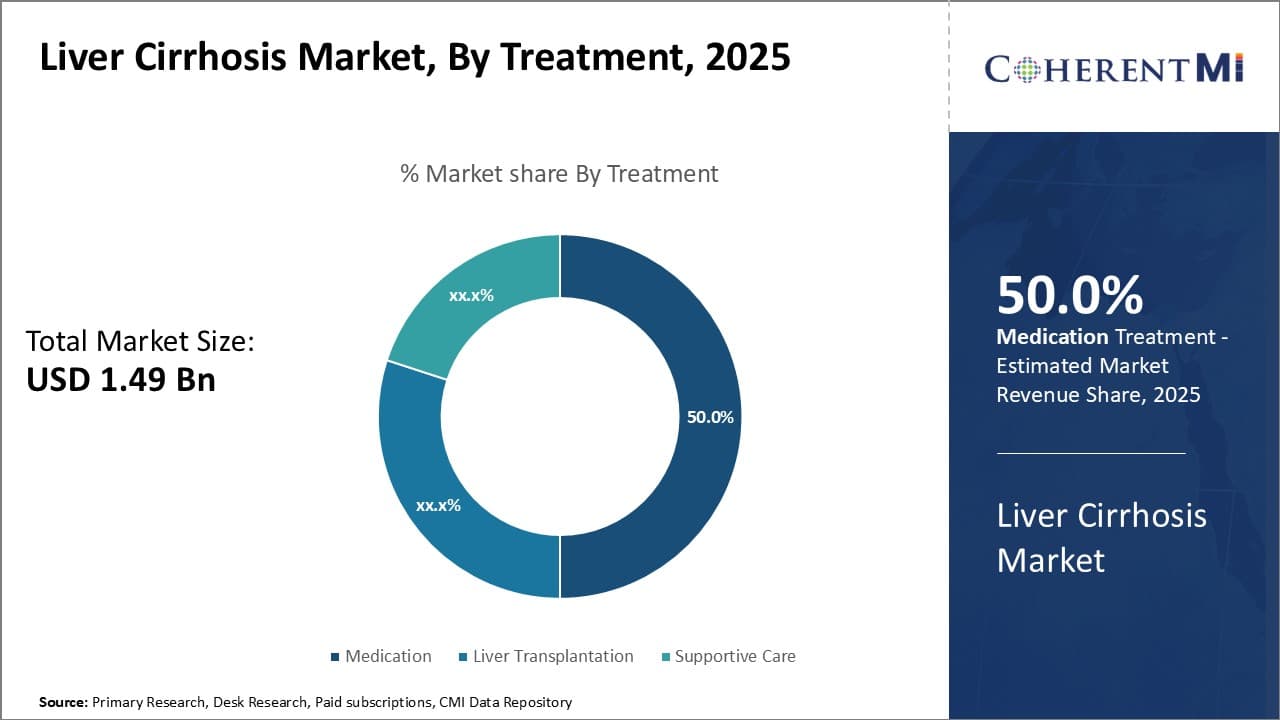

By Treatment - Medication dominates treatment landscapes

In terms of By Treatment, Medication contributes the highest share of the market with 50% in 2025 owing to advantages over other options. Drugs offer clinical benefits without requiring major surgery or lifestyle changes. They can help manage symptoms, slow disease progression, and prevent complications for compensated cirrhosis patients.

Key treatment classes include anti-inflammatory UDCA, antiviral drugs against hepatitis infections, antibiotics to prevent infections, diuretics to remove fluid retention, and lactulose to reduce intestinal pressure from built-up toxins. Newer targeted immunomodulators and antifibrotic agents are being explored for their mechanisms against advanced scarring.

Patients generally prefer ongoing medication supervision over lifestyle modifications. Drugs provide concrete, physiological actions without long-term commitment or discipline requirements. Their effects are immediately evident, improving adherence. Most medications involve simple, oral administration without need for specialized administration settings.

Given the chronic, relapsing nature of cirrhosis, lifelong treatment sustainment is required. Continuous medication regimens suit this long-term management aspect better than occasional procedures. Drugs offer flexible dosing schedules permitting adjustments at any time by physicians. This controllability empowers disease optimization on an individual level.

Insurance coverage for medications is widely available compared to costly procedures. Low per-use cost and bulk production economics make drugs affordable to healthcare systems. These economic factors have propelled the medication segment as societies address rising cirrhosis prevalence.

By Disease Stage- Compensated stage dominates due to its longer duration

In terms of By Disease Stage, Compensated Cirrhosis contributes the highest share of the market with 62% in 2025 owing to its longer duration within patients compared to the decompensated stage.

In the compensated phase, the liver still functions adequately despite damage, without any significant clinical signs or symptoms. This stage can last years or even decades before healthcare issues arise. During this prolonged time window, regular monitoring and basic management typically suffice to control the disease.

By the time severe complications emerge and patients enter the decompensated stage, extensive liver remodeling has already occurred. Further progression happens rapidly with worsening symptoms and poor prognosis. The average post-decompensation survival time is only around two years even with aggressive intervention.

The significantly longer natural history of the compensated stage means patients remain in this segment for much of their disease course. Clinicians therefore focus their efforts on regular surveillance for early detection, risk stratification and prevention of complications here to delay transition into the more advanced phase.

As cirrhosis prevalence rises globally due to chronic hepatitis infections and non-alcoholic steatohepatitis, the compensated population is swelling. Therapies are being improved to target the unique pathophysiological mechanisms occurring during this pre-symptomatic liver scarring period in order to slow disease pace. All of these factors contribute to the sizable market share held by this leading cirrhosis disease stage segment.

The major players operating in the Global liver cirrhosis market include Madrigal Pharmaceuticals, Inc., Galectin Therapeutics Inc., Grifols Therapeutics LLC, CymaBay Therapeutics, Akero Therapeutics, Inc., NGM Biopharmaceuticals, Inc., Gilead Sciences, Novo Nordisk A/S, Cellaion and Promethera Therapeutics.

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Liver Cirrhosis Market is Segmented By Etiology (Alcoholic Liver Cirrhosis, Nonalcoholic Fatty Liver...

Liver Cirrhosis Market

How big is the Liver Cirrhosis Market?

The Liver Cirrhosis Market is estimated to be valued at USD 1.49 in 2025 and is expected to reach USD 2.15 Billion by 2032.

What are the major factors driving the Global liver cirrhosis market growth?

The growing prevalence of liver cirrhosis due to factors such as alcoholism and hepatitis. and increase in research and development activities leading to the introduction of new therapies. are the major factor driving the Global liver cirrhosis market.

Which is the leading Etiology in the Global liver cirrhosis market?

The leading Etiology segment is Alcoholic Liver Cirrhosis.

Which are the major players operating in the Global liver cirrhosis market?

Madrigal Pharmaceuticals, Inc., Galectin Therapeutics Inc., Grifols Therapeutics LLC, CymaBay Therapeutics, Akero Therapeutics, Inc., NGM Biopharmaceuticals, Inc., Gilead Sciences, Novo Nordisk A/S, Cellaion, Promethera Therapeutics are the major players.

What will be the CAGR of the Global liver cirrhosis market?

The CAGR of the Global liver cirrhosis market is projected to be 5.4% from 2025-2032.