Malaysia Corrugated Packaging Market Size - Analysis

The Malaysia Corrugated Packaging Market is estimated to be valued at USD 1.78 Bn in 2025 and is expected to reach USD 2,11 Bn by 2032, growing at a compound annual growth rate (CAGR) of 3.2% from 2025 to 2032.

Market Size in USD Bn

CAGR3.2%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 3.2% |

| Market Concentration | Medium |

| Major Players | International Paper, WestRock (RockTenn), Mondi Group, Smurfit Kappa Group, Georgia-Pacific and Among Others |

please let us know !

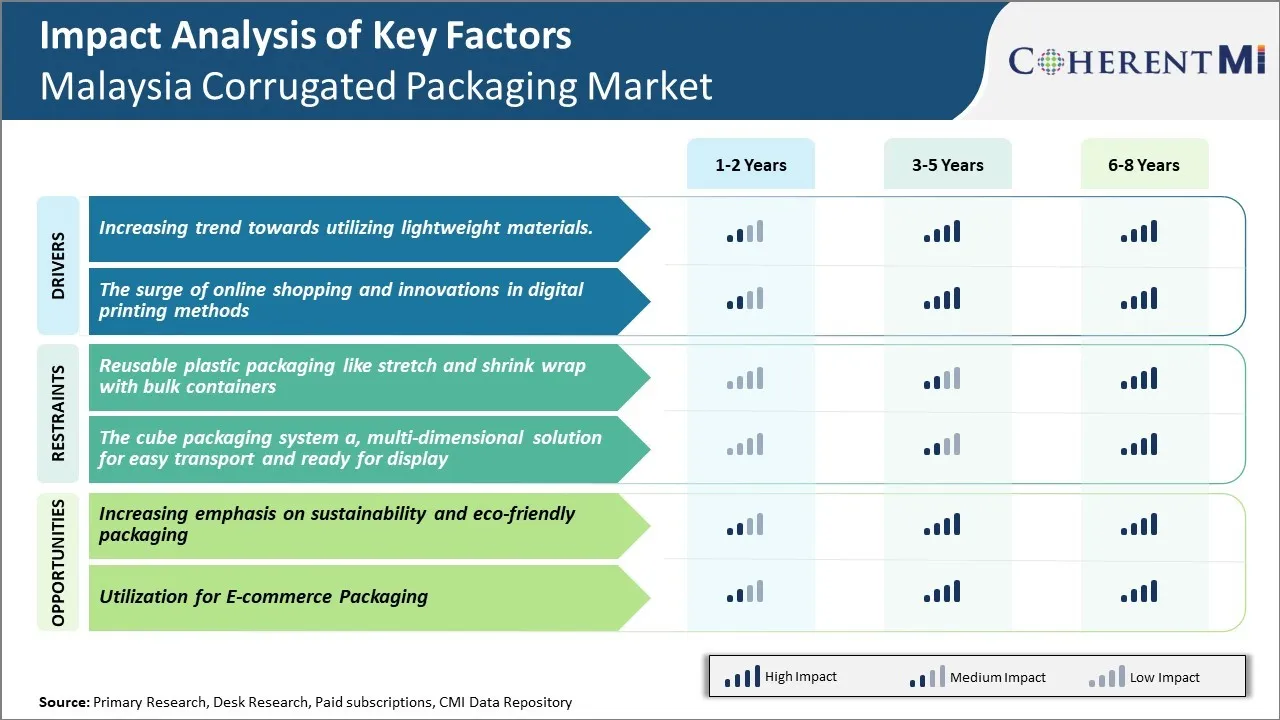

Malaysia Corrugated Packaging Market Trends

The increasing trend towards utilizing lightweight materials is a major factor driving the growth of Malaysia corrugated packaging market. In recent years, there has been a significant focus on sustainability and reducing environmental impact across industries. Companies are under pressure from regulators as well as consumers to utilize materials that are lighter and produce less carbon emissions in both manufacturing and transportation.

Manufacturers are leveraging this developmental push for sustainably sourced packaging products. The lighter weight of corrugated boxes allows for more units to be transported in a single shipment, thereby reducing overall freight charges and carbon footprint.

Market Driver – The Surge of Online Shopping and Innovations in Digital Printing Methods

To address this, packagers have significantly invested in new digital printing technologies that enable customized designs, quicker turnaround times and variable short-run lots on corrugated boxes and displays. This allows e-tailers and omnichannel retailers to test promotions, launch unique designs for new products and brands, and redesign packaging based on real-time consumer feedback. According to the United Nations Department of Economic and Social Affairs, global e-commerce grew 27% in 2020 alone with predictions that one in every four Malaysian consumers will purchase goods and services online by 2023.

Market Challenge – Reusable Plastic Packaging Like Stretch and Shrink Wrap With Bulk Containers

Market Challenge – Reusable Plastic Packaging Like Stretch and Shrink Wrap With Bulk ContainersReusable plastic packaging such as stretch wrap, shrink wrap, and bulk containers is having a significant negative impact on the growth of Malaysia's corrugated packaging industry. As businesses and consumers become increasingly concerned about sustainability and reducing waste, many are switching to reuse-oriented plastic options for packaging and shipping goods. According to a 2021 report from the United Nations Environment Programme, reusable plastic transport packaging helped avoid over 600,000 tons of packaging waste in Malaysia that year.

The growing focus on environmental protection and sustainability across Malaysia presents a major opportunity for growth in the corrugated packaging industry. Consumer awareness of environmental issues has increased substantially in recent years, driven by concerns over plastic pollution, climate change impacts and carbon emissions. According to a 2020 survey by the Department of Environment Malaysia, over 70% of Malaysians reported being willing to pay more for products with sustainable packaging. As consumer demand shifts towards eco-friendly options, corrugated packaging is well positioned to meet this demand.

Segmental Analysis of Malaysia Corrugated Packaging Market

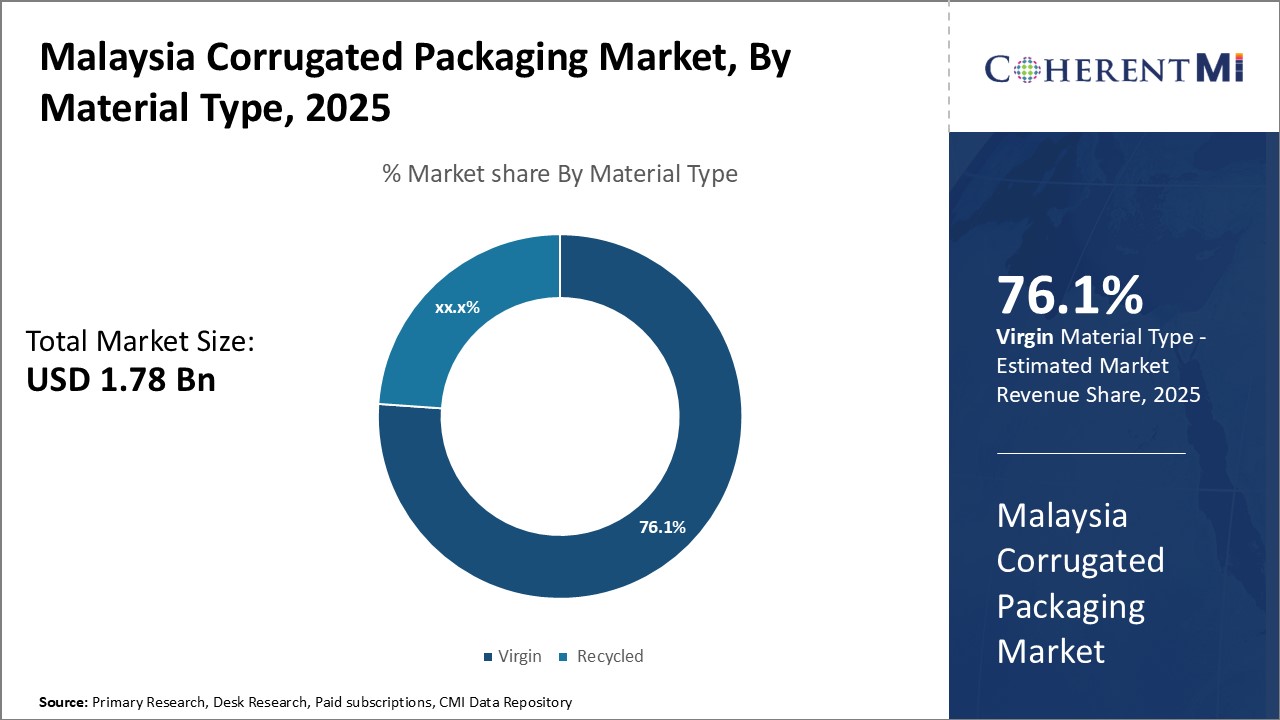

Insights, By Material Type: Cost Advantage and Sustainability Initiatives

Insights, By Material Type: Cost Advantage and Sustainability InitiativesIn 2025, recycled sub-segment contributes the highest market share of 76.1%, owing to cost advantage and sustainability initiatives

In addition, sustainability has become a major priority for Malaysian businesses amid the growing climate change crisis. Many companies have set environmental targets to reduce waste and carbon footprint. Using recycled corrugated packaging allows them to lower their impact on the environment. It supports the circular economy model and diverts waste from landfills. This eco-friendly perception of recycled packaging is appealing to both manufacturers and end-users.

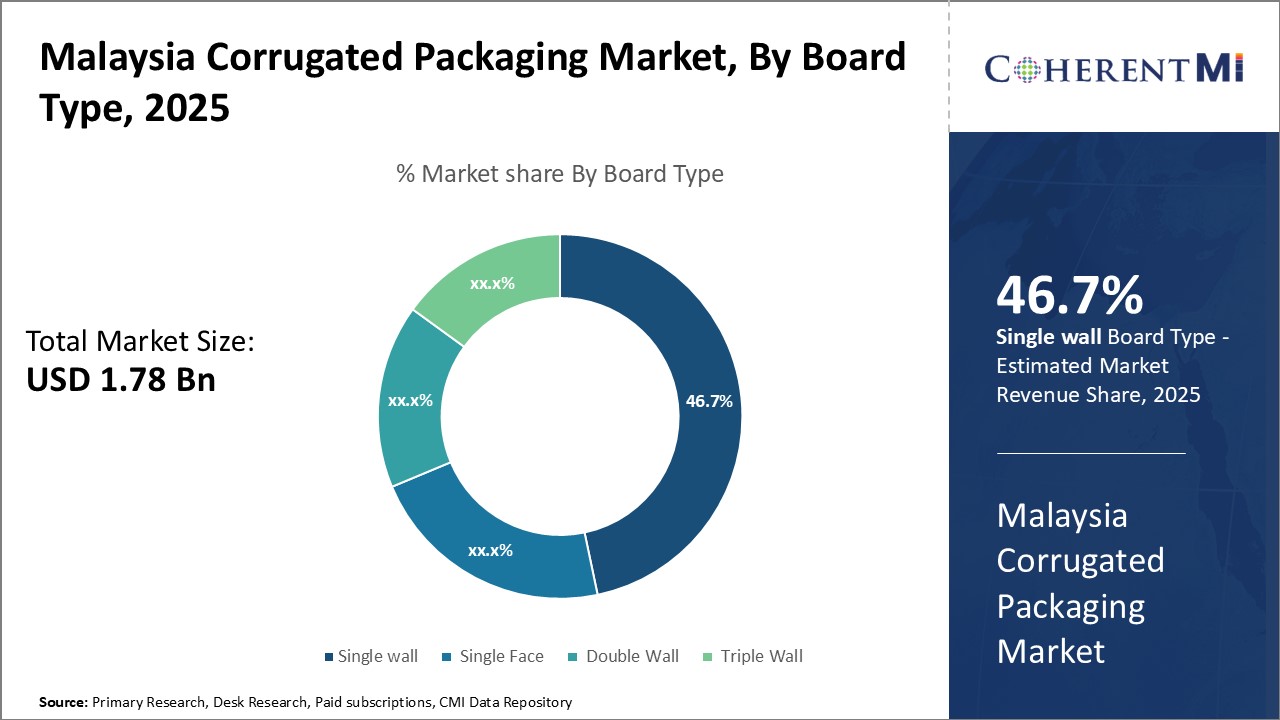

Insights, By Board Type: Widespread Applications and Cost-Effectiveness of Single Wall Structure

Insights, By Board Type: Widespread Applications and Cost-Effectiveness of Single Wall StructureIn 2025, single wall sub-segment contributes the highest share of 46.7% in the Malaysia Corrugated Packaging Market, owing to its widespread applications and cost-effectiveness.

Being the most inexpensive option among corrugated board types, single wall offers good value for money. Its affordable price point allows manufacturers to produce bulk consumable packaging at low unit costs. This cost structure helps boost sales volumes and maximize profits. Single wall board also qualifies for the lowest freight rates since it has a lighter weight.

Competitive overview of Malaysia Corrugated Packaging Market

The major players operating in the Malaysia corrugated packaging market include International Paper WestRock (RockTenn), Smurfit Kappa Group, Rengo, Georgia-Pacific, Mondi Group, Inland Paper, Oji, Cascades, and DS Smith.

Malaysia Corrugated Packaging Market Leaders

- International Paper

- WestRock (RockTenn)

- Mondi Group

- Smurfit Kappa Group

- Georgia-Pacific

Malaysia Corrugated Packaging Market - Competitive Rivalry

Malaysia Corrugated Packaging Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Malaysia Corrugated Packaging Market

- In March 2024, for the 18th consecutive time, International Paper was recognized by Ethisphere as one of the 2024 World's Most Ethical Companies.

- In January 2024, WestRock announced its plan to build new corrugated box plant in Wisconsin to meet growing demand from customers in the Great Lakes region.

- In February 2024, Smurfit Kappa announced €54 million investment in Spanish Bag-in-Box plant to double the capacity of their Ibi Bag-in-Box plant in Alicante and reduce the carbon footprint.

- In October 2023, Rengo subsidiary Tri-Wall acquired manufacturer of heavy duty packaging materials to meet the corrugated packaging, warehouse management and logistics services of heavy duty packaging materials.

- In February 2024, Mondi partnered with Veyzle, WEPA, and Soprema to enhance the circularity of release liner production waste through collaborative efforts. This partnership has helped to achieve hygiene paper, such as toilet paper and paper towels from Mondi's production waste.

Malaysia Corrugated Packaging Market Segmentation

- By Material Type

- Virgin

- Recycled

- By Board Type

- Single Face

- Single Wall

- Double Wall

- Triple Wall

- By Product Type

- Boxes

- Crates

- Octabins

- Pallets

- Others

- By End Use Industry

- Electronics and Electrical

- Home Care Products

- Food & Beverages

- Personal Care Products

- Transportation & Logistics

- Healthcare

- Others

Would you like to explore the option of buying individual sections of this report?

Shivam Bhutani has 6 years of experience in market research and strategy consulting. He is a Market Research Consultant with strong analytical background. He is currently an MBA candidate specializing in Business Analytics from BITS Pilani.

He is adept at navigating diverse roles from sales and marketing to research and strategy consulting. He excels in market estimation, competitive intelligence, pricing strategy, and primary research. He is skilled at analysing large datasets to provide precise insights, helping clients in achieving strategic transformation across various industries. He is skilled in leveraging data visualization techniques to drive innovation and enhance business processes.

Frequently Asked Questions :

How big is the Malaysia Corrugated Packaging Market?

The Malaysia Corrugated Packaging Market is estimated to be valued at USD 1.78 in 2025 and is expected to reach USD 2.22 Billion by 2032.

What are the major factors driving the Malaysia Corrugated Packaging Market growth?

The increasing trend towards utilizing lightweight materials and the surge of online shopping and innovations in digital printing methods are the major factors driving the Malaysia Corrugated Packaging Market growth.

Which is the leading Material Type in the Malaysia Corrugated Packaging Market?

The leading material type segment is recycled.

Which are the major players operating in the Malaysia Corrugated Packaging Market?

International Paper, WestRock (RockTenn), Smurfit Kappa Group, Rengo, Georgia-Pacific, Mondi Group, Inland Paper, Oji, Cascades, and DS Smith are the major players.

What will be the CAGR of the Malaysia Corrugated Packaging Market?

The CAGR of the Malaysia Corrugated Packaging Market is projected to be 3.2% from 2025-2032.