Plastic Crates Market Size - Analysis

Plastic crates are sturdy containers made from plastic materials such as polyethylene, polypropylene, polystyrene, etc. They are used for the storage and transportation of products across various end-use industries like food and beverage, retail, agriculture, etc. due to their durability and cost-effectiveness. The growth in the food processing, retail, and e-commerce industries is driving the demand for plastic crates globally.

- Growth of Retail and E-commerce Sectors: The rapid growth in organized retail and e-commerce sectors globally is a major driver for the plastic crates market. The rise of supermarkets, hypermarkets, and online retail and grocery delivery services has boosted the demand for plastic crates for efficient storage, handling, and transport of products. Retailers and e-commerce companies are increasingly using plastic crates for distribution centers, warehouses, and last-mile delivery. This enables optimization of logistics operations. For instance, in 2021, Amazon opened 11 new fulfillment centers in the U.S. with advanced automation and robotics, where plastic crates play a key role in inventory management. The expansion of retail and shift towards omnichannel models provide significant growth opportunities for plastic crate manufacturers.

- Expanding Food and Beverage Industry: The steady growth of the food and beverage industry globally drives the adoption of plastic crates for food supply chain operations. Plastic crates are increasingly used in the processing, storage, distribution, and retail of fresh produce, dairy products, meats, and packaged foods, among others, as they ensure product safety and quality. They also enable automation in food warehousing with compatibility for conveyors and robotics. For instance, according to UN FAO, global food demand is estimated to grow by 70% by 2050, indicating lucrative prospects for plastic crates. Emerging markets show high growth potential, fueled by rising middle class and changing lifestyles.

- High Demand from Logistics and Transportation Sector: The logistics and transportation industry is a major end-user of plastic crates owing to benefits such as durability, sustainability, and cost-efficiency compared to cardboard boxes. Supply chain visibility and asset tracking enabled by technologies like RFID also encourage large 3PL companies and others to use plastic crates. The chemical, automotive and pharmaceutical industries are other major end-users. For instance, according to 3PL studies, the global logistics market size was over US$9 trillion in 2021. The expansion of supply chain networks globally will pave strong growth avenues.

- Focus on Sustainable Packaging: There is an increased focus on the adoption of reusable and recyclable plastic packaging across end-use industries to reduce waste and environmental impact. This is contributing to higher demand for plastic crates as an alternative to single-use cardboard boxes. Manufacturers are developing eco-friendly plastic crates made using recycled materials and offering them through leasing models rather than sales. Stricter regulations on packaging waste and circular economy mandates also compel industries to use sustainable options like plastic crates.

Plastic Crates Market Opportunities

- Increasing Adoption in Emerging Economies: High growth opportunities exist for plastic crate manufacturers in emerging economies across Asia Pacific, Latin America, Middle East and Africa. These regions are expected to see rapid growth in retail, agriculture, food processing, and other key end-use sectors owing to urbanization, rising income levels, and a large population base. Local manufacturing and strategic partnerships will be key for companies.

- Rising Demand from Online Grocery Delivery: The global online grocery market has grown significantly over the past few years, generating substantial demand for plastic crates. Grocery delivery companies like Instacart, Amazon Fresh, and Big Basket are expanding operations across geographies and also enabling deliveries from neighborhood stores through aggregator models. Plastic crates enable efficient picking, storage, and delivery of grocery products while ensuring food safety and quality. Anti-microbial and antimicrobial crates are also gaining popularity. Player like International Food Container Organization (IFCO) is providing plastic crate pooling solutions customized for grocery delivery.

- Application in Emerging Areas like Construction and Utilities: Plastic crates are creating new application areas besides traditional end-users. For instance, collapsible crates are being used in construction sites for waste disposal and transport of tools, equipment, etc. Sturdy plastic crates enable organized storage and mobility. Similarly, utility companies utilize plastic crates for the storage and transport of pipes, cables, tools to remote project sites safely. Manufacturers can tap these emerging high-potential segments through focused product development.

- Adoption of Plastic Crates with Sensors and Connectivity: Integration of crates with sensors, IoT connectivity, and data analytics to enable tracking, condition monitoring, and supply chain transparency is an emerging opportunity area. RFID-tagged smart plastic crates provide real-time location and status updates. Inbuilt sensors can measure temperature, humidity, light exposure, etc. Big data analytics combined with traceability improves efficiency across the supply chain.

- Volatility in Prices of Key Raw Materials: The plastic crates market is impacted by fluctuations in the prices of raw materials like polyethylene and polypropylene, which affect the profit margins of manufacturers. Prices are influenced by the supply-demand dynamics of crude oil and natural gas, which are key feedstocks. Uncertain economic conditions and geopolitical conflicts exacerbate raw material price volatility. Companies unable to pass on cost inflation to customers face margin pressures. Securing long-term supplier contracts and effective hedging mechanisms help mitigate risks.

- Requirement of High Initial Investments: Setting up large-scale plastic crate manufacturing operations requires substantial capital investments in machinery like injection molding systems, fabrication tools, and molds. Advanced automation and robotics adoption also involve sizable investments. Lack of access to finance and funding can deter new entrants, especially small companies in developing countries, hindering market growth. Partnerships with funding bodies and incrementally scaling up help ease capital constraints.

- Logistics Costs Associated with Reverse Logistics: An area of concern impeding wider plastic crate adoption is the logistics costs associated with reverse logistics, i.e., the collection, sorting, and return of used crates to manufacturers or pooling service providers. Route optimization, the use of 3PLs, and the adoption of RFID tracking solutions are some ways companies are addressing reverse logistics challenges to expand plastic crate supply chain networks sustainably. Regional manufacturing helps reduce transit costs.

The plastic crates market is expected to experience moderate growth over the forecast period. The market is driven by the increasing use of plastic crates in industries such as food and beverages, chemicals, and pharmaceuticals for product packaging and transportation purposes. Asia Pacific dominated the market in 2025 owing to high demand from China, India, and other developing countries on account of expanding industrial sectors. North America and Europe are also major markets due to well-established industries. However, strict environmental norms regarding the use of plastics pose a challenge to market growth. Volatility in raw material prices can also impact the supply and pricing of plastic crates. On the other hand, increasing consumption of packaged food and drinks offers an opportunity to push demand. The demand is expected to be higher for reusable plastic crates that offer cost savings to end users over the long term. Moreover, strong industrial growth, especially in developing countries, will drive consumption of plastic crates.

Market Size in USD Bn

CAGR8.1%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.1% |

| Fastest Growing Market | Latin America |

| Larget Market | North America |

| Market Concentration | High |

| Major Players | Craemer Holding GmbH, Vaibhav Industries, Brambles Limited, Supreme Industries Limited, Nefab Group and Among Others |

please let us know !

Plastic Crates Market Trends

- Development of Customized and Bespoke Crates: A key trend is the introduction of customized plastic crates designed and engineered specifically for the application requirements of end-users. Companies are launching crates tailored for produce like fruits and vegetables, meat and poultry, dairy products, etc. in terms of dimensions, ventilation, water drainage, and stacking. Designs compatible with automated warehousing and dimensions that maximize transport vehicle space utilization are also gaining traction.

- Launch of Plastic Crates with Innovative Designs and Enhanced Strength: Manufacturers are focused on product innovation through new crate designs and the use of novel materials to enhance strength, appearance, and sustainability. For instance, folding and collapsing crates that require less storage space are becoming popular. Easy-to-assemble crates are also being introduced. Materials like polypropylene are being used to make sturdier and lighter crates suited for heavy loads. Manufacturers use advanced molding technology for novel crate designs.

- Adoption of Plastic Pallets and Containers for Sustainability: Major industries like consumer goods and retail are transitioning towards plastic pallets and containers from wood pallets for sustainability benefits. Plastic pallets have a longer life, require less maintenance, and eliminate contamination during storage and transport. Nestable and rackable plastic containers are also gaining adoption for efficient warehousing. Supply chain players like CHEP offer recyclable plastic pallets made using recycled polyethylene on a sharing and reuse model.

- Strategic Partnerships and M&A Activity by Key Players: Key plastic crate manufacturers are entering into strategic partnerships with major end-user companies, 3PLs, and recycling specialists to strengthen their capabilities and offerings. Acquisitions of companies providing value-added solutions are also taking place. For instance, Brambles acquired Ferguson Group and CAPS, while Greif Inc. took over Caraustar Industries. Partnerships help enhance the collection, reuse, and recycling of plastic crates across regions. These moves consolidate the market positions of companies.

Plastic Crates Market Regional Insights

- North America is expected to be the largest market for plastic crates market during the forecast period, accounting for over 41% of the market share in 2025. The growth of the market in Asia Pacific is attributed to the rapidly growing food processing and retail sectors in emerging economies like India and Southeast Asia.

- Europe market is expected to be the second-largest market for plastic crates market, accounting for over 22% of the market share in 2025. The growth of the market in Europe is attributed to the high demand from the well-established food and beverage industry.

- Latin America market is expected to be the fastest-growing market for plastic crates market, with a CAGR of over 14% during the forecast period. The growth of the market in Latin America is attributed to the expanding agriculture sector and growth in online grocery delivery services in the region.

Segmental Analysis of Plastic Crates Market

Competitive overview of Plastic Crates Market

The Plastic Crates Market is competitive and consists of some players in the market which help expand Food and Beverage Industry and the key players are Craemer Holding GmbH, Vaibhav Industries, Brambles Limited, Supreme Industries Limited, Nefab Group, Myers Industries, Allibert Group, DS Smith Plc, Rehrig Pacific Company, TranPak Inc, Schoeller Allibert, Buckhorn, USA Plastic Molders, Plastic Emballages, WestRock Company

Plastic Crates Market Leaders

- Craemer Holding GmbH

- Vaibhav Industries

- Brambles Limited

- Supreme Industries Limited

- Nefab Group

Plastic Crates Market - Competitive Rivalry

Plastic Crates Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Plastic Crates Market

New product launches

- In January 2022, Supreme Industries (manufactures industrial and engineering molded furniture products, storage and material handling crates) launched a new range of plastic storage and material handling products including crates. The new crates are made using food-grade raw materials for safety.

- In June 2021, Myers Industries (manufactures and distributes polymer products for the industrial, agricultural, automotive, commercial, and consumer markets) introduced new reusable plastic containers and trays for e-commerce fulfillment and supply chain operations. The containers enable efficient storage and transport.

- In March 2020, Allibert launched its new foldable ATTIX transport crate made from polypropylene for added strength and sustainability. The crates enhance logistics efficiency.

Acquisition and partnerships

- In September 2022, Brambles (specialises in the pooling of unit-load equipment, pallets, crates and containers) acquired Ferguson Group USA, a provider of reusable plastic containers, to expand its presence in North America.

- In June 2021, DS Smith (international packaging company, offering sustainable, plastic-free packaging, integrated recycling services, and sustainable paper products) partnered with Circular Corporate to improve the recycling of used plastic crates in Europe through advanced sorting technology.

- In December 2020, Rehrig Pacific (industry leader in pallets, waste and recycling containers, supply chain solutions and direct store delivery solutions) acquired Polymer Logistics, a manufacturer of reusable transport packs, to expand its crates business in North America.

Plastic Crates Market Segmentation

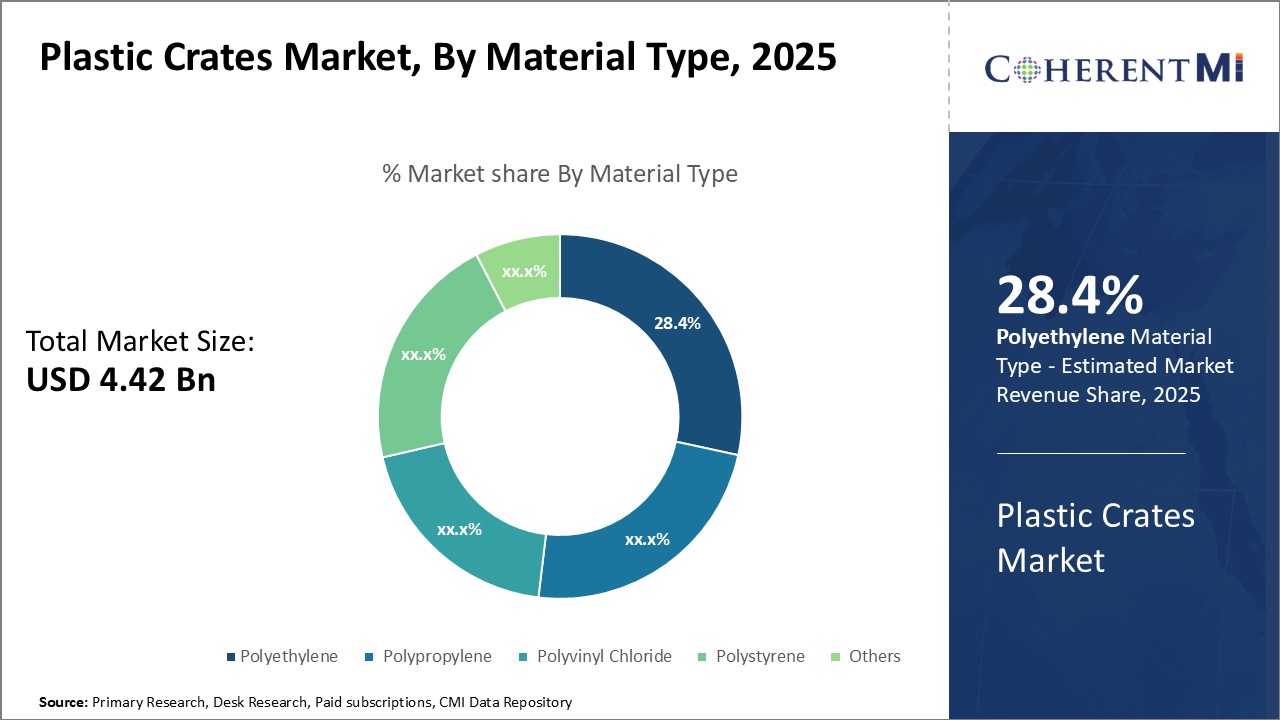

- By Material Type

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Polystyrene

- Others

- By Product Type

- Stackable

- Nestable

- Collapsible

- Foldable

- Other

- By End Use

- Agriculture

- Food and Beverage

- Retail

- Industrial

- Pharmaceutical

- Others

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Would you like to explore the option of buying individual sections of this report?

Kalpesh Gharte is a senior consultant with approximately 5 years of experience in the consulting industry. Kalpesh holds an MBA in Operations and Marketing Management, providing him with a strong foundation in market strategy and analysis. He has contributed to various consulting and syndicated reports, delivering valuable insights that support informed business decisions

Frequently Asked Questions :

How big is the Plastic Crates Market?

The Plastic Crates Market is estimated to be valued at USD 4.4 in 2025 and is expected to reach USD 7.6 Billion by 2032.

What are the major factors driving the plastic crates market growth?

Expanding food processing and retail sectors, demand from e-commerce and online grocery delivery, the need for sustainable packaging, high demand in emerging economies are some major factors driving the growth of the plastic crates market.

Which is the leading component segment in the plastic crates market?

The polyethylene segment held the largest share in the plastic crates market owing to its properties like durability, crack resistance, and lightweight nature.

Which are the major players operating in the plastic crates market?

Craemer Holding GmbH, Vaibhav Industries, Brambles Limited, Supreme Industries Limited, Nefab Group, Myers Industries, Allibert Group, DS Smith Plc, Rehrig Pacific Company, TranPak Inc, Schoeller Allibert, Buckhorn, USA Plastic Molders, Plastic Emballages, WestRock Company are the major players in the Plastic Crates Market.

Which region will lead the plastic crates market?

North America is to lead the plastic crates market.

What will be the CAGR of plastic crates market?

The CAGR of the plastic crates market is projected to be 8.1% from 2025 to 2032.