Metallized PET Packaging Market Size - Analysis

Market Size in USD Bn

CAGR5.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.4% |

| Market Concentration | High |

| Major Players | Hangzhau Hengxin (Jinxin) Filming Packaging, Gaylord Packers, Cosmo Films, Polyplex Corporation, Ester Industries Limited and Among Others |

please let us know !

Metallized PET Packaging Market Trends

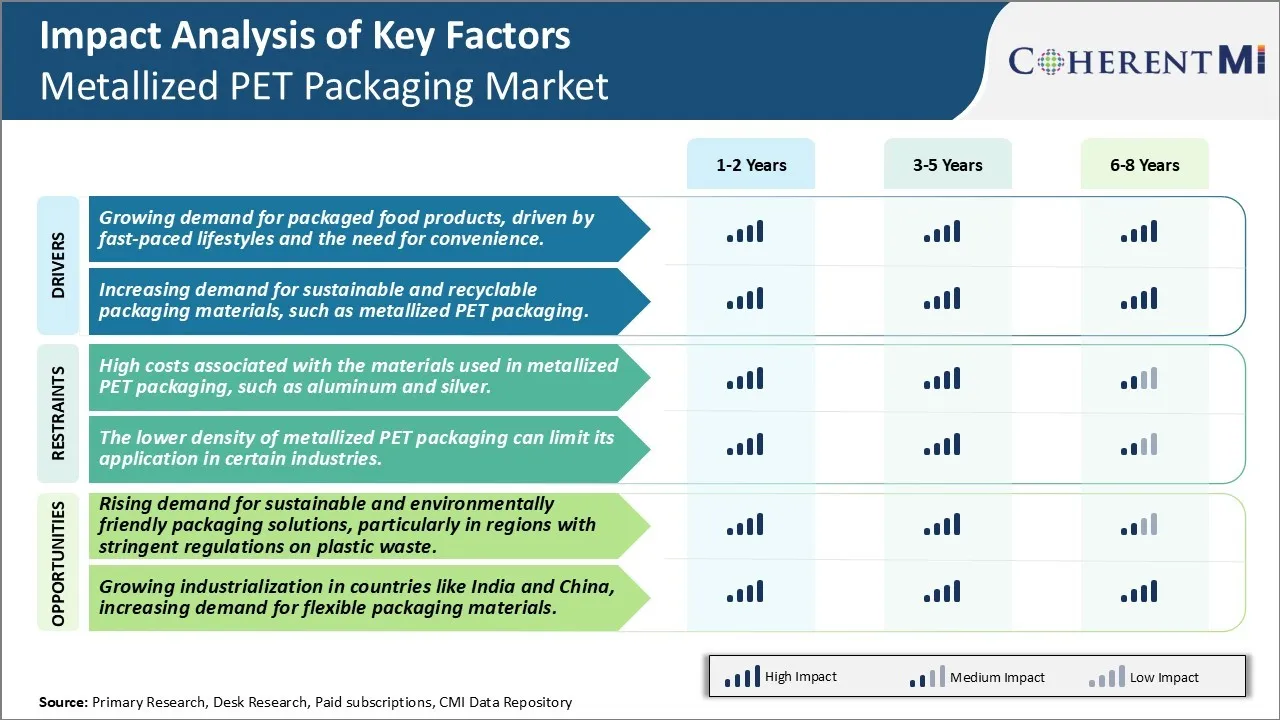

The fast-paced urban lifestyles that many people around the world are leading leaves little time for elaborate home cooking or eating out. People are relying more and more on packaged and ready-to-eat foods that can be prepared and consumed quickly. This is driving sales of prepared and packaged products across food categories like snacks, dairy, bakery and more. Metallized PET packaging has become the material of choice for many of these products as it allows manufacturers to extend shelf life of products while also providing barrier against moisture, gas and light. Its lightweight and shatter resistance properties ensure products packaged in metallized PET can withstand transportation and handling without damage.

With growing environmental awareness, consumers are increasingly focusing on packaging sustainability and searching for eco-friendly options. They want brands to take responsibility for minimizing waste and adopt greener solutions. Metallized PET packaging addresses this demand well as it delivers high barrier protection using less material compared to some alternatives. In addition, metallized PET films are fully recyclable and many communities now accept them in their regular recycling streams. Recycling rates for PET are improving consistently which diverts this material from landfills. Packaging manufacturers recognize the commercial opportunity in developing sustainable options made from recycled content in line with circular economy principles.

Market Challenge - High Costs Associated with The Materials used in Metallized PET Packaging, Such as Aluminum and Silver

One major opportunity for growth in the metallized PET packaging market is the rising demand for sustainable and environmentally friendly packaging solutions, particularly in regions with stringent regulations on plastic waste. Metallized PET packaging offers advantages over conventional plastic packaging in terms of recyclability and sustainability. The thin aluminum or silver coatings allow metallized PET packaging to be easily separated into metal and polymer components at recycling centers. This makes them suitable for both metal and plastic recycling streams. Moreover, the barrier properties of metallized PET enable downgauging of plastic material while maintaining product freshness. Less plastic usage equates to lower environmental footprint. Many brand owners and retailers are actively pursuing sustainable packaging goals to appeal to eco-conscious consumers and comply with waste management policies. This growing emphasis on sustainability and recyclability bodes well for the increasing adoption of metallized PET packaging across various industries in the coming years.

Key winning strategies adopted by key players of Metallized PET Packaging Market

Strategic partnerships and collaborations: One of the most successful strategies adopted by leading players has been entering into strategic partnerships and collaborations. For example, in 2020, Graham Packaging partnered with Amcor to produce metallized PET films for food and personal care packaging applications. This partnership allowed both companies to leverage their combined expertise and infrastructure to rapidly scale production of more sustainable packaging solutions.

Focus on sustainability and recyclability: As sustainability becomes a priority, companies like Ampac and Sealed Air have emphasized recyclable and compostable metallized film solutions. For example, in 2021 Ampac launched its REVUpet recycling technology which retains the barrier properties of used PET packaging post recycling. Similarly, in 2022 Sealed Air announced plans to make all its packaging fully reusable, recyclable or compostable by 2025.

Segmental Analysis of Metallized PET Packaging Market

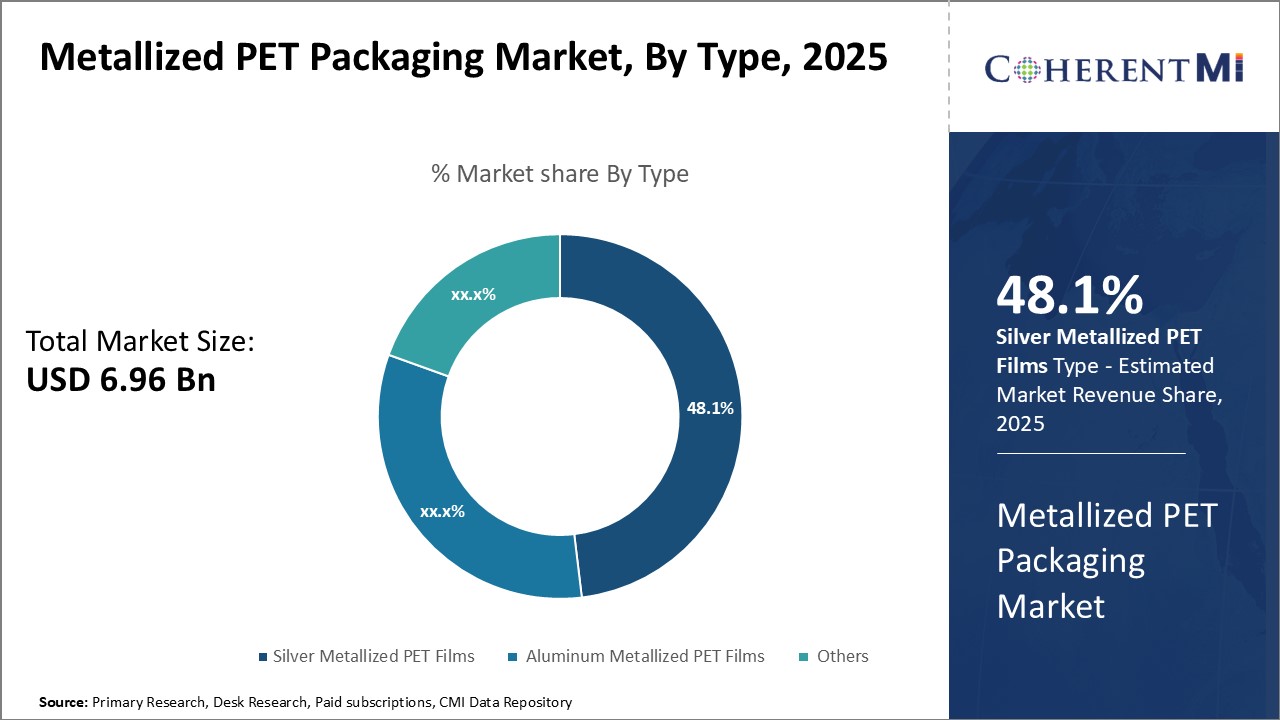

Insights, By Type, Silver Metallized PET Films Are Expected to Dominate in the Forecast Period

The high reflectivity of silver metallized PET films makes them ideal for packaging various food items that require protection from light exposure. The silver layer helps shield light-sensitive contents from degradation. It is thus frequently used for packing snacks, chips, dried foods and cereals. Silver metallized PET films significantly prolong the shelf-life of light-sensitive products.

The shiny surface renders an upmarket look and feel, adding to the visual appeal. This drives greater sales and brand perception for companies. Given the unmatched reflective shine and barrier strengths offered, silver metallized PET films remain the top choice for various packaging applications. The enhanced shelf-life and protection of product quality attributable to silver metallization is expected to further increase its market dominance over other metallized films.

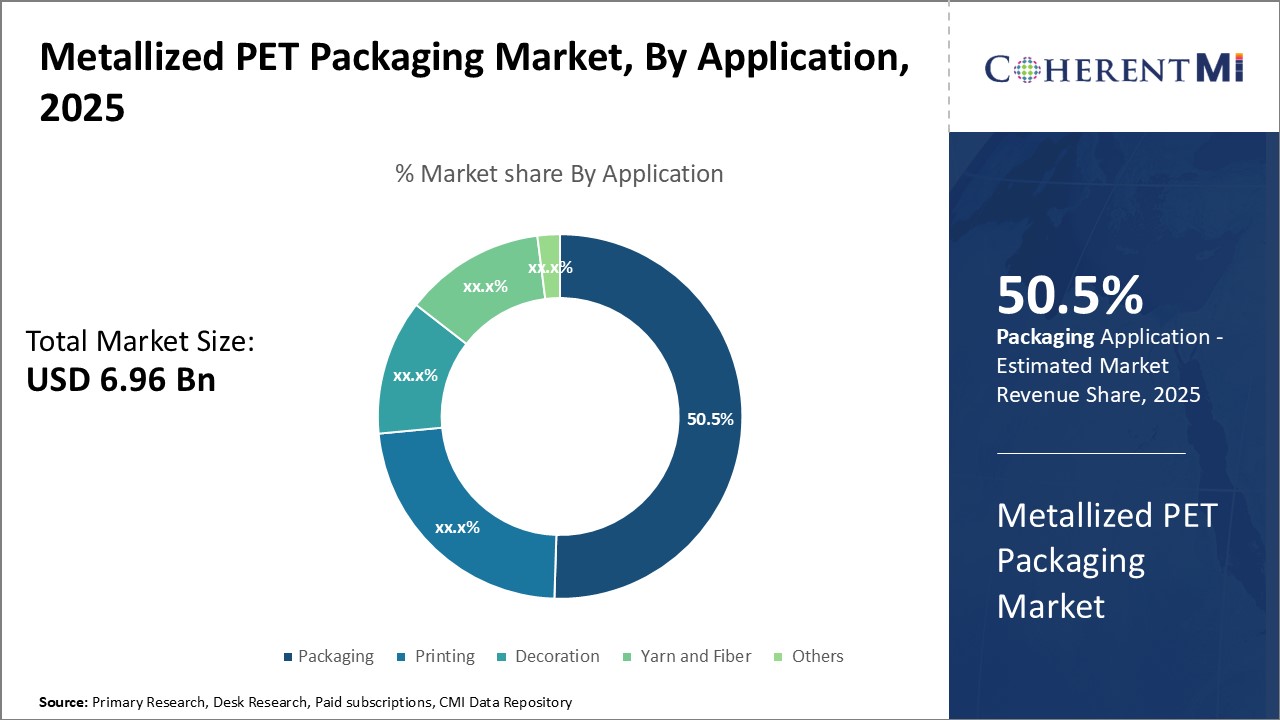

Insights, By Packaging, Packaging Dominates the Metallized PET Packaging Market owing to Widespread Usage in Food & Consumer Goods Industries

Insights, By Packaging, Packaging Dominates the Metallized PET Packaging Market owing to Widespread Usage in Food & Consumer Goods Industries

In the food industry, metallized PET films see extensive application for packaging snacks, chips, baked foods, confectionery items, dried fruits and ready-to-eat meals. Their high barrier attributes help maintain freshness and extend shelf-life of foods. For packaging pharmaceuticals, healthcare and personal care products, metallized PET films provide an effective moisture and oxygen barrier. In the electronics segment, these films are employed for packaging small appliances, gadgets and accessories. Their shiny appearance coupled with protection against external elements enhances the aesthetic appeal and longevity of electronic products. Metallized PET films also gain usage in the packaging of cosmetics, consumer lifestyle products, apparel and garments.

Additional Insights of Metallized PET Packaging Market

The global metallized PET packaging market is poised for steady growth, driven by increased demand for sustainable and efficient packaging solutions across various industries, including food and beverages, pharmaceuticals, and electronics. As consumers and governments increasingly prioritize environmental sustainability, companies are investing in recyclable and biodegradable packaging options. Metallized PET films offer several advantages, such as superior barrier properties, light weight, and flexibility, making them ideal for protecting products and maintaining their freshness. In addition, the expanding middle-class population in emerging economies like India and China is boosting the demand for packaged consumer goods, further accelerating the market. However, the high costs of metallized materials like aluminum and silver and lower density limitations may restrict broader adoption. Despite these challenges, the market is expected to grow at a CAGR of 5.11%, reaching a valuation of nearly USD 11 bn by 2034, making metallized PET packaging a key player in the global packaging landscape.

Competitive overview of Metallized PET Packaging Market

The major players operating in the Metallized PET Packaging Market include Hangzhau Hengxin (Jinxin) Filming Packaging, Gaylord Packers, Cosmo Films, Polyplex Corporation, Ester Industries Limited, Alpha Industry Company, Terphane (Tredegar Corporation), Vacmet India Ltd., Toray Plastics and Sumilon Industries.

Metallized PET Packaging Market Leaders

- Hangzhau Hengxin (Jinxin) Filming Packaging

- Gaylord Packers

- Cosmo Films

- Polyplex Corporation

- Ester Industries Limited

Metallized PET Packaging Market - Competitive Rivalry

Metallized PET Packaging Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Metallized PET Packaging Market

- In May 2024, Ester Industries Ltd. and Loop Industries Inc. formed a joint venture to build an Infinite Loop Manufacturing Facility in India, producing polymers from waste polyesters with a lower carbon footprint. This project is expected to advance the sustainable packaging market.

- In December 2023, Loop Industries announced that its Loop branded PET resin had been tested and approved for use in pharmaceutical packaging applications, strengthening its position in the sustainable packaging industry.

- In September 2023, Innovia Films launched RayofaceTM CPE45 and WPE45 label facestock films, thinner and printable options for the packaging and labeling industry, which align with sustainable packaging trends.

Metallized PET Packaging Market Segmentation

- By Type

- Silver Metallized PET Films

- Aluminum Metallized PET Films

- Others

- By Application

- Packaging

- Printing

- Decoration

- Yarn and Fiber

- Others

Would you like to explore the option of buying individual sections of this report?

Vidyesh Swar is a seasoned Consultant with a diverse background in market research and business consulting. With over 6 years of experience, Vidyesh has established a strong reputation for his proficiency in market estimations, supplier landscape analysis, and market share assessments for tailored research solution. Using his deep industry knowledge and analytical skills, he provides valuable insights and strategic recommendations, enabling clients to make informed decisions and navigate complex business landscapes.

Frequently Asked Questions :

How Big is the Metallized PET Packaging Market?

The Global Metallized PET Packaging Market is estimated to be valued at USD 6.96 Bn in 2025 and is expected to reach USD 10.06 Bn by 2032.

What will be the CAGR of the Metallized PET Packaging Market?

The CAGR of the Metallized PET Packaging Market is projected to be 5.2% from 2024 to 2031.

What are the major factors driving the Metallized PET Packaging Market growth?

The growing demand for packaged food products, driven by fast-paced lifestyles and the need for convenience. Increasing demand for sustainable and recyclable packaging materials, such as metallized pet packaging are the major factors driving the Metallized PET Packaging Market.

What are the key factors hampering the growth of the Metallized PET Packaging Market?

The high costs associated with the materials used in metallized pet packaging, such as aluminum and silver and the lower density of metallized pet packaging can limit its application in certain industries are the major factors hampering the growth of the Metallized PET Packaging Market.

Which is the leading Type in the Metallized PET Packaging Market?

The leading Type segment is Silver Metallized PET Films.

Which are the major players operating in the Metallized PET Packaging Market?

Hangzhau Hengxin (Jinxin) Filming Packaging, Gaylord Packers, Cosmo Films, Polyplex Corporation, Ester Industries Limited, Alpha Industry Company, Terphane (Tredegar Corporation), Vacmet India Ltd., Toray Plastics, Sumilon Industries are the major players.