Oil Refining Market Trends

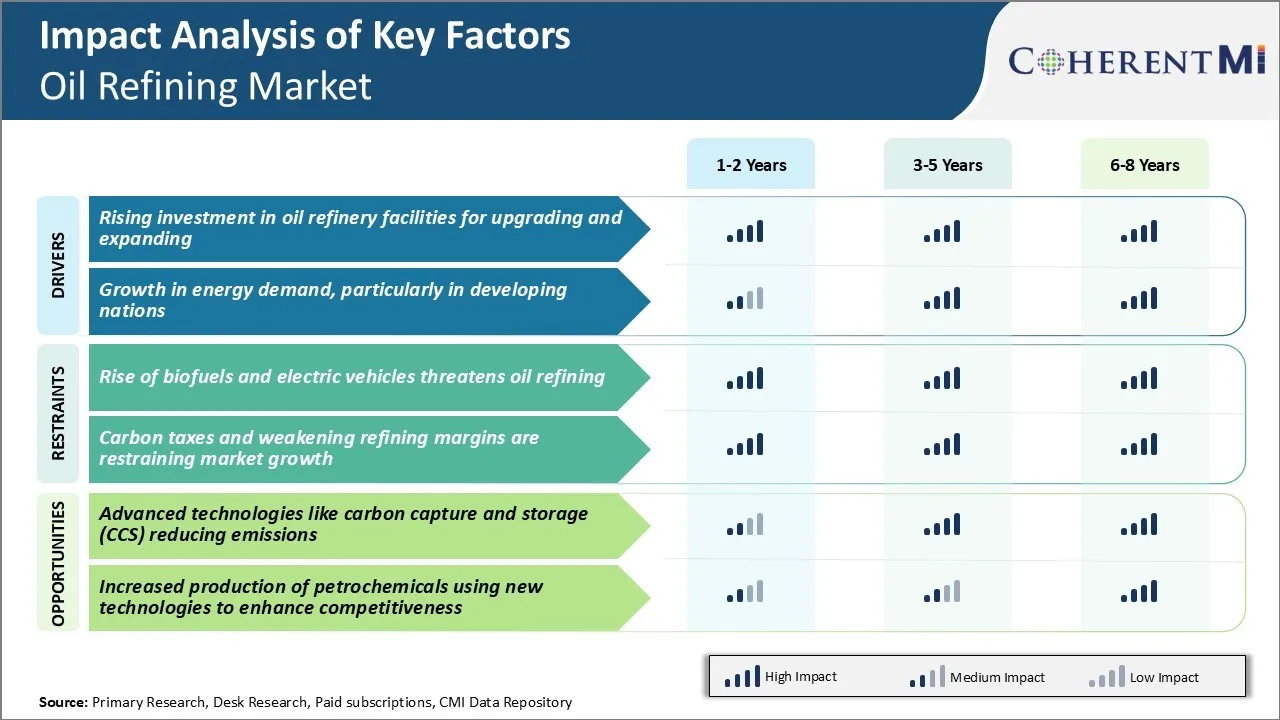

Market Driver - Rising Investment in Oil Refinery Facilities for Upgrading and Expanding

With rising demand for refined petroleum products, oil companies have been making significant investments in upgrading their existing refinery facilities as well as expanding operations. Refiners see the need to revamp facilities with new units like delayed cokers, hydrotreaters, and hydrocrackers that allow for deeper conversion of crude into high-value products like gasoline and diesel.

Apart from regulatory compliance, upgrading refineries also enhances flexibility to process a variety of crude oils and optimize output. This is crucial as oil quality differs widely across regions and the margins change frequently between fuel types depending on market demand and price volatility.

Similarly, Chinese companies are expanding their refining network extensively along with storage and pipeline infrastructure to meet fast growing local petrochemical and bunker fuel needs. Considering these refinery projects usually entail multi-billion-dollar investments with long gestation periods, oil firms are very optimistic about the surety of returns over the next couple of decades given Asia's rising consumption.

Market Driver - Growth in Energy Demand, Particularly in Developing Nations

With increasing industrialization and rising disposable income levels, the demand for energy is growing steadily across developing economies. Developing countries are expected to account for a major share of global increase in oil consumption over the next 20-30 years.

According to projections by the International Energy Agency, non-OECD nations will drive over 90% of the worldwide growth in oil demand by the year 2040. This rapid development offers huge potential to refiners who aim to expand their operations closer to emerging demand centers.

East and South Asia in particular have become hotspots for greenfield refinery megaprojects in recent years. Coastal regions across China, India and Southeast Asia are witnessing explosive urbanization along with mushrooming manufacturing hubs and transportation corridors.

Meanwhile, other places like Africa and the Middle East also require sizeable oil refining capacity additions to serve their domestic petrochemical, power, and mobility needs. With economic growth forecast to remain robust over the long run, such underlying energy demand fundamentals continue bolstering investments in the oil refining market.

Market Challenge - Rise of Biofuels and Electric Vehicles Threatens Oil Refining

One of the major challenges currently faced by the oil refining market is the rise of biofuels and electric vehicles. With growing environmental concerns worldwide about carbon emissions and their role in climate change, many countries are promoting the increased use of biofuels and electric vehicles to reduce dependence on fossil fuels.

Also, advances in battery technology are driving mass adoption of electric vehicles. Many nations have announced plans to phase out or ban petrol and diesel vehicles in the coming years and shift to electric. This poses a serious threat to the oil refining market as demand for gasoline and diesel is likely to fall sharply in the long run.

Oil refinery market may have to retool factories or retrofit plants to process more biofuels or face the risk of assets becoming stranded. Governments incentivizing consumers to switch to green fuels also impacts refining margins. The industry needs to closely monitor these macro trends and devise strategies to mitigate risks to business.

Market Opportunity - Advanced Technologies like Carbon Capture and Storage (CCS) Reducing Emissions

One major opportunity area for the oil refining market is the deployment of advanced low-carbon technologies. Carbon capture and storage (CCS) is one such promising technology that can help reduce greenhouse gas emissions from refineries and petrochemical plants significantly.

CCS involves capturing carbon dioxide from large industrial sources like oil refineries, transporting it via pipelines, and storing it deep underground in rock formations or depleted oil and gas fields. Some refiners have started pilot projects to test CCS technologies.

Oil refiners investing in CCS and other emission reduction solutions can gain a competitive edge in the long run. It also boosts their public image and social license to operate. Technology vendors stand to benefit as CCS deployment ramps up to decarbonize oil refining market and allied sectors.