Online Trading Platform Market Trends

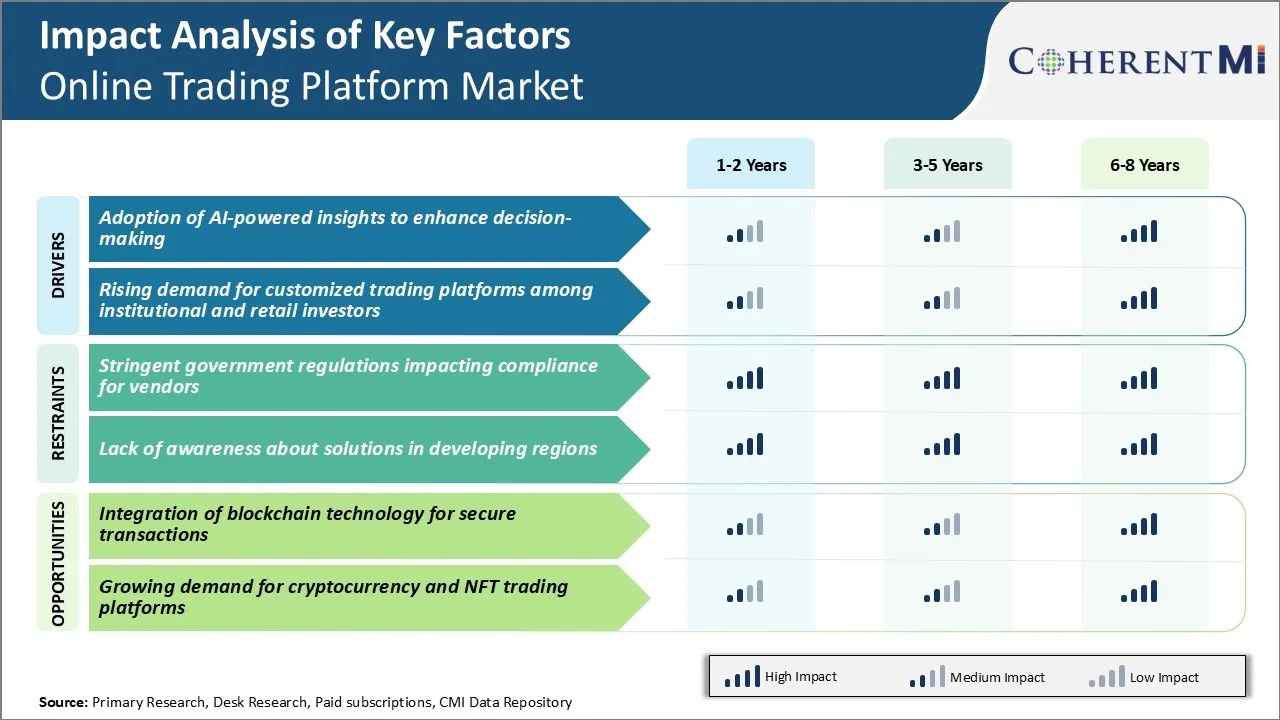

Market Driver - Adoption of AI-powered Insights to Enhance Decision-making

The online trading platform market has seen a spurt of innovation in recent times with many players increasingly leveraging advanced technologies to gain a competitive edge. One such promising technology attracting a lot of interest is artificial intelligence which has the potential to profoundly transform how investing decisions are made. AI is being levered by online trading platform providers to crunch huge amounts of market data and offer actionable insights to traders.

By analyzing patterns and trends from historical price movements, financial news, earnings reports and other variables, AI models can identify lucrative trading opportunities that may not be obvious otherwise. Established as well as new age online brokers are incorporating AI throughout the investing workflow, from idea generation to order execution. Players in the online trading platform market are developing Watson-style chatbots that can discuss market trends, explain strategies and generate customized recommendations.

As AI capabilities evolve rapidly, the ability to glean actionable insights from torrents of structured and unstructured financial data will decide competitive standings in coming years. Online trading platforms offering most powerful AI-enhanced decision support tools are expected to attract greater flows.

Market Driver - Rising Demand for Customized Trading Platforms Among Institutional and Retail Investors

Technology has enabled the emergence of myriad online investing options tailored for different trader profiles. Yet, with proliferation, comes complexity and not all platforms may dovetail seamlessly with investors' needs and preferred ways of interacting. There is an increasing demand from institutional as well as retail traders for deeply customized platforms optimized for their objectives, risk appetites, experiences and preferences.

Advanced UI/UX designs along with AI are facilitating continuous personalization. Online trading platforms also offer a suite of theme-based interfaces - from simple point and click modes for novices to depth views favored by experts. Providers excelling in customization will find it easier to lock-in traders and expand their share of trading volumes in future. As personalization further drives platform choices, the online trading platform market may witness increased specialization around user segments with differentiated needs.

Market Challenge - Stringent Government Regulations Impacting Compliance for Vendors

Online trading platform market is facing several challenges due to stringent government regulations regarding compliance. Regulations such as Know Your Customer (KYC) norms, Anti-Money Laundering (AML) policies, and data privacy laws have made it difficult for vendors to launch new products and services in a short span of time.

Establishing robust compliance mechanisms as per the dynamic regulations requires substantial investment of capital and time. Smaller platforms often lack the resources to appoint dedicated compliance teams, implement advanced technologies for monitoring transactions and maintain auditable records as prescribed by regulators.

Keeping track of changes across different global jurisdictions and ensuring adherence is another cumbersome task. Non-compliance can attract heavy financial penalties and even suspension of license to operate. This stringent regulatory oversight has stalled innovation and growth initiatives for some players in the online trading platform market. Vendors have to spend considerable efforts towards compliance instead of focusing solely on improving customer experience and expanding offerings.

Market Opportunity - Integration of Blockchain Technology for Secure Transactions

The integration of blockchain technology presents a massive opportunity for online trading platforms to offer more secure and transparent transactions. Blockchain allows creation of digital records or blocks of transactions that are recorded across a network of computer systems.

Once a transaction is recorded, it cannot be altered unless there is a consensus across the network. This distributed ledger technology can help eliminate vulnerabilities like double-spending and enable real-time verification and traceability of fund movements. Online trading platforms can leverage blockchain for instant cross-border settlements, peer-to-peer transfers and record-keeping of trade details. It also removes reliance on centralized intermediaries, bringing down costs.

This can help online trading platforms meet stringent AML and KYC norms in a seamless manner while enhancing the customer experience through quicker transactions. Lower transaction costs and secure infrastructure using blockchain is likely to boost adoption of online trading platforms over the long run.