Oropharyngeal Cancer Market Size - Analysis

The oropharyngeal cancer market is estimated to be valued at USD 2.23 Bn in 2025 and is expected to reach USD 3.27 Bn by 2032, growing at a compound annual growth rate (CAGR) of 5.6% from 2025 to 2032. According to recent statistics by WHO, over half a million new cases of oropharyngeal cancer are reported annually. The increasing prevalence of risk factors such as tobacco consumption, human papillomavirus (HPV) infection and alcohol use is contributing significantly to the disease burden.

Market Size in USD Bn

CAGR5.6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.6% |

| Market Concentration | High |

| Major Players | Innate Pharma, GlaxoSmithKline, Debiopharm, Checkpoint Therapeutics, Quadriga BioSciences and Among Others |

please let us know !

Oropharyngeal Cancer Market Trends

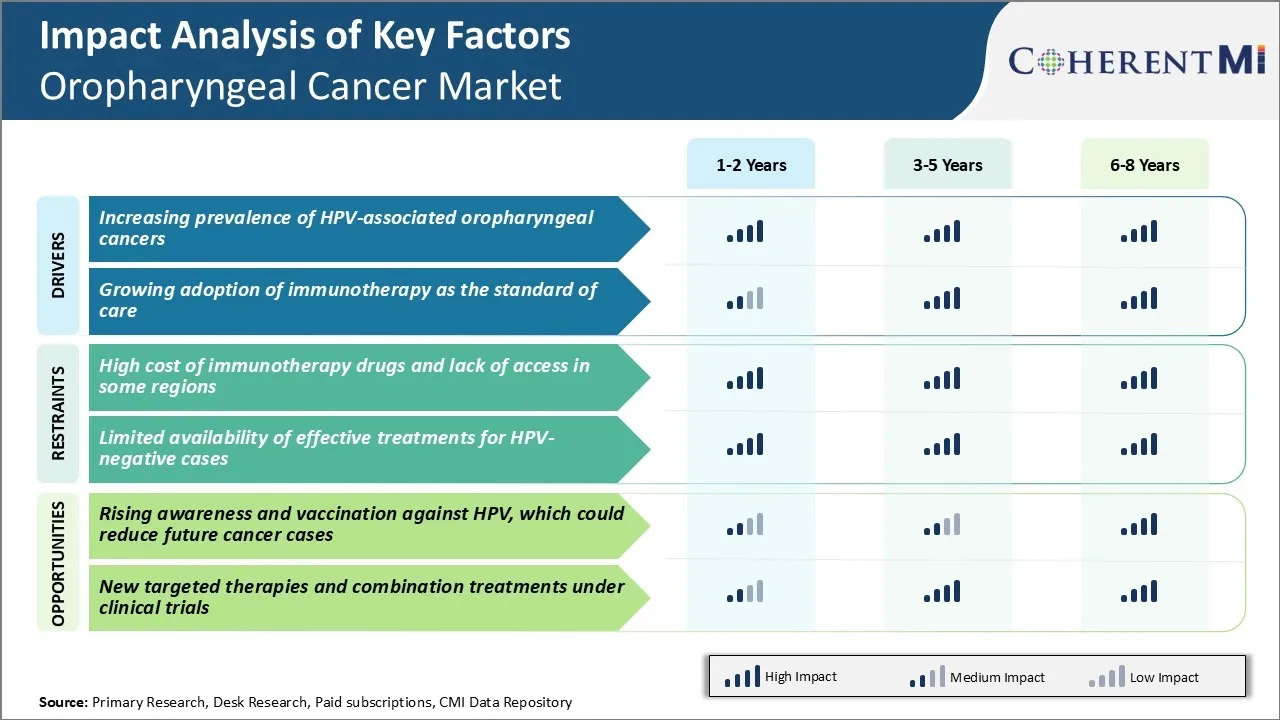

Market Driver - Increasing Prevalence of HPV-associated Oropharyngeal Cancers

The instances of HPV contracted oropharyngeal cancers are increasing at an alarming rate over the past few decades. The human papillomavirus is being identified as the leading cause in over 70% of newly reported oropharyngeal cancer cases.

Moreover, HPV seems to be more efficient in causing cancer in the oropharynx than tobacco and alcohol. Even non-smokers and non-drinkers are now falling prey to this HPV driven disease if they contract the virus.

Due to the widespread transmission of HPV, more and more patients with oropharyngeal cancers have minimal or no history of smoking and alcohol use. These patients are typically younger with a median age of 50-60 years. Their disease has a distinct pathobiology associated with infection by high-risk HPV types, especially HPV-16.

With no signs of abating HPV infections in communities, the patient base for oropharyngeal cancers linked to the virus is poised to grow further in the foreseeable future. This emerging epidemic will substantially drive the long-term demand for related therapies, screening and prevention.

Market Driver - Growing Adoption of Immunotherapy as the Standard of Care

Immunotherapies have ushered in a new era of hope for cancers that were previously difficult to treat including oropharyngeal cancer. Drugs that aid in boosting the body's natural immune defenses are demonstrating unprecedented and durable responses even in relapsed or metastatic settings. Checkpoint inhibitors targeting molecules like PD-1 and PDL-1 have led to a paradigm shift away from conventional cytotoxic chemotherapy and radiation.

Ongoing clinical trials as well as real-world evidence have cemented the use of immunotherapies especially pembrolizumab and nivolumab as the standard of care for recurrent or metastatic disease in eligible patients. Early use of immunotherapy is also being evaluated in combination with chemotherapy or radiation in the frontline setting for better outcomes compared to historical standards.

Novel combinations of immunotherapy agents hold promise to enhance efficacy as well. Moreover, with effective therapies now available, the focus is shifting towards maintenance and monitoring approaches to achieve extended remissions.

Strong partnership between pharmaceutical companies, medical fraternity and patient advocacy groups have helped raise awareness about the transformational role of immunotherapy. Sustained clinical development towards new immunotherapy regimens and combinations will continue to cement their leadership position in oropharyngeal cancer market in the future.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High Cost of Immunotherapy Drugs and Lack of Access in Some Regions

One of the major challenges faced in the oropharyngeal cancer market is the high cost of immunotherapy drugs and lack of access to these treatments in some regions. Immunotherapy drugs such as pembrolizumab and nivolumab have shown promising results in the treatment of recurrent or metastatic oropharyngeal cancer.

However, these drugs come with an extremely high price tag, often over $100,000 for a full course of treatment. This puts an immense financial burden not only on patients but also on public and private healthcare systems. Many cancer patients in developing nations and underinsured or uninsured patients even in developed countries don't have adequate means to afford such expensive treatments.

While pharmaceutical companies invest heavily in research and development of newer immunotherapies, the high profit margins on blockbuster drugs keep the prices of these therapies unaffordable for large sections of patient populations globally. Unless generic versions or affordable biosimilars of cancer immunotherapy drugs are rapidly made available in oropharyngeal cancer market, a significant number of patients will have very limited or no access to these life-saving treatment options.

Market Opportunity - Rising Awareness and Vaccination Against HPV Could Reduce Future Cancer Cases

One major opportunity present in the oropharyngeal cancer market is the rising awareness around HPV as a causative agent and the availability of HPV vaccines. Oropharyngeal cancer has strong associations with HPV infection, particularly with high-risk HPV-16 and HPV-18 strains.

Widespread vaccination programs targeted at adolescents and young adults against these high-risk HPV types have the potential to dramatically reduce the burden of oropharyngeal cancers in the future. Increased public messaging around HPV as a risk factor for oropharyngeal cancer and head and neck cancers in general is leading to greater vaccination uptake in several countries.

If high vaccination coverage is maintained globally and boosters are administered as recommended, the incidence of HPV-related oropharyngeal cancer cases could substantially decrease by 2030 and beyond. This would potentially open significant opportunities for healthcare cost savings as well as reduced market for cancer treatment drugs in the long run.

Prescribers preferences of Oropharyngeal Cancer Market

Oropharyngeal cancer treatment typically follows a step-wise approach based on the stage of disease. For early-stage (I-II) cancers, primary treatment involves surgery to remove the tumor. For more advanced stages (III-IVA), the standard first-line treatment is concurrent chemoradiotherapy. Chemotherapy drugs like cisplatin or carboplatin are commonly prescribed in combination with intensity-modulated radiation therapy (IMRT). This multimodal approach has significantly improved survival rates compared to radiation alone.

For cancers that relapse after chemoradiation or are deemed surgically unresectable, single-agent chemotherapy becomes the preferred second-line option. Prescribers frequently choose a platinum-based regimen using proven medications such as cisplatin (Platinol), carboplatin (Paraplatin) or nedaplatin (Nedaplatin). For patients who progress on or are intolerant to platinum therapies, the anti-PD-1 drug pembrolizumab (Keytruda) has gained favor as an effective alternative. Key factors influencing prescribers include each drug's efficacy and safety profile based on clinical evidence, as well as patients' needs, comorbidities, and responses to prior lines of treatment. Immunotherapy drugs are increasingly being explored in earlier stages as well.

Treatment Option Analysis of Oropharyngeal Cancer Market

Oropharyngeal cancer is typically classified into four main stages - Stage I, Stage II, Stage III, and Stage IV. The treatment plan is tailored based on the stage of the cancer.

For early stage (Stage I-II) cancers, primary treatment involves surgery to remove the tumor. This may be followed by adjuvant radiation therapy or chemoradiation to eliminate any remaining cancer cells and reduce the risk of recurrence. Chemoradiation, which involves chemotherapy along with radiation therapy, is also commonly used as primary treatment for early-stage cancers to avoid surgery.

For locally advanced (Stage III-IVA) cancers, primary treatment involves chemoradiation to shrink the tumor before surgery. The preferred regimen is weekly cisplatin chemotherapy along with intensity modulated radiation therapy (IMRT). This bimodal approach of chemoradiation followed by surgery offers higher cure rates compared to either modality alone.

For metastatic (Stage IVB) or late-stage cancers, chemotherapy remains the mainstay of treatment. The current standard of care is platinum-based chemotherapy involving cisplatin or carboplatin along with 5-fluorouracil and cetuximab. This PD-L1 inhibitor enhances the efficacy of chemotherapy. Alternatively, pembrolizumab monotherapy is also an option as it harnesses the power of the immune system against cancer cells.

Key winning strategies adopted by key players of Oropharyngeal Cancer Market

Focus on product development and innovation: Players have invested heavily in R&D to develop novel drugs and treatment options for oropharyngeal cancer. For example, in 2018, Bristol-Myers Squibb received FDA approval for Opdivo (nivolumab) as a first-line treatment for recurrent or metastatic head and neck squamous cell carcinoma (HNSCC).

Targeted therapies: Many companies are developing drugs that specifically target cancer cell pathways involved in oropharyngeal cancer. For example, Merck received FDA approval for Keytruda (pembrolizumab) in 2016 as monotherapy for recurrent or metastatic HNSCC. Keytruda harnesses the body's own immune system to fight cancer by blocking PD-1 receptors.

Strategic partnerships and collaborations: Players partner with other companies, research institutes and organizations to expand capabilities and access new technologies. For example, in 2020, AstraZeneca partnered with Daiichi Sankyo to develop and commercialize trastuzumab deruxtecan, an antibody drug conjugate, for head and neck cancers.

Acquisitions: Companies acquire other firms to gain access to their drug pipelines and portfolio. For example, in 2019, Bristol-Myers Squibb acquired Celgene for $74 billion, mainly to gain access to Celgene's promising early-stage pipeline including its IDH1 mutant targeting drug for solid tumors such as oropharyngeal cancers.

Segmental Analysis of Oropharyngeal Cancer Market

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

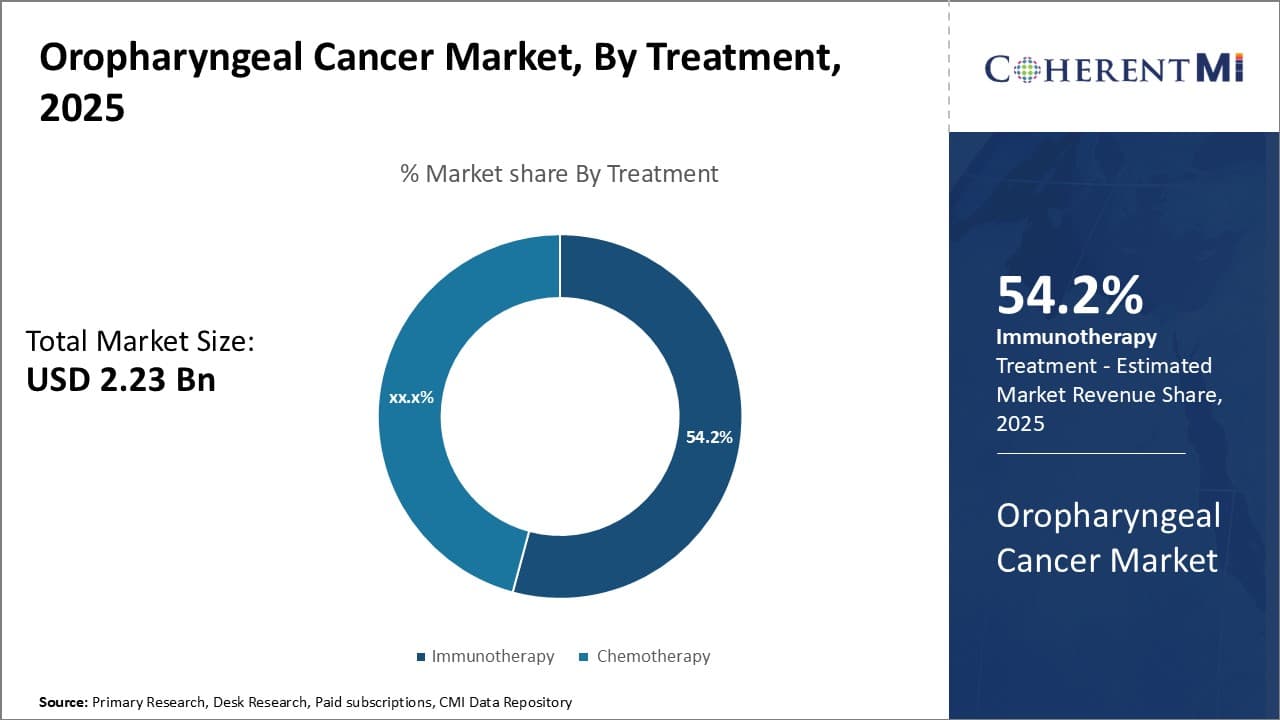

Insights, By Treatment: Focused Innovation in Immunotherapy Boosts Segment Growth

In terms of treatment, immunotherapy is expected to hold 54.2% share of the oropharyngeal cancer market in 2025, owning to ongoing research and development of novel products. Immunotherapy is focused on harnessing the body's own immune system to fight cancer.

Several new immune checkpoint inhibitors have been approved or are in late stages of clinical trials for oropharyngeal cancer. Key players are investing heavily in developing more targeted immunotherapy drugs with higher response rates and fewer side effects.

Monoclonal antibody drugs that block PD-1 and PD-L1 pathways have shown promising results with improved overall survival rates compared to standard therapies. New combination approaches using immune checkpoint inhibitors along with chemotherapy, radiation or other immunotherapies are expanding treatment options.

Continuous clinical testing of these therapies over larger patient groups will help optimize treatment protocols. Patent expiries of blockbuster drugs are also driving partnerships for combination therapy research.

Overall, rapid approvals and strong pipeline of immunotherapies hold significant potential to transform oropharyngeal cancer management, supporting the segment's growth.

To learn more about this report, Download Free Sample Copy

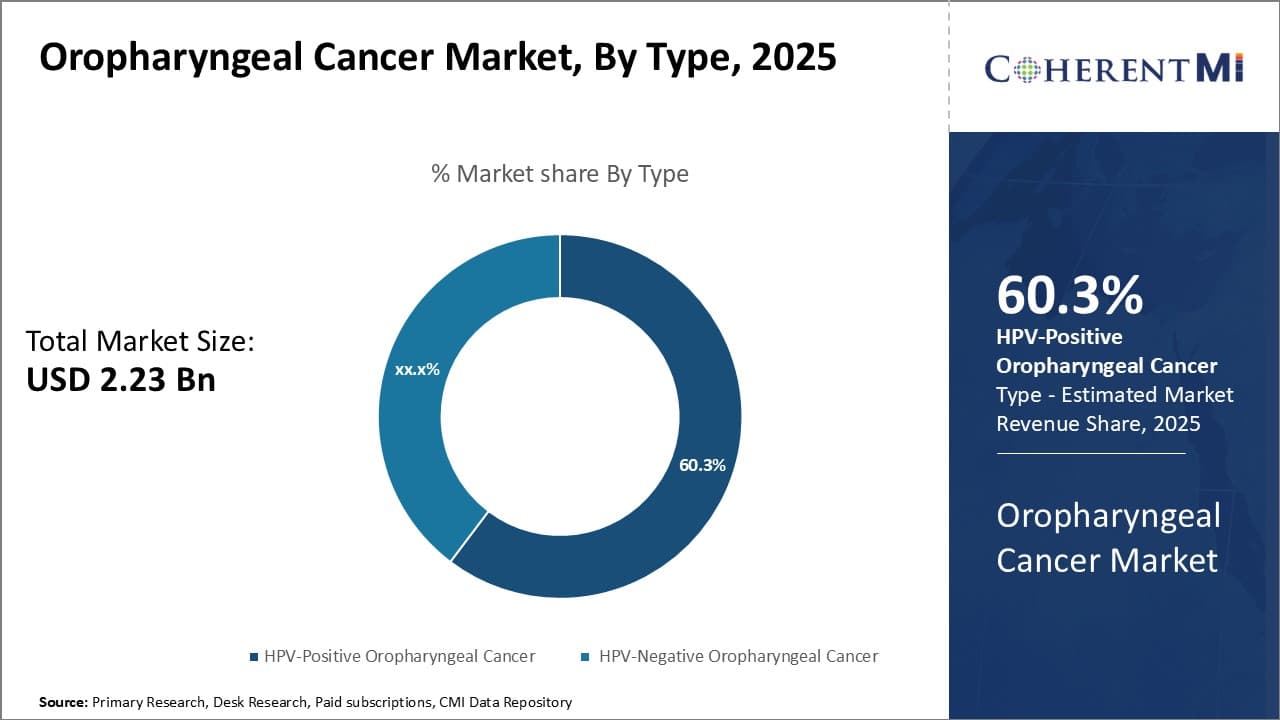

Insights, By Type: Rising Incidence of HPV-Positive Variant

To learn more about this report, Download Free Sample Copy

Insights, By Type: Rising Incidence of HPV-Positive Variant

In terms of type, HPV-positive oropharyngeal cancer is likely to account for 60.3% share of the oropharyngeal cancer market in 2025, driven by surging rates of HPV infection. Rising sexual activity during young adulthood has increased risk of HPV transmission globally. While HPV screening and vaccinationprograms in developed nations have shown initial success, most patients in low-and middle-income countries remain undervaccinated.

Current epidemiological data suggests HPV-positive oropharyngeal cancer is replacing HPV-negative cancer as the most common variant. Younger patients are increasingly presenting with HPV-positive disease owing to changes in sexual behavior. Risk factors like smoking also act synergistically with HPV to multipliy cancer risks.

Heightened public awareness through health campaigns on causal links between HPV and certain cancers is also encouraging higher testing rates. These trends will continue supporting growth prospects of the HPV-positive segment in the coming years.

Insights, By Patient Age Group: Aging Population Favors Adult Dominance

In terms of patient age group, adults (50+ years) contribute the highest share of the oropharyngeal cancer market owing to advantages of demographics and disease progression. Oropharyngeal cancer occurs mainly in middle-aged and elderly patients as it often takes many years after initial HPV infection or smoke exposure for cancer-causing changes to develop.

Developed nations worldwide are witnessing massive growth in the size of their geriatric population. Individuals aged 65 years and older represented 16% of the total population in the United States in 2020 and this number is projected to rise to over 20% of total population by 2030. The aging baby boomer generation will continue driving up demand for oncology services and treatments in this group.

Additionally, cancer development and treatment outcomes depend on the weakening of immune responses with increasing age. As a result, medical costs per patient and duration of overall treatments tend to be higher for older patients compared to younger ones.

Additional Insights of Oropharyngeal Cancer Market

- Oropharyngeal cancer cases related to HPV are increasing, now constituting more than 70% of all oropharyngeal cancers in the U.S. and Europe. This has driven demand for more effective and targeted treatments, especially immunotherapies.

- Oropharyngeal cancer is the eighth most frequent malignancy in men, with a significant portion of cases seen in adults under the age of 55.

Competitive overview of Oropharyngeal Cancer Market

The major players operating in the oropharyngeal cancer market include Innate Pharma, GlaxoSmithKline, Debiopharm, Checkpoint Therapeutics, Quadriga BioSciences, Bristol-Myers Squibb, Merck & Co., Pfizer, AstraZeneca, Palleon Pharmaceuticals, Klus Pharma, Bicycle Therapeutics, CSPC ZhongQi Pharmaceutical Technology, Memgen, I-Mab Biopharma, Intensity Therapeutics, Wellmaker Bio, and SN BioScience.

Oropharyngeal Cancer Market Leaders

- Innate Pharma

- GlaxoSmithKline

- Debiopharm

- Checkpoint Therapeutics

- Quadriga BioSciences

Recent Developments in Oropharyngeal Cancer Market

- In August 2024, Merck & Co. introduced Keytruda for HPV-positive oropharyngeal cancer, which has shown promising results in reducing tumor size and improving survival rates in advanced cases. Keytruda has been actively studied and used in treating head and neck cancers, including HPV-positive oropharyngeal cancer. Keytruda has already been approved for the treatment of head and neck squamous cell carcinoma, including HPV-positive cases, as part of combination therapies with chemoradiotherapy, showing positive results in improving tumor response and survival rates in advanced cases.

- In January 2023, AstraZeneca launched a clinical trial for a combination of Imfinzi and chemotherapy, targeting recurrent or metastatic oropharyngeal cancer, aiming to enhance treatment efficacy. This trial is part of AstraZeneca's broader research effort to explore and improve the efficacy of immunotherapy treatments for head and neck cancers. The combination therapy aims to enhance treatment efficacy by leveraging Imfinzi's ability to boost the immune response against cancer cells, alongside the traditional cancer-fighting effects of chemotherapy. This research focuses on improving outcomes for patients with this challenging and aggressive form of cancer.

Oropharyngeal Cancer Market Segmentation

- By Treatment

- Immunotherapy

- Chemotherapy

- By Type

- HPV-Positive Oropharyngeal Cancer

- HPV-Negative Oropharyngeal Cancer

- By Patient Age Group

- Adults (50+ Years)

- Younger Patients (Under 50 Years)

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.