The Peripheral Artery Disease (PAD) Market is estimated to be valued at USD 4.31 Billion in 2025 and is expected to reach USD 6.74 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.6% from 2025 to 2032. The PAD market is expected to witness a steady growth during the forecast period owing to the increasing aging population which is the major risk factor for PAD. Additionally, rising lifestyle diseases such as diabetes and government initiatives to increase awareness about early diagnosis and treatment of PAD will further aid the market growth.

Market Size in USD Bn

CAGR6.6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.6% |

| Market Concentration | High |

| Major Players | Abbott Laboratories, Medtronic plc, Boston Scientific Corporation, Cook Medical, Becton, Dickinson and Company and Among Others |

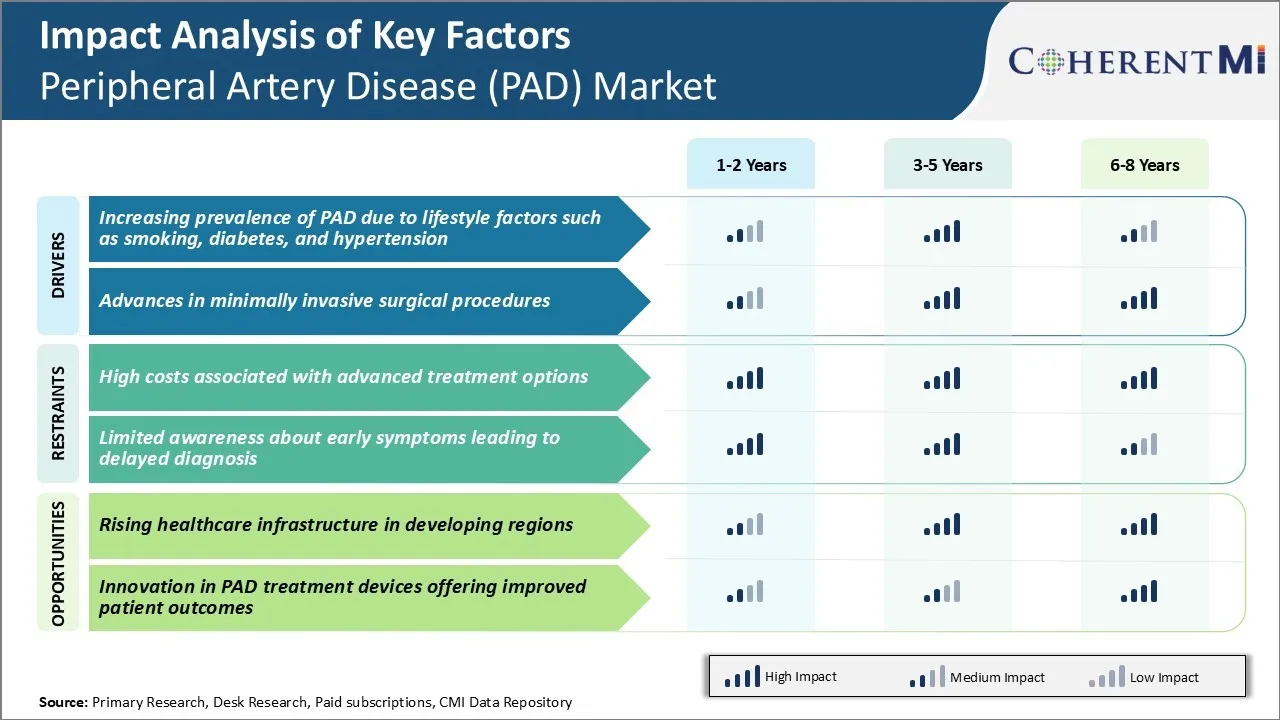

Market Driver - Increasing Prevalence of PAD due to Lifestyle Factors Such as Smoking, Diabetes, and Hypertension

The rising prevalence of peripheral artery disease around the world can largely be attributed to the adoption of poor lifestyle habits among many populations. According to available scientific literature and studies, smoking, diabetes, and high blood pressure/hypertension are some of the leading risk factors that increase one's chances of developing PAD significantly over time.

Statistics show smoking has been on the rise in developing nations, especially among youth, which can translate to a heavy burden of lifestyle ailments in their adult years if not curbed. Besides, unhealthy diet patterns and lack of physical activity associated with modern urban lifestyles are major drivers for the diabetes epidemic unfolding in regions undergoing rapid economic changes.

Similarly, a mix of genetic predisposition and stress has kept hypertension figures climbing across both developed and developing countries alike. All these imply PAD may seriously affect younger working populations too if not addressed proactively through awareness building and lifestyle modification programs.

While pharmaceutical inventions have benefitted those already diagnosed with PAD, focusing on root cause mitigation through behavioral change promotion and stricter policy-level interventions could do more to flatten the PAD prevalence curve. Thereby, demand for PAD treatment in expected to continue to rise in the coming years.

Market Driver – Advances in Minimally Invasive Surgeries

With continuous progress in the fields of medical devices, robotics, imaging technologies and other supportive specialties, minimally invasive techniques for peripheral artery disease treatment have become vastly more refined and effective over the past decade. Advancements in areas like catheter materials, new product designs, improved imaging capabilities and sophisticated surgical navigation systems now allow endovascular procedures to tackle even complex cases of PAD in a less traumatic manner.

Another notable recent development is the advent of drug-coated balloons and stents that elute medications to prevent arterial recoil and reduce post-surgical blockages or restenosis. Such innovations have boosted the durability and longevity of endovascular repairs compared to traditional bare metal implants. Stem cell and gene therapies being explored too may revolutionize customized solutions for advanced PAD in the future.

All in all, minimally invasive procedures are fast becoming the default treatment pathways preferred by both physicians and patients alike due to their improved safety profiles, reproducibility, and cost-effectiveness relative to open surgeries. This paradigm shift augurs well for continued expansion of the peripheral artery disease (PAD) market led by demand for new products spearheading the shift to less traumatic care.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High Costs Associated with Advanced Treatment Options

One of the major challenges faced in the peripheral artery disease (PAD) market is the high costs associated with advanced treatment options such as endovascular interventions and surgeries. PAD treatment often requires the use of specialty devices such as drug-coated balloons and stents which can be very expensive.

The prices of innovative products introduced by major medical device companies significantly impact the overall treatment cost. This poses affordability challenges, especially in developing regions where healthcare budgets are more constrained. The lack of adequate insurance coverage or public funding for such specialized procedures also adds to the patients' economic burden. This cost factor acts as a key barrier in expanding access to care and results in many patients not receiving optimal clinical management of their condition.

Additionally, advanced treatments also require specialized infrastructure and trained clinicians which adds to the overall investment needed to develop PAD services. Addressing these cost barriers through strategies like value-based pricing models, innovative payment schemes and expansion of public insurance schemes can help boost the uptake of new treatment technologies.

Market Opportunity - Rising Healthcare Infrastructure in Developing Regions

One significant opportunity area for the peripheral artery disease market is the rising healthcare infrastructure in developing regions. While PAD prevalence is increasing worldwide due to lifestyle changes and an aging population, many developing countries still have limited access to modern diagnostic and treatment services.

However, in the recent past there has been considerable economic growth and social development in regions like Asia Pacific, Latin America, Middle East and Africa. The governments of these nations have concurrently been investing heavily in building healthcare capacity through establishment of new specialty hospitals, training of clinicians and modernization of facilities. This improving medical infrastructure facilitates wider availability and adoption of advanced PAD management technologies.

It also raises awareness levels among local patients and physicians. The growing infrastructure thus expands the potential patient pool that can be accessed by international medical device companies and suppliers. With their lower treatment cost compared to developed markets, these emerging regions present lucrative opportunities for longer term revenue growth in the global PAD market.

PAD is generally treated based on symptoms and severity. For mild cases with minimal pain on exertion, lifestyle modifications focusing on exercise and risk factor management are usually prescribed. However, for more severe cases, medications play an important role.

In early stages with intermittent claudication, cilostazol (Pletal) is commonly prescribed to improve walking abilities. For those who cannot tolerate cilostazol or need additional therapy, prescribing a statin such as atorvastatin (Lipitor) is common to reduce inflammation and risk of future cardiovascular events.

As PAD progresses, supervised exercise programs combined with medication become essential for symptom management. Prescribers frequently prescribe pentoxifylline (Trental) either alone or with cilostazol to increase walking distance in this moderate stage. For severe claudication, where lifestyle changes and the above medications provide inadequate relief, endovascular or surgical procedures may be considered.

In critical limb ischemia stages with rest pain and non-healing ulcers/gangrene, the choices narrow down to revascularization or amputation to save the limb. Prescribers prefer prescribing anti-platelet drugs like clopidogrel (Plavix) along with risk factor control to reduce pain and risk of amputation if revascularization is not immediately possible.

PAD progresses through four stages - mild, moderate, severe, critical limb ischemia.

For mild PAD with minimal blockages and atypical leg pain, lifestyle changes like quitting smoking, exercise and lipid control may suffice. For more pain, medications may help.

In moderate PAD with blockages resulting in pain on walking, the first line treatment is clopidogrel (Plavix) along with aspirin which helps prevent blood clots. supervised exercise training is also encouraged to improve walking ability.

For severe PAD with blockages causing pain even at rest, the preferred treatment is Percutaneous Transluminal Angioplasty (PTA). This involves threading a catheter with a small balloon into the artery, inflating the balloon at the site of blockage to clear it. Drug eluting stents like Zilver PTX are often placed post PTA to help keep arteries open longer term.

For critical limb ischemia with non-healing wounds or significant pain at rest, Bypass surgery or amputation may be needed if blockages can't be cleared by PTA and stenting. Bypass requires grafting a blood vessel segment from elsewhere in the body to reroute blood flow past blockages.

The choice of treatment depends on the severity of symptoms, extent of blockages and patient fitness.

Product Innovation: One of the most important strategies adopted by players has been continuous innovation in product offerings. For example, Medtronic launched the In.Pact Admiral drug-coated balloon in 2015 for PAD treatment. This was one of the first drug-coated balloons to gain FDA approval and provided an alternative to plain balloons and stents.

Mergers & Acquisitions: Companies have engaged in strategic M&A activity to enhance their product pipelines and technology capabilities. For instance, Boston Scientific acquired BTG Plc in 2019 for $4.2 billion. This provided Boston Scientific access to BTG's PAD therapy portfolio including the Jetstream atherectomy system.

Clinical Evidence Generation: Players focus on conducting clinical trials to demonstrate the effectiveness of their PAD products. For example, between 2010-2015, Medtronic conducted 7 major clinical trials on its In. Pact Admiral balloon. This clinical evidence helped gain physician confidence and trust, leading to higher adoption rates.

Partnerships: Companies partner with other players to access new markets. For instance, in 2017, Bard Peripheral Vascular partnered with Terumo Medical Corporation to distribute Bard's PAD products in Japan. This strategy helped both companies leverage each other's geographic presence and strengthen their position in the attractive peripheral artery disease (PAD) market in Japan.

-market-by-treatment-type.webp&w=3840&q=75) To learn more about this report, Download Free Sample Copy

Insights, By Treatment Type: Access to Advance Surgical Procedures Drive Surgical Treatment Segment

To learn more about this report, Download Free Sample Copy

Insights, By Treatment Type: Access to Advance Surgical Procedures Drive Surgical Treatment Segment

The surgical treatment segment mainly includes bypass surgery and angioplasty procedures. Bypass surgery procedures such as femoral-popliteal bypass and aortofemoral bypass are commonly performed to treat severe PAD cases. These advanced surgical procedures are highly effective in restoring blood circulation in affected legs and prevents limb amputation risk. The success and effectiveness of surgical revascularization have established it as the standard of care for managing chronic limb threatening ischemia.

Continuous technological advancement in surgical devices and techniques have expanded treatment options and improved surgical outcomes. For example, the use of minimal invasive techniques such as catheter-based interventions and endovascular procedures have increased over traditional open surgeries. Minimally invasive procedures are associated with reduced trauma, hospital stay and recovery time. Also, the ability of surgeons to restore blood flow and correct blockages with high precision fuel the adoption of surgical treatment options. Furthermore, growing awareness about lifestyle modification and risks of amputation have encouraged patients to undergo surgeries even in early stages of the disease.

In terms of invasive nature, effectiveness and ability to treat severe cases, surgical procedures remain the standard treatment approach in managing advanced PAD. This ensures sustained demand and high market share for the surgical treatment segment.

-market-by-device-type.webp&w=3840&q=75) To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Insights, By Device Type: Dominance of Stents in Restoring Blood Flow

In terms of device type, stents contribute the highest share of the peripheral artery disease (PAD) market due to its effectiveness in restoring blood flow. Stents are tiny mesh-like tubes that are used to reopen narrowed or blocked arteries supplying blood to legs. It acts as a scaffold to help keep arteries open and improve blood circulation.

Different types of stents like bare-metal stents, drug-eluting stents and bioabsorbable stents are available based on materials used. Among these, drug-eluting stents which slowly release medications to prevent renarrowing of arteries have demonstrated excellent performance. The drugs limit smooth muscle cell proliferation and neointimal hyperplasia which are the major causes of renarrowing or restenosis post angioplasty.

Thanks to strong performance, flexibility in design and ability to deliver drugs, stents have emerged as the standardized treatment approach in percutaneous revascularization procedures like angioplasty. Stents provide long lasting improvement in arterial patency compared to plain old balloon angioplasty alone. The unmet clinical need, performance benefits and widespread insurance coverage favor sustained demand for stents from hospitals and physicians. Continued material innovation to further enhance drug elution properties and biocompatibility will extend the dominance of stents segment.

Insights, By End User: Concentration of Treatment in Hospitals

In terms of end user, hospitals contribute the highest share of the peripheral artery disease (PAD) market owing to concentration of advanced treatment facilities and skilled professionals. Both surgical and non-surgical treatment of PAD often requires specialized angiography equipment, operating rooms and skilled vascular surgeons or interventional radiologists. Most of these superior infrastructural and clinical resources are readily available only in hospitals.

PAD treatment in hospitals also benefits from comprehensive management of comorbid conditions. Many PAD patients have diabetes, high blood pressure or kidney disease which increases surgical risk and influences medical management. The ability of hospitals to provide multidisciplinary care involving cardiologists, endocrinologists and nephrologists prove advantageous.

Furthermore, hospitals are frequently the first contact point during limb threatening conditions like rest pain, non-healing ulcers or gangrene. The emergency nature of such cases drives patients to access pad treatment within hospital settings. Post procedure care including ICU monitoring and nursing is also well addressed in hospitals compared to other settings. Favorable reimbursement structures for inpatient treatments in many countries continue directing patients to hospitals.

This concentration of advanced treatment infrastructure, skilled professionals, efficacious multidisciplinary management and wider insurance coverage makes hospitals the dominant setting for PAD treatment globally.

The major players operating in the Peripheral Artery Disease (PAD) Market include Abbott Laboratories, Medtronic plc, Boston Scientific Corporation, Cook Medical, Becton, Dickinson and Company, Cardinal Health, Terumo Corporation, and Endologix, Inc.

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Peripheral Artery Disease (PAD) Market is segmented By Treatment Type (Surgical Treatment (Bypass Su...

Peripheral Artery Disease (PAD) Market

How big is the peripheral artery disease (PAD) market?

The peripheral artery disease (PAD) market is estimated to be valued at USD 4.31 Billion in 2025 and is expected to reach USD 6.74 Billion by 2032.

What are the key factors hampering the growth of the peripheral artery disease (PAD) market?

The high costs associated with advanced treatment options and limited awareness about early symptoms leading to delayed diagnosis are the major factors hampering the growth of the peripheral artery disease (PAD) market.

What are the major factors driving the peripheral artery disease (PAD) market growth?

The increasing prevalence of pad due to lifestyle factors such as smoking, diabetes, and hypertension, and advances in minimally invasive surgical procedures are the major factors driving the peripheral artery disease (PAD) market.

Which is the leading treatment type in the peripheral artery disease (PAD) market?

The leading treatment type segment is surgical treatment.

Which are the major players operating in the peripheral artery disease (PAD) market?

Abbott Laboratories, Medtronic plc, Boston Scientific Corporation, Cook Medical, Becton, Dickinson and Company, Cardinal Health, Terumo Corporation, Endologix, Inc. are the major players.

What will be the CAGR of the peripheral artery disease (PAD) market?

The CAGR of the peripheral artery disease (PAD) market is projected to be 6.6% during 2025-2032.