Pneumatic Tire Market Trends

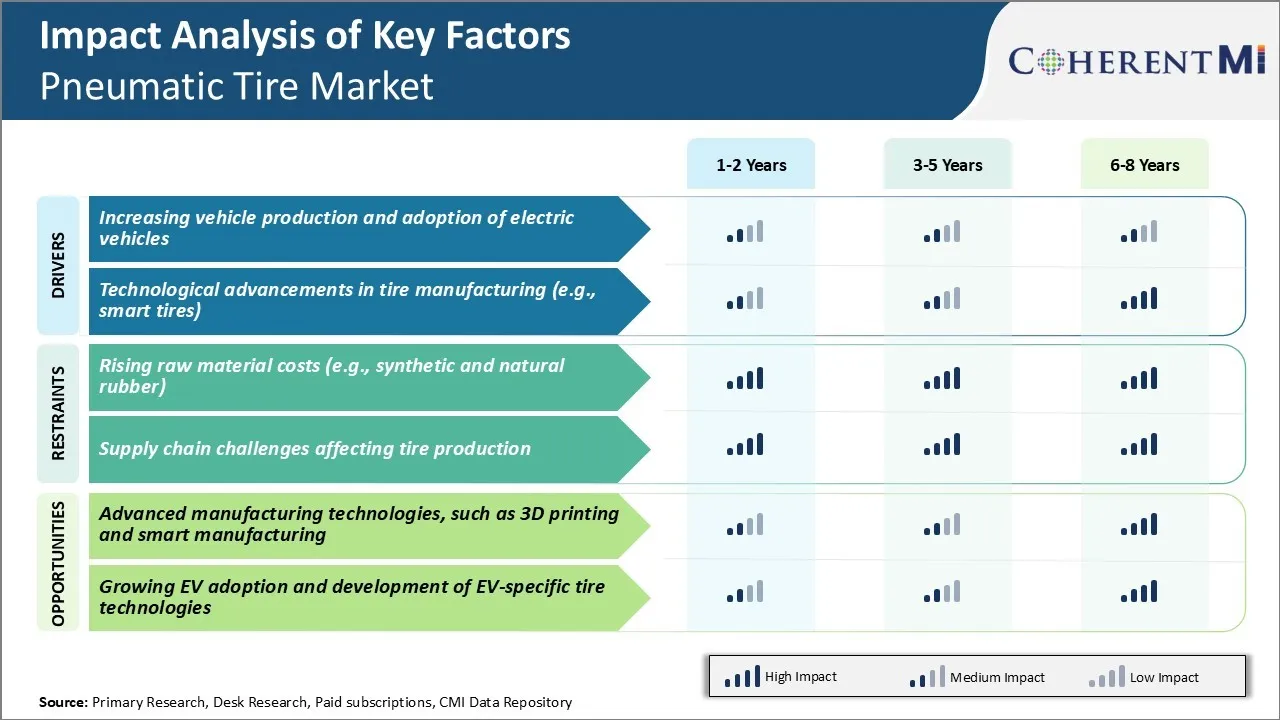

Market Driver - Increasing Vehicle Production and Adoption of Electric Vehicles

The automotive industry has seen tremendous growth over the past few years with rising vehicle production across major markets such as North America, Europe, China and India. Increased economic output and higher disposable incomes have enabled more consumers to purchase personal vehicles for private transport. This primarily drives the pneumatic tire market.

Another key trend is the proliferation of electric vehicles across the world. Driven by stricter emission norms and government incentives or mandates to curb pollution, automakers have accelerated investments and launches of electric cars.

Additionally, compared to traditional vehicles, EVs are easier to drive and require lesser maintenance annually which encourages vehicle usage. Higher mileage puts additional tread wear on tires leading to faster replacement cycles. Given most electric vehicles also have advanced technologies like regenerative braking, ABS, and traction control, tires fitted need to appropriately function without performance issues.

Furthermore, electric vehicles continue to gain broader consumer acceptance. Their total population on roads will multiply in the coming decade translating to continuous aftermarket opportunities for replacement pneumatic tires.

Market Driver - Technological Advancements in Tire Manufacturing (e.g., Smart Tires)

The pneumatic tire market has been consistently innovating through cutting-edge technologies to deliver enhanced performance, safety and fuel efficiency. One of the prominent ongoing advances is the development of “smart tires” embedded with various sensors and electronics. Smart tires can relay important real-time data about vehicle and road conditions to drivers, helping reduce accidents through predictive alerts. Telematics systems in smart connected cars can receive such critical pneumatic tire analytics wirelessly for prompt necessary action.

Automakers will prefer technologically advanced offerings from tire makers that not just meet but surpass warranty and industry standards. This helps reinforce brand reputation and increase original equipment sales and dependence on partner manufacturers. Aftermarket, maintenance and replacement demand will also remain intact as advanced features boost consumer confidence in product quality and reliability over longer usage durations.

Market Challenge - Rising Raw Material Costs (e.g., Synthetic and Natural Rubber)

One of the key challenges faced by the pneumatic tire market is the rising costs of raw materials. Tires are primarily made from natural and synthetic rubber, and prices of these raw materials have been surging in recent years. The costs of natural rubber have increased significantly due to low yield from rubber plantations and growing demand from China. Supplies are also being affected due to erratic weather patterns and disease outbreaks among rubber trees.

Similarly, petroleum-based synthetic rubber, which is used as a substitute for natural rubber, has witnessed high price volatility in line with fluctuating crude oil prices. As raw materials account for a major portion of tire production costs, rising material prices squeeze the margins of pneumatic tire manufacturers.

It also discourages investments aimed at developing advanced tire technologies which utilize high-quality specialty rubbers. If raw material costs continue to climb sharply, it could impact the affordability of tires and hurt overall demand growth in the pneumatic tire market.

Market Opportunity - Advanced Manufacturing Technologies

The pneumatic tire market is benefiting from advancing manufacturing technologies that allow greater innovation and efficient production. 3D printing technology is opening up opportunities to manufacture pneumatic tires with customized designs suited for specific vehicle types and driving conditions.

Similarly, the adoption of smart manufacturing practices involving internet-of-things technologies, big data analytics, and robotics is enhancing productivity and quality control in tire factories. Pneumatic tire makers are able to reduce manufacturing cycle times, scrap rates and achieve higher output through predictive maintenance and automation.

Advanced equipment is also reducing their environmental footprint by minimizing resource consumption during production. Such advanced manufacturing capabilities will help tire companies to introduce new product features, customize offerings, achieve greater operational efficiencies, and competitiveness in the growing pneumatic tire market.