Power Amplifier Market Size - Analysis

Market Size in USD Bn

CAGR10.76%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 10.76% |

| Market Concentration | Medium |

| Major Players | Texas Instruments Inc., Renesas Electronics Corporation, Qualcomm Incorporated, Skyworks Solutions, Inc., Infineon Technologies AG and Among Others |

please let us know !

Power Amplifier Market Trends

With the growing trends of digitization and internet connectivity, the need for high-speed data transfer has increased tremendously. As people leverage the full capabilities of 5G for such applications, it will generate even higher data traffic on networks. This can potentially lead to spectrum capacity issues that power amplifiers can help address through technologies such as massive MIMO and beamforming.

This modernization wave will open up significant opportunities for power amplifier manufacturers. Countries and regions that take early leadership in commercializing 5G applications are likely to experience strongest growth in the demand for power amplifiers to sustain their network requirements. Overall, the transition towards 5G is anticipated to be a key driver for growth of the power amplifier market.

Market Driver - Increased Adoption of Smart Devices Worldwide

Power amplifiers help boost network coverage without compromising user experience even in fringe areas. Powerful and energy efficient power amplifiers thus become critical enablers for meeting this exponential surge in network access points from expanding smart device landscape.

Market Challenge - High Production Costs of Power Amplifiers

Adding to this are the costs of precision packaging needed to dissipate the high levels of heat generated during operation. Maintaining reliability over a wide range of operating temperatures and voltages poses further engineering challenges. The complexity and precision involved in manufacturing power amplifiers makes the production process cost and time intensive.

One major market opportunity for power amplifier manufacturers lies in the growing adoption of electric vehicles worldwide. As electric vehicles rely on powerful electric motors powered by onboard battery systems, there is a strong demand for highly efficient power amplifiers.

Manufacturers who can deliver power amplifiers optimized for electric vehicle applications with improvements in power density, switching frequencies and heat dissipation will be well positioned to tap into this lucrative market opportunity. Continuous technological advancements are crucial to meet the evolving demands of the electric vehicle industry and capture the rewards of this rapidly emerging growth avenue for power amplifier market.

Key winning strategies adopted by key players of Power Amplifier Market

Focus on technology innovation: Technological advancement has been a key strategy for many leading power amplifier manufacturers to gain competitive advantage.

Pursue strategic acquisitions: Making targeted acquisitions is another strategy used to expand product lines and market reach. For example, in 2017 Texas Instruments acquired power amplifier supplier National Semiconductor for $7.5 billion.

Segmental Analysis of Power Amplifier Market

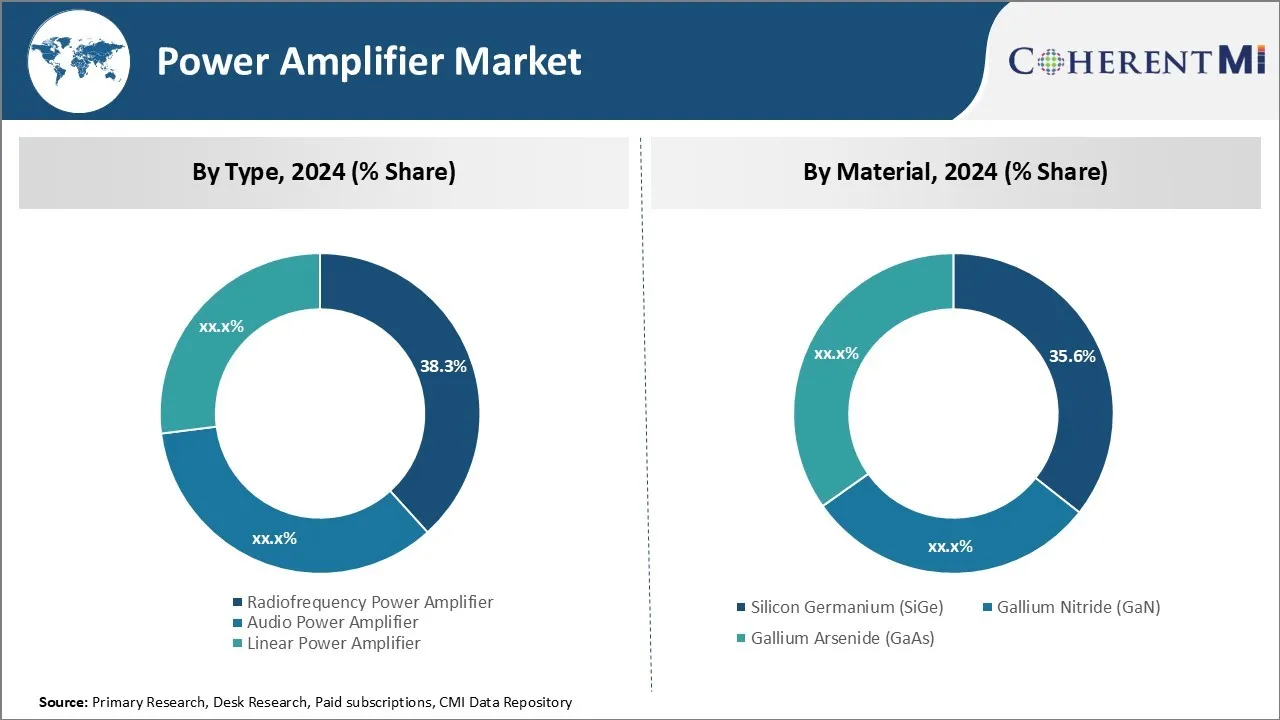

The radiofrequency power amplifier segment currently holds 38.3% share in the power amplifier market. It is due to increasing use of wireless communication technologies that employ radiofrequency signals. Radiofrequency amplifiers play a critical role in applications such as cellular networks, WiFi routers, Bluetooth devices and satellite communication systems.

Emerging opportunities in applications involving medical devices, autonomous driving, and Smart Cities also leverage radiofrequency-based wireless connectivity and rely more on radiofrequency power amplifiers. Therefore, continuous technology upgrades in both consumer and industrial wireless domains ensure sustainable growth prospects for this segment.

The silicon germanium segment presently holds the largest share in the power amplifier market in terms of material type due to inherent benefits of SiGe for microwave power amplification. Key attributes of SiGe that have made it widely adopted include higher electron mobility compared to silicon for better conduction, allowing construction of amplifiers for frequencies up to 100 GHz.

Growing deployment of such microwave networks and steady military budgets supporting radar development ensure continued prominence of SiGe in the power amplifier market over the foreseeable future.

Additional Insights of Power Amplifier Market

- The shift towards energy-efficient amplifiers has led manufacturers to invest in Class D amplifier technology, which offers higher efficiency compared to traditional designs.

- Miniaturization of components is becoming crucial as devices shrink in size, prompting power amplifier designers to focus on compact, integrated solutions without compromising performance.

- Asia-Pacific Region Dominance: The Asia-Pacific region accounts for over 40% of the global power amplifier market share, driven by manufacturing hubs in countries like China, Japan, and South Korea.

- Telecommunication Sector Growth: The telecommunication application segment is expected to witness the highest growth rate, with a projected CAGR of 8.5% during the forecast period, owing to the expansion of 5G networks.

Competitive overview of Power Amplifier Market

The major players operating in the power amplifier market include Texas Instruments Inc., Renesas Electronics Corporation, Qualcomm Incorporated, Skyworks Solutions, Inc., Infineon Technologies AG, STMicroelectronics N.V., Broadcom Inc., Toshiba Corporation, Analog Devices, Inc., NXP Semiconductors N.V., Broadcom Inc., Qorvo, Inc., and Maxim Integrated Products, Inc.

Power Amplifier Market Leaders

- Texas Instruments Inc.

- Renesas Electronics Corporation

- Qualcomm Incorporated

- Skyworks Solutions, Inc.

- Infineon Technologies AG

Power Amplifier Market - Competitive Rivalry

Power Amplifier Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Power Amplifier Market

- In June 2024, Qorvo introduced three monolithic microwave integrated circuit (MMIC) power amplifiers designed for Ku-Band satellite communications (SATCOM) terminals, aiming to enhance high-speed data communications in defense and aerospace applications.

- In June 2024, CML Micro introduced the CMX90A705, a Ka-band gallium nitride (GaN) power amplifier designed to enhance cost-effectiveness and scalability in satellite communication terminals. This two-stage linear power amplifier delivers 37.4 dBm (5.5 W) of saturated power across a frequency range of 27.5 to 31 GHz, with a small signal gain of 16.5 dB. Its compact design and 50 Ω matched RF ports facilitate integration.

- In November 2023, PMC introduced the power 750-8, an eight-channel amplifier designed for professional immersive audio and home theater applications. This 2U rack-mounted unit delivers 750 watts per channel and can be bridged to provide 1,500 watts per channel in a four-channel configuration.

- In August 2023, Apex Microtechnology introduced the PA198, a high-performance precision power operational amplifier. Designed for high-voltage applications, the PA198 features a 450V power operational amplifier with a remarkable 2,000V/µs slew rate, making it suitable for instrumentation, piezoelectric transducers, and electrostatic transducers and deflection.

Power Amplifier Market Segmentation

- By Type

- Radiofrequency Power Amplifier

- Audio Power Amplifier

- Linear Power Amplifier

- By Material

- Silicon Germanium (SiGe)

- Gallium Nitride (GaN)

- Gallium Arsenide (GaAs)

Would you like to explore the option of buying individual sections of this report?

As an accomplished Senior Consultant with 7+ years of experience, Pooja Tayade has a proven track record in devising and implementing data and strategy consulting across various industries. She specializes in market research, competitive analysis, primary insights, and market estimation. She excels in strategic advisory, delivering data-driven insights to help clients navigate market complexities, optimize entry strategies, and achieve sustainable growth.

Frequently Asked Questions :

How big is the power amplifier market?

The power amplifier market is estimated to be valued at USD 1.35 Bn in 2024 and is expected to reach USD 2.76 Bn by 2031.

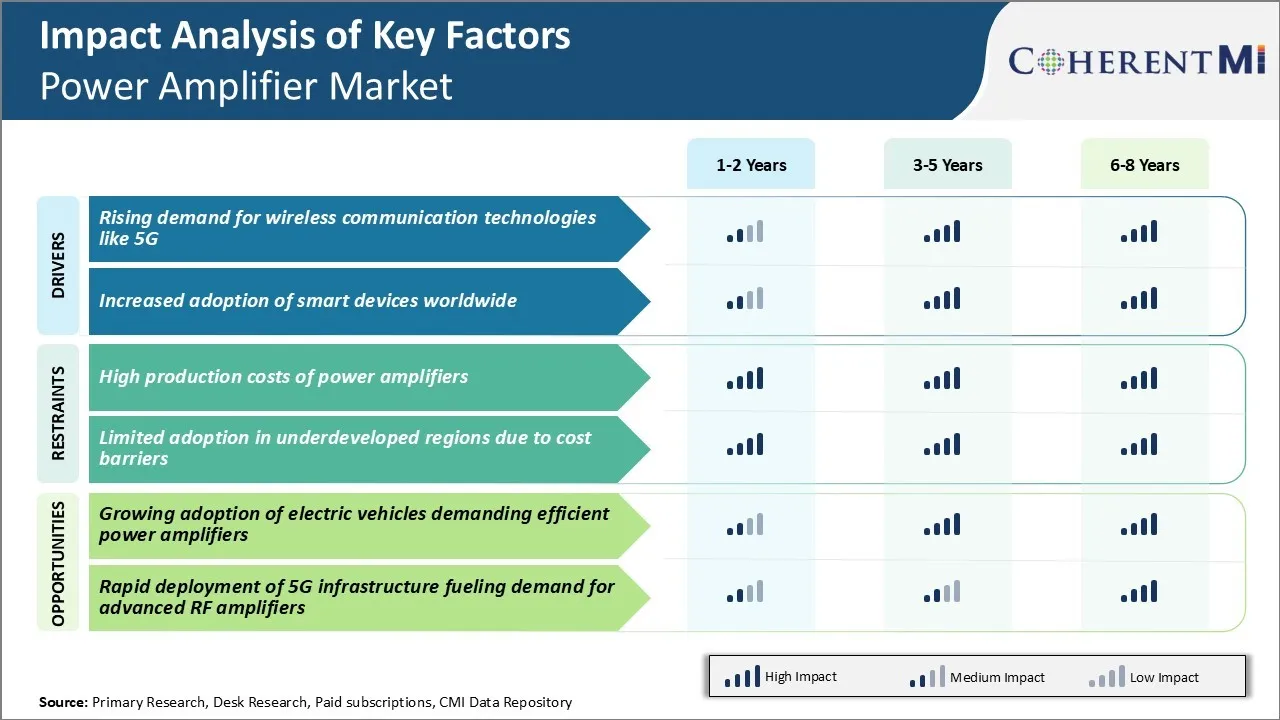

What are the key factors hampering the growth of the power amplifier market?

High production costs of power amplifiers and limited adoption in underdeveloped regions due to cost barriers are the major factors hampering the growth of the power amplifier market.

What are the major factors driving the power amplifier market growth?

Rising demand for wireless communication technologies like 5G and increased adoption of smart devices worldwide are the major factors driving the power amplifier market.

Which is the leading type in the power amplifier market?

The leading type segment is radiofrequency power amplifier.

Which are the major players operating in the power amplifier market?

Texas Instruments Inc., Renesas Electronics Corporation, Qualcomm Incorporated, Skyworks Solutions, Inc., Infineon Technologies AG, STMicroelectronics N.V., Broadcom Inc., Toshiba Corporation, Analog Devices, Inc., NXP Semiconductors N.V., Broadcom Inc., Qorvo, Inc., and Maxim Integrated Products Inc. are the major players.

What will be the CAGR of the power amplifier market?

The CAGR of the power amplifier market is projected to be 10.76% from 2024-2031.