Pressure Transducer Market Size - Analysis

Market Size in USD Bn

CAGR11.5%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 11.5% |

| Market Concentration | Medium |

| Major Players | ABB Ltd., Honeywell International Inc., Robert Bosch GmbH, Panasonic Corporation, Sensata Technologies, Inc. and Among Others |

please let us know !

Pressure Transducer Market Trends

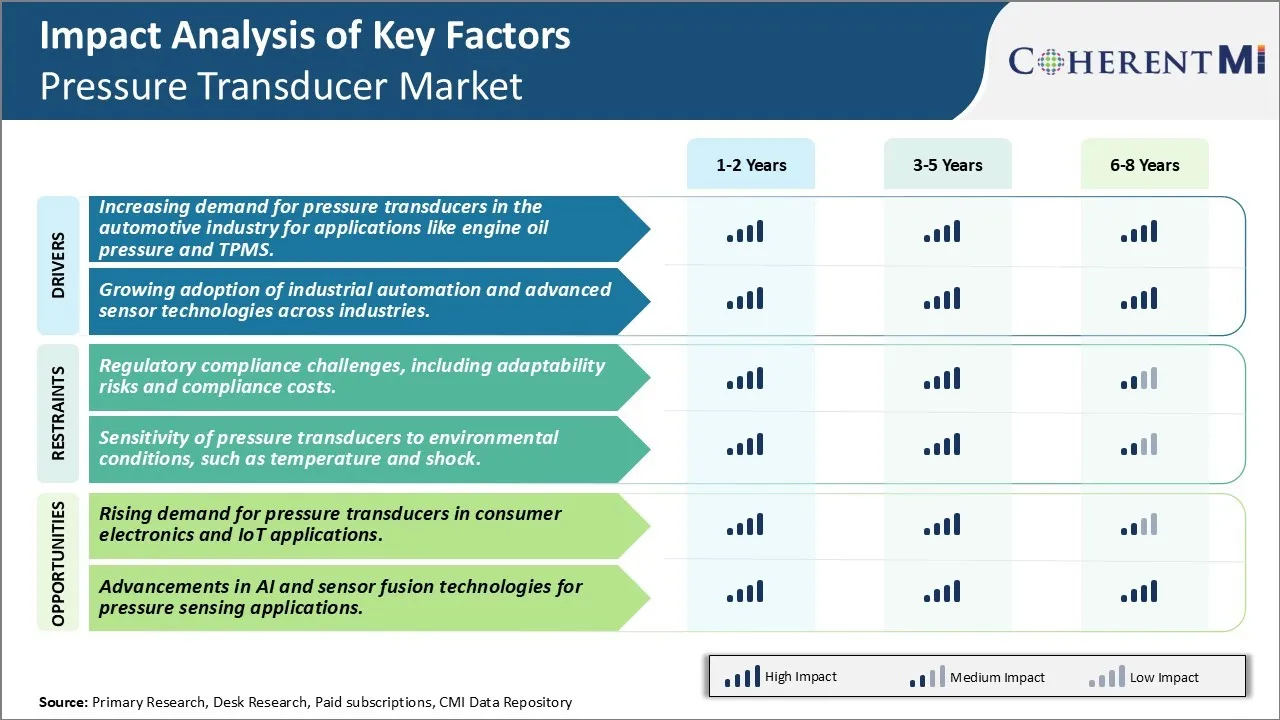

The automotive industry has seen substantial adoption of pressure transducers in a variety of safety critical applications such as engine oil pressure monitoring and tire pressure monitoring systems (TPMS). Pressure transducers play a vital role in helping automakers ensure engine and vehicle health in real-time which has helped reduce maintenance costs as potential issues can be detected early. An increasing number of vehicles nowadays come equipped with oil pressure sensors that continuously monitor engine oil pressure and alert the driver in case of any drops or malfunctions via dashboard warnings. This allows timely diagnosis and repair if needed, thus preventing costly engine damage.

The rapid technological upgrades in passenger vehicles along with the steady growth of the automotive industry has continued to drive the demand for sophisticated pressure sensors with improved accuracy and response time. This is expected to persist as automakers seek to enhance drivability, efficiency and reduce maintenance costs through condition monitoring of critical components.

Growing industrial automation and emphasis on process optimization across varied industries has propelled the adoption of advanced sensor technologies including pressure transducers. Manufacturing operations today extensively rely on real-time pressure data for critical applications like process monitoring and control, leak detection, level measurement etc. Sophisticated pressure sensors and transducers with high sensitivity and reliability are able to monitor minute pressure fluctuations which aid in achieving consistent quality, maximizing asset utilization and minimizing downtimes. Industries such as oil & gas, power generation, pharmaceuticals, food processing and chemicals commonly deploy pressure transducers at various stages to automatically regulate pressure levels, ensure pipeline integrity and facilitate predictive maintenance.

The pressure transducer market faces significant regulatory compliance challenges that hinder its growth potential. Pressure transducers are used across many industries, each with their own set of strict compliance regulations governing product quality, safety, and performance. Keeping pace with the frequent changes to these regulations demands continual product improvements and re-certifications. This adaptability challenge increases risks and costs for pressure transducer manufacturers. New regulations may require design modifications to ensure compliance, which involve time and capital expenditures for research, development, and testing before products can be brought to market. Further complicating matters is the lack of harmonization between regulatory regimes of different geographies. Meeting multi-jurisdictional compliance needs makes the threshold for market entry higher. The intricate certification procedures also delay the launch of innovative pressure transducer offerings. Overall, the regulatory volatility poses compliance uncertainties that pressure transducer suppliers must adeptly navigate to remain competitive.

Market Opportunity- Rising Demand for Pressure Transducers in Consumer Electronics and IoT Applications

Key winning strategies adopted by key players of Pressure Transducer Market

Focus on product innovation - Major players like Honeywell, Denso, Sensata, and TE Connectivity have invested heavily in R&D to develop new and innovative pressure transducer products. For example, in 2020 Honeywell launched a new range of industrial pressure transducers that offer improved accuracy, reliability and durability. This helped Honeywell gain market share from competitors.

Expand product portfolio - Leaders are diversifying their portfolio beyond basic pressure sensor types to address demands across industries.

Acquisitions and partnerships – Mid-sized players are acquiring peers or forming strategic alliances to enhance capabilities and geographical reach.

Segmental Analysis of Pressure Transducer Market

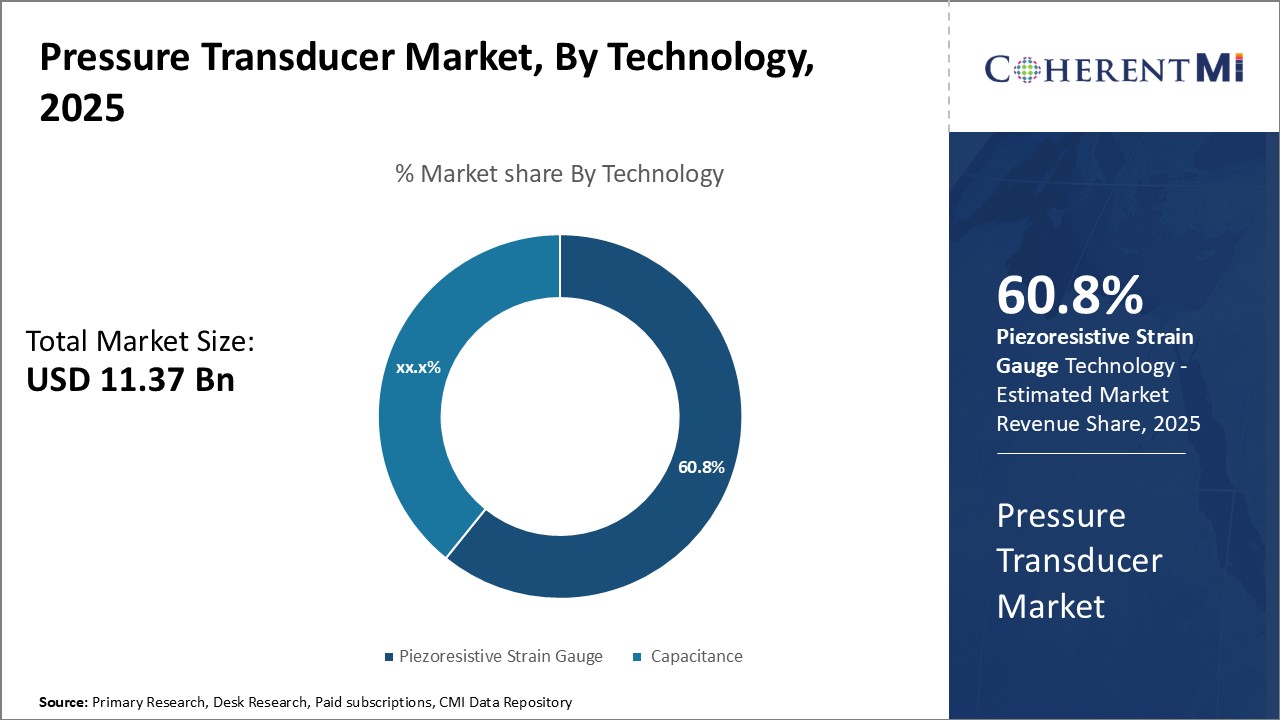

Insights, By Technology, Advancing Material Science Drives Piezoresistive Strain Gauge Adoption

Insights, By Technology, Advancing Material Science Drives Piezoresistive Strain Gauge AdoptionBy Technology, Piezoresistive Strain Gauge is expected to contribute 60.8% in 2025 owing to continuous improvements in materials science. Piezoresistive strain gauges operate by measuring changes in electrical resistance that occur when a material experiences mechanical stress or strain. Advances in semiconductor fabrication techniques and materials have enabled thinner, more sensitive strain gauges to be manufactured. Integrating these gauges into microelectromechanical systems (MEMS) allows for highly accurate measurements of very small pressures. Widespread deployment of MEMS technology across industries like automotive, medical devices, and consumer electronics is boosting demand. Additionally, piezoresistive sensors are extremely cost-effective to produce in high volumes compared to other sensing methods like capacitive transducers. This lowers the overall price point and facilitates adoption in more price-conscious applications. Continuous research into improving piezoresistive properties of exotic materials like graphene promises to push the boundaries of sensitivity, response time and miniaturization even further in the coming years.

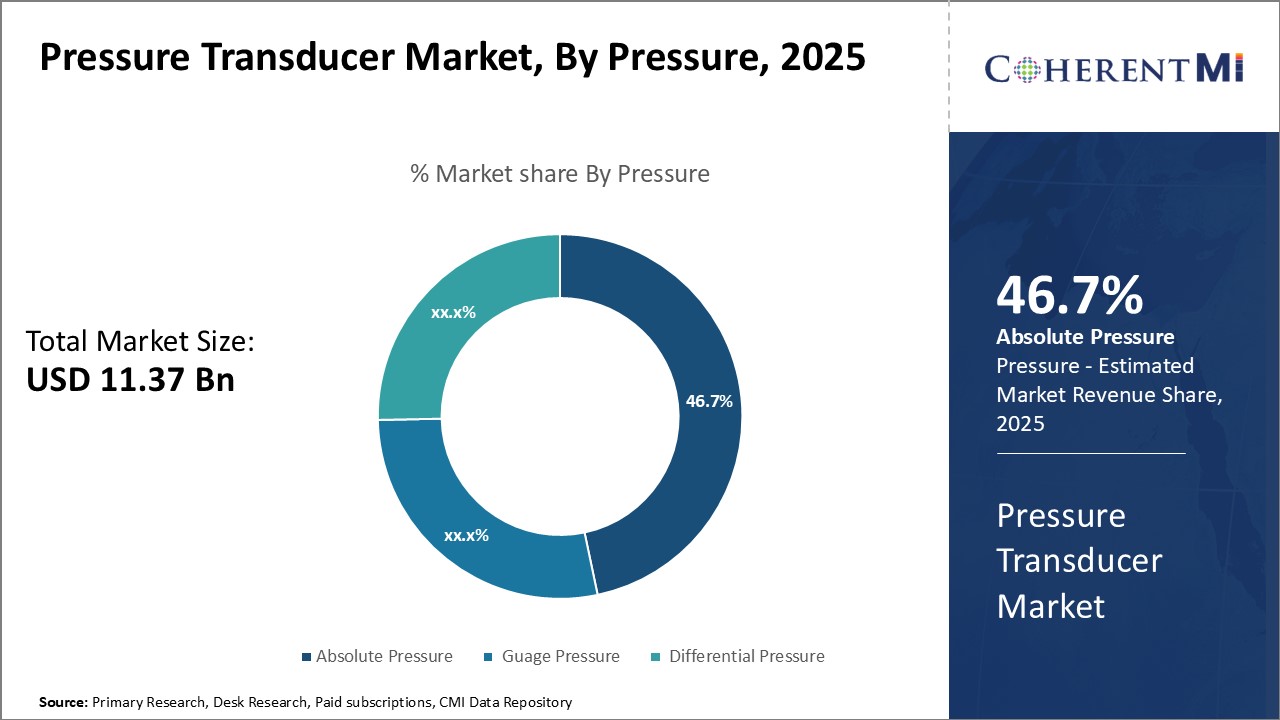

By Pressure, the absolute pressure segment is expected to contribute 46.7% in 2025 owing to its dependable and wide-ranging performance. Absolute pressure sensors are able to measure pressure relative to a complete vacuum rather than atmospheric pressure. This makes them suitable for applications involving low pressures inside closed systems, as well as high pressures encountered in industrial processes. Their measurement is unaffected by fluctuations in barometric pressure or altitude, unlike gauge sensors. As a result, absolute pressure transducers offer highly consistent and repeatable readings. They also have the largest usable pressure measurement range from deep vacuum pressures to very high overload pressures. These properties of accuracy, reliability and versatility have led to absolute pressure sensors seeing widespread adoption across critical applications in sectors such as aerospace, manufacturing and oil & gas.

Insights, By End-use, Automotive Segment Drives Adoption Due to Stringent Safety and Efficiency Standards

Additional Insights of Pressure Transducer Market

The global pressure transducer market is poised for significant growth driven by increasing demand in the automotive, aerospace, and industrial sectors. Pressure transducers play a crucial role in monitoring systems across various industries, ensuring accuracy and reliability. The market benefits from the integration of advanced technologies like AI and IoT, which enhance the performance of pressure transducers by improving sensitivity, flexibility, and real-time data processing. The use of pressure transducers in industries such as consumer electronics, oil & gas, and healthcare is expanding, contributing to the market’s broad application base.

Competitive overview of Pressure Transducer Market

The major players operating in the Pressure Transducer Market include ABB Ltd., Honeywell International Inc., Robert Bosch GmbH, Panasonic Corporation, Sensata Technologies, Inc., TE Connectivity, Amphenol Corporation, Siemens AG, Yokogawa Electric Corporation and Schneider Electric SE.

Pressure Transducer Market Leaders

- ABB Ltd.

- Honeywell International Inc.

- Robert Bosch GmbH

- Panasonic Corporation

- Sensata Technologies, Inc.

Pressure Transducer Market - Competitive Rivalry

Pressure Transducer Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Pressure Transducer Market

- In November 2023, ABB Ltd. launched a digital asset performance management platform for instrumentation, including pressure sensors, to improve operational efficiency in sectors like oil & gas and water treatment.

- In April 2023, Continental launched TPMS (Tire Pressure Monitoring System) production for passenger cars in India, enhancing tire pressure monitoring capabilities.

- In June 2024, Baker Hughes introduced three sensor technologies (T5MAX Transducer, HygroPro XP, XMTCpro) designed to enhance safety and productivity in hydrogen and industrial applications.

Pressure Transducer Market Segmentation

- By Technology

- Piezoresistive Strain Gauge

- Capacitance

- By Pressure

- Absolute Pressure

- Guage Pressure

- Differential Pressure

- By End-use

- Automotive

- Consumer Electronics

- Industrial

- Healthcare

- Oil & Gas

Would you like to explore the option of buying individual sections of this report?

As an accomplished Senior Consultant with 7+ years of experience, Pooja Tayade has a proven track record in devising and implementing data and strategy consulting across various industries. She specializes in market research, competitive analysis, primary insights, and market estimation. She excels in strategic advisory, delivering data-driven insights to help clients navigate market complexities, optimize entry strategies, and achieve sustainable growth.

Frequently Asked Questions :

How Big is the Pressure Transducer Market?

The Global Pressure Transducer Market is estimated to be valued at USD 11.37 Bn in 2025 and is expected to reach USD 24.36 Bn by 2032.

What will be the CAGR of the Pressure Transducer Market?

The CAGR of the Pressure Transducer Market is projected to be 11.3% from 2024 to 2031.

What are the major factors driving the Pressure Transducer Market growth?

The increasing demand for pressure transducers in the automotive industry for applications like engine oil pressure and TPMS. The growing adoption of industrial automation and advanced sensor technologies across industries are the major factors driving the Pressure Transducer Market.

What are the key factors hampering the growth of the Pressure Transducer Market?

The regulatory compliance challenges, including adaptability risks and compliance costs. The sensitivity of pressure transducers to environmental conditions, such as temperature and shock are the major factors hampering the growth of the Pressure Transducer Market.

Which is the leading Technology in the Pressure Transducer Market?

Piezoresistive Strain Gauge is the leading Technology segment.

Which are the major players operating in the Pressure Transducer Market?

ABB Ltd., Honeywell International Inc., Robert Bosch GmbH, Panasonic Corporation, Sensata Technologies, Inc., TE Connectivity, Amphenol Corporation, Siemens AG, Yokogawa Electric Corporation, Schneider Electric SE are the major players.