Produced Water Treatment Market Trends

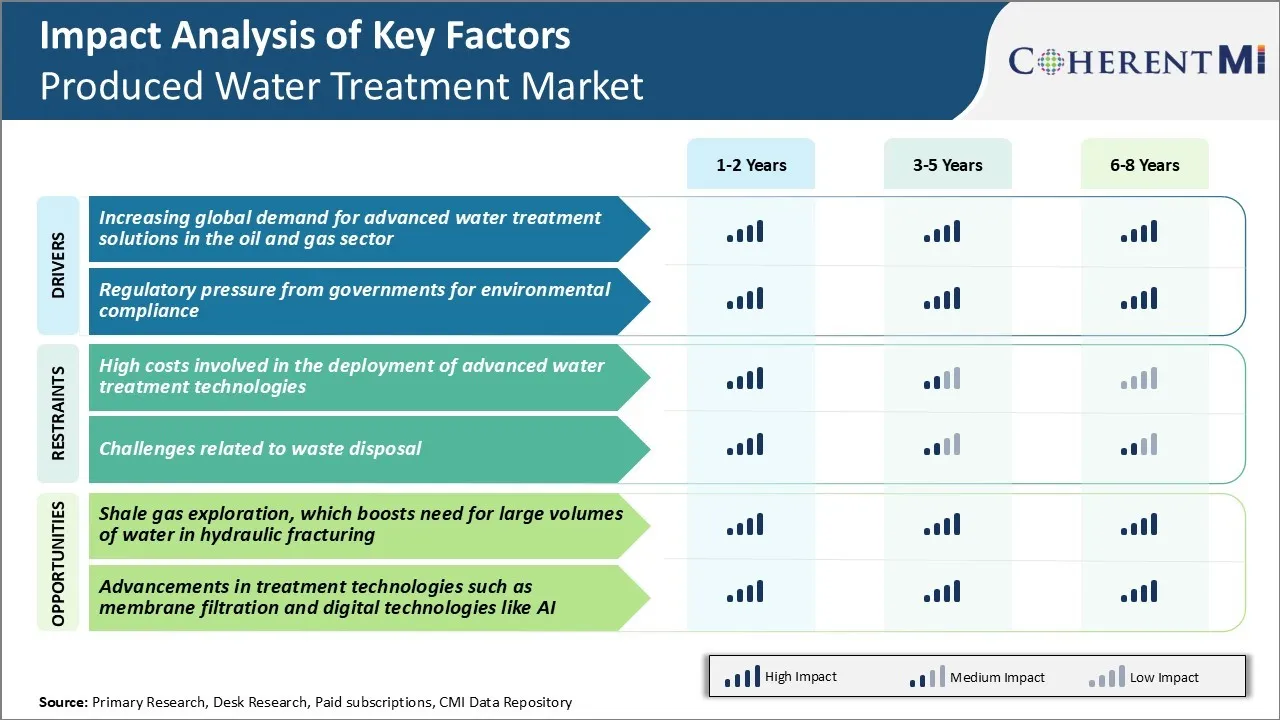

Market Driver - Increasing Global Demand for Advanced Water Treatment Solutions in the Oil and Gas Sector

The global oil and gas industry has been facing challenges posed by large volumes of produced water generation during hydrocarbon extraction processes. As oilfields around the world near depletion, operators are relying more on unconventional resources like shale oil and gas that generate extremely high quantities of contaminated water.

According to estimates, over 21 billion barrels of produced water is disposed as waste each year by the oil and gas industry. Such massive volumes have detrimental impacts on the environment if not handled properly.

At the same time, availability of water is becoming a major issue for drilling and hydraulic fracturing activities in many arid regions. This has heightened the importance of recycling and reuse of produced water within oilfield operations.

Membrane bioreactors, media filtration, reverse osmosis, thermal evaporators, and disinfection processes are now commonly employed. Companies in the produced water treatment market are also investing in digitalization to optimize treatment process and energy recovery. This is expected to drive market growth in the coming years.

Market Driver - Regulatory Pressure from Governments for Environmental Compliance

Governments across the world are tightening regulations related to management and discharge of oilfield wastewater due to rising public scrutiny on environmental performance of petroleum industry. Even underground injection into disposal wells is facing opposition over induced seismicity fears. Ever more stringent discharge standards are being established with stricter limits on chemical oxygen demand, toxicity, chlorides, and other impurities.

Non-compliance can now result in heavy penalties and temporary halts or bans on drilling activities. Producers are finding it difficult to rely only on underground injection infrastructure that is reaching capacity limits in many locations.

Regular audits and monitoring under regulatory scanner are driving investment in online instrumentation, automated process control as well as advanced wastewater characterization. Producers must also systematically handle issues around treatment sludge handling and disposal, which will drive growth of the produced water treatment market.

Policy makers today, emphasize reuse targets and sustainability goals. Thereby, oil companies have to significantly upgrade produced water treatment capabilities through harnessing latest treatment solutions and working with stringent environmental, health, and safety guidelines.

Market Challenge - High Costs Involved in the Deployment of Advanced Water Treatment Technologies

One of the major challenges faced in the produced water treatment market is the high costs involved in deploying advanced water treatment technologies at scale. Implementing produced water treatment systems that can remove dispersed oil, suspended solids, dissolved solids and other contaminants from produced water is an expensive endeavor.

Moreover, the logistical challenges of setting up extensive treatment infrastructure at remote production sites also translates to higher costs. While reuse and recycling of produced water helps reduce freshwater usage and disposal volumes to some extent, the costs of advanced treatment often outweigh these benefits for operators.

Tight capital budgets in the current low oil price environment further disincentivize investments in setting up large-scale, capital intensive water treatment facilities. This cost impediment remains a major roadblock in the produced water treatment market.

Market Opportunity - Shale Gas Exploration, which Boosts Need for Large Volumes of Water in Hydraulic Fracturing

One key opportunity area for the produced water treatment market is the rising shale gas exploration activities worldwide. Hydraulic fracturing techniques have enabled commercial production from shale reservoirs, boosting natural gas supplies.

However, shale gas extraction requires massive volumes of water to pump sand and chemicals deep underground to fracture shale formations and release trapped gas. This surging demand for water in unconventional drilling has led to increased generation of produced water.

This presents promising opportunities for companies in the produced water treatment market offering fit-for-purpose water treatment solutions tailored for the shale gas industry. Developing technologies that allow for cost-effective treatment and reuse of produced water at shale well sites will be key to sustainably address these rising produced water treatment needs.