Singapore Infant Formula Market Trends

Market Driver – Rising Female Workforce

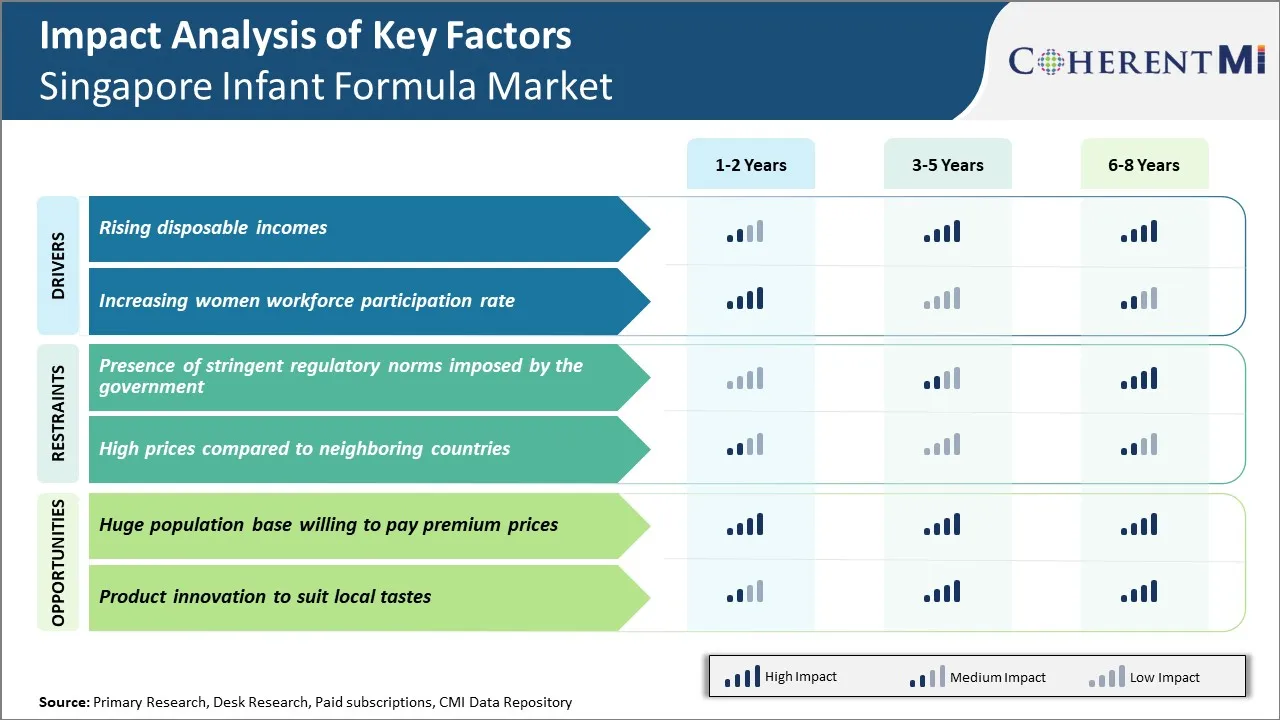

The rising number of women joining the workforce in Singapore has significantly impacted the demand for infant formula. In the past decade, female labor force participation in Singapore has steadily increased. More women are pursuing careers and are less reliant on staying at home to care for infants. With both parents working long hours to support the family financially, infant formula has become a necessity for many Singaporean families. It allows mothers to continue their careers while ensuring their babies are well fed in their absence.

Working mothers no longer have the time during the day to exclusively breastfeed and choose formula as a convenient alternative to expressed breastmilk. Some find formula feeding more flexible as it allows others like grandparents or domestic help to also take part in feeding the baby. The long working hours also mean mothers have little time during the day to pump and store breastmilk, causing many to switch fully to formula early on. The increasing number of dual-income households in Singapore plays a major role in the rising demand for formula products in the country.

Market Driver – Rising Disposable Incomes

Another key driver for the Singapore infant formula market is the rising disposable incomes of residents over the past decade. Singapore has a high cost of living but incomes have risen consistently in the post-pandemic economic recovery. This has given parents greater spending power and flexibility when it comes to choices for their babies.

Premium and imported infant formula brands from Europe and Australia are becoming increasingly affordable for middle-income families. Parents see high quality imported formula as providing the best nutrition for their babies' development. They are willing to spend more on products from reputed brands for the perceived health benefits. The ability to afford an international standard of living has also boosted the demand for premium European formulas seen as the gold standard. Working parents with less time also appreciate convenience features like single-serve packaging of premium formulas. The financial ability of residents to spending more on baby products like imported infant formula without worrying as much over costs is a crucial element propelling the Singapore market upwards.

Market Challenge – Presence of Stringent Regulatory Norms Imposed by The Government

One of the key challenges in the Singapore infant formula market is the presence of stringent regulatory norms imposed by the government to ensure high quality and safety standards are followed by all brands. Manufacturers need to obtain licenses and certifications from local regulatory bodies like Health Sciences Authority (HSA) in order to launch and sell their products in Singapore. Obtaining such approvals is a lengthy and expensive process which small or startup brands may find difficult to navigate.

Moreover, the approval process does not guarantee success in the market as consumer preferences play an important role. With sophisticated local consumers who are highly aware of product qualities, new or unfamiliar brands need to invest significantly in building awareness and establishing trust to gain market share. This regulatory environment poses considerable compliance challenges for companies, especially international brands who may not be familiar with Singapore's rules and requirements.

Market Opportunity – Huge Population Base Willing to Pay Premium Prices

Despite the challenges, the Singapore infant formula market presents many lucrative opportunities for brands that are able to position themselves well. As one of the wealthiest nations in Southeast Asia with a high living standard, Singapore has a sizable population base that is willing to pay premium prices for high quality products. Further, with rising women workforce participation, there is an increased demand for nutritional yet convenient solutions for baby feeding. Most working mothers rely on infant formula as it allows fathers and caregivers to also partake in feeding duties. This represents a strong opportunity for brands that offer modern formulations tailored for busy lifestyles. Additionally, the presence of many foreign residents and tourists means a part of sales comes from visitors from regions like China and Malaysia where overseas purchases of infant products are common. Innovative brands can tap this segment through effective tourist marketing programs.