South Korea Active Pharmaceutical Ingredients Market Trends

Market Driver – Growing Pharmaceutical Industry

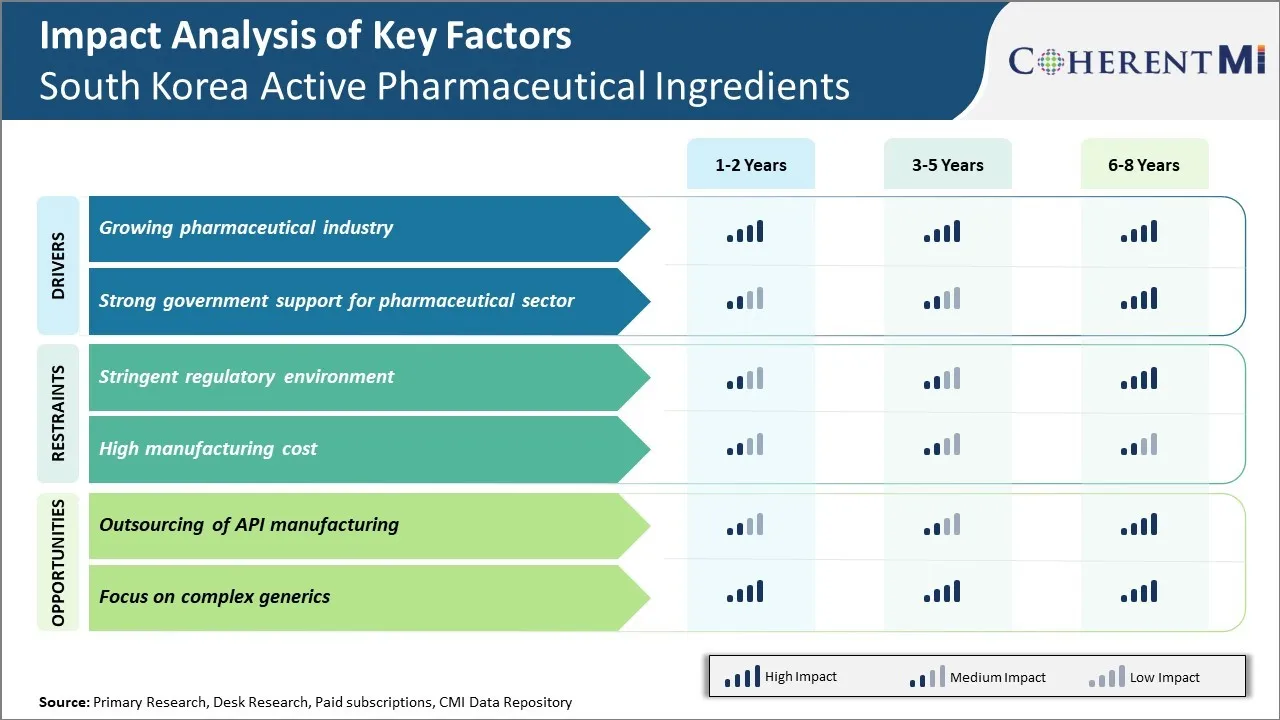

The pharmaceutical industry in South Korea has experienced tremendous growth over the past decade and is emerging as a global leader in drug development and manufacturing. This expanding industry is one of the key drivers propelling the active pharmaceutical ingredients (API) market forward in the country.

As domestic drugmakers in South Korea successfully develop and commercialize new innovative medicines to treat a wide range of diseases, demand for APIs utilized in these formulations continues to increase correspondingly. Major pharmaceutical companies such as Celltrion, Hanmi Pharmaceuticals and Samsung Bioepis have invested heavily in biologics research which requires the production of complex APIs. Additionally, the government has implemented measures like tax incentives for R&D activities to encourage further pharmaceutical innovation within the country.

This growing emphasis on development of advanced therapies among South Korean drug manufactures will likely sustain high demand for APIs in the coming years. For example, patents expiring on many blockbuster drug products worldwide is prompting drug companies to focus on discovering biosimilar medicines.

Market Driver – Strong Government Support for Pharmaceutical Sector

South Korea has emerged as one of the major manufacturing hubs for active pharmaceutical ingredients (API) in recent years, thanks to strong government support for the pharmaceutical sector. The Korean government has implemented several policies and incentives that have boosted investment and innovation in pharmaceutical manufacturing.

Some of the key policies include significant tax breaks for R&D spending as well as preferential loans for companies setting up API manufacturing plants. The government has also streamlined the approval process for APIs to make it faster for domestic companies to launch generic drugs. This regulatory assistance addresses a major pain point for pharma companies and promotes drug accessibility for patients.

As a result of these interventions, many large Korean conglomerates like Samsung Biologics, Celltrion and Daewoong have poured billions in expanding their API facilities over the past five years. According to data from Institute for Health Metrics and Evaluation, Korea’s health expenditure as a share of GDP has increased from 7.6 percent in 2011 to 8.4 percent in 2018.

Market Challenge – Stringent Regulatory Environment

The stringent regulatory environment in South Korea is posing significant challenges for the growth of the country's Active Pharmaceutical Ingredients (API) market. The regulatory guidelines handed down by the Korean Ministry of Food and Drug Safety (MFDS) are quite strict and complex to navigate for API manufacturers. Compliance with MFDS guidelines related to Good Manufacturing Practices (GMP), product quality standards, environmental and safety norms require substantial investments of time and capital.

Furthermore, obtaining approvals from MFDS for setting up new manufacturing facilities or expanding existing plants is a lengthy process. Comprehensive documentation and on-site inspections are mandatory at various stages as part of the approval procedures.

According to data from the World Health Organization (WHO), in 2021 South Korea ranked below the OECD average when it came to time taken for issuing manufacturing licenses. The report stated it took South Korean authorities an average of 450 days to grant license to new drug production plants as compared to 320 days in other developed nations.

Market Opportunity – Outsourcing of API Manufacturing

Outsourcing of API manufacturing could provide significant opportunities for growth in South Korea's active pharmaceutical ingredients (API) market. As the pharmaceutical industry moves towards complexity and specialty medicines, developing advanced APIs has become a major challenge even for large pharma companies. This requires substantial investment in R&D and manufacturing facilities, which many companies may not be able to undertake independently. Outsourcing API production allows pharmaceutical firms to focus on their core drug development work while leveraging the specialized manufacturing capabilities of contract manufacturers in South Korea.

South Korea has built a skilled workforce and established infrastructure in the pharmaceutical sector over the past few decades. The country is now home to world-class facilities that can support complex, patent-protected API synthesis routes. A number of South Korean companies have made huge investments to acquire advanced equipment and recruit talent with expertise in green chemistry and continuous flow methodologies. By outsourcing to these facilities, global drug makers can ensure security of supply for their products and address capacity issues during scale-up in a cost-effective manner.