South Korea Methyl Methacrylate (MMA) Market Trends

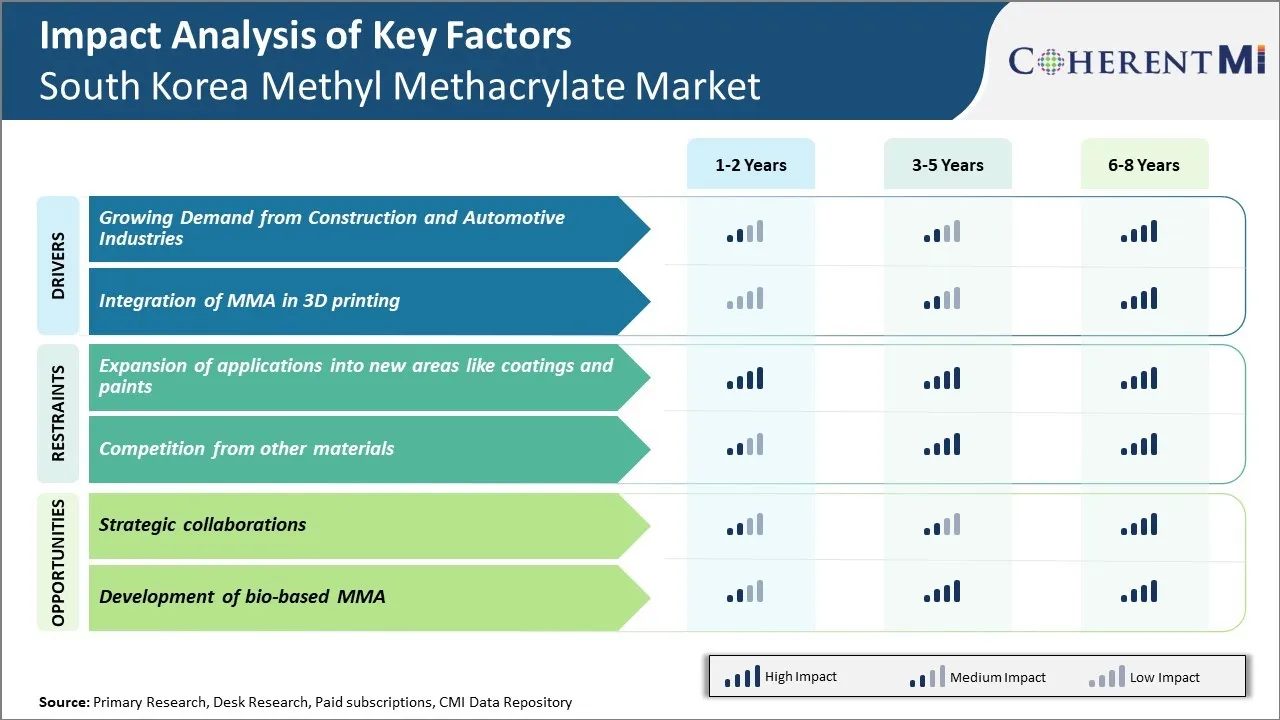

Market Driver – Growing Demand from Construction and Automotive Industries

The construction and automotive industries in South Korea have been experiencing steady growth in recent years, which has significantly boosted the demand for methyl methacrylate. Methyl methacrylate is a key raw material used in manufacturing polymethyl methacrylate (PMMA), which finds extensive applications in these industries.

In the construction sector, PMMA has emerged as a popular alternative to traditional materials like glass and steel due to its advantageous properties such as light weight, durability, and resistance to extreme weather conditions. Major infrastructure projects undertaken by the government such as new urban developments, bridges, tunnels, and metro systems have increased the consumption of PMMA sheets for glazing and roofing applications. According to statistics by the Ministry of Land, Infrastructure and Transport, Korea, construction investment grew by 5.2% year-on-year to KRW 129.4 trillion in 2020 driven by private sector housing and public works. This upward trend is likely to continue with ongoing urbanization across the country. The construction and automotive industries in South Korea have been experiencing steady growth in recent years, which has significantly boosted the demand for methyl methacrylate.

Market Driver – Integration of MMA in 3D Printing

The integration of MMA in 3D printing applications has opened up new growth opportunities for the South Korea MMA market. MMA is widely used as a main raw material in the production of polymethyl methacrylate (PMMA), which finds extensive application in 3D printing due to its transparency, stiffness and durability. Over the past few years, 3D printing has experienced heightened adoption across various industries in South Korea, such as automotive, aerospace, healthcare and consumer goods. This has substantially increased the demand for high-quality photopolymers that can deliver precision and accuracy in the final 3D printed components. PMMA tailored for 3D printing applications has emerged as one of the preferred polymers due to its UV light curability and capability to produce transparent and functional parts.

Moreover, continued technological advancements are expanding the scope of PMMA 3D printing to produce prototypes and end-use products for new potential sectors. For instance, researchers at Daegu Gyeongbuk Institute of Science and Technology have developed bio-compatible PMMA materials for 3D printing medical implants and prosthetics (DGIST, 2022).

Market Challenge – Expansion of Applications Into New Areas Like Coatings and Paints

The expansion of methyl methacrylate (MMA) applications into new areas like coatings and paints is creating regulatory hurdles that are restraining the growth of South Korea's MMA market. As MMA is increasingly being used as a replacement for toxic solvents in paints and coatings, issues around VOC emissions have come under scrutiny. According to data from the Korean Ministry of Environment published in 2022, MMA releases volatile organic compounds (VOCs) that contribute to the formation of ground-level ozone and smog. While its VOC emissions are lower than traditional solvents, the rapidly growing use of MMA in decorative and automotive paints has led to a rise in total VOC emissions from this sector.

This has prompted the South Korean government to propose tighter VOC regulations for MMA-based paints and coatings. In 2021, the Ministry of Environment announced plans to lower the allowable VOC content from the current level of 450 grams per liter to 400 grams by 2023. This would bring the limits in line with rules in Japan and China.

Market Opportunity – Strategic Collaborations

The expansion of methyl methacrylate (MMA) applications into new areas like coatings and paints is creating regulatory hurdles that are restraining the growth of South Korea's MMA market. As MMA is increasingly being used as a replacement for toxic solvents in paints and coatings, issues around VOC emissions have come under scrutiny. According to data from the Korean Ministry of Environment published in 2022, MMA releases volatile organic compounds (VOCs) that contribute to the formation of ground-level ozone and smog.

This has prompted the South Korean government to propose tighter VOC regulations for MMA-based paints and coatings. In 2021, the Ministry of Environment announced plans to lower the allowable VOC content from the current level of 450 grams per liter to 400 grams by 2023. This would bring the limits in line with rules in Japan and China. Additionally, regulations limiting ground-level ozone and smog concentrations are also proposed in major cities like Seoul, Busan and Incheon by 2025 based on WHO guidelines according to a 2022 report by the Korean Ministry of Environment.