Sustainable Materials Market Size - Analysis

The sustainable materials market is estimated to be valued at USD 375.34 Billion in 2025 and is expected to reach USD 861.38 Billion by 2032, growing at a compound annual growth rate (CAGR) of 12.6% from 2025 to 2032. The sustainable materials market is witnessing a noticeable shift towards sustainable materials as businesses and consumers alike are seeking out sustainable alternatives.

Market Size in USD Bn

CAGR12.6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 12.6% |

| Market Concentration | High |

| Major Players | BASF SE, Dow Inc., DuPont de Nemours, Inc., Arkema S.A., Covestro AG and Among Others |

please let us know !

Sustainable Materials Market Trends

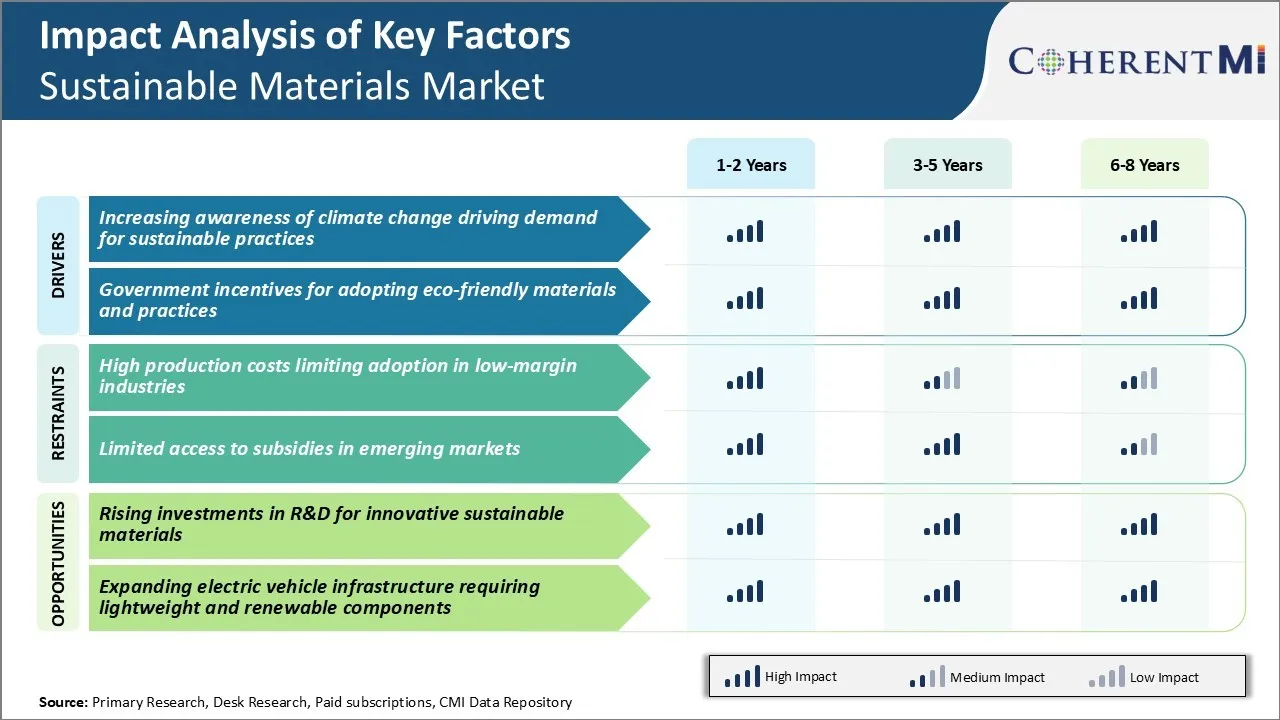

Market Driver - Increasing Awareness of Climate Change Driving Demand for Sustainable Practices

As concerns over climate change intensify across the world, more consumers and businesses are moving towards sustainable practices and eco-friendly choices. People are increasingly factoring in environmental sustainability as an important consideration in making purchasing decisions. At the same time, more companies are responding to this shift in customer preference by reducing their environmental footprint and sourcing materials in a responsible manner.

Choosing sustainable materials over conventional options is a key aspect of corporate strategy to gain a competitive edge in this evolving business environment. The mounting climate activism among the youth is also leaving its mark. With millions of students worldwide participating in climate strikes, companies in the sustainable materials market are carefully formulating their strategies.

Overall, the widespread recognition that climate change poses severe existential threats is a major driver for the increase in sustainable practices across various industries. The rising demand for eco-friendly choices is expected to accelerate the sustainable materials market in the coming years.

Market Driver - Government Incentives for Adopting Eco-friendly Materials and Practices

With mounting pressures to curb pollution and reach international climate targets, governments worldwide are incentivizing industries and businesses to go green. Many countries now incentivize renewable energy generation through programs like net metering and feed-in tariffs. They offer tax rebates and low interest loans for transitioning to clean technologies. These fiscal measures play a big role in accelerating the adoption of sustainable solutions.

At the same time, some nations are adopting regulatory push through carbon pricing programs and renewable portfolio standards. To encourage a circular economy, few jurisdictions have enacted extended producer responsibility laws that make brands financially responsible for collecting and recycling post-consumer packaging and products.

In a nutshell, favorable policies at the national and local levels play a big role in driving viable commercial markets for greener technologies and solutions. Such support addresses economic barriers and accelerates growth of the sustainable materials market.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High Production Costs Limiting Adoption in Low-Margin Industries

One of the major challenges currently being faced by the sustainable materials market is the high production costs associated with these materials. While sustainable materials are important for the environment, the technologies and processes required for their production make them more expensive compared to conventional materials. This high cost poses a significant barrier for adoption, especially in low-margin industries where the use of sustainable materials can drastically increase input costs.

Industries like packaging, construction and textiles operate on very low margins and demand very cost-effective materials. Passing on the increased costs of sustainable materials to customers also becomes difficult in these industries. Until production techniques are optimized, economies of scale are achieved and input costs are brought down, adoption of sustainable alternatives will remain limited in these key markets.

Market Driver - Rising Investments in R&D for Innovative Sustainable Materials

There is a growing opportunity in the sustainable materials market owing to rising investments in research and development activities. Various governments, corporations as well as venture capital and private equity funds are making significant investments to develop innovative and commercially viable sustainable material alternatives. This rising investment is directing more resources towards finding solutions that can overcome current technical and economic barriers.

Companies and research institutions are working on developing novel technologies and production processes that can bring down costs while enhancing material properties. For example, considerable progress is being made in areas like green cement, bio-based plastics, alternative fibers and novel lignin-based products.

Rising investments in R&D are expected to boost innovation and accelerate the pace of commercialization. This in turn is likely to drive the prices of sustainable materials down and help achieve wider adoption across different applications over the coming years. Sustainable materials are gradually transitioning from being niche to mainstream driven by these growing R&D investments.

Key winning strategies adopted by key players of Sustainable Materials Market

Strategy #1: Developing eco-friendly and sustainable product lines

Many companies have focused on developing new product lines that are made from sustainable and eco-friendly materials. For example, IKEA launched a new collection in 2019 made entirely from recycled or renewable materials such as seaweed fiber, recycled cotton, and waste wood.

Strategy #2: Obtaining sustainability certifications for products and supply chains

Leading players in the sustainable materials market ensure that their products and operations meet globally recognized sustainability standards. For instance, in 2015 BASF obtained ISO 50001 certification for its energy management systems across all major production sites.

Strategy #3: Partnerships and acquisitions to accelerate sustainable solutions

Companies in sustainable materials market actively partner with startups and make acquisitions to fast track the development of new sustainable technologies and solutions. For instance, in 2020 Kimberly-Clark partnered with Anthropic to apply artificial intelligence for developing less wasteful manufacturing processes.

Segmental Analysis of Sustainable Materials Market

To learn more about this report, Download Free Sample Copy

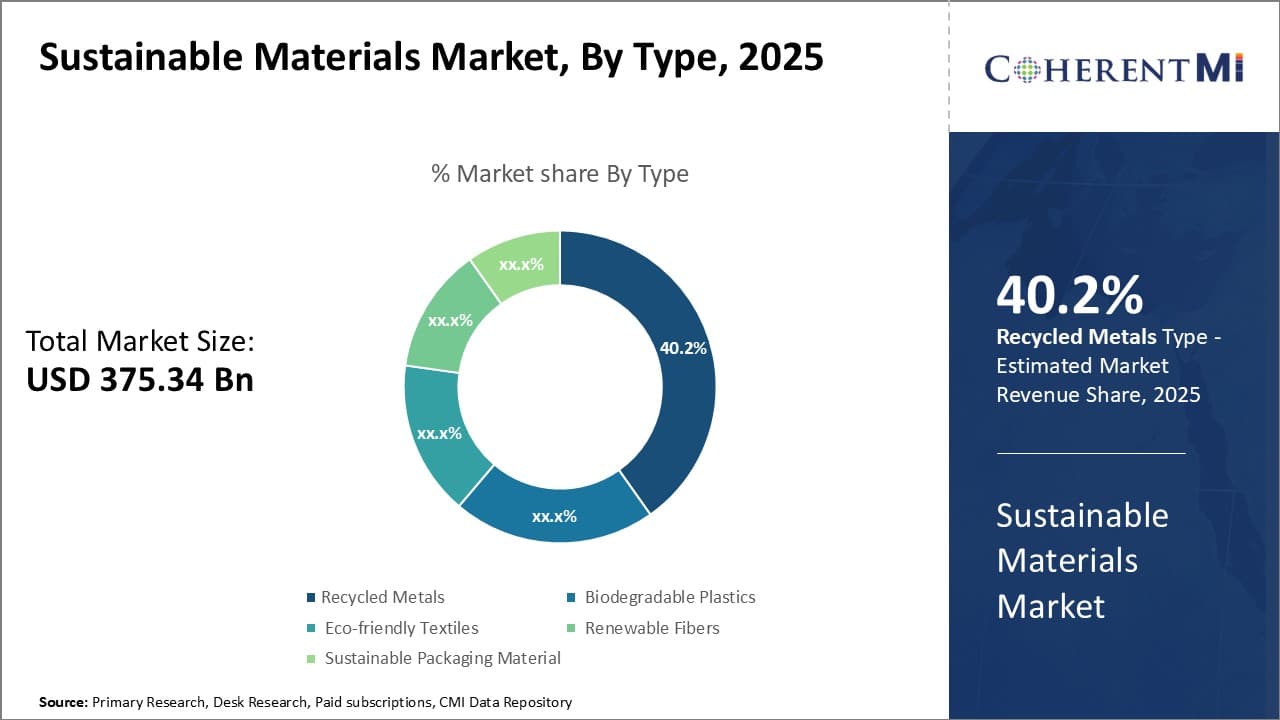

Insights, By Type: Resource Recovery Driving Recycled Metals' Dominance

To learn more about this report, Download Free Sample Copy

Insights, By Type: Resource Recovery Driving Recycled Metals' Dominance

In terms of type, recycled metals contributes 40.2% share of the sustainable materials market in 2025, owning to significant benefits of resource recovery. Metals can be infinitely recycled without loss of quality, making recycled metals an attractive option over mined metals. Nearly all metals including steel, aluminum, copper, and precious metals are recyclable making recycled metals versatile across industries.

Recycling metal production requires significantly less energy compared to primary metal production. For example, producing steel from recycled scrap requires 60% less energy compared to producing from iron ore. This reduces greenhouse gas emissions and lowers carbon footprint. Due to resource efficiency and energy savings, recycling metals is economically favorable over mining new resources.

Stringent regulations globally are encouraging recycling of scrapped metals to curb environmental impact of mining activities. Growing awareness among manufacturers regarding sustainability is fueling demand for recycled metal materials. Nearly all automotive and electronic product manufacturers use recycled steel and aluminum in production to meet sustainability targets.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

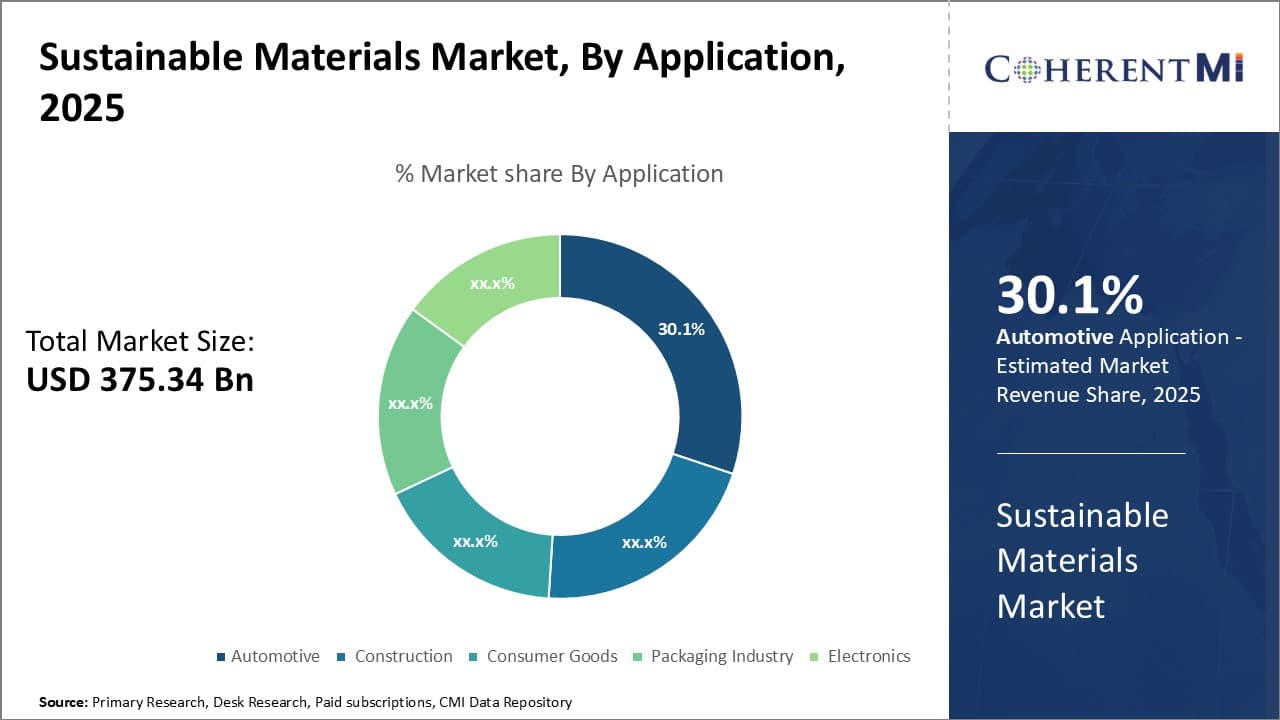

Insights, By Application: Automotive Dominates Due to Electrification and Lightweighting

In terms of application, the automotive industry contributes 30.1% share to the sustainable materials market in 2025. The global automotive industry is aggressively moving towards electrification of vehicles to reduce emissions. Extensive use of sustainable and light materials helps improve battery range of electric vehicles.

Automakers are increasingly using sustainable materials like bioplastics, recycled polymers, sustainable fibers and lightweight metals in exterior body panels, interior trims and components. Biodegradable plastics are replacing conventional plastics in dashboards, door trims and seating. Recycled aluminum and high strength steel reduce vehicle weight, thereby improving fuel efficiency of gasoline vehicles.

Regulatory pressure to lower vehicle emissions and transition to electric is driving increased spending on sustainable lightweight materials by automakers globally. Focus on eco-friendly branding encourages OEMs to prominently display use of recycled content to gain consumer trust.

Insights, By Material: Packaging Industry Adoption of Bioplastics and Recycled Materials

In terms of material, biodegradable plastics contribute the largest share in sustainable materials market driven by high adoption in the packaging industry. Rising awareness about single-use plastics pollution is encouraging packaging manufacturers to shift from conventional plastics to biodegradable alternatives.

Biodegradable plastics like PLA and PHA offer compelling advantages over traditional plastics in packaging applications. These offer compatibility with existing plastic manufacturing systems while degrading completely without polluting the environment at end-of-life. They can be processed on existing plastic conversion equipment to produce packaging films, containers, bottles and clamshells.

Many quick service restaurants, food outlets, and consumer goods brands are introducing packaging made from bioplastics to improve sustainability credentials. Stringent regulations targeting single-use plastics have spurred replacement with recycled PET, recycled PE, and bio-PET bottles and containers. Ease of processing recycled plastics on existing recycling infrastructure encourages packaging manufacturers to use higher recycled content.

Additional Insights of Sustainable Materials Market

- Adoption in Automotive Industry: Major automotive manufacturers are increasingly using biopolymers and recycled materials in vehicle components to reduce weight and enhance fuel efficiency. For example, incorporating sustainable fibers in upholstery and interior trims not only reduces environmental impact but also appeals to eco-conscious consumers.

- Retailers Promoting Sustainable Packaging: Leading retail chains have committed to transitioning to 100% recyclable or compostable packaging by 2025. This initiative is driving demand for sustainable materials in the packaging sector and encouraging suppliers to innovate.

- Regional Growth: The Asia-Pacific region is experiencing the fastest growth in the sustainable materials market, with an estimated CAGR exceeding 7%. Factors contributing to this growth include rapid urbanization, industrialization, and increasing environmental regulations in countries like China and India.

- Packaging Segment Dominance: The packaging application segment holds the largest market share, accounting for approximately 32.7% of the total market. This dominance is due to the high consumption of packaging materials and the shift towards sustainable options by major brands.

Competitive overview of Sustainable Materials Market

The major players operating in the sustainable materials market include BASF SE, Dow Inc., DuPont de Nemours, Inc., Arkema S.A., Covestro AG, Kingfa Sci & Tech Co Ltd, NatureWorks LLC, Novamont S.p.A., Biome Bioplastics Limited, and Toray Industries, Inc.

Sustainable Materials Market Leaders

- BASF SE

- Dow Inc.

- DuPont de Nemours, Inc.

- Arkema S.A.

- Covestro AG

Recent Developments in Sustainable Materials Market

- In May 2024, BASF SE introduced biomass-balanced versions of chemical intermediates such as 1,4-butanediol (BDO), tetrahydrofuran (THF), polytetrahydrofuran (PolyTHF®), and 3-(dimethylamino)propylamine (DMAPA). These products are certified by ISCC PLUS and REDcert2, contributing to the replacement of fossil resources with renewable raw materials.

- In June 2023, BASF SE announced plans to expand its global production capacity for alkyl polyglucosides (APGs), a class of bio-based and biodegradable surfactants, by adding new production lines at its sites in Bangpakong, Thailand, and Cincinnati, Ohio.

- In May 2023, Dow announced a collaboration with New Energy Blue to produce bio-based ethylene from renewable agricultural residues, such as corn stover. This bio-based ethylene is intended for use in manufacturing renewable plastics across various markets, including packaging.

Sustainable Materials Market Segmentation

- By Type

- Recycled Metals

- Biodegradable Plastics

- Eco-friendly Textiles

- Renewable Fibers

- Sustainable Packaging Material

- By Application

- Automotive

- Construction

- Consumer Goods

- Packaging Industry

- Electronics

- By Material

- Biodegradable Plastics

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch Blends

- Biopolymers

- Bio-PET

- Bio-PE

- Sustainable Chemicals

- Bio-based Acids

- Bio-based Alcohols

- Sustainable Fibers

- Organic Cotton

- Recycled Polyester

- Recycled Materials

- Recycled Metals

- Recycled Glass

- Biodegradable Plastics

- By End User

- Commercial

- Residential

- Industrial

Would you like to explore the option of buying individual sections of this report?

Vidyesh Swar is a seasoned Consultant with a diverse background in market research and business consulting. With over 6 years of experience, Vidyesh has established a strong reputation for his proficiency in market estimations, supplier landscape analysis, and market share assessments for tailored research solution. Using his deep industry knowledge and analytical skills, he provides valuable insights and strategic recommendations, enabling clients to make informed decisions and navigate complex business landscapes.