Systemic Amyloidosis Therapeutic Market Size - Analysis

The Global Systemic Amyloidosis Therapeutic Market is estimated to be valued at USD 6.69 Bn in 2025 and is expected to reach USD 11.54 Bn by 2032, growing at a compound annual growth rate (CAGR) of 8.1% from 2025 to 2032.

Market Size in USD Bn

CAGR8.1%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.1% |

| Market Concentration | High |

| Major Players | AstraZeneca, Attralus, Ionis Pharmaceuticals, Prothena Biosciences, Alexion Pharmaceuticals and Among Others |

please let us know !

Systemic Amyloidosis Therapeutic Market Trends

With advancements in research and development, awareness about systemic amyloidosis as a disease condition has increased significantly over the past decade. Various non-profit organizations and patient advocacy groups across the globe are educating people about its symptoms and importance of early diagnosis. This has motivated many high-risk individuals to get relevant medical tests done.

The collective effect of these trends has been higher diagnosis rates globally. Whereas previously many patients would remain unaware about having amyloidosis for years, today majority of those at risk are empowered to proactively check for it. Furthermore, physicians can now examine patient samples more accurately than relying on indirect clinical signs alone. As more cases come to light, it is reinforcing calls for improved treatments. Pharmaceutical companies will see this growing diagnosed patient pool as a strong driving factor to accelerate R&D of novel therapeutic solutions.

Market Driver - Advances in Gene Therapy and Targeted Monoclonal Antibodies to Encourage Market Developments

Gene silencing techniques hold promise for halting overexpression of abnormal proteins at the root cause. Trials involve delivering custom designed genetic material or viral vectors to switch off the faulty genes. Challenges remain in ensuring specificity and sustained activity but initial results have been encouraging.

Combination strategies fusing gene therapies and antibody drugs are under active consideration. The hope is to address systemic amyloidosis at the genetic, protein and organ levels simultaneously for optimal outcomes. While more research is still to be done, medical innovations centered on genes and targeted molecules are without a doubt revolutionizing treatment outlook for this previously difficult to handle disease.

One of the major challenges faced in the systemic amyloidosis therapeutic market is the high cost of treatment for these rare diseases. Systemic amyloidosis is a group of rare disorders caused by aggregation of misfolded proteins that are deposited abnormally in tissues and organs. With no approved disease-modifying treatments available, management of amyloidosis mainly involves alleviating symptoms through expensive strategies like chemotherapy, stem cell transplants, and organ transplantation. Due to the low prevalence of these conditions, pharmaceutical companies have little incentive to invest heavily in research and development of new therapies. Further, the small patient populations also result in high per-patient drug development costs that get reflected in the final price of approved therapies. This makes treatment unaffordable for many patients. Even developed healthcare markets often lack specialized programs and funding to support patients with these rare illnesses. Overall, the orphan drug designation does not entirely resolve the financial challenges involved in developing and accessing therapies for systemic amyloidosis and similar rare diseases.

Market Opportunity: Development of Novel Therapies Targeting Amyloid Deposits

Prescribers preferences of Systemic Amyloidosis Therapeutic Market

Systemic amyloidosis is a progressive disease characterized by the buildup of abnormal amyloid protein deposits in vital organs. Prescribers' treatment approaches vary depending on the type and stage of amyloidosis.

As the disease advances, options may include lenalidomide (Revlimid) either alone or with dexamethasone. For those with more severe accumulation, especially affecting the heart, carfilzomib (Kyprolis) or daratumumab (Darzalex) based regimens present alternative options.

Hereditary forms like ATTR amyloidosis associated with specific gene mutations are typically managed via supportive care due to lack of effective treatment. However, tafamidis (Vyndaqel) and inotersen (Tegsedi) have shown promise in halting neurologic decline for specific mutations and are increasingly prescribed earlier.

Treatment Option Analysis of Systemic Amyloidosis Therapeutic Market

Systemic amyloidosis has four main stages - early, intermediate, advanced and end-stage disease. Treatment depends on the type and stage of amyloidosis.

As the disease progresses to intermediate stage, chemotherapy continues to be the mainstay for AL amyloidosis. Regimens combining bortezomib with cyclophosphamide and dexamethasone are commonly used. For intermediate ATTR amyloidosis, inotersen (Tegsedi) or patisiran (Onpattro) are preferred as they interfere with transthyretin production.

In end-stage disease, treatment shifts to palliative care focusing on symptom relief. Liver transplantation is sometimes considered for hereditary ATTR amyloidosis to replace the mutated transthyretin gene. Overall, treatment continuously adapts based on amyloid type and stage to suppress protein deposition and improve quality of life.

Key winning strategies adopted by key players of Systemic Amyloidosis Therapeutic Market

Collaborations and Acquisitions: Many players have focused on collaborations and acquisitions to gain access to new drug candidates and strengthen their pipeline. For example, in 2018, Alnylam Pharmaceuticals acquired a clinical-stage RNAi therapeutics company, Dicerna Pharmaceuticals, to gain access to their pipeline of RNAi therapies for treating amyloidosis. This strengthened Alnylam's presence in this market.

Late-Stage Pipeline and Approvals: Players with drugs in late-stages of development or recent approvals have seen success.

These examples of strategies clearly show how collaborations, focus on orphan drugs, late-stage successes and expanded pipelines have helped key players gain significant leadership positions and maximize revenues in this market.

Segmental Analysis of Systemic Amyloidosis Therapeutic Market

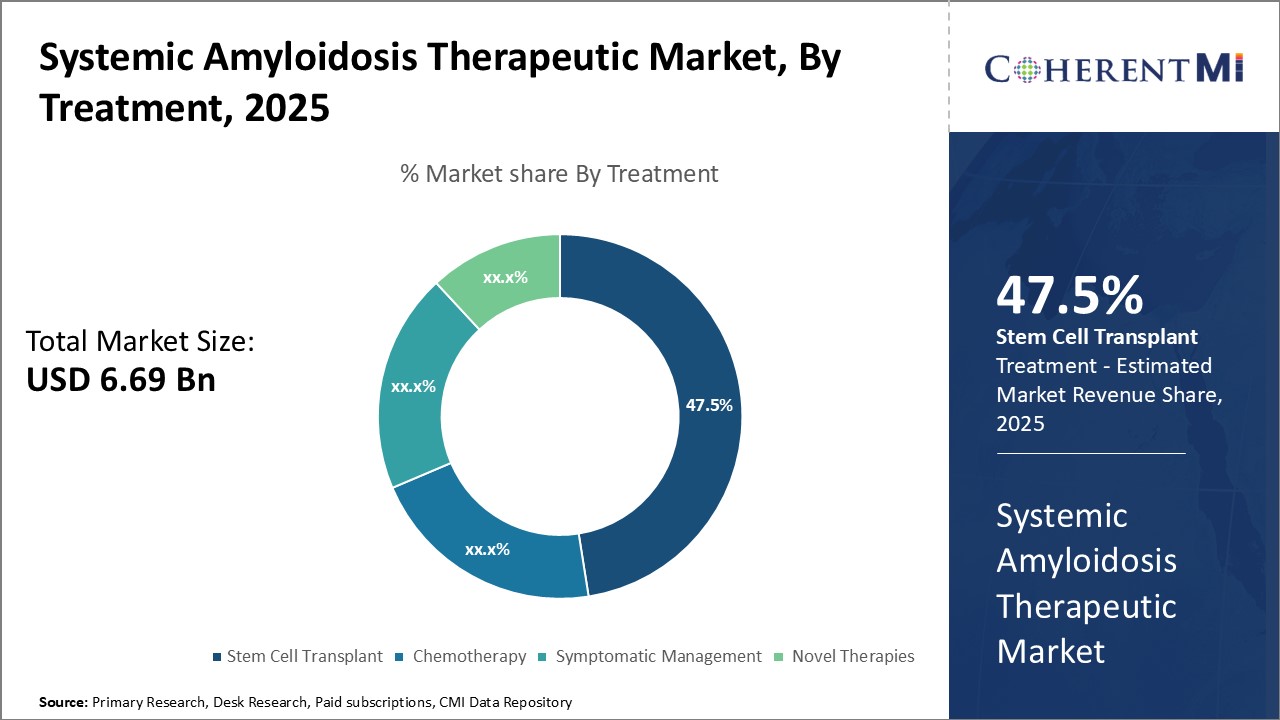

Insights, By Treatment, Stem Cell Transplant is the Leading Segment Throughout the Forecast Period

Stem cell transplant provides patients with a replacement set of healthy bone marrow, thereby essentially curing the disease. It has proven effective in conditions like AL amyloidosis where stem cells from a donor can target the aberrant plasma cells producing abnormal light chains. The success rates for stem cell transplants in AL amyloidosis have increased over the last decade, making it an attractive option for eligible patients.

Furthermore, greater awareness among physicians has led to more prompt diagnoses and timely referrals for stem cell transplant evaluation. Several clinical studies have highlighted transplant as the treatment of choice in suitable AL amyloidosis cases, strengthening its position as the go-to option when viable. Stem cell transplant being a one-time curative approach versus lifelong management with other therapies, along with the promising success rates, has contributed to its rising preference among AL amyloidosis patients and clinicians. This is expected to further increase its share in the systemic amyloidosis therapeutic market over the coming years.

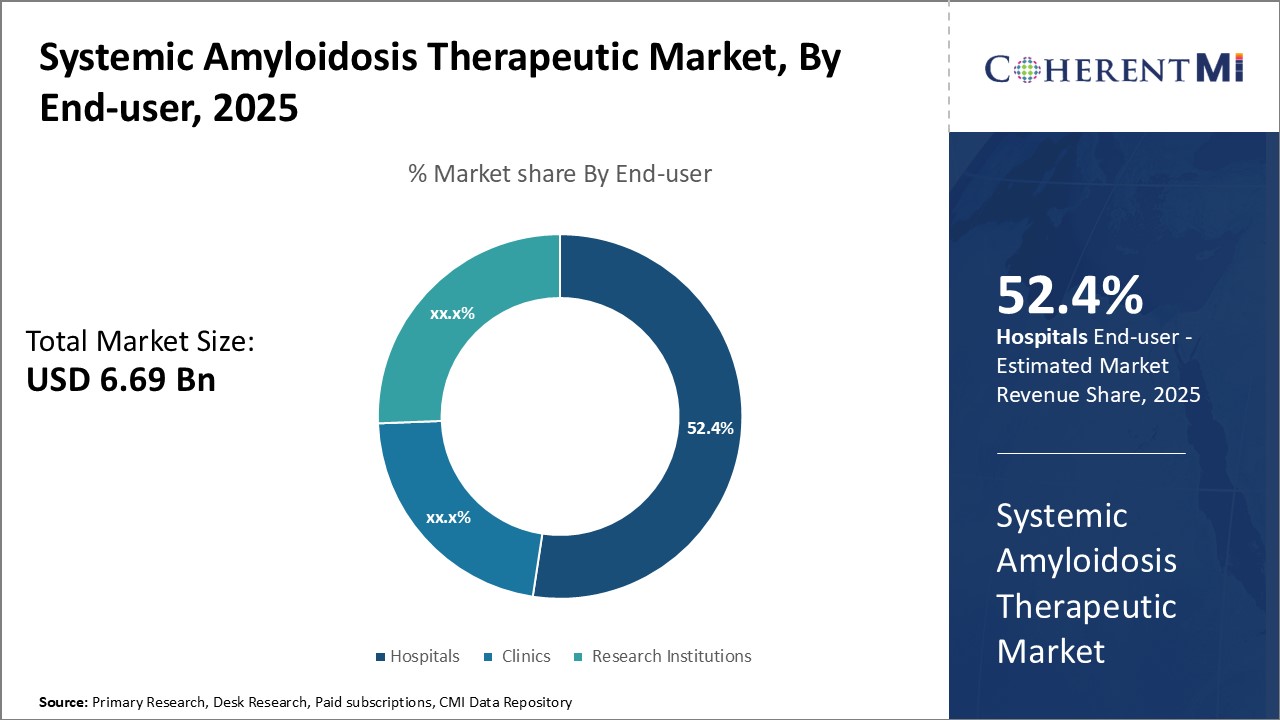

Insights, By End-user Hospitals Lead Throughout the Forecast Period

Insights, By End-user Hospitals Lead Throughout the Forecast Period

Further, hospitals have the requisite infrastructure and medical expertise to deliver intensive treatments like stem cell transplant. The complex nature of these procedures necessitates in-patient hospitalization, positioning hospitals at the forefront of specialized amyloidosis care.

Additional Insights of Systemic Amyloidosis Therapeutic Market

Systemic amyloidosis is a rare but potentially life-threatening disorder caused by the deposition of misfolded proteins in vital organs. The disorder’s heterogeneity complicates diagnosis and treatment, with types like AL amyloidosis commonly seen in conjunction with plasma cell disorders. Novel approaches, such as monoclonal antibodies and gene therapies, are transforming the treatment landscape. AstraZeneca's CAEL-101 and Attralus' AT-02 represent key developments in amyloid removal, showing potential in ongoing clinical trials. Despite progress, challenges remain, including the high cost of treatment and limited therapeutic options for advanced-stage patients. Continued investment in research and collaborations between academic and industry players are crucial to addressing unmet needs in this field. The future of systemic amyloidosis treatment lies in precision medicine and personalized therapies that target specific amyloid subtypes, improving survival rates and quality of life for affected individuals.

Competitive overview of Systemic Amyloidosis Therapeutic Market

The major players operating in the Systemic Amyloidosis Therapeutic Market include AstraZeneca, Attralus, Ionis Pharmaceuticals, Prothena Biosciences, Alexion Pharmaceuticals, Eidos Therapeutics, GSK Plc, Novartis Plc, Sanofi SA, Akcea Therapeutics and Janssen Pharmaceuticals.

Systemic Amyloidosis Therapeutic Market Leaders

- AstraZeneca

- Attralus

- Ionis Pharmaceuticals

- Prothena Biosciences

- Alexion Pharmaceuticals

Systemic Amyloidosis Therapeutic Market - Competitive Rivalry

Systemic Amyloidosis Therapeutic Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Systemic Amyloidosis Therapeutic Market

- AstraZeneca (May 2024): AstraZeneca is evaluating Anselamimab (CAEL-101), a first-in-class monoclonal antibody designed to treat AL amyloidosis by targeting amyloid deposits. Currently in Phase III, the drug has received Orphan Drug Designation from both the FDA and European Commission.

- Attralus (2023): Attralus is progressing its pan-amyloid removal therapeutic AT-02, which is in Phase II trials. This humanized monoclonal antibody is aimed at treating multiple amyloid deposit types across various organs, providing a comprehensive approach to systemic amyloidosis.

Systemic Amyloidosis Therapeutic Market Segmentation

- By Treatment

- Stem Cell Transplant

- Chemotherapy

- Symptomatic Management

- Novel Therapies

- By End-user

- Hospitals

- Clinics

- Research Institutions

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Frequently Asked Questions :

How Big is the Systemic Amyloidosis Therapeutic Market?

The Global Systemic Amyloidosis Therapeutic Market is estimated to be valued at USD 6.69 Bn in 2025 and is expected to reach USD 11.54 Bn by 2032.

What will be the CAGR of the Systemic Amyloidosis Therapeutic Market?

The CAGR of the Systemic Amyloidosis Therapeutic Market is projected to be 7.9% from 2024 to 2031.

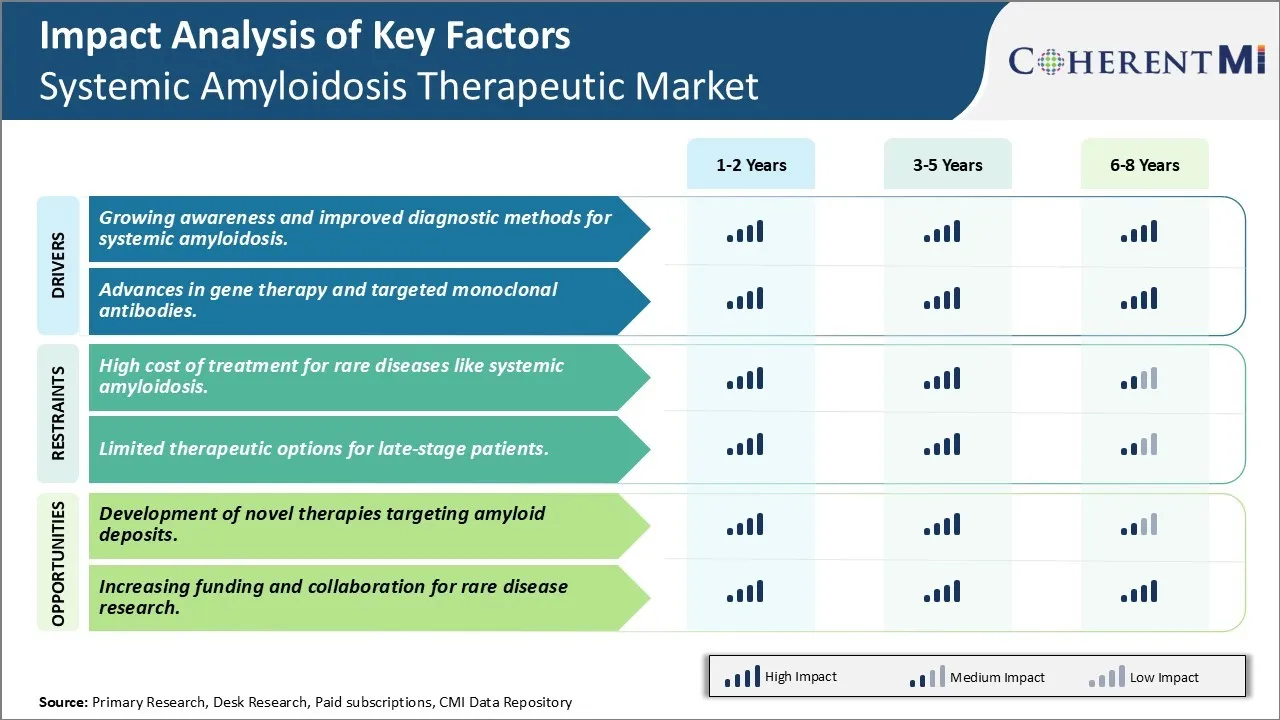

What are the major factors driving the Systemic Amyloidosis Therapeutic Market growth?

The growing awareness and improved diagnostic methods for systemic amyloidosis, advances in gene therapy and targeted monoclonal antibodies, are the major factors driving the Systemic Amyloidosis Therapeutic Market.

What are the key factors hampering the growth of the Systemic Amyloidosis Therapeutic Market?

The high cost of treatment for rare diseases like systemic amyloidosis and limited therapeutic options for late-stage patients are the major factor hampering the growth of the Systemic Amyloidosis Therapeutic Market.

Which is the leading Treatment in the Systemic Amyloidosis Therapeutic Market?

Stem Cell Transplant is the leading Treatment segment.

Which are the major players operating in the Systemic Amyloidosis Therapeutic Market?

AstraZeneca, Attralus, Ionis Pharmaceuticals, Prothena Biosciences, Alexion Pharmaceuticals, Eidos Therapeutics, GSK Plc, Novartis Plc, Sanofi SA, Akcea Therapeutics, Janssen Pharmaceuticals are the major players.