UAE Freight Forwarding Market Trends

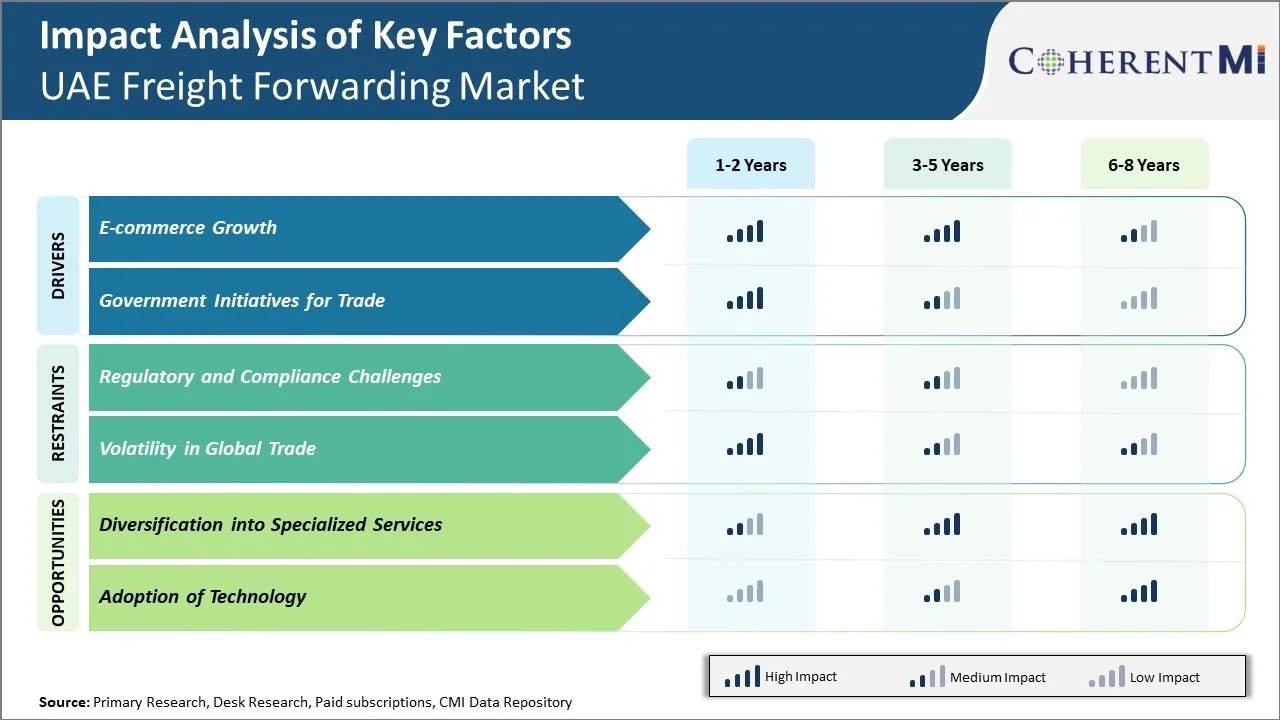

Market Driver – E-commerce Growth

The rapid growth of e-commerce has significantly impacted the freight forwarding market in UAE. With more consumers and businesses doing transactions online, there has been a substantial rise in cross-border shipments of goods. E-commerce retailers are heavily reliant on logistic and shipping companies to move products from warehouses to customers located around the world.

This surge in e-commerce activity has created booming demand for freight forwarding services in UAE. Forwarders play a crucial role in the international supply chain by arranging shipments, handling documentation needs, and facilitating customs clearance for e-commerce companies. They ensure timely and efficient transportation of parcels from overseas vendors to people's doorsteps within UAE and other destinations. According to the United Nations Conference on Trade and Development (UNCTAD), the share of individuals using the internet to purchase foreign goods increased from 15% in 2019 to 19% in 2021. The International Post Corporation also reported that cross-border e-commerce shipments grew globally by 26% in 2021 compared to the previous year.

Market Driver – Government Initiatives for Trade

The UAE government has taken various trade-friendly initiatives in recent years which have significantly propelled the growth of the freight forwarding market in the country. One of the most impactful moves was the establishment of free trade zones across major cities like Dubai, Abu Dhabi, Sharjah etc. These zones offer 100% foreign ownership, 0% corporate and income tax, and world-class infrastructure to foster global trade. With over 40 free trade zones currently operational, the UAE has emerged as a key regional trade and logistics hub connecting Asia, Africa and Europe. This has boosted the demand for freight forwarding services multi-fold as a wide range of industries have set up base in these zones to leverage the strategic advantages.

The government has also signed comprehensive trade agreements with several nations to promote both exports and imports. Notable among them is the Gulf Cooperation Council (GCC) agreement which allows for the free movement of goods between GCC countries without any custom duties or import restrictions. As per World Bank data, the total value of goods traded between GCC countries increased from $80 billion in 2020 to an estimated $105 billion in 2022.

Market Challenge – Regulatory and Compliance Challenges

The UAE freight forwarding market faces significant regulatory and compliance challenges that restrain its growth potential. As a global trade and logistics hub, the UAE has established strict protocols to ensure security and transparency in cargo movements. However, frequent changes in laws and lack of coordination between various government agencies sometimes creates hurdles for freight forwarding companies.

New regulations around safety, customs procedures, and transportation of restricted goods are regularly introduced but the implementation guidelines are not always clear or uniform across different jurisdictions within the country. This leads to delays in cargo clearance and uncertainty regarding duty structures. Small and medium freight forwarders struggle to keep up with the dynamic compliance environment as it requires substantial legal and process expertise.

Additionally, while free zones and dedicated economic regions offer tax incentives to boost trade, inconsistencies remain in documentation requirements between mainland and offshore locations. For example, as per a 2020 report by the United Nations Conference on Trade and Development, differences still persist in authorized customs brokers and insurance policies between Dubai mainland and Jebel Ali free zone which causes delays and uncertainties for transporters moving goods between the two areas.

Market Opportunity – Diversification into Specialized Services

Diversification into specialized services presents a huge opportunity for growth in the UAE freight forwarding market. As one of the major trade and logistics hubs in the world, the nation handles massive volumes of cargo through its ports and airports on a daily basis. However, the market has traditionally relied on conventional services like transportation and warehousing. With rising expectations from customers and evolving supply chain complexities, there is a need to offer differentiated value-added services.

Providers can expand beyond basic coordination and focus on niche areas that serve growing customer demands. For example, many sectors in the UAE like healthcare and manufacturing are adopting Just-In-Time and lean manufacturing techniques which require tightly integrated and time-critical logistics. Forwarders can develop capabilities in specialty services like managed inventory, cross-docking, container tracking and real-time cargo monitoring.

As another example, the e-commerce industry in the UAE recorded a shipment growth of over 32% year-on-year according to Emirates Post data for 2021. This sub-sector demands hyperlocal delivery capability within major cities along with value-added warehousing solutions for consolidation, return management and packaging.