United Kingdom Power Tools Market Size - Analysis

The United Kingdom Power Tools Market is estimated to be valued at USD 1.77 Bn in 2024 and is expected to reach USD 3.84 Bn by 2031, growing at a CAGR of 11.7% from 2024 to 2031.

Market Size in USD Bn

CAGR11.7%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 11.7% |

| Market Concentration | Medium |

| Major Players | Ralli Wolf, Jiangsu Dongcheng Power Tools Co., Ltd., Ingersoll Rand India, Fixtec, Kseibi Tools and Among Others |

please let us know !

United Kingdom Power Tools Market Trends

The demand for power tools in the United Kingdom construction industry has seen significant growth in recent years and is projected to continue rising due to increased demand for industrial tools from construction projects.

The types of power tools seeing most demand include corded and cordless drills, circular saws, grinders, sanders, nail guns and demolition hammers. Leading manufacturers have responded by developing more durable and efficient industrial-grade power tool variants with Li-ion batteries that last longer and offer versatility.

Market Driver – Increasing Automotive Sales

Vehicle manufacturing is a very mechanized and automated process that requires diverse power equipment at various stages ranging from metal cutting and shaping to assembly and inspection. The establishment of new production plants by global automakers and the investments made by existing manufacturers to ramp up local output have positively impacted the consumption of power tools in the industry. Similarly, the growing automotive servicing sector with numerous vehicle repair shops and independent garages catering to the maintenance and repair needs has also substantially boosted the sales of cutting, tightening and fastening power tools.

Market Challenge – Common Safety Regulations

Compliance to these regulations require substantial investment of time and capital. Tool manufacturers have to dedicate resources to upgrade their product designs, re-engineer tools where necessary to add safety features like guards, insulation etc. They also need to get every new tool or updated model certified by accredited third-party testing agencies before they can be sold in the market.

Advancement of power tools could provide a significant opportunity in the United Kingdom power tools market. With technological innovation progressing at a rapid pace, power tools are becoming smarter, lighter and more efficient. Manufacturers are developing advanced functionalities like brushed and brushless motor technologies, lithium-ion batteries, integrated electronic controls and connectivity features. These modernizations are allowing power tools to execute tasks with enhanced precision, control and versatility for diverse applications compared to traditional corded or cable-operated tools.

Segmental Analysis of United Kingdom Power Tools Market

Within the United Kingdom power tools market segmented by product type, tool type sub-segment accounts for the largest share of 86.6% due to the versatility these tools offer to both professional trades workers and DIY hobbyists. Tool type products include equipment such as drills, saws, sanders and other multi-purpose power tools that can be used for a wide range of applications. This versatility allows trades workers like carpenters, electricians and plumbers to accomplish a diverse array of tasks on the jobsite with a single tool, making them highly valuable tools to have in their arsenal.

Tool type power tools additionally benefit from strong brand loyalty among tradespeople, who rely on them for their livelihoods.

Insights, By Mode of Operation: Cordless Revolution Fuels Cordless Segment Growth

Professional trades workers have widely adopted cordless tools because they allow freedom of movement without the hassle and limits of extension cords. This makes cordless ideal for working at height or outdoors. Lengthy battery life and rapid charging also keeps tradespeople as productive as possible between charges. Cordless also provides safety advantages over corded by eliminating tripping hazards. Meanwhile, DIYers appreciate not having to mess with extension cords or dealing with outlets when working in different areas of their properties.

Competitive overview of United Kingdom Power Tools Market

The major players operating in the United Kingdom Power Tools Market include Ralli Wolf, Jiangsu Dongcheng Power Tools Co., Ltd., Ingersoll Rand India, Fixtec, and Kseibi Tools.

United Kingdom Power Tools Market Leaders

- Ralli Wolf

- Jiangsu Dongcheng Power Tools Co., Ltd.

- Ingersoll Rand India

- Fixtec

- Kseibi Tools

United Kingdom Power Tools Market - Competitive Rivalry

United Kingdom Power Tools Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in United Kingdom Power Tools Market

- In May 2022, Makita Corporation expanded the 40V | 80V max XGT System with the announcement of 19 new products. The 19 new XGT products have applications in residential construction, metalworking, and woodworking as well as dust extraction, outdoor power equipment, and others.

United Kingdom Power Tools Market Segmentation

- By Product Type

- Tool Type

- Drilling and Fastening Tools (Drills, Wrenches, etc.)

- Sawing And Cutting Tools (Reciprocating Saws, Band Saws, etc.)

- Routing Tools (Routers/Planers)

- Others (Sanders, Hammers, etc.)

- Accessories & Consumable

- Tool Type

- By Mode of Operation

- Fixed/Corded

- Cordless

- By Distribution Channel

- Online Sales

- Offline Sales

- By End User

- Industrial

- Commercial

- Residential

Would you like to explore the option of buying individual sections of this report?

Ramprasad Bhute is a Senior Research Consultant with over 6 years of experience in market research and business consulting. He manages consulting and market research projects centered on go-to-market strategy, opportunity analysis, competitive landscape, and market size estimation and forecasting. He also advises clients on identifying and targeting absolute opportunities to penetrate untapped markets.

Frequently Asked Questions :

What are the key factors hampering the growth of the United Kingdom Power Tools Market?

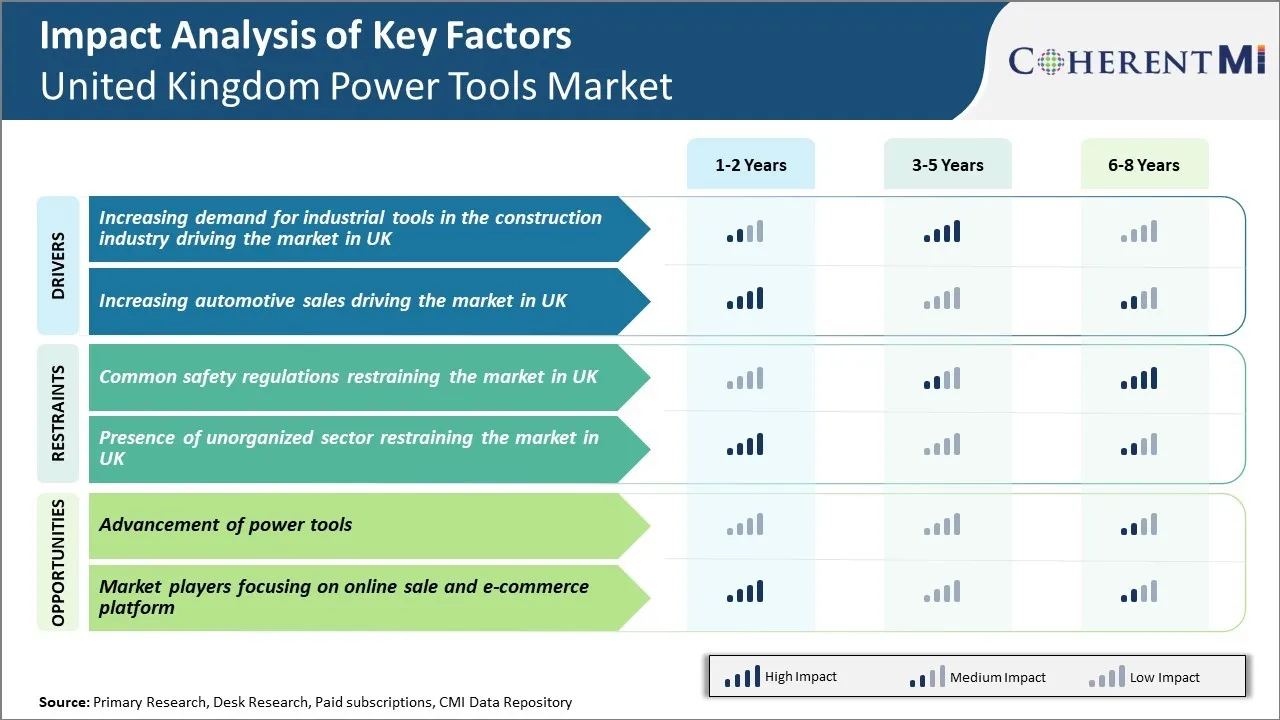

The common safety regulations and presence of unorganized sector are the major factors hampering the growth of the United Kingdom Power Tools Market.

What are the major factors driving the United Kingdom Power Tools Market growth?

The increasing demand for industrial tools in the construction industry and increasing automotive sales are the major factors driving the United Kingdom Power Tools Market growth.

Which is the leading Product Type in the United Kingdom Power Tools Market?

The leading Product Type segment is Tool Type.

Which are the major players operating in the United Kingdom Power Tools Market?

Ralli Wolf, Jiangsu Dongcheng Power Tools Co., Ltd., Ingersoll Rand India, Fixtec, and Kseibi Tools are the major players.

What will be the CAGR of the United Kingdom Power Tools Market?

The CAGR of the United Kingdom Power Tools Market is projected to be 11.7% from 2023-2031.