United Kingdom Power Tools Market Trends

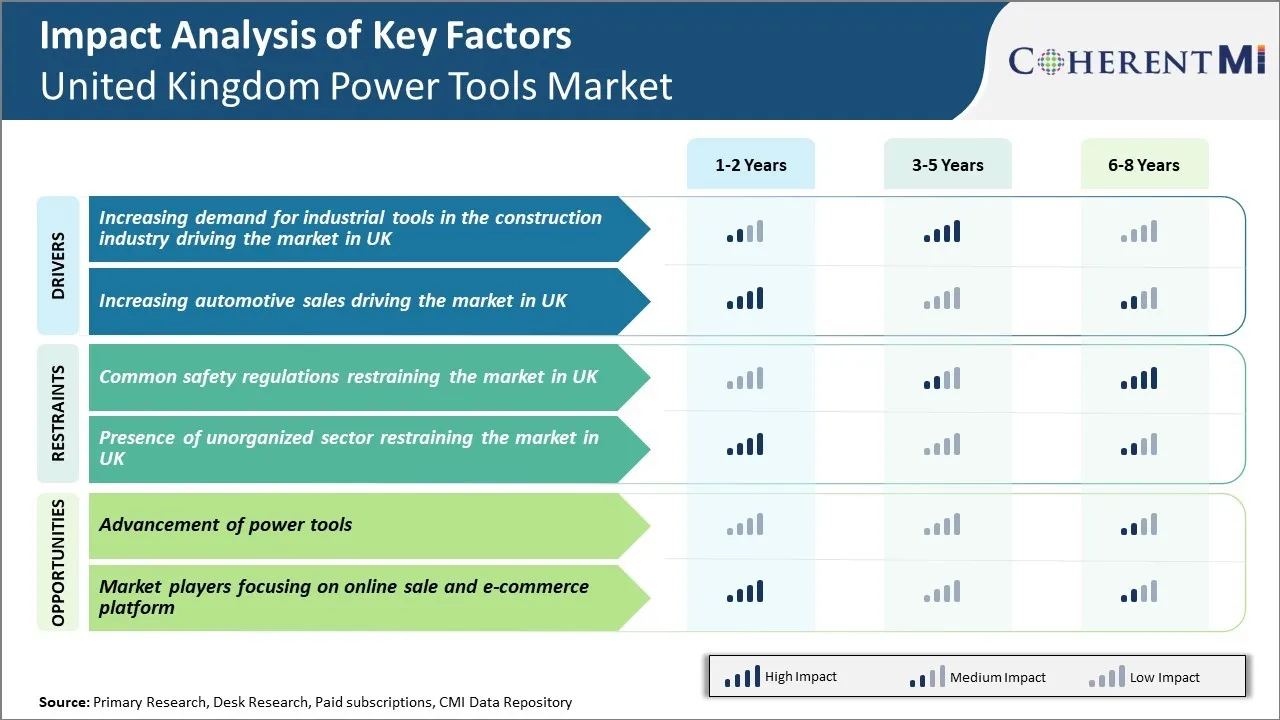

Market Driver – Increasing Demand for Industrial Tools in the Construction Industry

The demand for power tools in the United Kingdom construction industry has seen significant growth in recent years and is projected to continue rising due to increased demand for industrial tools from construction projects.

Over the past decade, the United Kingdom has experienced a boom in infrastructure development and residential construction activities. Several public and private projects have been initiated across United Kingdom cities to upgrade transportation systems, build commercial properties, residential complexes and public facilities. This has led to immense need for power tools at construction sites to speed up processes like drilling, sawing, cutting and polishing of materials during different construction stages. According to Office for National Statistics, the value of new work in construction increased by 14.9% in 2021 compared to 2020 levels. This clearly demonstrates the high activity in the sector which requires extensive use of power tools.

The types of power tools seeing most demand include corded and cordless drills, circular saws, grinders, sanders, nail guns and demolition hammers. Leading manufacturers have responded by developing more durable and efficient industrial-grade power tool variants with Li-ion batteries that last longer and offer versatility.

Market Driver – Increasing Automotive Sales

The automotive industry has seen strong growth in the United Kingdom over the past few years which has significantly contributed to the expansion of the domestic power tools market. As more vehicles are being manufactured and maintained in the country, there has been a surge in demand for a wide range of power tools that are essential for automotive production and servicing activities.

Vehicle manufacturing is a very mechanized and automated process that requires diverse power equipment at various stages ranging from metal cutting and shaping to assembly and inspection. The establishment of new production plants by global automakers and the investments made by existing manufacturers to ramp up local output have positively impacted the consumption of power tools in the industry. Similarly, the growing automotive servicing sector with numerous vehicle repair shops and independent garages catering to the maintenance and repair needs has also substantially boosted the sales of cutting, tightening and fastening power tools.

According to Department for Transport data, there were over 38 million licensed vehicles in England alone as of early 2023, a 14% increase compared to ten years ago.

Market Challenge – Common Safety Regulations

The common safety regulations that are applicable across European countries have significantly impacted the growth of United Kingdom power tools market in recent years. The regulations stipulate strict compliance standards for all power tools being sold and manufactured in the UK and European markets. This involves stringent testing, certification and labelling requirements for each power tool category and model.

Compliance to these regulations require substantial investment of time and capital. Tool manufacturers have to dedicate resources to upgrade their product designs, re-engineer tools where necessary to add safety features like guards, insulation etc. They also need to get every new tool or updated model certified by accredited third-party testing agencies before they can be sold in the market.

This immense compliance burden has restricted the ability of UK power tool companies to quickly launch new innovative product lines or regularly refresh existing models at a fast pace. Data from the UK Health and Safety Executive suggests that in 2021, major tool brands faced delays of over 9 months on average to get new product designs certified for sale, compared to just 3 months a decade ago.

Market Opportunity – Advancement of Power Tools

Advancement of power tools could provide a significant opportunity in the United Kingdom power tools market. With technological innovation progressing at a rapid pace, power tools are becoming smarter, lighter and more efficient. Manufacturers are developing advanced functionalities like brushed and brushless motor technologies, lithium-ion batteries, integrated electronic controls and connectivity features. These modernizations are allowing power tools to execute tasks with enhanced precision, control and versatility for diverse applications compared to traditional corded or cable-operated tools.

The UK government's recent increased infrastructure spending presents a prime opportunity for power tool makers to supply their innovative products. Major projects over the next few years like high-speed rail lines, renewable energy installations, residential developments and refurbishment of public facilities will generate high demand for power equipment across multiple industries. The construction sector in particular relies heavily on power tools for tasks like cutting, drilling, sanding and fastening. More efficiently designed power tools can help complete these jobs more quickly and achieve completion deadlines for large projects. Their extended run-times and useful features also support productivity gains in maintenance and repair work.