United States Car Rental Market Trends

Market Driver – Resurgence of Travel & Tourism

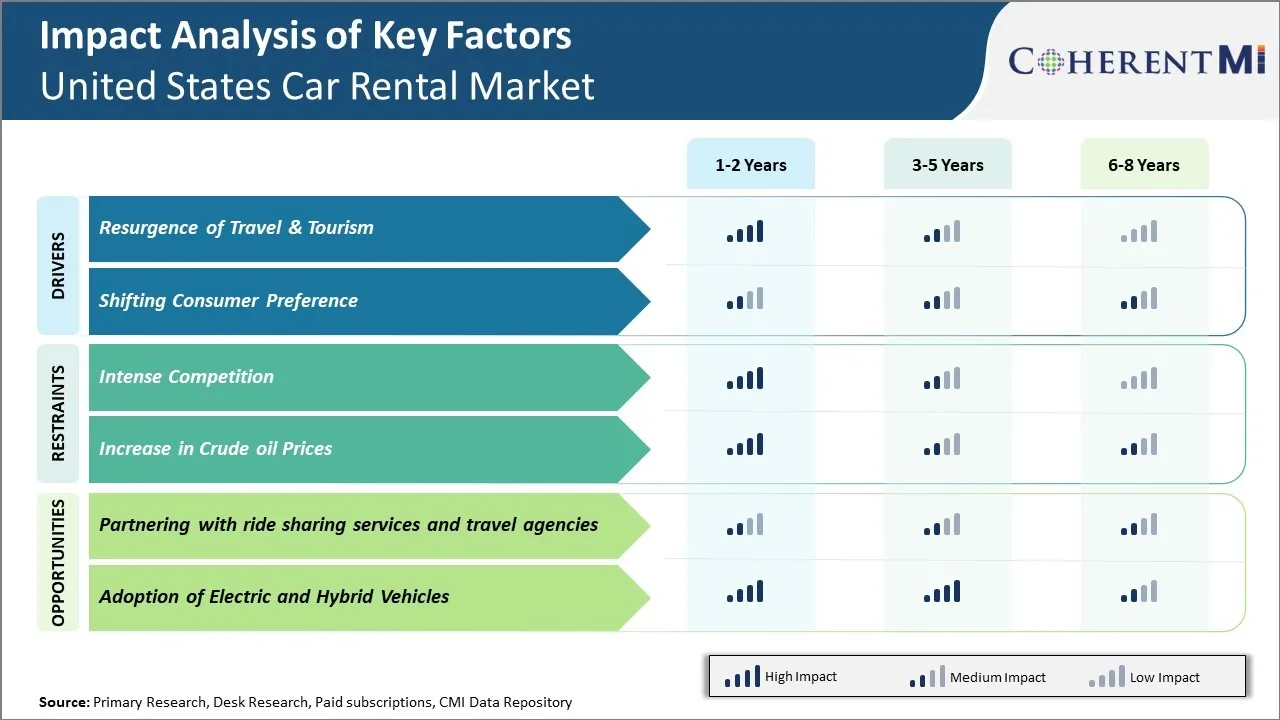

The revival of travel and tourism has catalyzed significant growth in the United States car rental market in recent years. As the lingering impacts of the pandemic gradually fade, more travelers are venturing out for both business and leisure purposes which has increased demand for rental vehicles. Popular tourist destinations within the country such as Florida, California, New York, and Hawaii have witnessed a notable upsurge in visitors arriving by air travel in 2022 compared to 2021 levels according to data from the U.S. Travel Association. This surge has directly benefited the car rental business as a large percentage of these travelers rely on rental cars to conveniently explore various areas, destinations and landmarks spread across vast geographic regions in different states.

The trend of drive vacations has also become increasingly popular post-pandemic amongst families and friend groups who want flexibility to travel at their own pace and follow their itineraries without strictly sticking to group plans. Rental car operators are actively targeting this emerging segment through varied fleet and product options to suit varied travel parties.

Market Driver – Shifting Consumer Preference

Shifting consumer preference towards experiences over material possessions is a major factor influencing the growth of the car rental market in the United States. Traditionally, owning a private vehicle was seen as a status symbol and necessity. However, today's consumers, especially millennials and generation Z, are more interested in spending money on life experiences rather than assets. This attitude is driven by environmental concerns about private vehicle ownership as well as a desire for flexibility and the experience of driving a variety of vehicles. As a result, consumers are turning to car rental services for short-term mobility needs rather than long-term ownership.

The pandemic further accelerated this shift as travel restrictions led to a preference for individual and private transportation options over public transit. According to the Bureau of Transportation Statistics, domestic air travel numbers in 2021 were still down 13% from pre-pandemic levels in 2019 indicating consumers continued preference for private vehicle travel. Car rental companies benefited significantly from this trend, with major players like Enterprise Holdings observing over 50% surge in demand compared to pre-pandemic levels.

Market Challenge – Intense Competition

The United States car rental market is facing intense competition which is restraining its growth potential. With many established players and new entrants vying for market share, companies are finding it difficult to expand and earn higher profits.

Some of the major players dominating the market include Enterprise Holdings, Hertz Global Holdings, Avis Budget Group and Sixt Rent a Car. These top four control over 70% of the overall market. With such high concentration among a few major players, there is very little room for new competitors to make notable inroads. The established players are aggressively targeting each other's customers by lowering prices, offering attractive discounts and tying up with various travel companies and airlines for bundled packages. This intense price war is negatively impacting revenues.

Furthermore, the ease of entry into this market has allowed many local and regional operators to come up. While such fragmented competition helps customers get better deals, it splits the market further and makes it difficult for individual companies to grow. For example, as of 2021 data from the US Census Bureau shows there were over 8,000 local car rental offices in the country.

Market Opportunity – Partnering with Ride Sharing Services and Travel Agencies

Partnering with ride sharing services and travel agencies could provide car rental companies with significant opportunities in the evolving United States car rental market. With evolving mobility solutions and preferences of customers towards connectivity, flexibility and sustainability - the car rental industry is witnessing seismic shifts. By offering integrated solutions through strategic partnerships, car rental companies can provide one-stop solutions to customers and gain competitive edge in the market.

Partnering with major ride sharing platforms would allow car rental firms to list their fleet on these platforms, tap into the huge database of active users and expand their customer reach. This could bridge the needs of customers during different phases of their journey seamlessly. For example, a customer takes an Uber to the airport after reserving a car from a rental firm online for the road trip portion of their vacation.

Collaborating with prominent travel agencies will help car rental companies to bundle their offerings as a part of the tourism packages. Travel agencies have large database of both domestic and international travelers. This will open up untapped segments for rental firms.