United States Chlorine Market Trends

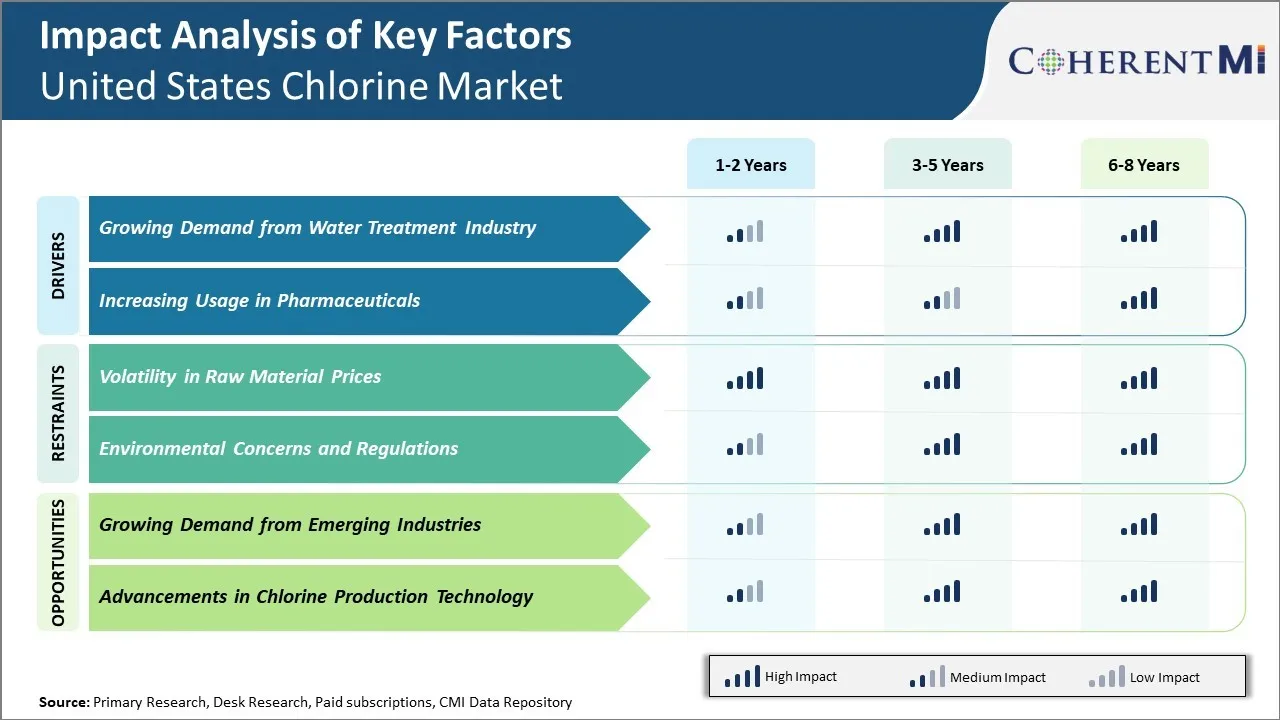

Market Driver – Growing Demand from Water Treatment Industry

The water treatment industry in the United States has been expanding rapidly over the past few years to meet the growing needs of water purification and disinfection. As the population increases and concerns over water safety rises, there has been a major drive towards advanced water treatment processes that utilize chlorine on a large scale.

Chlorine plays a key role in purifying water sources and ensuring safe drinking water by eliminating harmful microorganisms. Most municipal water facilities and wastewater treatment plants today heavily rely on chlorine for primary disinfection. Furthermore, industrial operations such as food and beverage production that use large amounts of water also chlorinate on-site to avoid contamination. The renovation and capacity expansion of existing treatment infrastructure as well as construction of new plants across the country has significantly contributed to higher chlorine consumption.

For example, according to data published by the US Environmental Protection Agency in 2022, over 91% of community water systems reported using chlorine for disinfection. Around 15% of these systems also upgraded their chlorination equipment or made process modifications to improve disinfection methods between 2020-2022. This clearly shows the continuing preference for chlorine-based disinfection and increasing investment in water treatment technologies using chlorine.

Market Driver – Increasing Usage in Pharmaceuticals

The usage of chlorine in the pharmaceutical industry has seen significant rise in the United States and is one of the key factors boosting the growth of the chlorine market. Chlorine and its derivatives such as ethylene dichloride, vinyl chloride monomer and others are extensively used across different domains in the pharmaceutical industry for manufacturing of several essential drugs and medicines.

Chlorine is used as an antimicrobial agent and disinfectant in medical facilities. According to the data published by the Centers for Disease Control and Prevention in 2021, healthcare associated infections are on the rise and an estimated 4.8% of hospitalized patients at any time will contract at least one infection. The growing focus on sanitization and disinfection amidst the ongoing pandemic is likely to augment the demand for chlorine in the healthcare sector for sterilizing medical devices, hard surfaces and equipment. In addition, chlorine derivatives act as essential intermediates in the production of various antibiotics, vaccines and other therapeutic drugs. The active pharmaceutical ingredients manufactured utilizing chlorine and its byproducts are widely adopted for treating cardiovascular, respiratory, neurological and infectious diseases.

Market Challenge – Volatility in Raw Material Prices

The volatility in raw material prices has negatively impacted the growth of the United States chlorine market in recent times. Chlorine is a key feedstock or raw material that is used across many major end-use industries like water treatment, pharmaceuticals, paper, construction, etc. However, the prices of chlorine raw materials like salt, hydrogen, and electricity have witnessed significant fluctuations over the past couple of years.

Salt is the primary raw material used in the production of chlorine and it accounts for nearly 35-40% of the total production cost. Salt prices in the United States increased sharply from $80 per ton in 2020 to nearly $120 per ton in early 2022 due to disruptions caused by severe winter storms and higher global demand (U.S. Geological Survey, 2022). Similarly, hydrogen which is used along with salt for chlorine production through electrolysis has also seen strong price escalation over the past year due to shortage of natural gas globally. Electricity costs have surged across many American states due to power outages and shutdown of coal-fired plants further driving up production costs for chlorine producers.

Market Opportunity – Growing Demand from Emerging Industries

The United States chlorine market is poised to benefit greatly from growing demand emanating from emerging industries in the coming years. One of the key industries driving increased chlorine consumption is water treatment. With rising concerns around water scarcity and quality, especially in the western states facing drought conditions, extensive investment is being made towards desalination and wastewater recycling infrastructure. Chlorine and its derivatives form an indispensable part of municipal water treatment processes to ensure safety.

According to data from the United Nations, over 80% of wastewater in America flows untreated into the environment presenting a major health concern. To address this issue, the US government has allocated funds towards building new wastewater treatment plants across 25 states under the Bipartisan Infrastructure Law. These plants will incorporate advanced treatment technologies relying on chlorine for disinfection. Similarly, desalination is gathering steam in California to augment water supplies. The state currently has over $4.5 billion in pipeline for seawater desalination projects by 2023. All such facilities will create a sustained need for chlorine and its compounds.