United States of America Suboxone Market Size - Analysis

The United States of America Suboxone Market is estimated to be valued at USD 2.39 Bn in 2025 and is expected to reach USD 3.21 Bn by 2032, growing at a CAGR of 4.3% from 2025 to 2032.

Market Size in USD Bn

CAGR4.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 4.3% |

| Market Concentration | Medium |

| Major Players | Dr. Reddy’s Laboratories Ltd. , Mylan N.V., Novartis AG, Sun Pharmaceutical Industries Ltd, Alkem Labs and Among Others |

please let us know !

United States of America Suboxone Market Trends

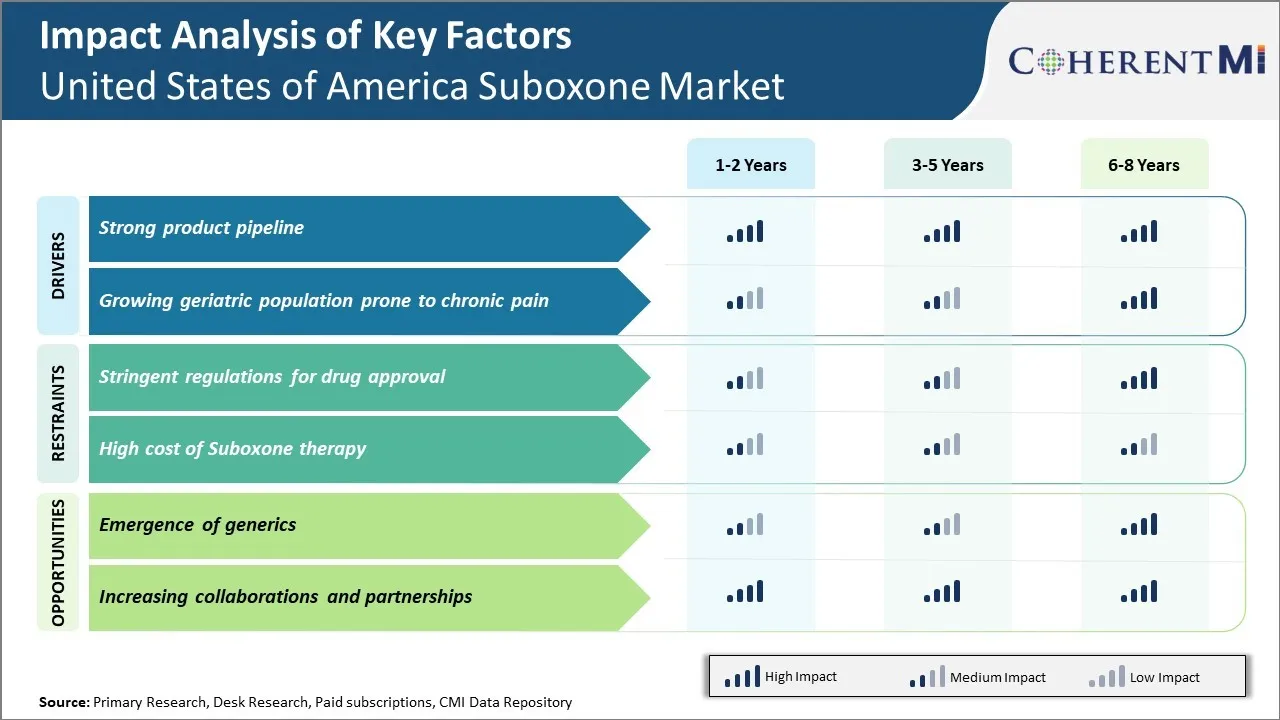

The stable and strong pipeline of products in the Suboxone market in the United States of America is a key driver of growth. Companies in the market have consistently introduced new and innovative formulations of Suboxone to treat opioid addiction more effectively.

The product pipeline in the upcoming years also remains robust with several pharmaceutical giants like Indivior and Rhodes actively researching newer advanced treatments which are safer and more comfortable for patients. Some formulations under development target specific patient populations like adolescents or allow for monthly or quarterly dosing depending on the individual's needs.

Market Driver – Growing Geriatric Population Prone to Chronic Pain

This rising prevalence of chronic pain among the aging population is fueling the demand for effective pain management solutions like suboxone in the country. As conventional treatments such as opioids carry risks of dependence and addiction among the elderly, doctors are increasingly recommending buprenorphine-based treatments such as suboxone to geriatric patients experiencing chronic pain. Suboxone offers long-lasting relief from moderate to severe pain and has lesser abuse potential and side effects compared to opioids.

Stringent regulations for drug approval in the United States has greatly impacted the growth of the Suboxone market over the past few years. The drug approval process carried out by the United States Food and Drug Administration (FDA) is an extensive one aimed at ensuring safety and efficacy of new drugs. However, this lengthy and meticulous review cycle has significantly delayed the entry of new and potentially more effective drugs in the suboxone market.

The emergence of generic versions of Suboxone in the United States represents a significant opportunity for increased access and affordability of medication-assisted treatment for opioid use disorder. For many years, the brand name formulation held a monopoly due to FDA exclusivity protections. However, as of late 2020 the first generic versions of Suboxone sublingual film were approved by the FDA and entered the market. This introduced much-needed competition which has already begun to lower the cost of this vital treatment significantly.

Segmental Analysis of United States of America Suboxone Market

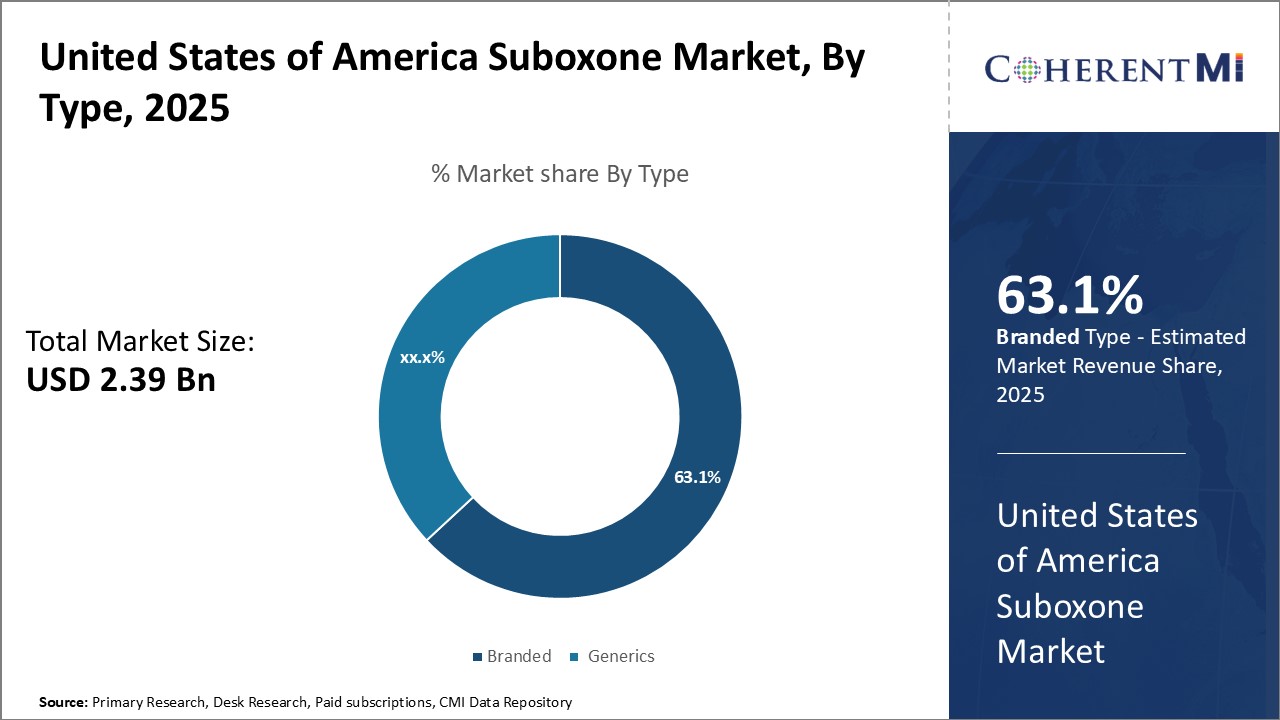

Insights, By Type: Generics Dominate the Type Segment Due to Lower Prices

Insights, By Type: Generics Dominate the Type Segment Due to Lower PricesWithin the United States of America Suboxone market segmented by type, generics sub-segment contributes the largest share of 63.1%. The primary driver of generics' dominance is their significantly lower prices compared to branded Suboxone. Generics are able to offer prices that are a fraction of the cost of branded drugs once they come off patent exclusivity and face competition. For patients struggling with opioid addiction and seeking treatment, the lower price of generics makes them much more accessible and affordable as an option.

Major generic manufacturers like Teva, Mylan, and Sandoz have capitalized on the patent cliff of branded Suboxone to quickly gain market share. Their manufacturing and distribution infrastructure allows nationwide availability, further cementing generics in the top spot. PBM formularies also strongly incentivize the use of low-cost generics through favorable co-pay tier placement and coverage restrictions on higher priced brands.

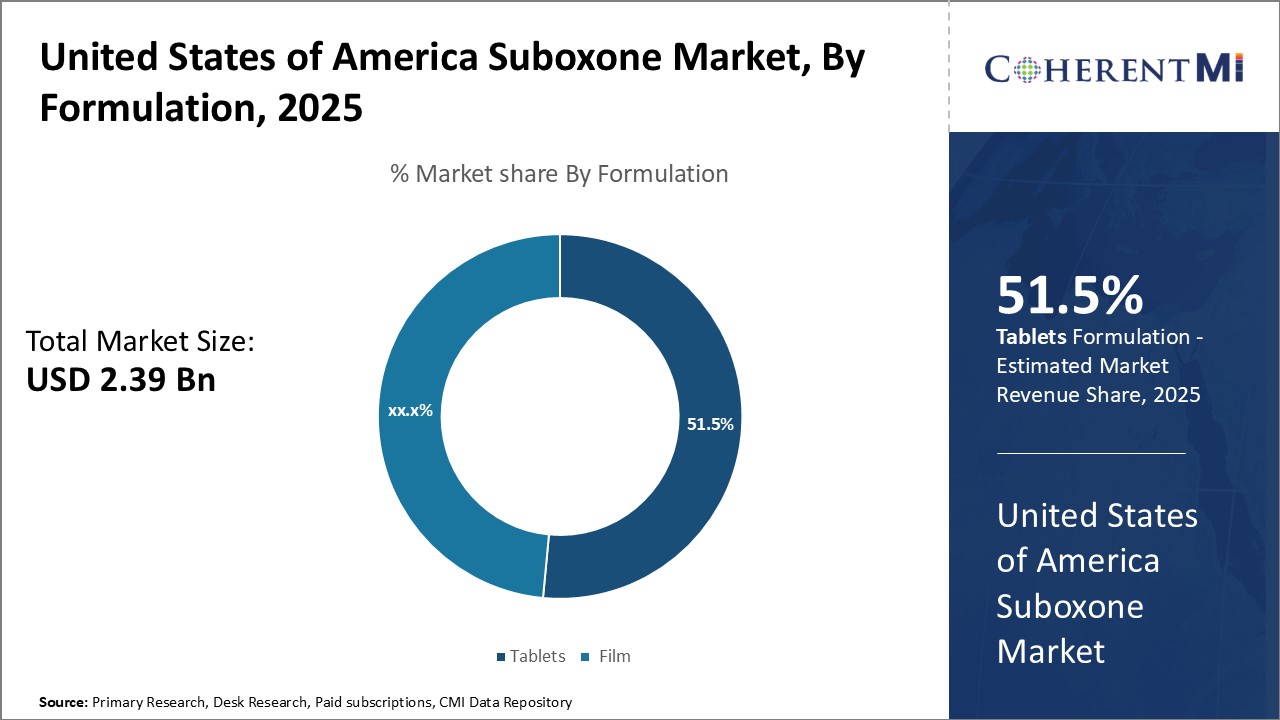

When analyzing the United States of America Suboxone market segmented by formulation, tablets contribute the highest share of 51.5% over film. The primary driver of tablets' majority position is their simpler and more user-friendly dosage form compared to film. For those new to treatment or early in their recovery journey, taking a tablet is a much more straightforward process than properly applying and dissolving a small film under the tongue.

From a supply chain perspective, tablets are simpler and less expensive to manufacture at scale versus film, leading to frequent drug shortages of the latter. Tablet blister packs also take up less physical space on pharmacy shelves compared to bulky film pouches. As a result of these various advantages, tablets have maintained their majority despite the entrance of alternative film offerings in recent years.

Competitive overview of United States of America Suboxone Market

The major players operating in the United States of America Suboxone Market include Indivior PLC., Dr. Reddy’s Laboratories Ltd., Amneal Pharmaceuticals LLC., Mylan N.V., Novartis AG, Teva Pharmaceutical Industries Ltd., Mallinckrodt, Lannett Co Inc., Sun Pharmaceutical Industries Ltd., and Alkem Labs are the major players.

United States of America Suboxone Market Leaders

- Dr. Reddy’s Laboratories Ltd.

- Mylan N.V.

- Novartis AG

- Sun Pharmaceutical Industries Ltd

- Alkem Labs

United States of America Suboxone Market - Competitive Rivalry

United States of America Suboxone Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in United States of America Suboxone Market

- In 2020, the U.S. Food and Drug Administration (FDA) approved a generic drug buprenorphine and naloxone tablet developed by Rhodes Pharmaceuticals, a subsidiary of Purdue, an American privately held pharmaceutical company.

United States of America Suboxone Market Segmentation

- By Type

- Branded

- Generics

- By Formulation

- Tablets

- Film

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Frequently Asked Questions :

How big is the United States of America Suboxone Market?

The United States of America Suboxone Market is estimated to be valued at USD 2.39 in 2025 and is expected to reach USD 3.21 Billion by 2032.

What are the major factors driving the United States of America Suboxone Market growth?

The strong product pipeline and growing geriatric population prone to chronic pain are the major factors driving the United States of America Suboxone Market.

Which is the leading Type in the United States of America Suboxone Market?

The leading Type segment is Generics.

Which are the major players operating in the United States of America Suboxone Market?

Indivior PLC., Dr. Reddy’s Laboratories Ltd., Amneal Pharmaceuticals LLC., Mylan N.V., Novartis AG, Teva Pharmaceutical Industries Ltd., Mallinckrodt, Lannett Co Inc., Sun Pharmaceutical Industries Ltd., and Alkem Labs are the major players.

What will be the CAGR of the United States of America Suboxone Market?

The CAGR of the United States of America Suboxone Market is projected to be 4.3% from 2025-2032.