U.S. Gas Leak Detectors Market Size - Analysis

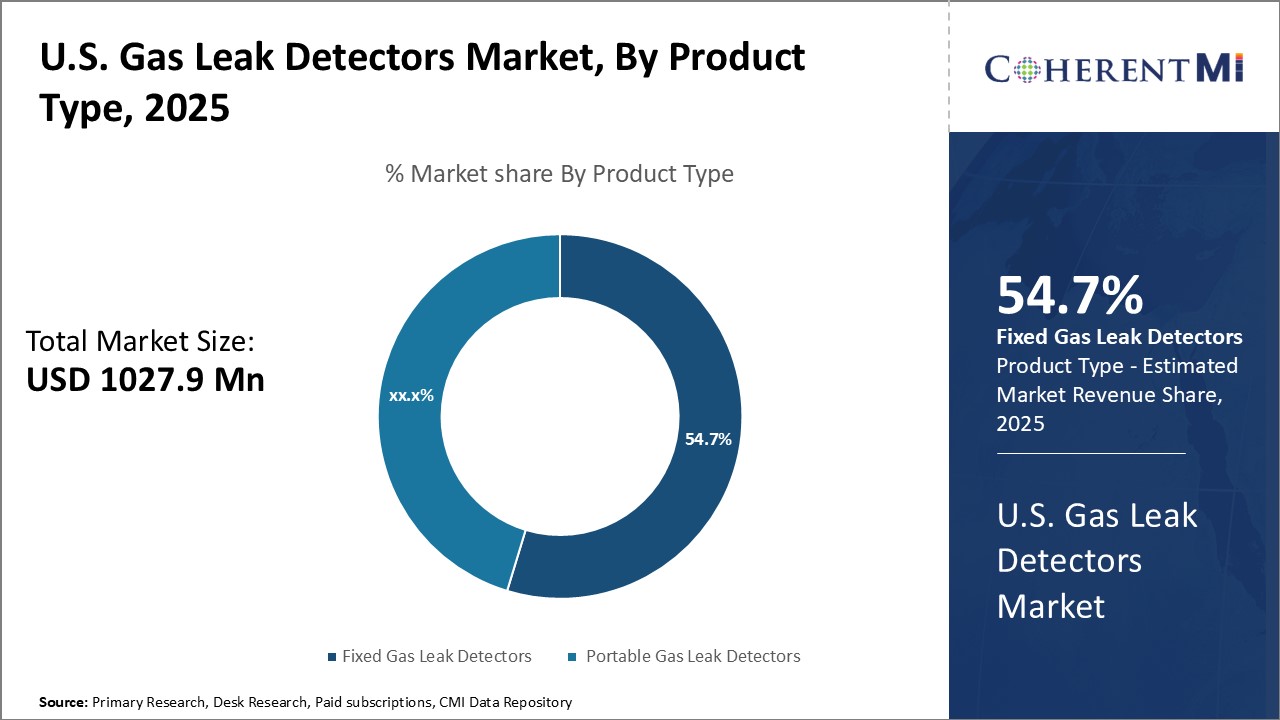

The U.S. Gas Leak Detectors Market is segmented by Product, application, and region. By Product type, the market is segmented into fixed gas leak detectors and portable gas leak detectors. Product Type Segment Increased applications in the oil and gas industry likely boost demand for both fixed and portable gas detectors, as they are essential in early detection of gas leaks to prevent accidents and ensure safety. These are handheld devices used for personal safety or spot detection of gas leaks. They are widely used by workers in industries where they might be exposed to harmful gas.

U.S. Gas Leak Detectors Market Drivers

- Growing Application in Oil & Gas Industry: The growing application of gas leak detectors in oil and natural gas industries is one of the primary factors driving the growth of the US gas leak detectors market. With increasing exploration and production activities in oil and shale gas industries, safety has become a top priority. Undetected gas leaks can lead to fires or explosions, putting both humans and environment at risk. Gas leak detectors help in timely detection of gas leaks during various oil and gas operations such as drilling, extraction, processing, storage and transportation of oil and natural gas. Various regulatory mandates by bodies such as Occupational Safety and Health Administration (OSHA) and Environmental Protection Agency (EPA) regarding regular monitoring of gas leaks have also pushed industries to deploy gas leak detection systems for compliance. For instance, the revised OSHA standards in 2021 now require continuous monitoring of enclosed spaces and confined areas in oil and gas facilities that may contain hazardous gases. This has significantly increased demand for stationary and portable gas leak detectors that can monitor wide areas as well as detect multiple gases. Furthermore, increasing shale gas production in the US has also amplified gas leak detection requirements. According to the US Energy Information Administration, US natural gas production from shale formations doubled from 35% in 2011 to over 74% in 2020. This has made gas leak detection an integral part of shale gas workflows.

- Strict Regulatory Norms Associated With Safety: Strict regulatory policies and safety norms regarding gas leaks in numerous industries is expected to propel the S. Gas Leak Detectors Market growth over the forecast period. Stringent regulatory policies, laws, and safety norms are being implemented in various industries including chemical, pharmaceuticals, energy, petrochemicals, etc. the US Environmental Protection Agency (EPA) has also issued guidelines mandating regular leak surveys of natural gas distribution pipelines, storage facilities and city gas networks. According to a 2021 report by EPA, methane emissions from oil and gas operations in the US are significant and reducing gas leaks can help lower emissions as well gas wastage. Compliance with EPA norms on gas leak monitoring and detection has thus become extremely important for companies in the oil, gas and petrochemical industries. Professional gas leak detection devices, sensors, and monitoring equipment are becoming more and more necessary in many industries due to the stringent regulatory drive towards maintaining workplace safety and lowering greenhouse gas emissions. It is mandatory to install a gas detector as per work regulations, to detect flammable gases and oxygen. Thus, these factors are expected to support the market growth over the forecast period.

- Increasing Consumption of Industrial Gases: Growing consumption of industrial gases such as argon, helium, and nitrogen across different manufacturing industries is expected to boost the demand for gas leak detectors. Moreover, increasing use of gases in refrigeration and Heating, ventilation, and air conditioning (HVAC) processes in automotive applications is expected to provide major growth opportunities for market players in the near future. For instance, CleanAir, a company which provides solutions to air emissions and air quality problems, offer the ‘ION GasCheck G’ portable gas leak detector, which can detect leakage of various gases such as helium, hydrogen, argon, nitrogen, and others.

- Increasing Development of Infrastructure: In commercial and residential applications, gas leak detectors are primarily used for detection of propane gas leak from appliances, gas pipe fittings, and propane tank. Increasing development of commercial infrastructure combined with various large-scale projects such as malls, company headquarters, airports, and hospitals are expected to offer lucrative growth opportunities in the near future. Gas leak detectors are used in commercial and residential applications, owing to increasing demand for safety and security features in residential projects. Market players such as Honeywell International Inc. offers various gas detection solutions designed for use in commercial buildings, shopping centres, office towers, universities, and others.

- Growth in Emerging Markets: The growing middle class in emerging economies also presents a significant business opportunity as greater affluence coincides with higher spending on safety, convenience and well-being. For instance, the International Energy Agency predicts that energy needs in developing nations will increase by as much as 50% between 2018 and 2040 to support rising living standards. This points towards a growing market potential for gas detectors targeted at residential and commercial consumers to address risks of gas exposure and asphyxiation. Furthermore, many governments in the mentioned developing regions have identified worker safety and pollution control as high-priority agendas that will mandate increased adoption of gas detectors and boost the revenues of providers.

- Low Profit Due To Intense Competition: There is intense competition among the market players. The global gas leak detectors market is highly fragmented due to the presence of domestic and international market players. This high intensity of competition among the existing global and local players result in lower profit margins from products. Hence, low profit due to intense competition is expected to restrain growth of the global gas leak detectors market during the forecast period. Local players compete by offering cost-effective solutions and focusing on niche markets. The competition is further intensified due to the following factors such as Innovation and technological advancements leading to the frequent launch of new and improved products, Aggressive marketing strategies and sales promotions and Strategic partnerships and collaborations for expanding product reach and capabilities.

- Lack of Highly Skilled Workers: Training associated with specific applications of gas leak detectors is essential, typically for personnel using portable gas leak detectors apart from guidelines from the manufacturer’s side such as quick-start guides and electronic simulators. Gas leak detectors are designed to alarm people in the form of light, sound, or vibrate when some gas is detected. However, in case of critical situations, it is very important to understand technical limitations and environmental influences to avoid misinterpretations, major accidents, or personnel panic. Relative operational complexities and costs associated with advanced technology based systems hamper their wide-scale adoption, especially among relatively smaller scale end users. Hence, these factors are expected to hinder the market growth during the forecast period.

U.S. Gas Leak Detectors Market Overview:

The U.S. Gas Leak Detectors Market is poised to show healthy growth if manufacturers focus on developing affordable solutions without compromising on safety features. Rising safety concerns and implementation of stringent regulations will continue driving the demand for gas detectors from industries.

Market Size in USD Mn

CAGR6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6% |

| Larget Market | U.S. |

| Market Concentration | High |

| Major Players | MSA - The Safety Company, Honeywell International Inc., Siemens, Xylem Inc., Emerson Electric Co., Schneider Electric SE and Among Others |

please let us know !

U.S. Gas Leak Detectors Market Trends

- Integration of Advanced Technology: Many manufacturers are focused on development of gas detectors incorporated with advanced features and novel technologies such as artificial neutral network (ANN) and Internet of Things (IoT), in order to make gas detectors highly efficient. For instance, in February 2020, IntelliView Technologies Inc. Specializes in developing AI-powered vision IoT solutions focused primarily on the petroleum and mining industries, Launched a dual camera analytic module Methane (DCAM-M) for continuous monitoring and autonomous real-time detection and alerting of methane leaks. Moreover, General Monitor, a U.S.-based manufacturer of gas leak detectors, developed Observer-i, an ultra-sonic multiple gas leak detector, based on ANN technology platform, which can distinguish between real gas leaks and false alarms. Furthermore, in May 2021, Dragerwerk AG & Co. KGaA the company focuses on manufacturing medical devices, safety technology, and aerospace equipment, launched wireless gas detection solution for flexible and cost-efficient monitoring of plants.

- Emergence of Drones for Gas Leak Detection: Gas leak detection systems are being increasingly incorporated with drones to include gas leak surveillance in specific areas. This is essential to reach in hazardous areas or difficult-to-reach areas where gas detection can be made possible by use of drones fitted with gas detection systems. Moreover, drones could be able to establish communication with a combination of visual and infrared views real-time, facilitating the participation of a vast number of professionals in gas detection across the world. The companies such as ULC Robotics, Viper Drones, and others offer gas leak detection drone solutions and services.

Segmental Analysis of U.S. Gas Leak Detectors Market

Competitive overview of U.S. Gas Leak Detectors Market

MSA - The Safety Company, Honeywell International Inc., Siemens, Xylem Inc., Emerson Electric Co., Schneider Electric SE, Industrial Scientific, Det-Tronics, RKI Instruments, GE Measurement & Control and Dragerwerk AG

U.S. Gas Leak Detectors Market Leaders

- MSA - The Safety Company

- Honeywell International Inc.

- Siemens, Xylem Inc.

- Emerson Electric Co.

- Schneider Electric SE

U.S. Gas Leak Detectors Market - Competitive Rivalry

U.S. Gas Leak Detectors Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in U.S. Gas Leak Detectors Market

New product launches:

- In January 2023, The University of British Columbia's Okanagan campus (UBC Okanagan) Okanagan researchers are developing a method to monitor underground gas pipelines using ultrasonic sensors, with a focus on HDPE pipes. The research is still in the early stages, but the majority of the current research has involved the development and assessment of a deep-learning algorithm for detecting diversion in pipes.

- In May 2021, Industrial Scientific specializes in designing and manufacturing gas detection equipment, launched the Tango TX2, a new two-gas monitor that increases site safety by allowing users to detect two gases with one small, reliable monitor. The Tango TX2 helps organizations to reduce project shutdowns from false alarms, increase worker trust in gas monitors, and minimize time spent on monitor charging and maintenance.

- In April 2021, Honeywell International Inc. That manufactures aerospace and automotive products; residential, commercial, and industrial control systems; specialty chemicals and plastics; and engineered materials, announced the launching of gas cloud imaging (GCI) system in Europe to provide automated and continuous monitoring for leaks of dangerous and polluting gases such as methane at oil and gas, chemical and power generation facilities across the continent.

Acquisition and partnerships:

- In May 2021, MSA Safety, a global safety equipment manufacturer, acquired Bacharach, Inc., a leader in gas detection technologies used in the heating, ventilation, air conditioning, and refrigeration (HVAC-R) markets. The acquisition, valued at US$337 million, expands MSA's gas detection portfolio and leverages MSA's product and manufacturing expertise into new markets. Bacharach's advanced instrumentation technologies help protect lives and the environment, while also increasing operational efficiency for its diversified customer base.

U.S. Gas Leak Detectors Market Segmentation

- By Product Type:

- Fixed Gas Leak Detectors,

- Portable Gas Leak Detectors

- By Application

- Industrial

- Oil & Gas

- Chemicals

- Power Generation

- Commercial Establishment

- Shopping Malls

- Hotels & Restaurant

- Other

- Residential

- Others

- Industrial

- By Technology

- Electrochemical

- Infrared

- Semiconductor/MOS

- Ultrasonic

- Others (Holographic, etc.).

Would you like to explore the option of buying individual sections of this report?

Ramprasad Bhute is a Senior Research Consultant with over 6 years of experience in market research and business consulting. He manages consulting and market research projects centered on go-to-market strategy, opportunity analysis, competitive landscape, and market size estimation and forecasting. He also advises clients on identifying and targeting absolute opportunities to penetrate untapped markets.

Frequently Asked Questions :

How big is the U.S. Gas Leak Detectors Market?

The U.S. Gas Leak Detectors Market is estimated to be valued at USD 1027.9 in 2025 and is expected to reach USD 1545.6 Million by 2032.

Which is the leading component segment in the U.S. Gas Leak Detectors Market?

The leading component segment in the U.S. Gas Leak Detectors Market is the product type in which fixed gas leak detectors.

Which are the major players operating in the U.S. Gas Leak Detectors Market?

MSA - The Safety Company, Honeywell International Inc., Siemens, Xylem Inc., Emerson Electric Co., Schneider Electric SE, Industrial Scientific, Det-Tronics, RKI Instruments, GE Measurement & Control and Dragerwerk AG

What will be the CAGR of U.S. Gas Leak Detectors Market?

The CAGR of the U.S. Gas Leak Detectors Market is projected to be 5.8% from 2024-2031.