Viral Vaccine Cell Culture Media Market Trends

Market Driver - Rising global demand for viral vaccines due to pandemics and emerging diseases

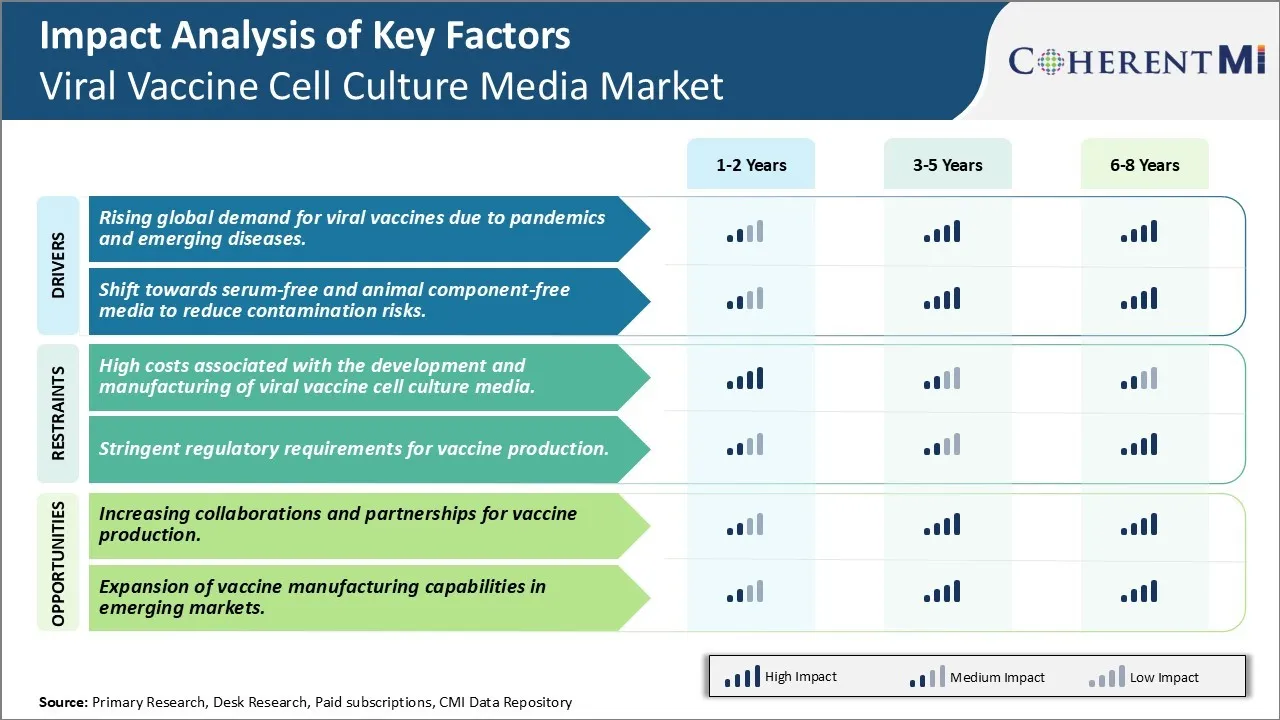

The ever-increasing prevalence of viral infections and pandemics worldwide has led to a significant rise in the demand for viral vaccines over the recent past. The outbreak of Covid-19 pandemic in particular has highlighted the importance of vaccination in curbing the spread and severity of such respiratory viral diseases. Development of effective vaccines requires efficient production through cell culture media which serves as a growth environment for virus production.

As vaccine manufacturers aim to scale up supply and expand access to meet the massive global demand generated through vaccination programs, the requirement for cell culture media is growing substantially. Establishment of new production facilities and incremental capacities by leading vaccine companies is further propelling media demand. Additionally, constant efforts towards the development of vaccines for emerging diseases such as Zika, Ebola and Nipah viruses require continuous investments in research involving optimization of cell culture conditions and media formulations.

Rising government focus on immunization globally through initiatives like GAVI and recommendations for booster doses has also contributed to strong off-take of viral vaccines in recent times. The growing elderly population worldwide makes them more susceptible to infectious diseases and necessitates newer vaccine targets. This augurs well for the long term prospects of both viral vaccine development and mammalian cell culture media production. Overall, the critical role played by cell culture media in the large-scale commercial manufacture of all modern viral vaccines through robust and standardized processes is likely to drive significant consumption in the forthcoming years.

Market Driver - Shift towards serum-free and animal component-free media

With increasing regulatory pressures and industry move towards cleaner production methods, serum-free and animal origin raw material-free cell culture media formulations have gained widespread acceptance in recent years. Traditional serum-supplemented media cultivation relies on animal-sourced raw materials like fetal bovine serum which are associated with batch-to-batch inconsistency and risk of pathogen transmission. This necessitates extensive characterization and testing during production adding to costs.

In contrast, defined media with documented composition offer higher consistency and safety by removing animal-derived components and serum from the process altogether. Advanced serum-free media featuring protein-free and chemically-defined formulations facilitate robust viral replication without the concern for adventitious agents. Their utilization enables adherence to quality and biocontainment standards demanded by regulatory bodies. Furthermore, they improve downstream process efficiency by eliminating unnecessary purification steps for removal of animal proteins.

Leading vaccine makers worldwide have proactively invested in understanding cell behavior in absence of serum to come up with optimized chemically-defined and xeno-freemedia platforms. This shift supports reliable commercial-scale manufacturing while ensuring biosafety. With greater emphasis on process analytical technology and real-time material attribute monitoring, advanced animal-free media are likely to emerge as the production system of choice; thereby accelerating market growth over the coming years.

Market Challenge - High costs associated with the development and manufacturing of viral vaccine cell culture media

The development and manufacturing of viral vaccine cell culture media requires high capital investments and operational expenditures. Manufacturers have to invest heavily in biosafety cabinets, bioreactors, media formulation equipment and facilities that meet rigorous quality and regulatory standards. They also need to utilize premium quality raw materials in the media formulation process to ensure optimal cell growth and virus replication. This makes the media production a costly affair. Additionally, regulations demand strict quality control testing at various stages of manufacturing that increases the production costs. The low volumes and specialized nature of viral vaccine cell culture media compared to other cell culture products also do not allow economies of scale, further bumping up the per unit costs. The high costs involved pose a major challenge for biopharmaceutical companies and may delay the development of new vaccines, especially for diseases prevalent in low and middle income countries.

Market Opportunity - Increasing collaborations and partnerships for vaccine production

The viral vaccine manufacturing landscape is witnessing growing instances of collaborations between research institutes, global health organizations and manufacturers. This is helping pool resources as well as expertise for more efficient and affordable vaccine production. For example, the Global Alliance for Vaccines and Immunization (GAVI) is supporting several collaboration initiatives between manufacturers from developing and developed countries for transferring technologies and strengthening local vaccine manufacturing capabilities. Many manufacturers are also signing material transfer agreements, licensing deals and contract manufacturing partnerships with emerging contract development and manufacturing organizations from Asia and Latin America. This allows tapping their comparatively lower-cost infrastructure and skilled workforce. Such partnerships enable greater capacity utilization of existing vaccine production facilities and shared risks of investments. In the long run, they are expected to bolster global vaccine supplies and drive down costs through economies of scale, which would facilitate increased immunization in low and middle-income regions.