Stepper Motors Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Stepper Motors Market is segmented By Type (Permanent Magnet Stepper Motor, Hybrid Stepper Motor, Variable Reluctance Stepper Motor), By Motion Contro....

Stepper Motors Market Size

Market Size in USD Bn

CAGR4.24%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.24% |

| Market Concentration | High |

| Major Players | MOONS Industries, Minebea Mitsumi Inc., Nidec Corporation, Nanotec Electronic GmbH & Co. KG, Oriental Motor Co., Ltd. and Among Others. |

please let us know !

Stepper Motors Market Analysis

The stepper motors market is estimated to be valued at USD 5.9 Bn in 2024 and is expected to reach USD 7.89 Bn by 2031, growing at a compound annual growth rate (CAGR) of 4.24% from 2024 to 2031. The stepper motors market is expected to witness steady growth with increasing industrial automation and demand for compact motor solutions across applications such as automation equipment, CNC machines, and3D printers.

Stepper Motors Market Trends

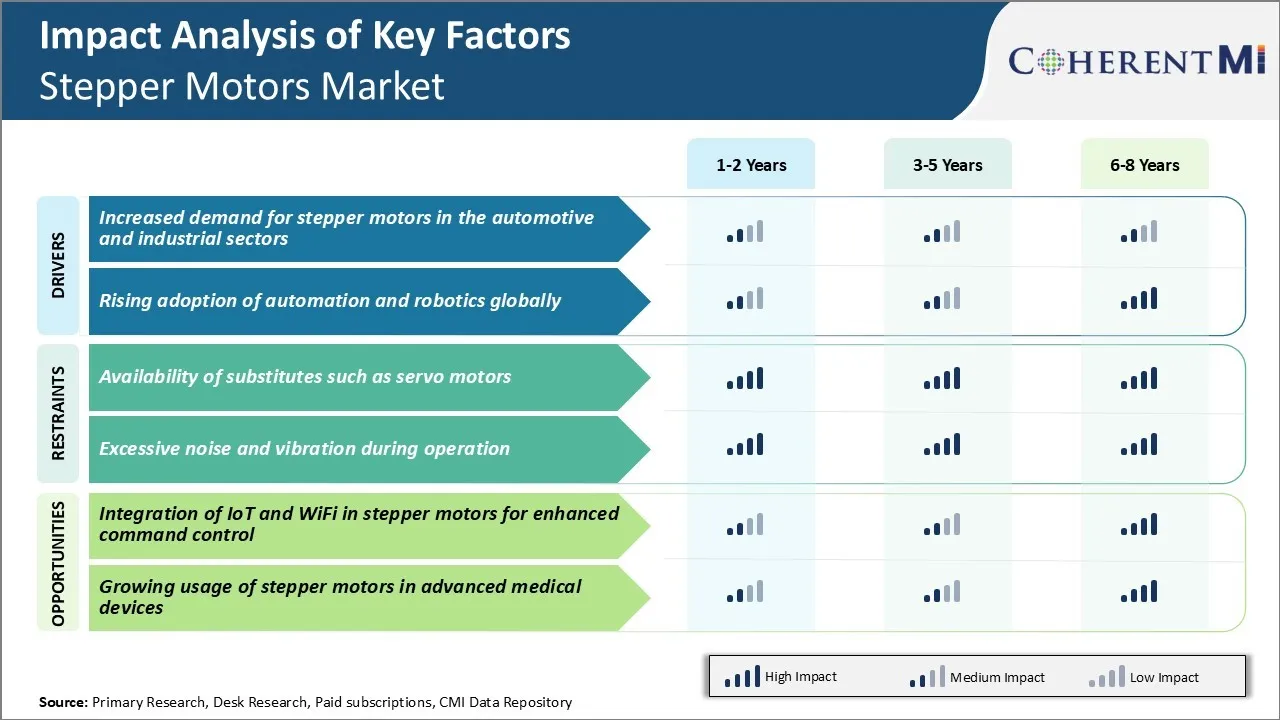

Market Driver - Increased Demand for Stepper Motors in the Automotive and Industrial Sectors

Growing automation in the automotive industry has significantly boosted the usage of stepper motors. Automakers are adopting stepper motors in their production lines for tasks such as precision assembly, quality inspection, and packaging and palletizing.

The demand for stepper motors from auto component manufacturers is high as well. Component makers producing automated systems for engine, drivetrain, brakes, chassis, and lighting sub-assemblies rely heavily on stepper motors. Systems for Advanced Driver Assistance Systems (ADAS), electric vehicle powertrains, battery packs, and connected vehicle technologies all employ stepper motors.

Adoption of industrial automation across various sectors has augmented the uptake of stepper motors too. machinery used for packaging, labeling, material handling, 3D printing, semicon industrial product manufacturers count on stepper motors for critical automation needs. Furthermore, the growing complexity of industrial products requiring many stages of assembly has amplified the demand for precision motion control applications where stepper motors serve very well.

These industries are expected to contribute vastly to the growth of the stepper motors market.

Market Driver - Rising Adoption of Automation and Robotics Globally

The rapidly evolving factory automation and process optimization demands are fueling the ascent of robotics implementation worldwide. Industrial robots equipped with stepper motors are deployed aggressively to boost production volumes while maintaining stringent quality standards. With their ability to function as self-controlled actuators, stepper motors assume critical roles as joint motors in robotic arms designed for assembly, material handling, logistics, processing, packaging and palletizing applications.

The trend towards cobot installation or collaborative robots for functions like inspection, testing, proofing is also driving robotics adoption higher. These robots share workspace with humans and demand inherent safety; hence stepper motors are commonly utilized as joint actuators. The thriving service robotics and medical robotics domains place more requirement for stepper motors too.

Automated guided vehicles, surgical robots and rehabilitation robots used for physiotherapy widely employ stepper motors to power critical motion links precisely and repeatably. This will open new avenues of growth for players in the stepper motors market.

Market Challenge - Availability of Substitutes such as Servo Motors

One of the major challenges faced by the stepper motors market is the availability of substitutes such as servo motors. Servo motors offer advantages over stepper motors such as higher accuracy and precision of movement. Manufacturers are increasingly preferring servo motors over stepper motors for applications that require high degrees of precision such as medical equipment, semiconductor manufacturing equipment, and industrial automation equipment.

The price points of servo motors are also becoming more competitive compared to stepper motors. This increasing preference for servo motors poses a threat to the demand and growth of the stepper motors market. To remain competitive, stepper motor manufacturers need to focus on innovating their product offerings to enhance precision capabilities and reduce the price differential with servo motors.

Market Opportunity - Integration of IoT and WiFi in Stepper Motors for Enhanced Command Control

One of the major opportunities for growth in the stepper motors market is the integration of technologies such as IoT and WiFi. With the increasing connectivity of machines and automation of industrial processes, stepper motors that can be controlled remotely through communication networks will see rising demand. Integration of sensors, controllers and communication capabilities in stepper motors can enable enhanced command and control features. This will allow stepper motors to be controlled and monitored remotely using smartphones and tablets.

Manufacturers are working on developing stepper motors integrated with IoT connectivity to enable monitoring of motor health parameters like temperature, noise and vibration remotely. Incorporating WiFi in stepper motors can facilitate wireless programming of motion profiles and simplify commissioning processes.

The IoT-enabled smart stepper motors will have applications in areas like robotics, 3D printing, CNC machines and autonomous vehicles. They will add more value to customers by enhancing functionality and enabling data-driven predictive maintenance.

Key winning strategies adopted by key players of Stepper Motors Market

Focus on technology innovation: A major strategy adopted by stepper motor market leaders such as Shinano Kenshi, MinebeaMitsumi and Nidec is continuous investment and advancement in stepper motor technology. For example, in 2018 Shinano launched its new MG-60 series of hybrid stepper motors which provide higher torque and efficiency compared to traditional motors.

Product portfolio expansion: Leading players such as Nidec and Panasonic Industrial Devices expanded their product offerings to address wider application areas. In 2020, Nidec acquired Ontario Drive & Gear Limited to enhance its capabilities in the industrial automation market.

Geographic expansion: Players like Nidec and Shinano have aggressively expanded their geographic footprint through greenfield plants and acquisitions. For example, Nidec established a new Motors and Hall Sensors factory in Mexico in 2021 to tap the growing demand from NAFTA countries.

Focus on customized solutions: Companies offering customized stepper motor solutions as per specific application requirements have gained an edge. For instance, Portescap, a Meltric subsidiary focuses exclusively on providing highly customized motors and drives to OEMs.

Segmental Analysis of Stepper Motors Market

Insights, By Type: High Precision and Performance Drives Permanent Magnet Segment

In terms of type, permanent magnet stepper motor contributes 40.7% share of the stepper motors market owning to their inherent advantages over other types. Permanent magnet stepper motors are able to achieve high precision and accuracy due to their robust motor structure that incorporates strong permanent magnets. This allows them to reliably achieve full step angles without any chance for missteps or lost steps even under heavy loads.

Engineers are increasingly choosing permanent magnet stepper motors for applications requiring minimal position loss or vibration, high speeds, and predictable movement. Industries like medical devices and factory automation heavily rely on their consistent and repeatable motion profiles. Overall characteristics like compact size, long functional life, and low maintenance costs have cemented permanent magnet stepper motors as the ideal choice where high performance and precision are top priorities.

Insights, By Motion Control: Open Architecture Meets Application Versatility

In terms of motion control, open loop contributes 53.7% share of the stepper motors market primarily due to its open architecture nature. Unlike closed loop which requires additional feedback sensors and control loops, open loop stepper motors have a relatively straightforward and inexpensive design. They are plug-and-play motion solutions that can be easily integrated into a variety of mechanical and electrical systems. This open and modular approach allows open loop stepper motors to meet the functional needs of diverse applications, from simple pick-and-place machines to motion tools.

Overall, open loop stepper motors provide a versatile, cost-effective motion control option for applications where absolute position accuracy is not critical but torque, speed and movement direction are the main priorities. Their architecture flexibility has made them the preferred motor type in markets, where adaptability and quick design cycles matter most.

Insights, By End-user Industry: Industrial Control and Precision Manufacturing Boosts Machinery Segment

In terms of end-user industry, industrial machinery contributes the highest share of the market owing to the scale of precision manufacturing and industrial automation processes. Stepper motors are extensively used in factory machinery, assembly lines, CNC machines, and automation systems to control positioning, motion feedback, cutting and various material handling operations.

Growing global industrial capacity and rising complexity of manufacturing processes have augmented demand for stepper motors across factory equipment, machine tools, presses and industrial robots. Their motor characteristics like precise positioning and torque control match the technical requirements of industries like semiconductor, electronics and automotive manufacturing.

In addition, continuous innovations in motion control make stepper motors increasingly indispensable for industrial machinery innovation. Overall, expansion of global industrial capacity and automation will continue driving growth in utilization of stepper motors for industry-defining machinery and industrial control systems.

Additional Insights of Stepper Motors Market

- The integration of stepper motors in 3D printing technology has significantly improved the precision and quality of printed objects, leading to increased demand in the consumer and industrial sectors.

- Automotive manufacturers are increasingly utilizing stepper motors in advanced driver-assistance systems (ADAS) for better control and safety features, reflecting a trend towards more automated and intelligent vehicles.

- Regional Dominance: The Asia-Pacific region holds the largest share of the global stepper motors market, accounting for approximately 45% of the global market, driven by rapid industrialization and the presence of major manufacturing hubs in countries like China and India.

- Fastest-Growing End-User Segment: The medical equipment sector is experiencing the fastest growth in the stepper motors market, with a CAGR of 7.5%, due to the increasing need for precise and reliable motion control in medical devices.

- Technological Advancements: The development of IoT-enabled stepper motors is emerging as a significant trend in the stepper motors market, allowing for real-time monitoring and predictive maintenance.

Competitive overview of Stepper Motors Market

The major players operating in the stepper motors market include MOONS Industries, Minebea Mitsumi Inc., Nidec Corporation, Nanotec Electronic GmbH & Co. KG, Oriental Motor Co., Ltd., MinebeaMitsumi Inc., Moons' Industries, SANYO DENKI Co., Ltd., ABB Ltd., Schneider Electric SE, Delta Electronics, Inc., Applied Motion Products, Inc., and Nippon Pulse Motor Co., Ltd.

Stepper Motors Market Leaders

- MOONS Industries

- Minebea Mitsumi Inc.

- Nidec Corporation

- Nanotec Electronic GmbH & Co. KG

- Oriental Motor Co., Ltd.

Stepper Motors Market - Competitive Rivalry, 2024

Stepper Motors Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Stepper Motors Market

- In May 2024, MOONS' Industries celebrated its 30th anniversary and inaugurated a new manufacturing facility in Taicang, China. This plant is their largest production base globally, featuring the most complete product line.

- In November 2023, igus introduced a double-shaft stepper motor designed for its drylin® linear technology. This motor enables the simultaneous operation of two linear axes, offering a space-saving and cost-effective solution for automation applications.

- In August 2023, Nidec Corporation announced the development of a new high-efficiency hybrid stepper motor aimed at the electric vehicle market. This motor promises reduced energy consumption and improved performance, potentially accelerating the adoption of electric vehicles globally.

- In May 2023, MinebeaMitsumi Inc. acquired ABC Motors, a specialist in precision motors for medical equipment. This strategic move is expected to enhance MinebeaMitsumi's product portfolio and strengthen its position in the medical sector.

- In January 2023, Oriental Motor Co., Ltd. introduced the PKP Series of high-torque, compact stepper motors, which are well-suited for robotic applications. These motors provide increased torque across the entire speed range, from low to high, compared to standard models of the same size.

Stepper Motors Market Segmentation

- By Type

- Permanent Magnet Stepper Motor

- Hybrid Stepper Motor

- Variable Reluctance Stepper Motor

- By Motion Control

- Open Loop

- Closed Loop

- By End-user Industry

- Industrial Machinery

- Manufacturing Equipment

- Automation Systems

- Medical Equipment

- Diagnostic Devices

- Surgical Instruments

- Automotive

- Electric Vehicles

- Advanced Driver-Assistance Systems (ADAS)

- Consumer Electronics

- Printers and Scanners

- Cameras

- Industrial Machinery

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the stepper motors market?

The stepper motors market is estimated to be valued at USD 5.9 Bn in 2024 and is expected to reach USD 7.89 Bn by 2031.

What are the key factors hampering the growth of the stepper motors market?

Availability of substitutes such as servo motors and excessive noise and vibration during operation are the major factors hampering the growth of the stepper motors market.

What are the major factors driving the stepper motors market growth?

Increased demand for stepper motors in the automotive and industrial sectors and rising adoption of automation and robotics globally are the major factors driving the stepper motors market.

Which is the leading type in the stepper motors market?

The leading type segment is permanent magnet stepper motor.

Which are the major players operating in the stepper motors market?

MOONS Industries, Minebea Mitsumi Inc., Nidec Corporation, Nanotec Electronic GmbH & Co. KG, Oriental Motor Co., Ltd., MinebeaMitsumi Inc., Moons' Industries, SANYO DENKI Co., Ltd., ABB Ltd., Schneider Electric SE, Delta Electronics, Inc., Applied Motion Products, Inc., and Nippon Pulse Motor Co., Ltd. are the major players.

What will be the CAGR of the Stepper Motors Market?

The CAGR of the stepper motors market is projected to be 4.24% from 2024-2031.