Continuous Delivery Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Continuous Delivery Market is segmented By Deployment (Cloud, On-premise), By Enterprise Size (Large Enterprises, SMEs), By End Use (Banking, Financia....

Continuous Delivery Market Size

Market Size in USD Bn

CAGR15.35%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 15.35% |

| Market Concentration | Medium |

| Major Players | Google LLC, Atlassian Corporation Plc., IBM Corporation, Microsoft Corporation, XebiaLabs, Inc. and Among Others. |

please let us know !

Continuous Delivery Market Analysis

The continuous delivery market is estimated to be valued at USD 4.27 Bn in 2024 and is expected to reach USD 11.60 Bn by 2031. It is estimated to grow at a compound annual growth rate (CAGR) of 15.35% from 2024 to 2031. Continuous delivery market has seen growth with increased adoption as more organizations shift to cloud-native architectures and microservices. It is driven by the need for speed and agility in software development and deployment across industries.

Continuous Delivery Market Trends

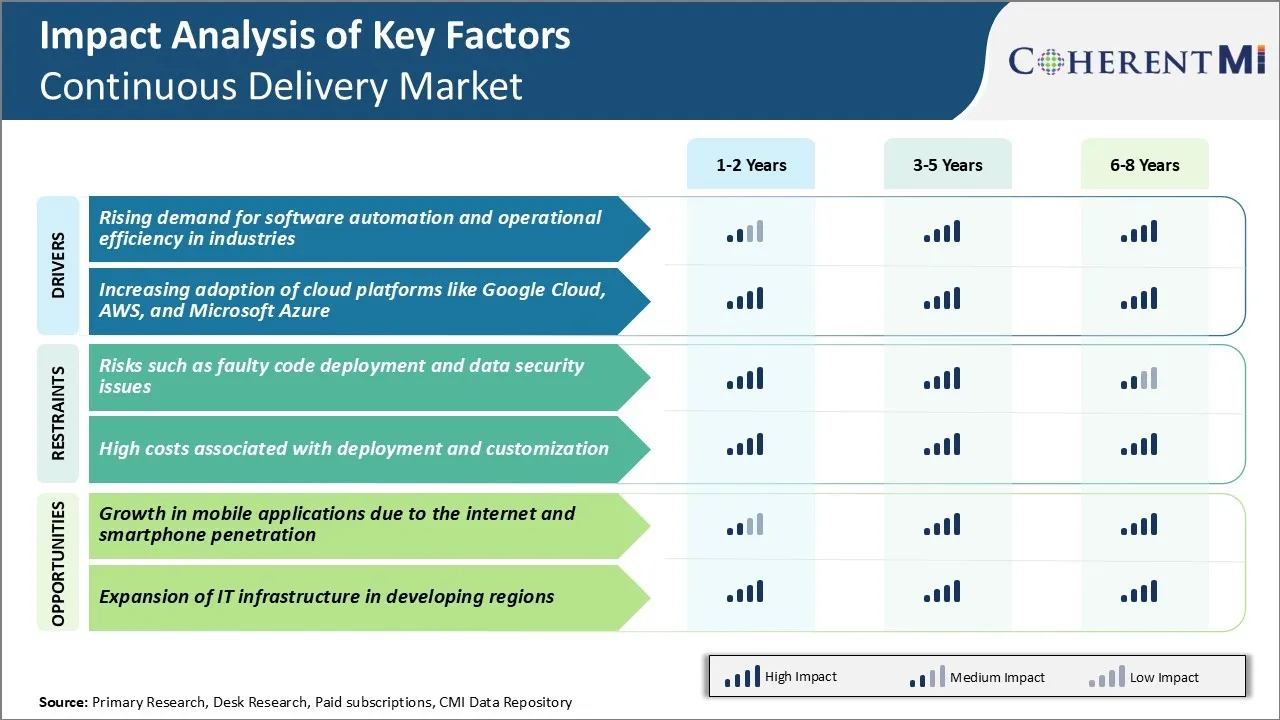

Market Driver - Rising Demand for Software Automation and Operational Efficiency

The rapid pace of digital transformation across industries has brought unprecedented pressures on organizations to release new features and enhancements at a faster pace. To keep up with continuously evolving customer needs and competitor actions, businesses need to automate and streamline their software release processes. This has led to a rising demand for practices and tools that support continuous delivery of software updates.

Continuous delivery leverages automation at all stages of the software release process from coding to deployment. Adopting a continuous delivery approach improves operational efficiency in several ways. It frees up development resources by streamlining routine tasks through automation. Continuous delivery further aids in managing infrastructure costs.

The rising complexity of applications is further driving the need for practices like continuous delivery that bring predictability, speed and agility to software release processes. Growing demand from businesses is positively impacting the adoption of tools and platforms developed for enabling continuous delivery models.

Market Driver - Increasing Adoption of Cloud Platforms like Google Cloud, AWS, and Microsoft Azure

Cloud platforms have emerged as the preferred computing environments for implementing modern software development approaches like continuous delivery. They offer infrastructure services that are easy to procure and configure on demand through web interfaces and APIs. This self-service, pay-per-use model of the cloud is well aligned with the dynamic nature of continuous delivery practices.

The scale and sophistication of cloud platforms also allow for building feature-rich continuous delivery systems that are difficult to create internally. Services like AWS CodePipeline, Google Cloud Build, Azure DevOps etc. provide out-of-the-box solutions for automated code testing, packaging, deployment and monitoring. Third party tools for tasks like configuration management, artifact storage and monitoring can integrate seamlessly with the native services.

As cloud infrastructures mature with each passing year, they are rapidly gaining developers' trust as reliable production environments. Growing confidence in cloud operations encourages organizations to shift their production workload from On-Premise data centers to IaaS platforms. This is expected to influence upcoming trends in the continuous delivery market.

Market Challenge - Risks such as Faulty Code Deployment and Data Security Issues

One of the key challenges facing the continuous delivery market is the risks associated with faulty code deployments and data security issues. While continuous delivery aims to integrate and deliver code changes seamlessly and frequently through automated processes, there is always a risk of bugs or errors being introduced during development and make it into production. Ensuring code quality during each stage is crucial but challenging given the pace of continuous delivery.

Additionally, as applications move to the cloud and data is increasingly stored and processed online, concerns around data security are heightened. Continuous delivery may raise security vulnerabilities if processes are not well managed and monitored. Strict access controls and change management need to be in place across development, testing and production environments handling sensitive user data.

Overall, continuous delivery market demands robust quality assurance measures and stringent security protocols to address the risks in a satisfactory manner.

Market Opportunity - Growth in Mobile Applications

One major opportunity for the continuous delivery market is the rising demand for faster and more frequent updates to mobile applications due to increased internet and smartphone penetration globally. As mobile devices have become the primary computing platform for many, the expectations of users in terms of app functionality, features, and fixes have grown tremendously.

At the same time, the app economy has become highly competitive with new offerings emerging constantly, requiring developers to innovate rapidly and release updates at a much faster pace than before. Continuous delivery provides an effective way to support this mobile-first, instant-gratification culture.

It allows building, testing, and releasing of apps and their features seamlessly across varying mobile platforms. This growing need for nimble, continuous software processes and delivery in the mobile domain will significantly drive the growth of continuous delivery market.

Key winning strategies adopted by key players of Continuous Delivery Market

Product Innovation: Continuous innovation of products and features is key to success in this rapidly evolving market. For example, Docker adopted a strategy of continuously innovating and releasing new features in its container platform from 2013-2018.

Acquisitions: Acquisiting emerging startups helps companies expand their portfolio and capabilities. A prominent example is AWS acquiring CodeBuild and CodePipeline in 2015 and 2016 respectively.

Strategic Partnerships: Partnering with leading companies enhances market reach and credibility. Jenkins partnered with AWS, Azure, Google Cloud etc. to offer tighter integration of their continuous integration server with cloud platforms.

Brand Promotion: Aggressive promotion through marketing, events and advocacy builds brand awareness. Visual Studio App Center adopted this approach since 2017 launch.

Free Trial & Open Source: Offering open source and freemium versions brings more users into the ecosystem who often upgrade to paid tiers. GitHub Actions adopted this model since 2018.

Segmental Analysis of Continuous Delivery Market

Insights, By Deployment: Increased Scalability and Flexibility Drives Cloud Adoption

In terms of deployment, cloud contributes 63.6% share of the continuous delivery market in 2024. This is owning to its ability to support rapid scaling. Cloud-based continuous delivery solutions offer unprecedented elasticity that allows organizations to dynamically scale infrastructures up or down depending on demand. This improves resource utilization and reduces overhead costs associated with procuring and maintaining on-premise servers and data centers.

Cloud platforms also provide virtual server instances that can be provisioned on demand through intuitive control panels. This gives development and operations teams the flexibility to experiment extensively without worrying about hardware limitations. Furthermore, cloud deployment eliminates the need for large upfront capital investments in physical infrastructure and lowers maintenance costs. Organizations can avoid costs associated with powering and cooling servers as well as hiring additional IT staff for system administration.

Insights, By Enterprise Size: Emphasis on Continuous Improvement Drives Adoption Among Large Enterprises

In terms of enterprise size, large enterprises contributes 58% share of the continuous delivery market in 2024. This is due to their focus on continuous process optimization. Large enterprises are under constant pressure to innovate at a faster pace while improving the quality, reliability, and security of software applications. Continuous delivery tools help streamline development workflows and automate various stages of the software release lifecycle. This enables large enterprises to deliver higher quality code, features, and fixes to end users more rapidly.

It also facilitates seamless collaboration across globally distributed teams. Advanced capabilities for application monitoring and analytics further help large enterprises glean valuable insights from user behavior and feedback to continuously refine products. Robust governance and compliance features ensure changes adhere to standardized processes and policies.

Insights, By End Use: Demand for Digital Transformation Fuels Adoption in BFSI

In terms of end use, banking, financial services, and insurance (BFSI) contributes the highest share of the continuous delivery market driven by the demand for digital transformation. The BFSI industry is actively pursuing digital initiatives and embracing emerging technologies like cloud, mobile, AI/ML to enhance customer experience and operational efficiency.

Continuous delivery practices help BFSI organizations accelerate delivery of new features in existing digital products and channels. It also enables faster rollout of innovative, customer-centric digital services. This strengthens competitive positioning and supports business growth objectives. Furthermore, continuous delivery improves the overall agility, quality and security of software releases in highly regulated environments like BFSI where compliance is critical. It establishes uniform processes for auditable, controlled changes and facilitates timely resolution of defects or issues.

Additional Insights of Continuous Delivery Market

- The statistics indicate that the Asia Pacific region is poised for substantial growth in the global continuous delivery market due to rising cloud adoption and the acceleration of digital transformation initiatives. Such trends forecast that emerging economies will witness a faster uptake of continuous delivery solutions, contributing notably to the global continuous delivery market.

- Factors such as use of cloud deployment for efficient one-step promotions and rollbacks and adoption of continuous delivery pipelines in BFSI for mobile banking apps contributes to growth of the continuous delivery market.

Competitive overview of Continuous Delivery Market

The major players operating in the continuous delivery market include Google LLC, Atlassian Corporation Plc., IBM Corporation, Microsoft Corporation, XebiaLabs, Inc., Puppet, Inc., Electric Cloud, Inc., CircleCI, Chef Software, Inc., Flexagon LLC, Amazon Web Services, Inc. (AWS), Docker, Inc., Red Hat, Inc., JetBrains s.r.o., CloudBees, Inc., GitLab Inc., Flexagon LLC, Broadcom Inc., Clarive Software Inc., and Accenture plc.

Continuous Delivery Market Leaders

- Google LLC

- Atlassian Corporation Plc.

- IBM Corporation

- Microsoft Corporation

- XebiaLabs, Inc.

Continuous Delivery Market - Competitive Rivalry, 2024

Continuous Delivery Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Continuous Delivery Market

- In 2023, Harness Inc. introduced and expanded upon features that leverage AI/ML, including tools to provide pipeline intelligence, improve troubleshooting, and enhance developer experience. For instance, in August 2023, the company highlighted AI-driven improvements in their developer platform.

Continuous Delivery Market Segmentation

- By Deployment

- Cloud

- On-premise

- By Enterprise Size

- Large Enterprises

- SMEs

- By End Use

- Banking, Financial Services, and Insurance (BFSI)

- Telecommunications

- Media and Entertainment

- Retail and E-commerce

- Healthcare

- Manufacturing

- Education

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the continuous delivery market?

The continuous delivery market is estimated to be valued at USD 4.27 Bn in 2024 and is expected to reach USD 11.60 Bn by 2031.

What are the key factors hampering the growth of the continuous delivery market?

Risks such as faulty code deployment and data security issues and high costs associated with deployment and customization are the major factors hampering the growth of the continuous delivery market.

What are the major factors driving the continuous delivery market growth?

Rising demand for software automation and operational efficiency in industries and increasing adoption of cloud platforms like Google Cloud, AWS, and Microsoft Azure are the major factors driving the continuous delivery market.

Which is the leading deployment in the continuous delivery market?

The leading deployment segment is cloud.

Which are the major players operating in the continuous delivery market?

Google LLC, Atlassian Corporation Plc., IBM Corporation, Microsoft Corporation, XebiaLabs, Inc., Puppet, Inc., Electric Cloud, Inc., CircleCI, Chef Software, Inc., Flexagon LLC, Amazon Web Services, Inc. (AWS), Docker, Inc., Red Hat, Inc., JetBrains s.r.o., CloudBees, Inc., GitLab Inc., Flexagon LLC, Broadcom Inc., Clarive Software Inc., and Accenture plc are the major players.

What will be the CAGR of the continuous delivery market?

The CAGR of the continuous delivery market is projected to be 15.35% from 2024-2031.