PV Inverters Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

PV Inverters Market is segmented By Product (String PV Inverter, Central PV Inverter, Micro PV Inverter, Other PV Inverter), By End Use (Utilities, Co....

PV Inverters Market Size

Market Size in USD Bn

CAGR18.34%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 18.34% |

| Market Concentration | High |

| Major Players | Delta Electronics, Inc., SMA Solar Technology AG, Eaton Corporation plc, Emerson Electric Co., Fimer Group and Among Others. |

please let us know !

PV Inverters Market Analysis

The PV inverters market is estimated to be valued at USD 16.01 Bn in 2024 and is expected to reach USD 52.05 Bn by 2031, growing at a compound annual growth rate (CAGR) of 18.34% from 2024 to 2031. The PV inverters market is expected to expanding rapidly owing to the rising demand for renewable energy generation across both residential and non-residential sectors.

PV Inverters Market Trends

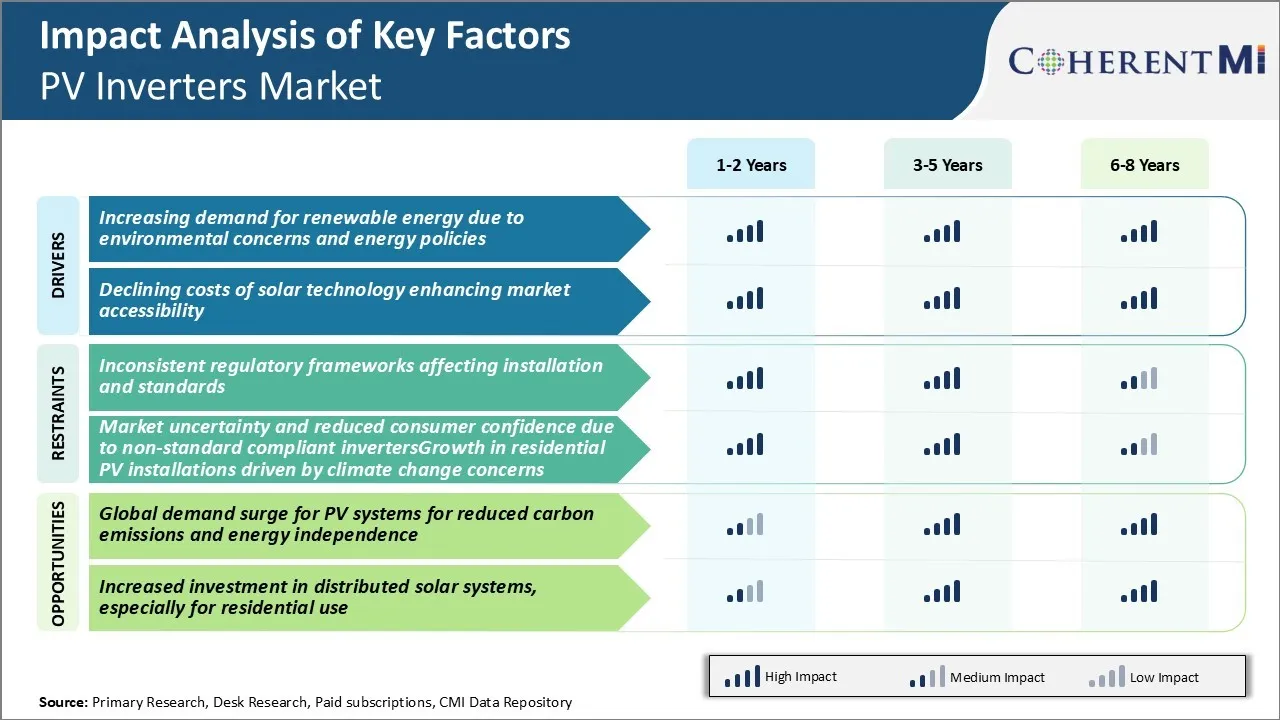

Market Driver - Environmental Concerns Drive Shift to Renewable Energy Sources

The threat posed by climate change has become increasingly evident in recent decades. Devastating natural disasters like wildfires, hurricanes and droughts have intensified due to rising global temperatures. In response to growing environmental concerns, many countries have implemented policies to reduce greenhouse gas emissions and support renewable energy adoption.

The European Union has pledged carbon neutrality by 2050 which will require a major escalation in renewable capacity over the next decades. In the United States, the Inflation Reduction Act provides tax credits to homeowners and businesses installing solar that is expected to vastly increase the pace of deployments.

Technological advances have made renewable power sources like solar increasingly viable and cost-competitive alternatives to fossil fuels. Photovoltaic (PV) inverters play an essential role in enabling homes and facilities to benefit from solar power generation. Growing need for robust, high-quality inverters to maximize that renewable generation will drive growth for the PV inverters market in the coming years.

Market Driver - Decreasing Solar Prices Drive Wider Accessibility and Adoption

A major factor driving the growth of the PV inverters market has been the dramatic decline in the cost of photovoltaic panel installation. Technological improvements, manufacturing scale-ups, competitive pressures, and policy support have all contributed to price reductions of around 80-90% from 2008 levels.

These steep cost decreases have made rooftop solar financially accessible to vastly more homeowners and companies. Plunging prices position solar power as a compelling option compared to traditional fossil fuel sources, increasing its appeal beyond early fans and enthusiasts. Even those without existing incentive structures can find that solar provides long-term electricity cost savings.

With payback periods often under a decade, all sectors of the economy can now consider solar as renewable baseload generation becomes viable on an unprecedented scale. PV inverters are a critical component enabling solar energy's wider adoption as accessibility grows through declining costs. Strong inverters maximize generation and speed returns on solar investments, fueling continued expansion of PV inverters market globally.

Market Challenge - Inconsistent Regulatory Frameworks Affecting Installation and Standards

One of the key challenges facing the PV inverters market is the presence of inconsistent regulatory frameworks affecting installation and standards across different geographic regions. With many countries and municipalities having their own set of standards and regulations for solar panel installations, it becomes difficult for inverter manufacturers to develop standardized products that can meet all compliance requirements.

The permitting procedures and technical specifications vary widely, requiring customized solutions. This regulatory complexity increases costs for both manufacturers who must navigate a maze of certification protocols, as well as for EPC firms and installers who may face delays in getting new projects approved. Lack of harmonization at a global level has slowed the rate of technology transfer and new product introductions across borders.

However, many nations and trade bodies are now working to develop more uniform PV policy guidance and interconnection procedures to help streamline regulatory compliance going forward.

Market Opportunity - Global Demand Surge for PV Systems

The PV inverters market is poised to witness tremendous growth opportunities driven by the global surge in demand for solar photovoltaic systems aimed at reducing carbon emissions and improving energy independence. Climate change mitigation efforts are growing. As solar capacity additions expand around the world, the demand for necessary balance of systems components like PV inverters will scale up proportionately.

New product innovations catering to the fast-evolving solar sector as well as integrated solutions for storage and grid services will further help drive revenues for inverter manufacturers. With solar energy costs falling below fossil fuel based power generation rates on commercial scales, PV systems are increasingly seen as economically viable and self-sustaining energy options globally. This will ensure uninterrupted growth opportunities for the PV inverters market over the coming years.

Key winning strategies adopted by key players of PV Inverters Market

Focus on technology innovation - Constant innovation in inverter technology has helped players gain an edge. More recently, companies like Enphase have introduced microinverters and Huawei introduced their string inverters with 96% efficiency, both boosting customer value.

Expand product portfolio - Leading players like SMA, Fimer, and Delta have witnessed success by expanding their portfolio beyond string inverters to include central inverters, battery storage solutions and retrofit solutions.

Focus on after-sales service - Establishing strong service networks has helped companies increase customer satisfaction and trust. For example, Huawei and Fimer strengthened foothold in Europe in 2019 by setting up local warehouses and partner programs for faster repairs/replacements.

Offer financial flexibility - Providing flexible financing options has boosted sales for players. For example, Enphase launched battery backup subscription plans without upfront costs in 2021 making homeowners resilient during outages.

Target emerging markets - Early focus on China, India and other developing markets has paid off for top players.

Segmental Analysis of PV Inverters Market

Insights, By Product: String PV Inverter Dominate the Market

In terms of product, string PV inverter contribute 48.1% share of the PV inverters market in 2024, owning to their compatibility and scalability. They are designed to handle strings of solar panels connected in series.

String inverters are also very compatible with different panel configurations. They can accommodate mismatched panels where one part of the array may be in shade while another receives full sunlight. This helps optimize energy harvesting even when environmental conditions are inconsistent across the installation area.

Ease of installation is another key factor driving the popularity of string inverters. As each string has its own dedicated microinverter, installation involves simply connecting the strings in parallel. String inverters continue to gain market share through ongoing enhancements in monitoring capabilities as well. This boosts system transparency and empowers users to maximize energy yields, contributing to recent trends in the PV inverters market.

Insights, By End User: Utilities Segment Driven by Political Will for Renewable Energy Adoption

The utilities segment holds the largest share of the PV inverters market due to strong political motives for expanding the use of solar and other renewable energy sources. Many national and local governments have established mandates requiring that a certain percentage of electricity comes from clean, carbon-free generation by specific deadlines. Compliance is heavily driving utility-scale solar farm development.

Power companies are responding by rapidly building out new solar arrays and modernizing existing projects to capture more of the available sunshine. Also, government subsidies are also fueling solar farm projects at the utility level. Generous tax credits and other financial incentives aim to make renewable development commercially appealing for power providers making long-term capital investments.

As long as statutes prioritize renewable portfolio standards, the utilities segment will continue driving central and other large inverter adoption. Political will remains the primary driver of their prominence in the PV inverters market.

Additional Insights of PV Inverters Market

- Asia Pacific: The region held a 45% share in PV inverters market in 2023 due to high solar installations, notably in China and India, where government policies support renewable energy growth.

- North America: Led by the US and Canada, driven by supportive policies and research investments, further expanding the PV inverters market.

- Utilities segment dominated the PV inverters market in 2023 with a 45% share due to increased renewable energy demands and governmental incentives.

- PV inverters have achieved an average energy conversion efficiency of 98%, making them a critical component in maximizing solar power utilization.

Competitive overview of PV Inverters Market

The major players operating in the PV inverters market include Delta Electronics, Inc., SMA Solar Technology AG, Eaton Corporation plc, Emerson Electric Co., Fimer Group, Huawei Technologies Co., Ltd., SolarEdge Technologies Inc., Fronius International GmbH, and ABB Ltd.

PV Inverters Market Leaders

- Delta Electronics, Inc.

- SMA Solar Technology AG

- Eaton Corporation plc

- Emerson Electric Co.

- Fimer Group

PV Inverters Market - Competitive Rivalry, 2024

PV Inverters Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in PV Inverters Market

- In June 2024, Huawei Technologies Co., Ltd. announced a strategic partnership with a major utility company to deploy large-scale PV inverter systems, expanding their footprint in the commercial sector.

- In March 2024, SolarEdge Technologies Inc. launched a new high-efficiency inverter model, enhancing performance by 15%. This development strengthens their market position and offers consumers more efficient energy solutions.

- In February 2024, Sungrow Power Supply Co. Ltd. launched the “SG iNext” string inverter series with grid support improvements, targeting efficiency gains.

- In February 2024, SMA Solar Technology AG formed a strategic partnership with ENGIE to accelerate solar and storage solutions in Europe, enhancing distributed energy capabilities.

PV Inverters Market Segmentation

- By Product

- String PV Inverter

- Central PV Inverter

- Micro PV Inverter

- Other PV Inverter

- By End Use

- Utilities

- Commercial & Industrial

- Residential

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the PV inverters market?

The PV inverters market is estimated to be valued at USD 16.01 Bn in 2024 and is expected to reach USD 52.05 Bn by 2031.

What are the key factors hampering the growth of the PV inverters market?

Inconsistent regulatory frameworks and reduced consumer confidence due to non-standard compliant inverters growth in residential PV installations are the major factors hampering the growth of the PV inverters market.

What are the major factors driving the PV inverters market growth?

Increasing demand for renewable energy and declining costs of solar technology enhancing market accessibility are the major factors driving the PV inverters market.

Which is the leading product in the PV inverters market?

The leading product segment is string PV inverter.

Which are the major players operating in the PV inverters market?

Delta Electronics, Inc., SMA Solar Technology AG, Eaton Corporation plc, Emerson Electric Co., Fimer Group, Huawei Technologies Co., Ltd., SolarEdge Technologies Inc., Fronius International GmbH, ABB Ltd. are the major players.

What will be the CAGR of the PV inverters market?

The CAGR of the PV inverters market is projected to be 18.34% from 2024-2031.