항공기 엔진 시장 규모 및 점유율 분석 - 성장 추세 및 예측 (2024 - 2031)

항공기 엔진 시장은 엔진 유형 (Turbofan 엔진, 터보 추진 엔진, 터보 갱구 엔진, 피스톤 엔진)에 의해 분류됩니다, 신청 (상업 항공, 군 항공, 일반 항공, 사업 항공)에 의하여, 성분 (압축기, 터빈, 변속기, 배기 장치, 연료 체계)에 의하여, 플랫폼 (....

항공기 엔진 시장 크기

USD 기준 시장 규모 Bn

CAGR7.9%

| 연구 기간 | 2024 - 2031 |

| 추정 기준 연도 | 2023 |

| CAGR | 7.9% |

| 시장 집중도 | High |

| 주요 플레이어 | 일반 전기 회사 (GE Aviation), 롤스로이스 홀딩 PLC, 스파 & 웰빙 센터, Honeywell 국제 주요사업, Safran 항공기 엔진 및 기타 |

저희에게 알려주세요!

항공기 엔진 시장 분석

항공기 엔진 시장은 추정된다 50-100 원 Bn 에 2024 견적 요청 50-100 원 으로 2031화합물 연례 성장률에서 성장하는 (CAGR) 의 7.9% 에서 2024 받는 사람 2031. 항공기 엔진 시장은 국제 관광 도착 및 국내 항공 교통과 같은 요인에 의해 지원되는 예측 기간에 긍정적 인 성장을 목격 할 것으로 예상됩니다.

항공기 엔진 시장 트렌드

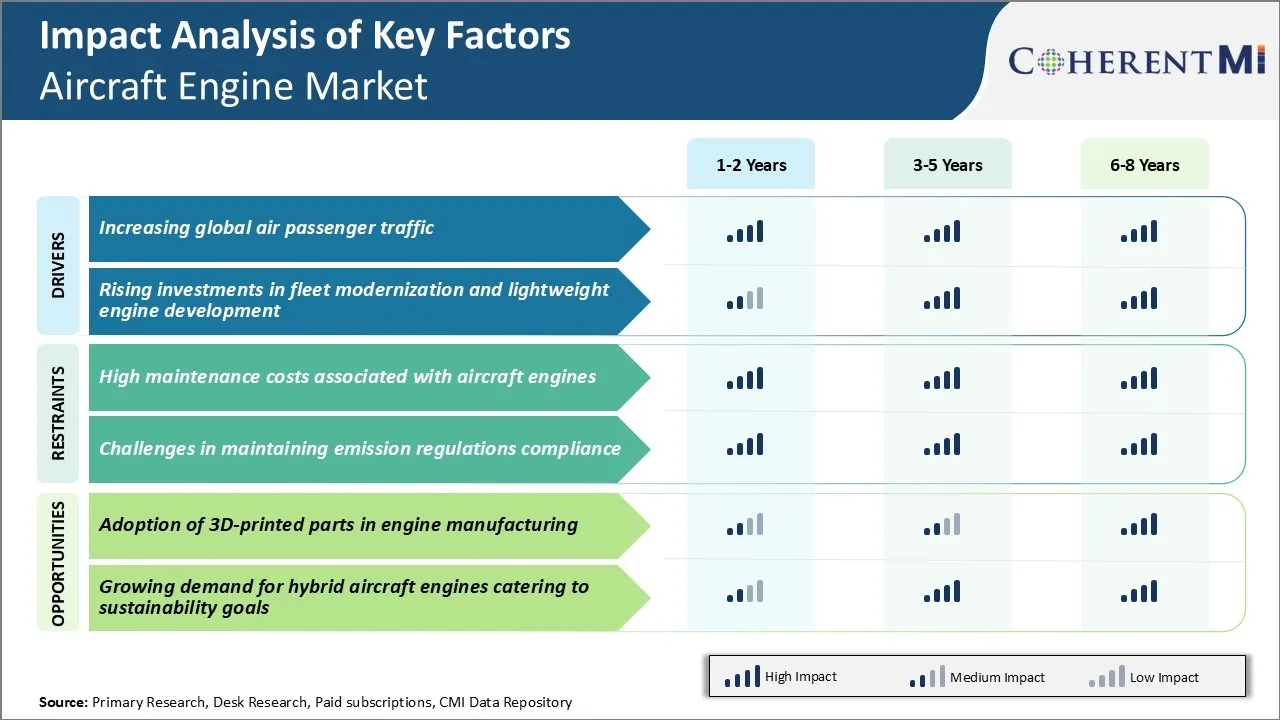

Market Driver - 글로벌 에어 여객 트래픽 증가

다양 한 산업 소스에서 추정에 따르면, 매년 비행 승객의 수는 다음 20 년 동안 두 배로 계획, 2037에 의해 추정 8.2 억에 도달. 글로벌화는 또한 사무실을 설정하고 인터콘티넨탈 여행에 대한 국경을 넘어 사업을 수행하기 위해 드라이버로 행동합니다.

이 모든 호의를 베푸는 추세는 항공기 및 항공기 엔진 제조업체에 대한 거대한 기회를 생성하여 항공사의이 용량 확장과 일치하도록 함대를 확장합니다. 승객 번호의 지속적 성장은 항공사가 최신 세대 엔진과 장착 된 새로운 연료 효율적인 항공기를 취득해야하며 새로운 시장에 대한 네트워크 확장을 의미합니다.

공기 교통의이 안정적인 증가는 향후 2 년 동안 모든 지역에서 새로운 상용 항공기 엔진에 상당한 수요를 구동 할 것으로 예상됩니다. 글로벌 항공기 엔진 시장의 성장을 계속할 것입니다.

시장 드라이버 - Fleet Modernization 및 경량 항공기 엔진 개발 투자

curbing 탄소 배출량을 목표로하는 환경 규정의 상승에 따라 항공기 제조업체는 기술 혁신에 큰 투자를하고 있습니다. 항공기 엔진 시장의 플레이어는 더 적은 연료를 태우고 더 적은 온실 가스를 방출하는 신세대 항공기 엔진 개발에 중점을 둡니다.

주요 초점은 경량 항공기 구조 및 엔진을 개발하여 고급 복합 재료 및 설계 최적화의 사용. 마찬가지로, 항공기 엔진 제조업체는 시뮬레이션 도구, 고급 합금 및 첨가제 제조에 대한 조정 투자를 통해 더 적은 부품과 고급 경량 엔진을 구축하는 것을 노력합니다.

Fleet 현대화는 환경 규범 회의의 이중 이득뿐만 아니라 캐리어의 하단 라인 경제를 개선합니다. 이 항공사의 최신 엔진 기술에 대한 건강한 수요를 뛰어넘는 것은 그들의 운영을 그린다. 기존 장비 제조업체는 향후 교체 및 현대화 사이클에 자본화하는 제품 개발 활동에 적극적으로 참여하고 있습니다.

Market Challenge - 항공기 엔진과 관련된 높은 유지 보수 비용

항공기 엔진 시장에서 주요 과제 중 하나는 항공기 엔진과 관련된 높은 유지 보수 비용입니다. 항공기 엔진은 일반 유지 보수 검사 및 과해가 최적의 성능과 안전을 보장하기 위해 복잡한 기계입니다. 엔진 부품은 높은 스트레스와 마모를 경험하며 극한 기후 조건, 진동, 열 및 압력과 같은 요인으로 인해 발생합니다.

엔진 overhaul 프로세스는 항공기에서 제거 될뿐만 아니라 항공기 가동 중단으로 인한 엔진을 요구합니다. 또한 예상치 못한 엔진 고장도 계획되지 않은 유지보수 비용에 기여합니다. 노동 및 재료 비용 높은, 항공기 엔진 유지 보수 항공에 대 한 큰 금융 부담을 포즈.

견적에 따르면, 유지 보수, 수리 및 과해 비용은 많은 항공사의 총 운영 비용의 20 % 이상을 차지합니다. 이것은 항공기 엔진 시장에서 수익성있는 운영의 지속을위한 주요 도전입니다.

시장 기회 - 3D 프린팅 부품의 채택

항공기 엔진 시장의 주요 기회 중 하나는 엔진 제조 및 유지 보수에 3D 인쇄 부품의 증가 채택이다. 3D 프린팅 또는 첨가제 제조는 항공기 엔진의 복잡한 내부 통로, 챔버 및 구성품을 통해 노동 집중 가공에 의존하지 않고 CAD 파일에서 정밀도로 직접 제작할 수 있습니다.

항공기 엔진 제조업체는 이제 3D 프린팅을 사용하여 연료 노즐, 터빈 블레이드, 콤보서 부품 등을 직접 판매하고 있습니다. 3D 프린팅 부품의 사용은 엔진 유지 보수에서 인기를 얻고, 높은 착용 부품에 대한 교체의 주문형 제조를 용이하게합니다. 이것은 항공기 가동 중단 및 지연을 최소화하는 데 도움이됩니다. 3D 프린팅의 사용자 정의 자연은 빌드-인쇄 사업 모델을 지원합니다.

3D 인쇄 부품의 Wider 채택은 엔진 디자인을 최적화 할 수있는 기회를 제공하며 생산주기와 비용을 절감하고 애프터 마켓 서비스에 부스트를 제공합니다. 그것은 앞으로 몇 년 동안 항공기 엔진 시장에 대한 주요 게임 체인이 될 가능성이있다.

주요 플레이어가 채택한 주요 승리 전략 항공기 엔진 시장

GE Aviation에 의해 채택 된 가장 성공적인 전략 중 하나는 광범위한 R & D 투자를 통해 지속적인 혁신이었다. GE는 2010년부터 R&D에서 매년 3억 달러 이상을 투자했습니다. 이 GE는 2008-2014 년 사이에 GEnx와 LEAP 가족과 같은 새로운 매우 연료 효율적인 엔진 프로그램을 출시했습니다.

Pratt & Whitney는 적극적인 시장 확장 전략을 수행했습니다. 2015-19 사이에서, 그것은 전략적으로 MRJ와 E-Jets E2와 같은 새로운 항공기 프로그램에 대한 엔진을 공급하기 위해 미쓰비시와 Embraer와 같은 에어프레더를 대상으로. 새로운 프로그램 Lockheed, 그리고 Irkut는 40% 이상에 의해 Pratt의 순서 Backlog를 증가 돕습니다.

Honeywell은 엔진을 넘어 스마트 인수 및 다변화를 통해 그 위치를 강화했습니다. 2018에서 항공기 엔진 부품 제조업체 UTC Aerospace Systems를 인수했습니다. avionics, 기계 시스템 및 기어와 같은 보완 자산을 제공합니다. 항공 서비스 솔루션과 같은 새로운 사업 부문으로 확장했습니다.

세그먼트 분석 항공기 엔진 시장

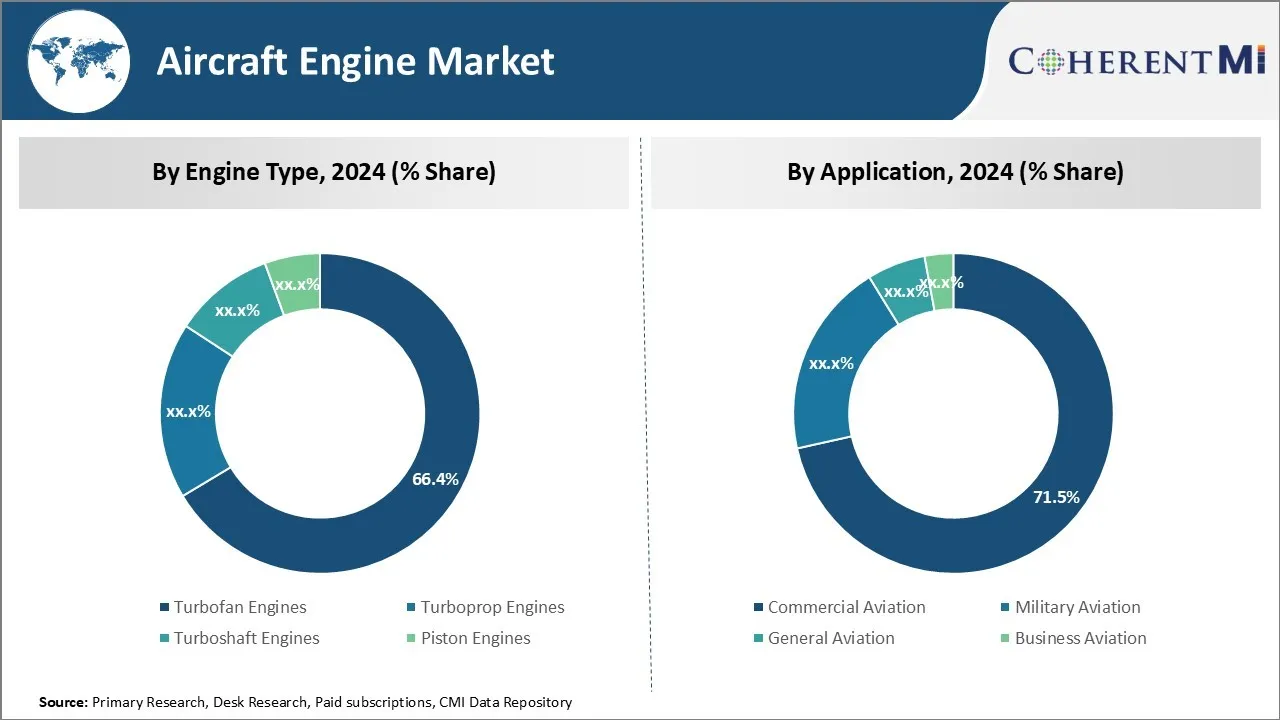

Insights, 엔진 유형 : 기술 발전 연료 Turbofan 엔진 지배

엔진 유형의 관점에서 터보 팬 엔진은 연료 효율을 최적화 한 중요한 기술 발전에 2024 년에 항공기 엔진 시장의 66.4%의 점유율에 기여합니다. 지난 수십 년 동안, GE Aviation 및 Pratt & Whitney와 같은 터보 팬 엔진 제조업체는 엔진의 특정 연료 소비 및 소음 수준을 줄이기 위해 연구 및 개발에 크게 투자했습니다.

기어드 터보 팬 디자인과 같은 첨단 기술, 팬 케이스 및 네셀의 복합 재료, 최적화 된 에어로 역학은 새로운 세대 터보 팬 엔진의 연료 효율과 신뢰성을 실질적으로 밀어. 터보 팬 엔진은 또한 가스 터빈 물자에 있는 발전에서 이득이 있고 개량한 돌격을 위한 더 높은 연소와 터빈 인레트 온도를 허용하는 코팅.

디지털 엔진 제어 및 3D 인쇄 부품은 엔진 작동 최적화를 지원했습니다. 이 지속적인 기술 발전은 항공기 엔진 시장에서 터보 팬 엔진의 지배력을 강화하기 위해 계속됩니다.

Insights, 응용 프로그램 : 상업용 항공 수요 드라이브 엔진 시장

애플리케이션의 관점에서 상업 항공은 전 세계 항공 승객 트래픽의 일관성 증가에 2024 년 항공기 엔진 시장의 71.5% 점유율에 기여합니다. 상업 항공 부문은 항공사, 항공기 소지자 및 기타 사업자가 상업 항공편에 승객 및화물을 수송하는 데 관여했습니다.

신흥 경제의 처분할 수 있는 소득은 사업과 여가 목적을 위한 항공 여행에 가지고 가는 중급을 허용했습니다. Low-cost 캐리어는 더 저렴한 항공 여행을 만들고, 더 많은 수요를 자극합니다. Boeing 및 Airbus와 같은 항공기 제조업체는 항공에서 큰 주문을 받고 노후화 함대를 대체하고 향후 2 년 동안 예상 여객 성장을 위한 용량을 추가합니다.

또한, 높은 산출을 위한 그것의 필요, 지속적인 가동을 위해 적당한 연료 효율적인 엔진은 현재 기술 동향과 잘 맞춥니다. 상업 항공 부문의 지속적 인 풀은 항공기 엔진 시장에서 primacy를 보장 할 것입니다.

Insights, 구성 요소에 의해 : Core Engine Function에 의해 구동 압축기

구성 요소 측면에서 압축기는 가스 터빈 엔진의 핵심 작동에 중요한 역할을하는 항공기 엔진 시장의 가장 높은 점유율에 기여합니다. 압축기는 어떤 항공기 엔진의 근본적인 첫번째 성분이고 고압에서 연소 단면도로 공기를 압축합니다. 30:1 이상의 압축 비율은 현대 터보팬 엔진 압축기에서 일반적으로 달성됩니다.

Concentrated R&D는 엔진 OEM에 의해 지속적으로 더 높은 압력 비율 및 최대 열역학 효율성을 통해 향상된 성과를 위한 압축기 디자인을 낙관합니다. 현대 컴프레서는 축 및 원심 다단 구성, 고급 에어 프로파일, 컴프레서 블리드 시스템 및 세라믹 복합물을 포함합니다. 압축기를 조밀하게 유지하고 또한 강력한 보조 엔진 포장.

3D 프린팅, 대안 토폴로지 및 모든 전기 디자인을 포함한 온고 컴프레서는 지속적인 시장 수요를 구동할 것입니다. 수집적으로, 압축기의 긴요한 핵심 기능 및 광대한 연구는 항공기 엔진 성분 중 dominating 세그먼트를 만듭니다.

추가 통찰력 항공기 엔진 시장

- 잡종 전기 추진 탐험: 제조업체는 하이브리드 전기 엔진 기술에 투자하여 환경 영향을 줄이고 미래의 배출 규정을 준수합니다. 이 연구는 전통적인 항공기 엔진과 통합 된 배터리 기술 및 전기 모터에 포함되어 있습니다.

- 아시아 태평양 성장 잠재력: 아시아 태평양 지역은 중국과 인도와 같은 국가의 항공 여행 수요와 함대 확장을 증가하기 때문에 글로벌 항공기 엔진 시장에서 실질적인 성장을 목격하기 위해 계획된다. 이 서지는 성장 중급에 의해 구동되고 연결 증가.

- 지속 가능한 항공 연료에 대한 Emphasis (SAFs) : 탄소 발자국을 줄이기 위해 SAF를 채택하는 성장 추세가 있습니다. 항공기 엔진 제조업체는 이러한 대체 연료와 호환되는 엔진을 적용하고 있습니다.

경쟁 개요 항공기 엔진 시장

항공기 엔진 시장에서 운영되는 주요 플레이어는 일반 전기 회사 (GE Aviation), Rolls-Royce Holding PLC, Pratt & Whitney, Honeywell International Inc., Safran Aircraft Engines, IHI Corp., Mitsubishi Heavy Industries Aero Engines Ltd, MTU Aero Engines AG, Rostec, Textron Inc., Williams International Co. LLC, CFM International, IAE International Aero Engines AG 및 Engine Alliance를 포함합니다.

항공기 엔진 시장 선두

- 일반 전기 회사 (GE Aviation)

- 롤스로이스 홀딩 PLC

- 스파 & 웰빙 센터

- Honeywell 국제 주요사업

- Safran 항공기 엔진

항공기 엔진 시장 - 경쟁 경쟁

항공기 엔진 시장

(주요 플레이어가 지배)

(많은 플레이어가 있는 매우 경쟁적)

최근 개발 항공기 엔진 시장

- 잡종 전기 추진 탐험: 제조업체는 하이브리드 전기 엔진 기술에 투자하여 환경 영향을 줄이고 미래의 배출 규정을 준수합니다. 이 연구는 전통적인 항공기 엔진과 통합 된 배터리 기술 및 전기 모터에 포함되어 있습니다.

- 아시아 태평양 성장 잠재력: 아시아 태평양 지역은 중국과 인도와 같은 국가의 항공 여행 수요와 함대 확장을 증가하기 때문에 글로벌 항공기 엔진 시장에서 실질적인 성장을 목격하기 위해 계획된다. 이 서지는 성장 중급에 의해 구동되고 연결 증가.

- 지속 가능한 항공 연료에 대한 Emphasis (SAFs) : 탄소 발자국을 줄이기 위해 SAF를 채택하는 성장 추세가 있습니다. 항공기 엔진 제조업체는 이러한 대체 연료와 호환되는 엔진을 적용하고 있습니다.

항공기 엔진 시장 세분화

- 엔진 유형

- Turbofan 엔진

- Turboprop 엔진

- 터보 샤프트 엔진

- 피스톤 엔진

- 회사연혁

- 상업 항공

- 군 항공

- 일반 항공

- 사업 항공

- 제품정보

- 제품 정보

- 터빈 터빈

- 기어박스

- 배기 시스템

- 연료 시스템

- 플랫폼

- 고정 스윙 항공기

- 로터리 스윙 항공기

- 무인 공중 차량 (UAVs)

구매 옵션을 알아보시겠어요?이 보고서의 개별 섹션?

자주 묻는 질문 :

얼마나 큰 항공기 엔진 시장?

항공기 엔진 시장은 USD 109.83로 평가 될 것으로 예상됩니다. 2024년 Bn은 2031년까지 USD 187.05 Bn에 도달 할 것으로 예상됩니다.

어떤 핵심 요소는 항공기 엔진 시장의 성장 hampering?

항공기 엔진과 관련된 높은 유지 보수 비용 및 배출 규정 준수 유지에 대한 도전은 항공기 엔진 시장의 성장에 대한 주요 요인입니다.

항공기 엔진 시장 성장을 구동하는 주요 요인은 무엇입니까?

글로벌 항공 승객 교통 및 함대 현대화 및 경량 엔진 개발의 상승 투자는 항공기 엔진 시장을 구동하는 주요 요인입니다.

항공기 엔진 시장에서 선도적 인 엔진 유형은 무엇입니까?

주요 엔진 유형 세그먼트는 터보 팬 엔진입니다.

어떤 주요 선수는 항공기 엔진 시장에서 운영?

일반 전기 회사 (GE 항공), Rolls-Royce Holding PLC, Pratt & Whitney, Honeywell International Inc., Safran Aircraft Engines, IHI Corp., Mitsubishi Heavy Industries Aero Engines Ltd, MTU Aero Engines AG, Rostec, Textron Inc., Williams International Co. LLC, CFM International, IAE International Aero Engines AG 및 Engine Alliance는 주요 선수입니다.

항공기 엔진 시장의 CAGR는 무엇입니까?

항공기 엔진 시장의 CAGR은 2024-2031에서 7.9%로 예상됩니다.