Logistics Robotics Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Logistics Robotics Market is segmented By Robot Type (Autonomous Mobile Robots, Robot Arms, Automated Guided Vehicles, Others), By Application (Pick a....

Logistics Robotics Market Size

Market Size in USD Bn

CAGR16.4%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 16.4% |

| Market Concentration | High |

| Major Players | KUKA AG, FANUC CORPORATION, Kawasaki Heavy Industries, Ltd., Toshiba Corporation, Yaskawa America, Inc. and Among Others. |

please let us know !

Logistics Robotics Market Analysis

The logistics robotics market is estimated to be valued at USD 10.22 Bn in 2024 and is expected to reach USD 29.58 Bn by 2031, growing at a compound annual growth rate (CAGR) of 16.4% from 2024 to 2031. The growing demand for automation in warehousing and material handling application is one of the major factors driving the logistics robotics market.

Logistics Robotics Market Trends

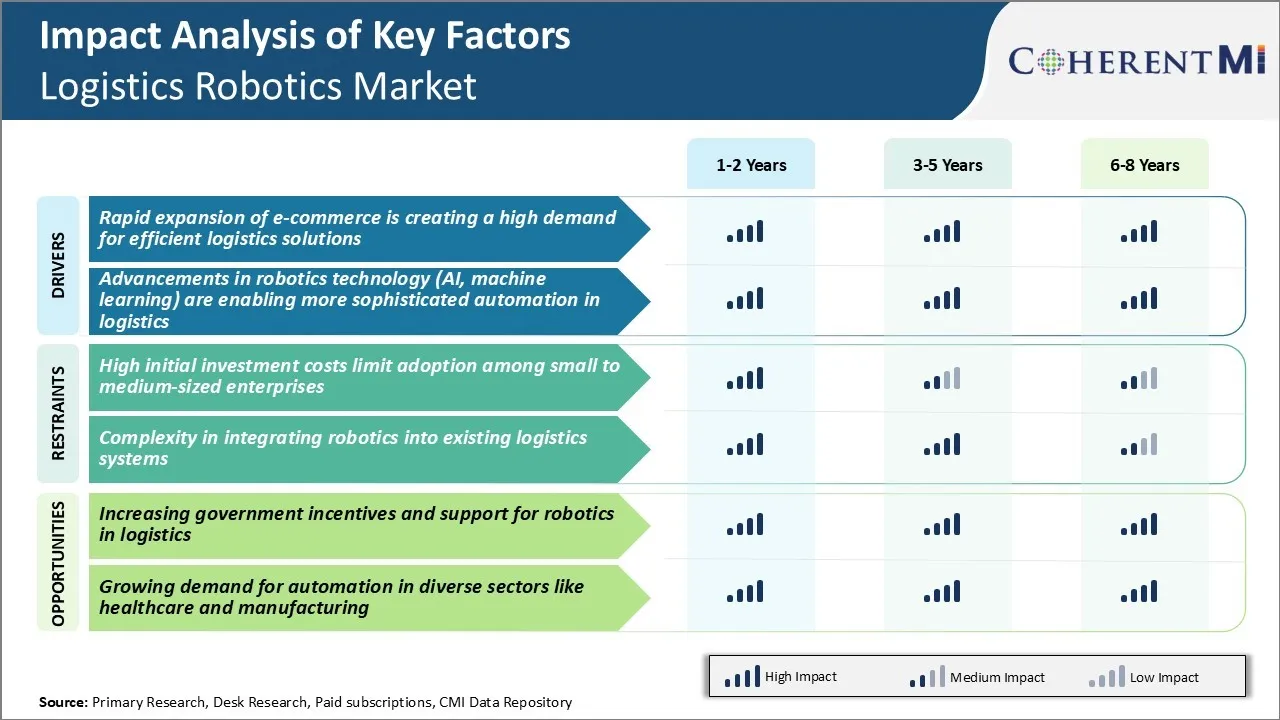

Market Driver - Rapid Expansion of e-Commerce is Creating a High Demand for Efficient Logistics Solutions

The rise of online shopping has been one of the most prominent trends over the past decade. As consumer preferences continue to shift online, e-commerce platforms and retailers are witnessing substantial growth in order volumes. However, fulfilling the increasing demand from customers spread worldwide in a timely and cost-effective manner presents significant logistical challenges.

To address these trends, many companies are increasingly adopting robotics technologies within their distribution centers. Collaborative robots are being deployed to assist human pickers by carrying out repetitive picking, sorting and packing tasks. Autonomous mobile robots (AMRs) are also automating the movement of materials within large fulfillment centers.

Such robots have proven effective in reducing order lead times, minimizing costs and improving inventory accuracy for online retailers handling millions of shipments annually. Their role in enhancing logistics operations will continue expanding as e-commerce grows strongly, thereby boosting logistics robotics market.

Market Driver - Advancements in Robotics Technology Enabling More Sophisticated Automation in Logistics

While robotics advancements have aided automation for some time, new technologies are allowing more intelligent and adaptable solutions. Recent innovations in areas such as computer vision, motion planning and machine learning have enabled the development of robots capable of more complex logistical tasks. Such intelligent robots learn from their environments and can autonomously execute multi-step activities with greater flexibility compared to traditional robotics.

Similarly, advanced AMRs are employed to incorporate simultaneous localization and mapping to safely navigate unfamiliar facilities without pre-programming. Combined with machine learning algorithms, AMR fleets are optimizing their movements based on analyzed traffic patterns and inventory hotspots.

As robotics technology powers ahead through continued AI development, logistics automation solutions will incorporate deeper cognitive abilities. They will be better equipped to deal with the less predictable realities of real-world logistics in a safe, efficient and cost-effective manner. This will accelerate the adoption of robotics across the entire supply chain, translating into positive growth of the logistics robotics market.

Market Challenge - High Initial Investment Costs Limit Adoption Among Small to Medium-sized Enterprises

One of the key challenges that the logistics robotics market is facing is the high upfront costs associated with automating logistics operations. While robotics offer benefits such as improved productivity and efficiency over the long term, the high capital expenditure required for automating tasks such as palletizing, packaging, transportation, and sorting is prohibitive for small and medium-sized enterprises.

The installation and start-up costs for logistics robots along with the expenses associated with programming, integrating and maintaining these systems can run into hundreds of thousands or even millions of dollars based on the scale and complexity of solutions. This means that for smaller companies with limited capital budgets, investing in robotics may not generate adequate returns within a short timeframe.

Further, upgrading and expanding automated fleets also demands heavy periodic investment. As a result, the high initial costs are limiting the adoption of logistics robotics among SMBs, with deployment remaining concentrated among large corporations currently. This is restricting the overall growth potential of the logistics robotics market.

Market Opportunity - Increasing Government Incentives and Support for Robotics in Logistics

One significant opportunity for the logistics robotics market is the increasing government support and incentives to drive adoption. Many countries are actively promoting the use of logistics robotics and automation technologies in logistics and warehousing as a way to boost productivity, create skilled jobs and gain competitive advantage.

Governments in regions such as Europe, Asia and North America are offering subsidies, tax benefits and funding support for companies investing in robotics. This includes schemes such as grants for equipment purchases, reimbursements for pilot implementation costs and workforce training programs. Such incentives are helping to alleviate concerns over initial costs among SMBs and are making robotics projects financially more viable.

As governments step up support through initiatives promoting research, skills development and PPP models, it could accelerate the pace of automation in logistics spaces and unfold new growth avenues for players in the logistics robotics market over the coming years.

Key winning strategies adopted by key players of Logistics Robotics Market

- Automation of warehouses and distribution centers: Amazon heavily automated its warehouses and distribution centers starting in 2012 using logistics robotics. This helped Amazon scale up operations massively while reducing costs. It deployed thousands of robots to retrieve inventory from shelves and deliver them to human workers.

- Focus on robotics for order fulfillment: Leading players like Amazon, Alibaba invested in logistics robots that could identify, pick and pack orders for shipping.

- Collaboration with logistics robotics startups: Locus Robotics' collaborative robots helped DHL automate its warehouse in Dallas in 2018, improving productivity by 200%. This strategy helped big players integrate new technologies faster.

- Form strategic alliances: In 2020, Anthropic partnered with Ocado to develop human-level manipulative abilities in logistics robots. This will help Ocado deploy logistics robotics in its warehouses.

Segmental Analysis of Logistics Robotics Market

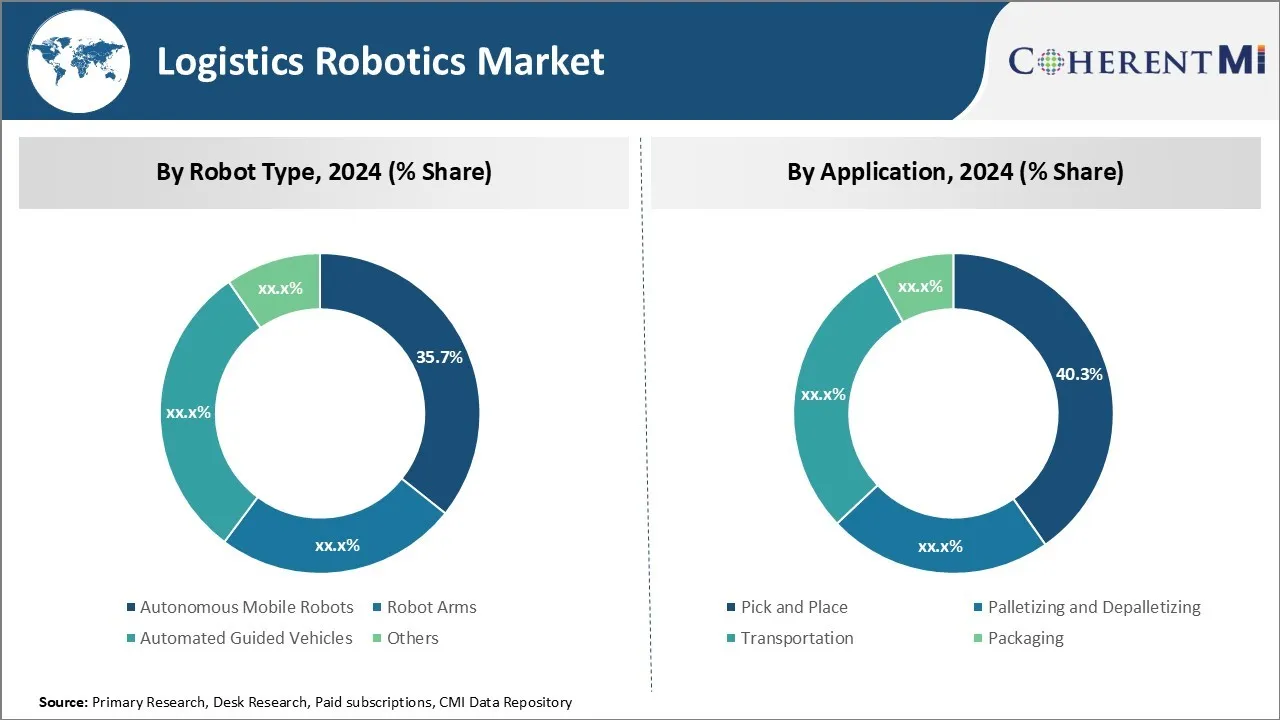

Insights, By Robot Type: Autonomous Mobile Robots Witness Increasing Demand for Flexible Automation

In 2024, autonomous mobile robots account for 35.7% share in the logistics robotics market by robot type. Compared to other types of robots, autonomous mobile robots offer more flexibility in handling different tasks. They can easily navigate around warehouses and facilities without needing fixed guidance systems like overhead rails or wires. This flexibility allows autonomous mobile robots to be redeployed quickly as business needs change through logistics robotics.

Additionally, advances in technologies like artificial intelligence, computer vision, and navigation systems have made autonomous mobile robots more intelligent and capable. Also, compared to human workers, autonomous mobile robots reduce variable operating costs as they can work continuously without breaks or overtime pay. The total cost of ownership of autonomous mobile robots also decreases over time as their capabilities improve with software upgrades. This will dominate upcoming trends in the logistics robotics market.

Insights, By Application: Robotics Demand Ups for Pick and Place Applications

Among the different applications in the logistics robotics market, pick and place accounts for 40.3% market share in 2024. This can be attributed to increased focus on automating order fulfillment processes in the e-commerce and retail industries.

Current pick and place robots are highly accurate and fast in selecting items from bins or shelves and accurately positioning them in racks, boxes or on pallets. Additionally, the growing demand for same-day and fast delivery has pressured organizations to quickly ship high volumes of small orders on time. Adopting pick and place robots as logistics robotics application, streamlines the order assembly process and ensures committed delivery windows are met reliably.

As online retail continues to grow, more companies are automating various order fulfillment functions like inventory intake, storage, picking, sorting, and packing/shipping. This drives the highest share of pick and place robots in the logistics robotics market.

Additional Insights of Logistics Robotics Market

- Adoption of Collaborative Robots in Warehouses: Logistics companies are increasingly using collaborative robots (cobots) that work alongside human workers to improve efficiency and safety. These cobots handle repetitive tasks, allowing human workers to focus on more complex activities.

- Shift Towards Autonomous Mobile Robots (AMRs): There is a significant trend of replacing traditional Automated Guided Vehicles (AGVs) with AMRs due to their flexibility and ability to navigate dynamic environments without fixed paths.

- E-commerce Influence: E-commerce activities contribute to over 40% of the demand for logistics robotics, driven by the need for rapid order processing and efficient inventory management.

- Regional Growth Patterns: The Asia-Pacific region is expected to exhibit the highest growth rate in the logistics robotics market, attributed to rapid industrialization and increased investment in automation technologies.

Competitive overview of Logistics Robotics Market

The major players operating in the logistics robotics market include KUKA AG, FANUC CORPORATION, Kawasaki Heavy Industries, Ltd., Toshiba Corporation, Yaskawa America, Inc., Vecna Robotics, Omron Corporation, Dematic, ABB Ltd., Toyota Industries Corporation, Mitsubishi Electric Corporation, Kion Group AG, Seiko Epson Corporation, and Hyundai Robotics.

Logistics Robotics Market Leaders

- KUKA AG

- FANUC CORPORATION

- Kawasaki Heavy Industries, Ltd.

- Toshiba Corporation

- Yaskawa America, Inc.

Logistics Robotics Market - Competitive Rivalry, 2024

Logistics Robotics Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Logistics Robotics Market

- In December 2023, Helsinki conducted a pilot program utilizing autonomous delivery robots to enhance urban logistics robotics. The initiative, managed by Forum Virium Helsinki, the city's innovation company, aimed to address the surge in deliveries during the holiday season, particularly in the Ruoholahti and Jätkäsaari districts, which lack local post offices.

- In October 2023, A.P. Moller - Maersk and Kodiak Robotics expanded their collaboration by launching the first commercial autonomous trucking lane between Houston and Oklahoma City. Since August 2023, Kodiak has been transporting eight loads per week for Maersk customers, with a safety driver present.

- In June 2023, JD Logistics, the logistics arm of JD.com, launched the second phase of its Kunshan Asia No.1 Intelligent Logistics Park in Jiangsu province, China. This expansion introduced an automatic sorting center equipped with over 80 state-of-the-art sorting lines and a fleet of 10,000 intelligent sorting robots, achieving a sorting accuracy rate of 99.99%.

- In May 2023, ABB Ltd. announced a strategic partnership with a leading e-commerce company to provide robotics solutions for their distribution centers. This collaboration aims to implement advanced robotic sorting and packaging systems, improving order fulfillment speed and accuracy. The development underscores the growing trend of automation in e-commerce with logistics robotics.

Logistics Robotics Market Segmentation

- By Robot Type

- Autonomous Mobile Robots

- Robot Arms

- Automated Guided Vehicles

- Others

- By Application

- Pick and Place

- Palletizing and Depalletizing

- Transportation

- Packaging

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is logistics robotics market?

The logistics robotics market is estimated to be valued at USD 10.22 Bn in 2024 and is expected to reach USD 29.58 Bn by 2031.

What are the key factors hampering the growth of the logistics robotics market?

High initial investment costs and complexity in integrating robotics into existing logistics systems are the major factors hampering the growth of the logistics robotics market.

What are the major factors driving the logistics robotics market growth?

Rapid expansion of e-commerce boosting demand for efficient logistics solutions and advancements in robotics technology are the major factors driving the logistics robotics market.

Which is the leading robot type in the logistics robotics market?

The leading robot type segment is autonomous mobile robots.

Which are the major players operating in the logistics robotics market?

KUKA AG, FANUC CORPORATION, Kawasaki Heavy Industries, Ltd., Toshiba Corporation, Yaskawa America, Inc., Vecna Robotics, Omron Corporation, Dematic, ABB Ltd., Toyota Industries Corporation, Mitsubishi Electric Corporation, Kion Group AG, Seiko Epson Corporation, Hyundai Robotics are the major players.

What will be the CAGR of the logistics robotics market?

The CAGR of the logistics robotics market is projected to be 16.4% from 2024-2031.