CNC Milling Machines Market Size - Analysis

Market Size in USD Bn

CAGR3.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 3.7% |

| Market Concentration | Medium |

| Major Players | Doosan Corp, F-Zimmermann, DMG MORI SEIKI, HYUNDAI WIA, Gleason Corporation and Among Others |

please let us know !

CNC Milling Machines Market Trends

As various industries are expanding across regions, there is significant growth in the manufacturing sector. Countries are focusing on developing local manufacturing abilities to improve production and meet the rising demands. This rapid industrialization has increased the need for advanced machining technologies and precise machining of components. CNC milling machines have emerged as a popular choice for factories due to their high-precision capabilities.

This improves equipment uptime while minimizing storage and handling costs of excess inventory. Their precision machining abilities also allow creation of complex 3D geometries and near-net-shape production reducing raw material wastage. All such factors lower the total operational expenses for manufacturers justifying investments in advanced CNC milling machines to meet the growing volume of spare parts manufacture.

Market Driver - Increased Production in Automotive, Aerospace, and Defense Sectors

Automakers are aggressively ramping up production capacities to sustain market shares. However, modern vehicles comprise numerous intricate components that push the limits of tolerances and surface finishes achievable through conventional methods. CNC milling machines offer precise cutting abilities for milling complex contours on engine blocks, transmission cases and other critical automobile parts.

Likewise, defense budgets are expanding in line with rising geopolitical tensions. Various nations are boosting defense manufacturing capabilities and indigenization. Again, CNC milling technology proves suitable with capabilities to machine military-grade aluminum and steel alloy components. This is expected to contribute to the growth of the CNC milling machines market.

One of the major challenges faced by the CNC milling machines market is the high cost and maintenance requirements associated with these machines. The high precision components used in CNC milling machines also increase their vulnerability to wear and tear. Regular maintenance and repair work is necessary to keep their precise functioning and minimize downtime.

High investment requirements pose a major barrier especially for smaller enterprises and businesses in CNC milling machines market to adopt advanced automated machining technologies. The complexity of maintenance procedures also means that specialized technical expertise is required for repairs which increases service charges. Overall, the high purchase and operational costs associated with the machines can discourage their widespread adoption, thereby slowing growth of CNC milling machines market.

Market Opportunity - Growing Demand for Maintenance Activities in Various Sectors

With the emergence of predictive maintenance techniques using IoT and analytics, there is potential to optimize servicing schedules and reduce downtime of machines. This presents lucrative growth prospects for maintenance service providers to expand their service portfolios and clientele. The growing complexity of CNC machine operation also warrants regular training and upskilling of technicians, thereby driving opportunities in the CNC milling machines market.

Key winning strategies adopted by key players of CNC Milling Machines Market

Focus on innovation and technology: In 2020 Haas Automation launched the UMC-750 5-axis machining center with features like a rigid boxway design, high torque spindles and advanced controls. This helped it gain market share.

Partnerships and acquisitions: 2017, Yamazaki Mazak acquired Dies toolmaker DMG Mori to extend its range of machine tools. This expanded Yamazaki Mazak's European footprint and diversified its portfolio.

Segmental Analysis of CNC Milling Machines Market

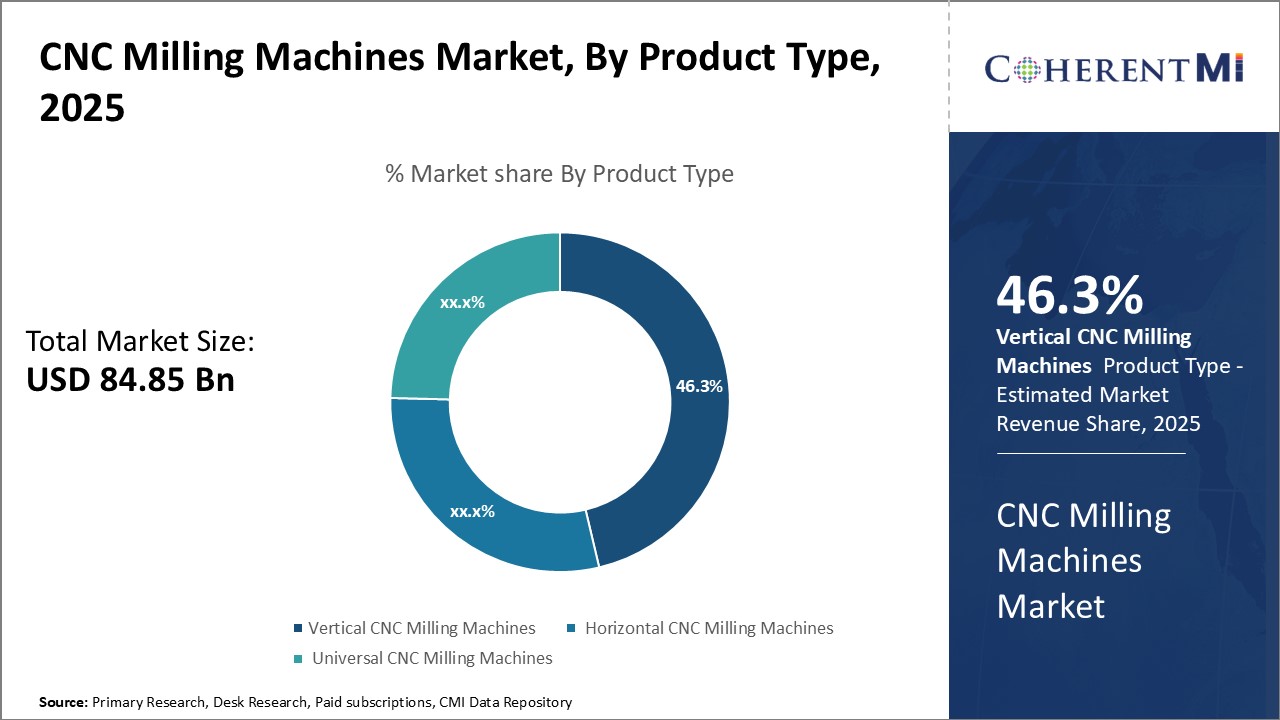

Insights, By Product Type: Precision and Flexibility Driving Vertical CNC Milling Adoption

Insights, By Product Type: Precision and Flexibility Driving Vertical CNC Milling AdoptionIn terms of product type, vertical CNC milling machines contribute 46.3% share of the CNC milling machines market in 2025, owning to the precise machining capabilities and flexibility they offer. Vertical mills excel at milling complex parts with tight tolerances due to their ability to mill flat and narrow surfaces with great accuracy. Their vertical spindle orientation allows for milling surfaces over the full Z-axis range, enabling the production of deep cavity parts. This makes them highly suitable for applications requiring precision milling of 3D contour parts.

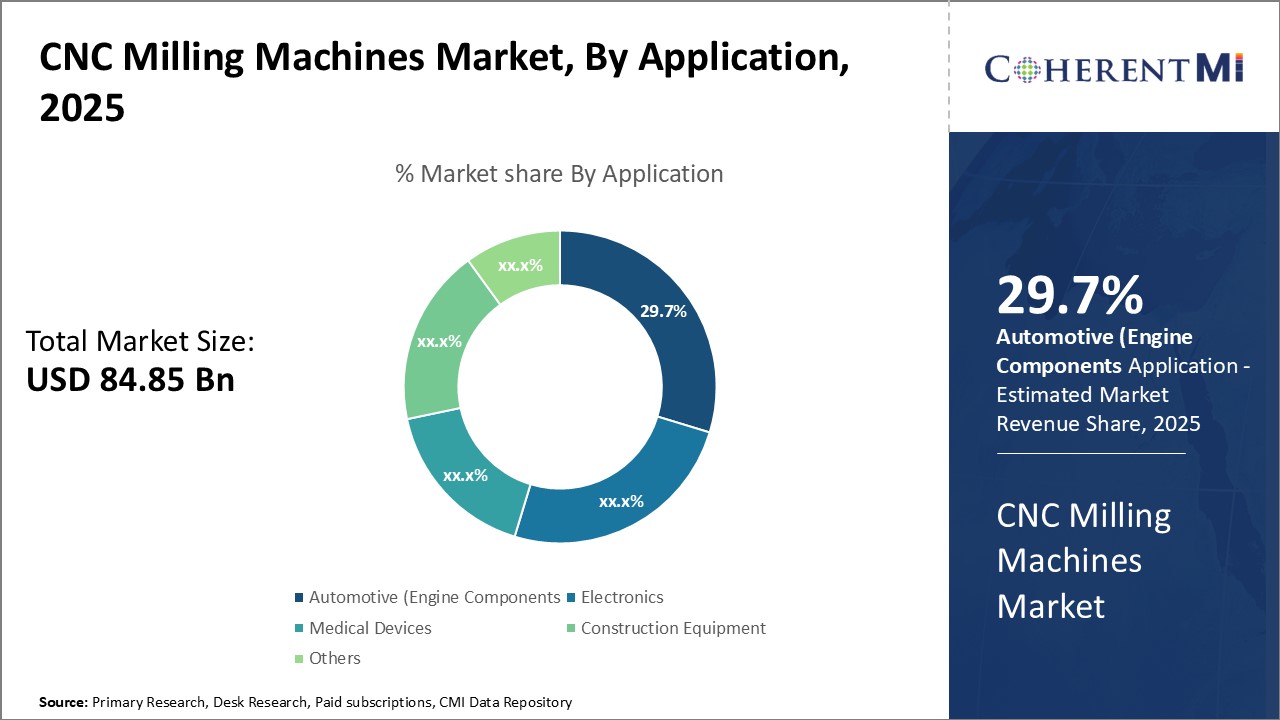

Insights, By Application: Optimizing Production in Automotive Manufacturing

Additionally, CNC milling supports flexible manufacturing practices in the industry. With their ability to quickly change tooling and process different workpieces, mills allow automotive plants to adjust production plans in response to changing market demands. For instance, they allow flexible machining of common parts for different vehicle models on the same line. This boosts plant capacity utilization and quick fulfillment of batch orders from regional CNC milling machines markets.

Insights, By End-user Industry: Enabling Complex Parts Manufacturing in Industrial Applications

Additionally, CNC milling allows optimized machining of critical hydraulic, pneumatic, and structural parts in industrial machinery. This helps increase machining efficiency multi-fold compared to conventional mills.

Additional Insights of CNC Milling Machines Market

- Asia-Pacific Region: Dominated the CNC milling machines market in 2023 with a 43% share, supported by increased industrial investments and a high demand for precise machinery in electric vehicle production.

- Europe: Projected as the fastest-growing region in the global CNC milling machines market, driven by automation trends in aerospace and defense sectors, improving cost efficiency in production.

- The automotive industry increasingly adopts CNC milling machines for manufacturing complex engine parts, enhancing fuel efficiency and performance.

- In the aerospace sector, CNC milling machines are essential for producing high-precision components required in aircraft, such as turbine blades and structural frames, ensuring safety and reliability.

Competitive overview of CNC Milling Machines Market

The major players operating in the CNC milling machines market include Doosan Corp, F-Zimmermann, DMG Mori Co., Ltd., HYUNDAI WIA, Gleason Corporation, GF Machining Solutions Management, Haas Automation, The CHIRON Group, GROB-WERKE, FANUC Corporation, Okuma Corporation, Hurco Companies, Inc., Makino Milling Machine Co., Ltd., Yamazaki Mazak Corporation, Siemens AG, Mitsubishi Electric Corporation, and JTEKT Corporation.

CNC Milling Machines Market Leaders

- Doosan Corp

- F-Zimmermann

- DMG MORI SEIKI

- HYUNDAI WIA

- Gleason Corporation

CNC Milling Machines Market - Competitive Rivalry

CNC Milling Machines Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in CNC Milling Machines Market

- In September 2024, Haas Automation, Inc. announced the commencement of construction on a new 2.4-million-square-foot manufacturing facility in Henderson, Nevada. This expansion aims to meet the growing global demand for CNC milling machines and underscores Haas Automation's commitment to domestic production.

- In September 2023, during the EMO Hannover 2023 exhibition, FANUC Corporation unveiled its upcoming FS500i-A series CNC system, which is currently under development. This new system is designed to enhance performance and user experience, featuring a new Human-Machine Interface (HMI) that simplifies operations for both seasoned and new users.

- In August 2023, CGTech released VERICUT 9.4, the latest version of its CNC machine simulation software. This update introduced several enhancements, notably the ToolsUnited interface, which provides access to tool and cutting data from over 40 tooling vendors.

- In March 2023, DMG MORI Co., Ltd. introduced a new line of CNC milling machines featuring advanced automation capabilities designed to enhance productivity and minimize downtime in manufacturing processes. These machines offer a range of automation solutions, including workpiece, and pallet handling systems, as well as robotic integration, to streamline operations and improve efficiency.

- In February 2023, Shilpin Machine Tools Pvt. Ltd. organized the 13th DIE AND MOULD INDIA 2024 exhibition at the Bombay Exhibition Center. The event highlighted challenges in polishing and machining, and featured the launch of the Acuka machine, improving precision in CNC milling machines.

CNC Milling Machines Market Segmentation

- By Product Type

- Vertical CNC Milling Machines

- Turret Mills

- Bed Mills

- Horizontal CNC Milling Machines

- Plain Horizontal Mills

- Universal Horizontal Mills

- Universal CNC Milling Machines

- Vertical CNC Milling Machines

- By Application

- Automotive

- Engine Components

- Transmission Systems

- Aerospace & Defense

- Aircraft Components

- Defense Equipment

- Electronics

- PCB Manufacturing

- Semiconductor Components

- Medical Devices

- Surgical Instruments

- Orthopedic Implants

- Construction Equipment

- Hydraulic Components

- Structural Parts

- Others

- Automotive

- By End-User Industry

- Industrial Manufacturing

- Precision Engineering

- Energy & Power

- Oil & Gas

- Others

Would you like to explore the option of buying individual sections of this report?

Ramprasad Bhute is a Senior Research Consultant with over 6 years of experience in market research and business consulting. He manages consulting and market research projects centered on go-to-market strategy, opportunity analysis, competitive landscape, and market size estimation and forecasting. He also advises clients on identifying and targeting absolute opportunities to penetrate untapped markets.

Frequently Asked Questions :

How big is the CNC milling machines market?

The CNC milling machines market is estimated to be valued at USD 84.85 Bn in 2025 and is expected to reach USD 109.42 Bn by 2032.

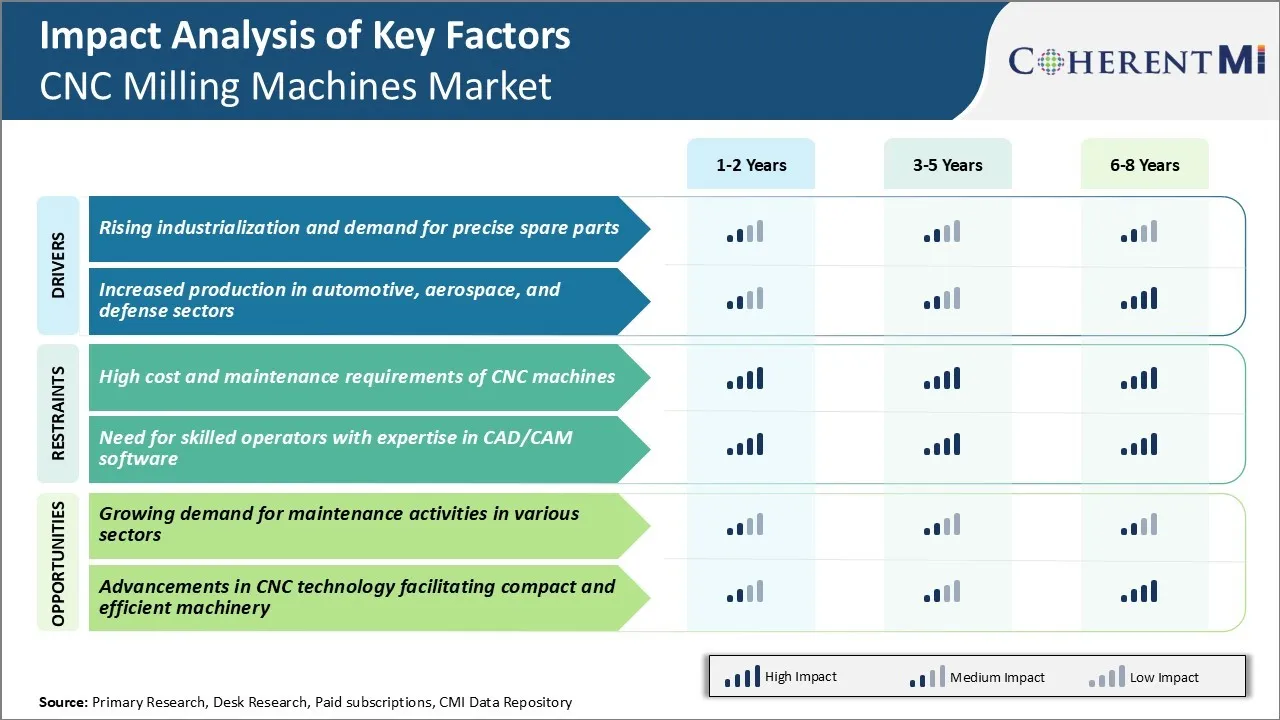

What are the key factors hampering the growth of the CNC milling machines market?

High cost and maintenance requirements of CNC machines and need for skilled operators with expertise in CAD/CAM software are the major factors hampering the growth of the CNC milling machines market.

What are the major factors driving the CNC Milling machines market growth?

Rising industrialization and demand for precise spare parts, and increased production in automotive, aerospace, and defense sectors are the major factors driving the CNC milling machines market.

Which is the leading product type in the CNC milling machines market?

The leading product type segment is vertical CNC milling machines.

Which are the major players operating in the CNC milling machines market?

Doosan Corp, F-Zimmermann, DMG Mori Co., Ltd., HYUNDAI WIA, Gleason Corporation, GF Machining Solutions Management, Haas Automation, The CHIRON Group, GROB-WERKE, FANUC Corporation, Okuma Corporation, Hurco Companies, Inc., Makino Milling Machine Co., Ltd., Yamazaki Mazak Corporation, Siemens AG, Mitsubishi Electric Corporation, and JTEKT Corporation are the major players.

What will be the CAGR of the CNC milling machines market?

The CAGR of the CNC milling machines market is projected to be 3.7% from 2025-2032.