代謝性アシドーシス市場 규모 및 점유율 분석 - 성장 추세 및 예측 (2024 - 2031)

代謝性アシドーシス市場は、タイプ別(急性代謝性アシドーシス(薬剤誘発性アシドーシス、乳酸アシドーシス)、慢性代謝性アシドーシス(腎尿細管性アシドーシス、糖尿病性ケトアシドーシス))、治療別(重炭酸塩療法(経口重炭酸塩、静脈内重炭酸塩)、透析(血液透析、腹膜透析)、薬理学的薬剤(重炭酸ナトリウム錠剤、....

代謝性アシドーシス市場 크기

USD 기준 시장 규모 Mn

CAGR5.89%

| 연구 기간 | 2024 - 2031 |

| 추정 기준 연도 | 2023 |

| CAGR | 5.89% |

| 시장 집중도 | High |

| 주요 플레이어 | Tisento 치료, 프로모션, Advicenne 약, 스낵 바, 인기 카테고리 및 기타 |

저희에게 알려주세요!

代謝性アシドーシス市場 분석

metabolic acidosis 시장은 평가될 것으로 예상됩니다. 2024년 USD 177.9 Mn 견적 요청 2031년 USD 265.5 Mn화합물 연례 성장률에서 성장하는 (CAGR) 의 5.89% 에서 2024 받는 사람 2031. 신장 질환과 같은 연령 관련 의학적 조건 때문에 대사 산증 개발에 더 많은 장군 인구는 수요를 운전하는 주요 요인입니다.

代謝性アシドーシス市場 트렌드

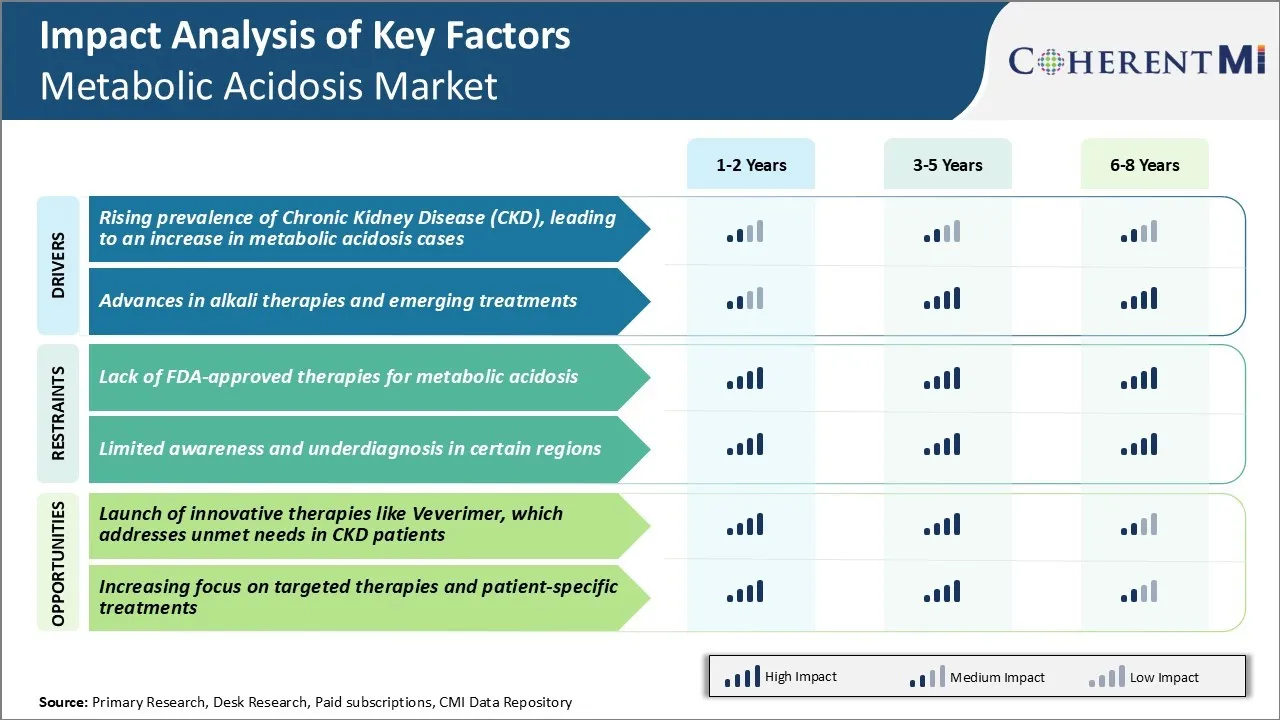

시장 드라이버 - Chronic Kidney Disease (CKD)의 상승률, 대사 산증 사례 증가

만성 신장 질환은 고급 CKD 단계에서 발생하는 대사 산증의 가장 일반적인 원인 중 하나입니다. 신장 기능으로 질병 진도, 대사 산후 케이스가 급격히 증가합니다.

연구에 따르면 모든 CKD 환자의 약 20 %가 신진 대사 산증과 전분이 신장 질환으로 50-60 %로 상승하여 당뇨병을 필요로합니다.

CKD Prevalence는 전 세계적으로 크게 최근 몇 년 동안 성장한 대사 산증 환자 풀에 기여했습니다. 최근 보고서에 따르면, CKD는 현재 세계 인구의 10 % 이상에 영향을 미쳤으며 사례는 1990 년부터 30 % 이상 증가했습니다.

국가 개발은 70-80% 이상의 인구와 라이프 스타일 질병으로 증언되었습니다. 심지어 개발 지구는 날카로운 상승을 경험하고있다. CKD 케이스에 있는 이 unlenting 증가는 앞으로 십년간에 관련한 대사 산후의 관리를 위한 필요를 평행하게 몰기 위하여 예상됩니다.

무능한 노력은 CKD 임신률이 상승하는 curb 신장병 위험 요인에, 계속 metabolic acidosis 시장에 압력을 두기 위하여 합니다.

Market Driver - Alkali Therapies 및 Emerging Treatments의 사전

고려 연구 노력은 최근 시간에 대사 산증에 대한 더 효과적인 알칼리 치료 및 소설 치료 방법을 개발하기 위해 지시되었습니다. 나트륨 중탄산염을 포함한 전통적인 알칼리 처리는 가난한 palatability 및 규정 준수와 같은 문제를 극복하기 위해 최적화되었습니다. 발전된 정립, 납품 방법 및 장시간 방출 단면도를 산출했습니다. Novel 알칼리 소금과 산 바인더는 또한 강화된 완충기 수용량 및 더 적은 양 짐 제안했습니다. 이러한 신흥 알칼리 옵션은 더 큰 유연성과 편의성을 가진 의사와 환자를 제공합니다.

또한 산 축적을 해결하는 새로운 메커니즘은 조사 중입니다. 초점의 Emerging 지역은 endogenous 산 생산을 금하고, 순환 산을 덫을 놓고 gut 미생물 활동을 개조합니다. 이러한 대안 접근 방식을 타겟팅하는 여러 후보자는 늦은 단계 개발에서 몇 가지 임상 시험을 입력했습니다.

연구자는 낙관적인 몇몇은 현재 알칼리 치료 보다는 더 튼튼한 해결책을 혼자 제공할지도 모릅니다. 성공적으로 개발된 경우, 이 새로운 세대 대사 산후 치료는 더 큰 시장 점유율을 포획할 것입니다. 시험과 승인을 통해 후보자의 진행은 중간에서 장기적으로 강력한 성장 기회를 유지해야합니다.

시장 도전 - Metabolic Acidosis를 위한 FDA 승인 치료의 부족

metabolic acidosis 시장의 주요 도전은 FDA 승인 약물의 부족으로 만성 대사 산증 상태를 효과적으로 치료합니다. 현재, metabolic acidosis 대우를 위해 특별히 나타난 약리학적인 대리인이 없습니다. 나트륨 중탄산염은 대사 acidosis를 대우하기 위하여 널리 이용됩니다 떨어져 상표, 그것만 임시 기복을 제공하고 underlying 상태를 해결하지 않습니다.

탄산염 치료는 또한 높은 알약 짐과 유동성 하중의 위험 같이 실제적인 도전을 선물합니다. 이 중요한 unmet 필요는 시장에 크게 untapped 지켜졌습니다. 바이러스성 약물 치료 옵션의 부재는 임상 연구 및 질병 진행의 이해를 제한합니다.

치료 풍경을 더 확립하고 대사 산증 평가에 있는 진단 도전 그리고 variability입니다. 더 많은 연구는 더 나은 subtypes를 특성화하고 표준화한 진단 의정서를 설치하기 위하여 필요합니다. 승인된 약리학적인 개입의 부족은 시장 성장에 중요한 장벽을 선물하고 그들의 상태를 위한 효과적인 장기 처리를 얻기에서 많은 환자를 막습니다.

Market Opportunity - Veverimer와 같은 혁신적인 치료 시작

대사 산후 시장에 있는 1개의 중요한 기회는 안전한 효과적인 FDA 승인 처리 선택권을 위한 현재 unmet 필요를 해결할 수 있는 참신 약의 발사입니다. Veverimer (Takhzyro)는 최근 만성 신장 질환 (CKD) 환자의 대사 산증 치료에 약속을 표시 한 혁신적인 비 흡수 폴리머입니다.

승인되면 Veverimer는 CKD에서 만성 대사 산후 처리를 위해 특별히 나타난 첫번째 약일 것입니다. 이것은 잠재적으로 acidosis에서 고통받는 CKD 환자 인구의 sizable 부분을 캡처 할 수 있습니다. Veverimer의 행동의 소설 메커니즘과 체계적인 흡수 없이 산성 상승 이익의 강한 증거는 CKD를 위한 돌파구 약으로 잘 위치를 알아냅니다.

그것의 승인은 중요한 치료 표적으로 acidosis를 유효할지도 모릅니다, 더 연구 및 개발 투자 및 혁신적인 파이프라인 프로그램에 시장을 추진. Veverimer와 같은 전반적으로 일류 치료에는 치료 선택권을 혁명화하는 잠재력이 있고, 환자 흡입을 몰고 대사 산증 시장 조경을 변형시킵니다.

처방자의 선호도 代謝性アシドーシス市場

대사 산증 대우를 위한 처방약은 조건의 밑으로 원인과 severity에 달려 있을지도 모릅니다. 원인이 알려지고 일시적 인 경우, 처방전은 산베이스 불균형을 수정하기 위해 첫 번째 라인 요법으로 구강 탄산염 보충제를 선호 할 수 있습니다.

더 심각한 또는 생활 감소 케이스를 위해, 또는 원인이 불명하거나 만성적이거나, 처방전은 IV 탄산염 또는 다른 완충기 대리인을 더 급속하게 정상화하는 PH 및 전해질 수준을 고려할 것입니다. 선택은 환자의 임상 안정성, comorbidities 및 다른 관리 물질 또는 노선에 대 한 공차에 요인 수 있습니다.

소화 문제의 추가 관리는 신장 질환에 대한 신장 대체 요법과 같은 전신에 영향을 미칠 것입니다. 더 나은 전반적인 건강에 있는 젊은 환자는 다수 만성 상태를 가진 이전 성인 보다는 더 가동 가능한 선택권이 있을지도 모릅니다.

비용, 보험 적용, 공식 포함, 그리고 같은 표시를 위해 유효한 다른 사람에 약의 전반적인 안전 단면도 비교는 상표 또는 일반적인 선호도에 충격을 줄 수 있었습니다. Peer-reviewed 증거, 임상 경험, 광고 또는 승진은 인식할지도 모릅니다.

치료 옵션 분석 代謝性アシドーシス市場

Metabolic acidosis는 조건의 근본 원인과 심각성에 따라 여러 잠재적 치료 옵션이 있습니다. 밀드 케이스는 설사, 증가 유체 흡입, 또는 보충제 바이 카보네이트를 사용하여 뿌리 원인을 해결하여 치료 될 수 있습니다.

더 가혹한 케이스를 위해, 정맥 나트륨 중탄산염 치료는 혈액 PH 수준을 올리는 표준 첫번째 선 처리입니다. 몇몇 약은 혈액의 완충기 수용량을 증가하는 나트륨 중탄산염 (Bicitra)를 포함하여 통용됩니다. 급성 신장 부상을 위해, 탄산염 치료는 환자의 underlying 상태를 개량하고 신장 기능의 더 악화를 방지하기 위하여 추구합니다.

비탄산염 치료는 혼자 충분히 정확한 acidosis를 하지 않는 경우에, adjunctive 처리는 필요할지도 모릅니다. 퇴행성 lactic acidosis 시나리오에서, 완충제는 일반적으로 셀룰러 물질 대사를 지원하기 위해 thiamine과 결합됩니다. furosemide (Lasix)와 같은 diuresis를 유도하는 약은 또한 충분한 수화 및 전해질 수준을 유지하는 동안 명확한 과잉 산을 도울지도 모릅니다.

장기적인 관리를 필요로 하는 만성 신장병 환자를 위해, 구두 나트륨 중탄산염 (Bicitra)는 빈번한 병원 방문에서 합병증을 방지하기 위하여 정맥 노선에 선호됩니다. 전해질과 산 기초 상태의 가까운 감시는 아직도, untreated 신진 대사 acidosis가 때에 신장 손상을 가속할 수 있기 때문에, 필요로 합니다.

주요 플레이어가 채택한 주요 승리 전략 代謝性アシドーシス市場

제품 혁신: 새로운 제품 개발과 혁신은 기업을 위한 주요 전략이 되었습니다. 예를 들어, 2020 AstraZeneca는 성인 대사 산증 환자에서 hyperkalemia (고 칼륨 수준)의 치료에 대한 Lokelma (나트륨 지르코늄 cyclosilicate)에 대한 FDA 승인을 받았습니다.

전략적 인수: 보완 기술 및 기업은 제품 포트폴리오를 확대하는 데 도움이되었습니다. 2017 년 Fresenius Medical Care는 NxStage Medical, dialysis 장비 및 서비스의 선도적 인 공급 업체 인 2 억 달러를 인수했습니다. 이 확장 Fresenius의 만성 신장 질환 및 신장 보충 치료에 대 한 솔루션의 범위 metabolic acidosis 치료에 사용. 그것은 거의 50%에 의해 가정 hemodialysis에 있는 그들의 시장 점유율을 밀어주었습니다.

확장된 배포 네트워크:: Wider 지리적 범위는 새로운 환자 풀에 액세스 할 수 있습니다. 2015년에, Aetna는 동북 미국에 있는 공급자의 네트워크를 확장하고, 관련 시험/처리를 위한 대사 전문가 및 확장한 적용에 회원 접근을 증가합니다.

정밀 마케팅: 최신 치료 지침 및 옵션에 따라 의사와 환자를 교육하는 대상 캠페인은 배당금을 지급했습니다. DaVita의 대사 산증 증상에 대한 디지털 및 온라인 마케팅에 초점을 맞추고 그들의 통합 관리 서비스는 nephrologists에서 약 25 %로 성장하는 것으로 나타났다 2018-2020, 용량 활용.

세그먼트 분석 代謝性アシドーシス市場

Insights, 유형 : 라이프 스타일 질병의 Emerging Prevalence는 Acute Metabolic Acidosis Segment의 성장

유형의 관점에서 급성 대사 산증 세그먼트는 2024 년에 시장에서 55.8%의 점유율을 보유 할 것으로 예상되며 급성 장애 및 건강 상태의 상승 인스턴스를 소유하고 잠재적으로 대사 산증으로 이어질 수 있습니다. 당뇨병과 같은 라이프 스타일 질병의 증가 된 임신 및 건강식 다이어트는 당뇨병 ketoacidosis의 위험이 크게 증가했습니다.

또한, 알코올의 과도한 소비는 lactic acidosis를 위한 중요한 가성 요인입니다. 특정 심장 혈관 조건 및 간 또는 신장 장애뿐만 아니라 신체의 산과 기초의 급성 불균형에서 종종 발생합니다. 상승하는 geriatric 인구는 또한 신진 대사 산후를 해결하기 위하여 즉시 의학 개입을 요구하는 심각한 감염 및 건강 악화에 더 중대한 감염을 몰고 있습니다.

Insights, 치료 : 효과적인 치료를위한 인식 및 수요 증가 Bicarbonate 치료 세그먼트

치료의 관점에서, 탄산염 치료는 2024년에 시장에 47.6%의 점유율을 붙들기 위하여 계획되고, 산 기초 균형에 있는 그것의 효과에 owing 및 의학 공급자 뿐 아니라 환자의 사이에서 일어나는 인식. 구두 뿐 아니라 정맥 탄산염 보충교재는 과잉 산 및 ameliorating 산후 증후에 능률적으로 돕습니다. 그들의 이용은 심각한 대사 산증의 경우에는 광대하게 문서화됩니다.

또한, 대안 pharmacological remedies의 한정된 가용성은 비탄산염 치료 특히 귀중한 만듭니다. 신속한 치료를위한 건강 의식과 수요는 더 큰 채택을 구동합니다. 탄산염 보충 및 임상 설정의 솔루션.

Insights, End User : 환자 풀 및 의료 인프라 강화 병원 세그먼트 확장

최종 사용자의 관점에서 병원은 고급 시설과 전문 의사 팀의 가용성에 가장 높은 공유에 기여합니다. 성장하는 geriatric demographic prone to metabolic acidosis with rising Lifestyle Disease incidence has considerably expanded 환자 풀 requiring medical care and monitoring.

또한, 의료 인프라를 확장하고 여러 전문 병원의 성장 수를 특히 개발 지역 제안 개선 된 액세스 및 환자 편안함을 제공합니다. 강력한 규제 프레임 워크는 또한 최고의 임상 관행과 배려의 품질을 보장합니다. 이 요인은 크게 세계적인 대사 산후 시장에 있는 중요한 최종 사용자 세그먼트로 병원의 지배력을 호소했습니다.

추가 통찰력 代謝性アシドーシス市場

- 2023년에, 대사 산증의 대략 1.7 백만개의 케이스는 7개의 중요한 시장 (7MM)의 맞은편에 진단되었습니다. 미국에서 약 850,000 건의 경우 만성 신장 질환 (CKD) 단계 3 ~ 5.

- Gender-specific 전분: 2023 년 남성은 더 높은 CKD 및 당뇨병 임신으로 인한 대사 산증 사례의 55%를 차지했습니다.

- 미국 시장은 고급 의료 인프라로 인해 70 %의 시장 점유율을 차지했습니다. 2023 년 미국 대사 산증 치료를위한 시장 크기는 117.6 백만 달러였습니다. 독일은 유럽에서 가장 큰 시장이었다, USD의 가치와 9.1 백만.

경쟁 개요 代謝性アシドーシス市場

metabolic acidosis 시장에서 운영되는 주요 플레이어는 Tisento Therapeutics, Tricida, Advicenne Pharma, Zagociguat, Fresenius Medical Care, Novartis, Relypsa, Inc., Zydus Cadila 및 Amneal Pharmaceuticals를 포함합니다.

代謝性アシドーシス市場 선두

- Tisento 치료

- 프로모션

- Advicenne 약

- 스낵 바

- 인기 카테고리

代謝性アシドーシス市場 - 경쟁 경쟁

代謝性アシドーシス市場

(주요 플레이어가 지배)

(많은 플레이어가 있는 매우 경쟁적)

최근 개발 代謝性アシドーシス市場

- 6 월 2024에서 Tisento Therapeutics는 Zagociguat, metabolic acidosis를 치료하기위한 구강 정제, Phase II 평가판을 입력했으며, acidosis를위한 치료 옵션에서 상당한 진도를 표시했습니다. 시험 시작 날짜는 9 월 2024, 2025 주위에 예상 완료와 함께 계획됩니다. Zagociguat는 현재 단계 2b 임상 시험으로 이동하여 효능 및 안전성을 평가합니다. 이 약은 수용성 guanylate cyclase (sGC) 자극제로 그것의 기계장치를 위해 적당하, 중앙 신경 체계 (CNS) 둘 다에 행동하고 피로와 인지적인 불기 같은 주변 증상.

- 3 월 2024에서 Tricida는 유럽 제약 회사와 파트너십을 체결하여 EU4 국가의 대사 산증 치료법을 배포했습니다. 이것은 접근성과 시장 침투를 증가할 것으로 예상됩니다.

- 8 월 2023에서 Advicenne은 Distal renal tubular acidosis (dRTA)의 치료로 선택 시장에서 ADV7103을 출시했습니다. 이 치료는 환자를 위한 새로운 치료 선택권을, 몸의 산 균형에 영향을 미치는 희소한 신장 상태를 표하는 제안합니다. ADV7103는 신장 방출 정립에 있는 칼륨 구연산염과 칼륨 중탄산염의 조합입니다, 몸에 있는 산성 수준을 관리하는 것을 돕는, 성인에 있는 아이들과 신장 관련 문제점에 있는 성장 지연과 같은 합병증을 극적으로 감소시키는. 이 발사는 이 희소한 상태에서 고통받는 환자를 위한 뜻깊은 기복을, 처리 선택권이 전하기 전에 제한되었습니다 제공합니다.

- 7 월 2023에서 Advicenne Pharma는 초기 단계 CKD 관련 대사 산증에 겨냥한 새로운 탄산염 처리의 발달을 발표했습니다. 이것은 초기 개입 치료에 중요한 격차를 채울 것입니다. Advicenne의 핵심 초점은 ADV7103 (Sibnayal)에, 영국을 포함하여 유럽 전역에 긍정적 인 임상 시험 및 마케팅 허가를 보았던 distal renal tubular acidosis (dRTA)에서 1 차적으로 겨냥한 처리입니다.

- 2019년에 이어 Tricida는 FDA의 Accelerated 승인 프로그램 밑에 Veverimer를 위한 NDA를 제출하고, FDA는 2020년을 위한 PDUFA 날짜 세트로 검토를 위해 그것을 받아들여졌습니다. 그러나 FDA는 2020 년 8 월 완전한 응답 편지 (CRL)를 발행했습니다. 승인이 지연되어 치료 효과 및 적용 가능성에 대한 추가 데이터를 인용합니다.

代謝性アシドーシス市場 세분화

- 이름 *

- Acute 대사 산증

- 약 유도된 acidosis

- 관련 제품

- Chronic 대사 산증

- Renal 관 Acidosis

- 당뇨병증

- Acute 대사 산증

- 관련 기사

- 채용정보 ·

- 구두 Bicarbonate

- Intravenous 탄산염

- 공급 업체

- 화학 성분

- 공급 능력

- 약리학 이름 *

- 나트륨 Bicarbonate 정제

- 칼륨 Citrate 보충교재

- 채용정보 ·

- 최종 사용자

- 병원소개

- Inpatient 서비스

- Outpatient 서비스

- 진료시간

- 전문 클리닉

- 진료시간

- Homecare 설정

- 홈 Dialysis

- 홈 의약품 관리

- 병원소개

구매 옵션을 알아보시겠어요?이 보고서의 개별 섹션?

자주 묻는 질문 :

metabolic acidosis 시장은 얼마입니까?

대사 산후 시장은 2024년에 USD 177.9 Mn에 평가되고 2031년까지 USD 265.5 Mn에 도달하기 위하여 예상됩니다.

metabolic acidosis 시장의 성장에 대한 주요 요인은 무엇입니까?

특정 지역에 있는 대사 산증 및 한정된 인식 및 underdiagnosis를 위한 FDA 승인된 치료의 부족은 신진 대사 산증 시장의 성장을 침몰하는 중요한 요인입니다.

metabolic acidosis 시장 성장을 구동하는 주요 요인은 무엇입니까?

만성 신장 질환 (CKD)의 상승률은 대사 산증 사례의 증가와 알칼리 치료 및 신흥 치료의 발전을 선도하는 주요 요인입니다 대사 산증 시장.

metabolic acidosis 시장에서 선도적 인 유형은 무엇입니까?

주요 유형 세그먼트는 급성 metabolic acidosis입니다.

metabolic acidosis 시장에서 작동하는 주요 선수는 무엇입니까?

Tisento 치료, Tricida, Advicenne Pharma, Zagociguat, Fresenius Medical Care, Novartis, Relypsa, Inc., Zydus Cadila 및 Amneal Pharmaceuticals는 주요 선수입니다.

metabolic acidosis 시장의 CAGR는 무엇입니까?

대사 산후 시장의 CAGR는 2024-2031에서 5.89%로 계획됩니다.