Vehicle Periodic Maintenance Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Vehicle Periodic Maintenance Market is segmented By Service Type (Engine Services, Brake Services, Tire Services, Battery Services, Others), By Vehicl....

Vehicle Periodic Maintenance Market Size

Market Size in USD Bn

CAGR4.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.1% |

| Market Concentration | High |

| Major Players | ADNOC, Nippon Express Co., Car Parts.com Inc, Belron International Ltd., EUROPART Holding GmbH and Among Others. |

please let us know !

Vehicle Periodic Maintenance Market Analysis

The vehicle periodic maintenance market is estimated to be valued at USD 930.12 Bn in 2024 and is expected to reach USD 1236.5 Bn by 2031, growing at a compound annual growth rate (CAGR) of 4.1% from 2024 to 2031. The vehicle periodic maintenance market continues to grow steadily due to the increasing number of vehicles on the road and increasing demand for regular servicing and repair needs.

Vehicle Periodic Maintenance Market Trends

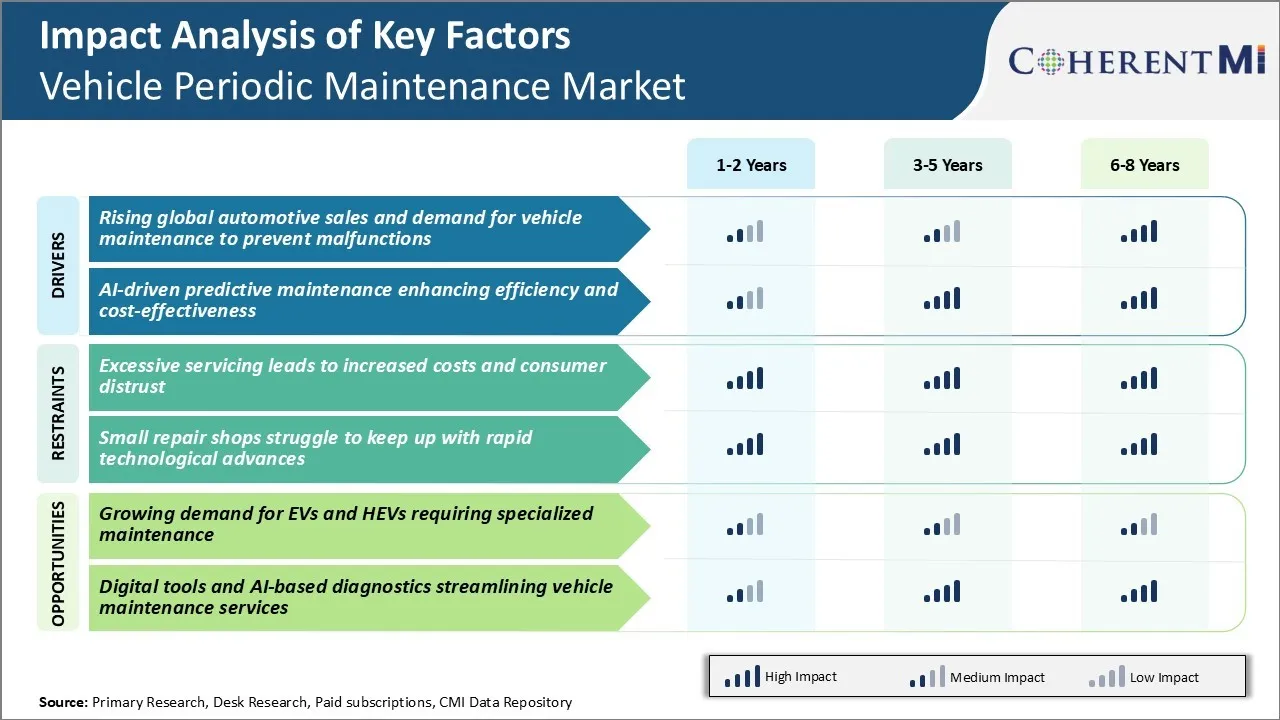

Market Driver - Rising Global Automotive Sales and Demand for Vehicle Maintenance to Prevent Malfunctions

As automotive sales across the globe continue to rise steadily, the installed base of vehicles on road is increasing at a significant pace. More number of vehicles inevitably leads to higher demand for periodic maintenance services in order to prevent unexpected breakdowns and malfunctions during operation. Customers understand the importance of timely maintenance and servicing of key components like engine oil, brakes, filters, batteries etc. to maximize fuel efficiency and ensure smooth driving experience.

Additionally, original equipment manufacturers introduce attractive service packages and extended warranty programs to encourage periodic servicing from their extensive dealership network. This helps in building brand loyalty while gaining valuable customer insights which aid new product development. With digitization, customers also have access to maintenance record of their vehicles which instills confidence in resale value.

This is expected to reflect in positive growth prospects of the vehicle periodic maintenance market in the coming years.

Marekt Driver - AI-driven Predictive Maintenance Enhancing Efficiency and Cost-effectiveness

Adoption of artificial intelligence (AI) and machine learning algorithms is revolutionizing automotive aftermarket in significant ways. Connected vehicles nowadays come equipped with myriad sensors that capture operational data of critical components in real-time. This trove of operating parameters and performance analytics and diagnostic alerts are analyzed by AI models. They are trained to detect subtle anomalies or deterioration patterns to predict imminent defects, failures or performance issues before they actually occur and impact usability. By leveraging predictive capabilities, scheduled maintenance work can be done proactively instead of waiting for a breakdown.

This predictive approach enhances overall equipment effectiveness while lowering downtime costs associated with unexpected repairs. Customers benefit from improved planning as well as potential warranties or discounts offered by OEMs/service centers. The approach also helps optimize resource utilization like inventory, tooling or technician schedules at workshops.

Over time, as AI systems learn more through unsupervised methods, they are expected to provide increasingly accurate remaining useful life estimates. This will make routine service far more efficient, seamless, and economically viable for all stakeholders involved in vehicle periodic maintenance market.

Market Challenge - Excessive Servicing Leads to Increased Costs and Consumer Distrust

The vehicle periodic maintenance market currently faces the challenge of excessive servicing which often leads to increased costs for consumers and loss of trust in service providers. Many service centers tend to recommend repairs or part replacements that may not be entirely necessary with an aim to generate more revenue. This practice of recommending unnecessary services has led to rising maintenance costs for vehicle owners over time.

As a result, vehicle owners now lack trust in the transparency and intentions of service providers. They feel that the providers take advantage of the owners' lack of technical expertise to sell additional services. This lack of trust has created a negative perception of the overall vehicle periodic maintenance market.

For the long-term growth and sustainability of the vehicle periodic maintenance market, it is important that appropriate checks and balances are established to prevent unwarranted servicing. Service providers will need to focus on building transparency and establishing trusted customer relationships.

Market Opportunity - Growing Demand for EVs and HEVs Requiring Specialized Maintenance

The rising threat of global warming and increasing environmental awareness has accelerated the global transition towards more eco-friendly electric vehicles (EVs) and hybrid electric vehicles (HEVs). Several global automobile manufacturers are aggressively pushing new EV and HEV models to comply with stringent emission norms.

As the sales of EVs and HEVs continue to surge, it will drive significant growth opportunities for the vehicle periodic maintenance market. Specialized maintenance services will be required to service the advanced electric powertrains, battery packs, and auxiliary components that are different from conventional gasoline vehicles. This represents a major market opportunity for both independent garages and authorized dealerships. They can upskill their technical teams, invest in diagnostic tools, and establish themselves as preferred service points for electric vehicles.

Companies that make proactive investments to ramp up their competencies around EV technologies stand to gain significantly in the coming years. The evolving mobility landscape with more EVs on roads will open up substantial revenue potential for vehicle periodic maintenance market players.

Key winning strategies adopted by key players of Vehicle Periodic Maintenance Market

Bundling of services - Many leading service providers like Jiffy Lube and Midas have adopted a strategy of bundling various vehicle periodic maintenance services into affordable packages. For example, Jiffy Lube introduced its "Complete Car Care" package in 2017 that bundled oil change, fluid check, brake inspection, and more for a bundled price. This boosted their sales by over 25% as customers valued the convenience.

Leveraging technology - For instance, Midas invested $50 million in 2015 to upgrade their tools and introduced dashboard diagnostics and online check-in systems across all U.S. stores. This improved customer satisfaction scores by 20% as reported by J.D. Power surveys. The technology edge also helped Midas recruiting highly skilled technicians.

Expanding multi-brand service networks - Instead of focusing on specific brand vehicles, companies like Goodyear, Monro, and Firestone have established vast multi-brand service networks across regions. For example, by 2017, Goodyear operated over 1000 commercial truck and passenger vehicle services centers across 50 states serving all vehicle brands.

Segmental Analysis of Vehicle Periodic Maintenance Market

Insights, By Service Type: Consumers' Dependence on Vehicles for Daily Commuting

In terms of service type, engine services account for 28.7% share of the vehicle periodic maintenance market in 2024. This is due to consumers' growing dependence on vehicles for daily commuting and transportation needs. Engine is one of the most crucial components of a vehicle that requires regular vehicle periodic maintenance and servicing to ensure optimal performance.

Even a minor issue in the engine can significantly impact the fuel efficiency and driveability of the vehicle. Therefore, vehicle owners tend to prioritize engine services through periodic oil changes, filters replacement, tune-ups, and other general check-ups. This helps in early detection and resolution of any engine problems, thereby reducing unexpected repair costs and vehicle downtimes.

As more individuals and families rely on personal vehicles for work and other activities, the demand for routine engine services continues to remain robust.

Insights, By Vehicle Type: Increasing Ownership of Passenger Vehicles

In terms of vehicle type, passenger cars account for 42.6% share of the vehicle periodic maintenance market in 2024, owing to the increasing ownership of passenger vehicles for private and family use. Cars have become a necessity for daily commuting in urban and suburban areas due to growing road infrastructure and easier availability of financing options.

Regular preventive maintenance through services such as brake inspection, replacement of brake pads and shoes, alignment and balancing of tires helps ensure passenger safety over long-term usage. It also prevents unexpected breakdowns and repairs.

With rising disposable incomes, consumers are willing to spend on vehicle periodic maintenance of their cars to maintain resale value and avoid high repair costs in future. This drives consistent demand for vehicle periodic maintenance services from the passenger cars segment.

Insights, By Service Provider: Dealerships' Specialized Service Competence

In terms of service provider, automobile dealership contributes the highest share of the market owing to dealerships' specialized service competence and convenience offered to customers. Vehicle dealerships employ automotive technicians who are factory-trained and certified to service specific car models. They also have access to genuine spare parts and latest diagnostic tools recommended by automakers. This helps dealership technicians accurately diagnose problems and fix vehicles as per manufacturers' guidelines.

Moreover, dealerships provide one-stop maintenance packages and often communicate recommended service schedules to owners via text/email. Their extensive service network coverage allows for easy drop-off and pick-up of vehicles, thereby saving customers' time and effort. Such dealership value propositions have made them the most trusted providers for vehicle periodic maintenance requirements over local garages.

Additional Insights of Vehicle Periodic Maintenance Market

- North America, especially the U.S., is seeing an increase in repair centers, while Asia-Pacific leads due to strict vehicle safety and maintenance regulations.

- The average vehicle age in the U.S. is over 12 years, increasing demand for vehicle periodic maintenance.

- The Asia-Pacific region accounts for the largest share in vehicle periodic maintenance market, with over 40% of global revenue, driven by high vehicle sales in countries like China and India.

- Electric vehicles are expected to represent 15% of the vehicle periodic maintenance market by 2031 due to increasing adoption rates.

- Many manufacturers in the vehicle periodic maintenance market are now offering extended warranty and service packages to retain customers within their authorized service networks.

Competitive overview of Vehicle Periodic Maintenance Market

The major players operating in the vehicle periodic maintenance market include ADNOC, Nippon Express Co., Car Parts.com Inc, Belron International Ltd., EUROPART Holding GmbH, Hance’s European, Inter cars, LKQ Corporations, M&M Auto Repair, Mekonomen Group, Mobivia Groupe, My TVS, Sun Auto Service, USA Automotive, and Wrench, Inc.

Vehicle Periodic Maintenance Market Leaders

- ADNOC

- Nippon Express Co.

- Car Parts.com Inc

- Belron International Ltd.

- EUROPART Holding GmbH

Vehicle Periodic Maintenance Market - Competitive Rivalry, 2024

Vehicle Periodic Maintenance Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Vehicle Periodic Maintenance Market

- In June 2024, Goodyear launched a “tires-as-a-service” program, integrating tire monitoring and automatic inflation to improve vehicle periodic maintenance. The program aimed at enhancing vehicle periodic maintenance for commercial and last-mile delivery fleets in the U.S. and Europe. This offering integrates continuous tire monitoring and automatic inflation systems.

- In September 2023, Bridgestone Corporation announced the expansion of their service centers in Southeast Asia, aiming to capture the vehicle periodic maintenance market.

- In July 2023, Bosch Automotive Service Solutions introduced cloud-based diagnostic software aimed at enhancing the accuracy of vehicle assessments. This initiative is part of Bosch's broader strategy to develop digital platforms and services for the transportation and logistics industry.

- In July 2023, KwikFix Auto, a vehicle periodic maintenance company, launched a mobile application in India designed to help car owners manage maintenance and emergencies. The app allows users to specify their vehicle model and access tailored services, including products like tires, batteries, and accessories, as well as vehicle periodic maintenance services such as denting and painting, car detailing, mechanical maintenance, tire care, and vehicle health check-ups.

Vehicle Periodic Maintenance Market Segmentation

- By Service Type

- Engine Services

- Brake Services

- Tire Services

- Battery Services

- Others

- By Vehicle Type

- Passenger Cars

- Two-Wheelers

- Light Commercial Vehicles

- Heavy-Duty Trucks

- Buses & Coaches

- Off-Road Vehicles

- By Service Provider

- Automobile Dealership

- Franchise General Repairs

- Specialty Shops

- Local Owned Repair Shops

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the vehicle periodic maintenance market?

The vehicle periodic maintenance market is estimated to be valued at USD 930.12 Bn in 2024 and is expected to reach USD 1236.5 Bn by 2031.

What are the key factors hampering the growth of the vehicle periodic maintenance market?

Excessive servicing leads to increased costs and consumer distrust. Furthermore, small repair shops struggle to keep up with rapid technological advances. These are the major factors hampering the growth of the vehicle periodic maintenance market.

What are the major factors driving the vehicle periodic maintenance market growth?

Rising global automotive sales, growing demand for vehicle maintenance to prevent malfunctions, and AI-driven predictive maintenance enhancing efficiency and cost-effectiveness are the major factors driving the vehicle periodic maintenance market.

Which is the leading service type in the vehicle periodic maintenance market?

The leading service type segment is engine services.

Which are the major players operating in the Vehicle Periodic Maintenance Market?

ADNOC, Nippon Express Co., Car Parts.com Inc, Belron International Ltd., EUROPART Holding GmbH, Hance’s European, Inter cars, LKQ Corporations, M&M Auto Repair, Mekonomen Group, Mobivia Groupe, My TVS, Sun Auto Service, USA Automotive, and Wrench, Inc. are the major players.

What will be the CAGR of the Vehicle Periodic Maintenance Market?

The CAGR of the Vehicle Periodic Maintenance Market is projected to be 4.1% from 2024-2031.