Container Fleet Market Size - Analysis

Market Size in USD Bn

CAGR5.7%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.7% |

| Market Concentration | High |

| Major Players | China COSCO Shipping Corporation Limited, CMA CGM S.A., MSC Mediterranean Shipping Company S.A., Maersk, Hapag-Lloyd AG and Among Others |

please let us know !

Container Fleet Market Trends

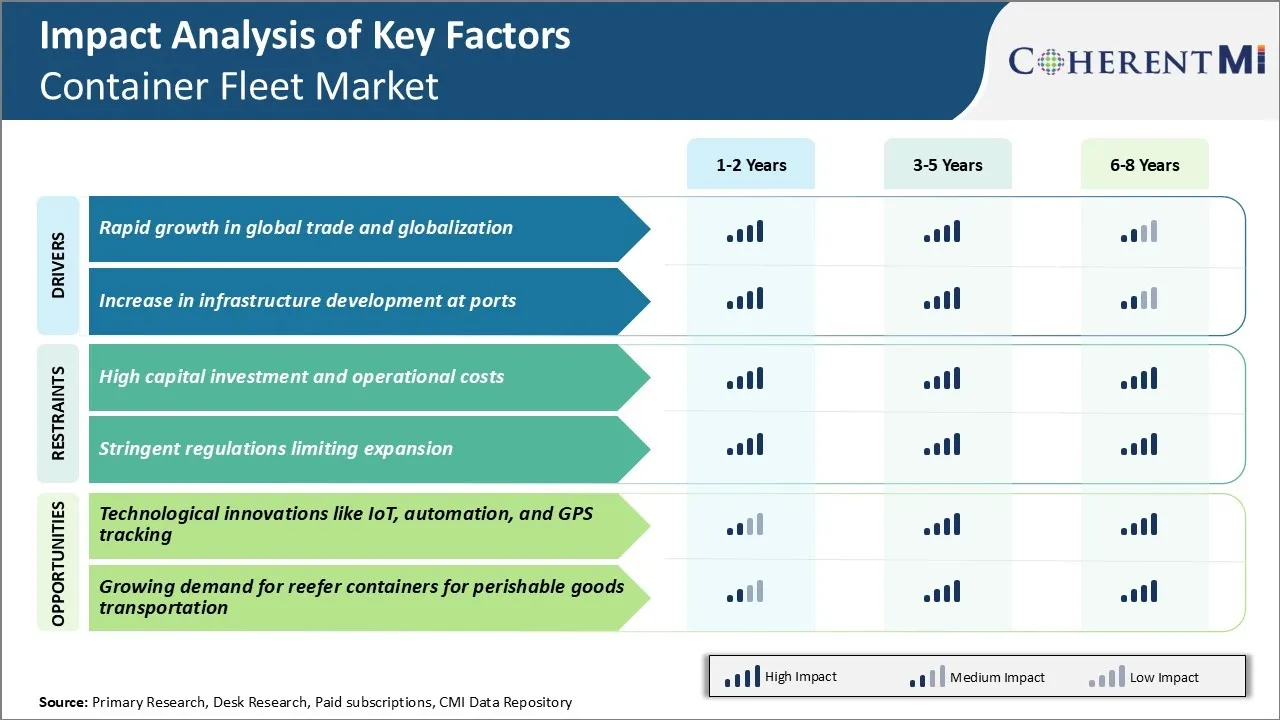

Global trade has seen an unprecedented surge following the introduction of liberalization policies and reduction of trade barriers across countries. Containerization has emerged as the most efficient mode of transporting these goods over long distances by container fleet.

Regional trade blocs like European Union and Asian powerhouses like China have also driven up intra-regional commerce. Container fleet today act as the lifeline of international trade, facilitating just-in-time deliveries. This is expected to emerge as a major driver for the container fleet market.

Market Driver - Increase in Infrastructure Development at Ports

Container fleet market is also witnessing development of automated terminals powered by computerized terminal operating systems. These ensure swift turnaround of container fleet. Dedicated inland clearways and rail/road linkages are also being upgraded to improve hinterland connectivity, which can immensely support growth of the container fleet market.

Market Challenge - High Capital Investment and Operational Costs

Furthermore, with rising fuel costs and expenses related to maintenance and repairs, the operational costs of running container fleets are also very high. This puts pressure on shipping lines and fleet owners to maximize revenue from each voyage in order to realize reasonable returns on investments and cover daily operational expenses.

The container fleet market is poised to benefit significantly from ongoing technological innovations. The integration of Internet of Things (IoT) solutions, automation technologies, and advanced tracking systems can help optimize operations and reduce costs. IoT sensors installed on containers and ships can monitor temperature, humidity and other critical parameters to ensure safety and quality of cargo.

Adoption of these new technologies allows fleet operators to supervise operations remotely, predict maintenance needs, streamline processes and enhance customer experience. This paves the way for lower operating costs and higher revenues through improved capacity utilization and customer retention for companies in the container fleet market.

Key winning strategies adopted by key players of Container Fleet Market

Strategic Acquisitions and Consolidation: Acquiring or merging with competitors has helped players scale up and expand their fleet capacity. For example, in 2016, Maersk Line acquired Hamburg Sud, becoming the largest container shipping company. This increased its fleet size by over 50% to around 4 million TEU.

Technology Adoption: Advanced technologies like IoT, telematics, analytics and automation help improve fleet performance and customer experience. For example, fleet telematics solutions from companies like MarineTraffic provide real-time location, speed and condition of vessels.

Segmental Analysis of Container Fleet Market

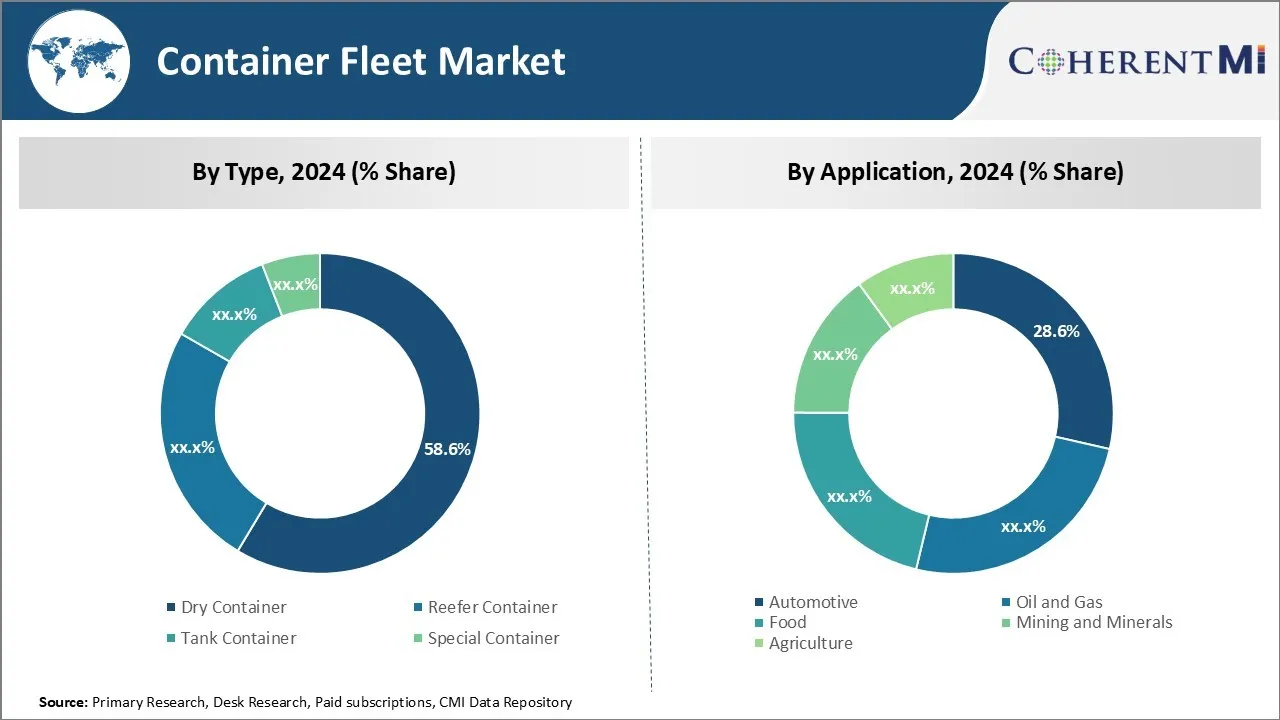

In terms of type, dry container segment is expected to account for 58.6% share of the container fleet market in 2024. Dry containers represent the bulk of the total container fleet owing to their widespread usage across various industries. As global trade increases year-on-year, dry containers experience consistent demand for transportation of general cargo over long distances.

Growing e-commerce is another factor driving the volume of dry container shipments in the container fleet market. With worldwide consumption and emerging economies modernizing logistics infrastructure, dry container demand looks set to expand steadily. Their versatility and compatibility with diverse supply chain nodes cement dry containers' position as the most heavily deployed intermodal container fleet.

Insights, By Application: Automotive Industry Witnesses Extended International Sourcing Networks

Containerized maritime shipping affords automakers reliable transport capacity and schedule flexibility to seamlessly synchronize flows of materials between factories. Similarly, exporting completed vehicles from the plant of origin to dealerships abroad occurs predominately via container shipments.

Modular container loads suit this need, ensuring a continuous yet adaptable stream of inputs keeps pace with dynamic production schedules. Overall, complex international automotive supply chains have become an important part of growth prospects of the container fleet market.

Additional Insights of Container Fleet Market

- The global tank container fleet increased by 8.65% in 2022, reaching 801,800 units worldwide.

- Shipyards delivered a record 2.2 million TEU (Twenty-foot Equivalent Units) in 2023, beating the previous record of 1.7 million TEU delivered in 2015.

- Reefer containers are becoming increasingly vital due to rising demand for temperature-controlled shipping of food and pharmaceuticals.

- Asia Pacific held the largest share in the container fleet market in 2023, primarily driven by port infrastructure development and increased demand for refrigerated cargo containers.

- North America is expected to witness rapid growth in the container fleet market due to growing global trade and adoption of advanced technologies in shipping.

Competitive overview of Container Fleet Market

The major players operating in the container fleet market include China COSCO Shipping Corporation Limited, CMA CGM S.A., MSC Mediterranean Shipping Company S.A., Maersk, Hapag-Lloyd AG Evergreen Marine Corporation, Matson Inc., Ocean Network Express Pte. Ltd., Orient Overseas Container Line Limited, Pacific International Lines Pte. Ltd., Unifeeder A/S (DP World), Wan Hai Lines Ltd., Yang Ming Marine Transport Corporation, ZIM Integrated Shipping Services Ltd., Mitsui O.S.K, Hyundai Merchant Marine Co. Ltd., and Kawasaki Kisen Kaisha Ltd.

Container Fleet Market Leaders

- China COSCO Shipping Corporation Limited

- CMA CGM S.A.

- MSC Mediterranean Shipping Company S.A.

- Maersk

- Hapag-Lloyd AG

Container Fleet Market - Competitive Rivalry

Container Fleet Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Container Fleet Market

- In May 2024, Thenamaris, a Greek shipping company, began deploying Starlink connectivity on its fleet of vessels, enhancing communication and data services for its 87 vessels, including 47 tankers and 25 bulk carriers. This deployment is expected to improve both operational efficiency and crew welfare, allowing for better communication and increased data quotas for crew members.

- In April 2024, Hapag-Lloyd launched a real-time tracking system called "Live Position," which is being implemented across its nearly 3 million container fleet. This initiative makes Hapag-Lloyd the first container shipping line to offer a fleet-wide tracking product specifically for dry containers.

- In September 2023, MSC Mediterranean Shipping Company S.A. entered into a strategic partnership with Hamburger Hafen und Logistik Aktiengesellschaft (HHLA) through a binding Memorandum of Understanding. This partnership is structured as a joint venture, where the City of Hamburg will hold a 50.1% stake, while MSC aims to acquire up to 49.9% of HHLA's shares.

- In July 2023, Maersk Line launched the world's first carbon-neutral methanol-powered container vessel, named "Laura Mærsk." This vessel completed its maiden voyage on green methanol, marking a significant milestone in the company's efforts to lead in sustainable shipping practices.

Container Fleet Market Segmentation

- By Type

- Dry Container

- Reefer Container

- Tank Container

- Special Container

- By Application

- Automotive

- Oil and Gas

- Food

- Mining and Minerals

- Agriculture

Would you like to explore the option of buying individual sections of this report?

Gautam Mahajan is a Research Consultant with 5+ years of experience in market research and consulting. He excels in analyzing market engineering, market trends, competitive landscapes, and technological developments. He specializes in both primary and secondary research, as well as strategic consulting across diverse sectors.

Frequently Asked Questions :

How big is the container fleet market?

The container fleet market is estimated to be valued at USD 13.36 Billion in 2024 and is expected to reach USD 19.7 Billion by 2031.

What are the key factors hampering the growth of the container fleet market?

High capital investment, high operational costs, and stringent regulations limiting expansion are the major factors hampering the growth of the container fleet market.

What are the major factors driving the container fleet market growth?

Rapid growth in global trade and globalization and increase in infrastructure development at ports are the major factors driving the container fleet market.

Which is the leading type in the container fleet market?

The leading type segment is dry container.

Which are the major players operating in the container fleet market?

China COSCO Shipping Corporation Limited, CMA CGM S.A., MSC Mediterranean Shipping Company S.A., Maersk, Hapag-Lloyd AG Evergreen Marine Corporation, Matson Inc., Ocean Network Express Pte. Ltd., Orient Overseas Container Line Limited, Pacific International Lines Pte. Ltd., Unifeeder A/S (DP World), Wan Hai Lines Ltd., Yang Ming Marine Transport Corporation, ZIM Integrated Shipping Services Ltd., Mitsui O.S.K, Hyundai Merchant Marine Co. Ltd., and Kawasaki Kisen Kaisha Ltd. are the major players.

What will be the CAGR of the container fleet market?

The CAGR of the container fleet market is projected to be 5.7% from 2024-2031.