Electric Vehicle Battery Market Size - Analysis

The electric vehicle battery market is estimated to be valued at USD 62.84 Bn in 2025 and is expected to reach USD 97.01 Bn by 2032. It is projected to grow at a compound annual growth rate (CAGR) of 6.4% from 2025 to 2032. With an increasing focus on developing sustainable and eco-friendly transportation, the electric vehicle battery market has seen significant growth over the past few years.

The electric vehicle battery market is estimated to be valued at USD 62.84 Bn in 2025 and is expected to reach USD 97.01 Bn by 2032.

It is projected to grow at a compound annual growth rate (CAGR) of 6.4% from 2025 to 2032.

With an increasing focus on developing sustainable and eco-friendly transportation, the electric vehicle battery market has seen significant growth over the past few years.

Market Size in USD Bn

CAGR6.4%

| Study Period | 2025 - 2032 |

| Base Year of Estimation | 2025 |

| CAGR | 6.4% |

| Market Concentration | Medium |

| Major Players | Panasonic Corporation, LG Chem (LG Energy Solution), BYD Company Ltd., Contemporary Amperex Technology Co., Limited (CATL), Samsung SDI Co., Ltd. and Among Others |

please let us know !

Electric Vehicle Battery Market Trends

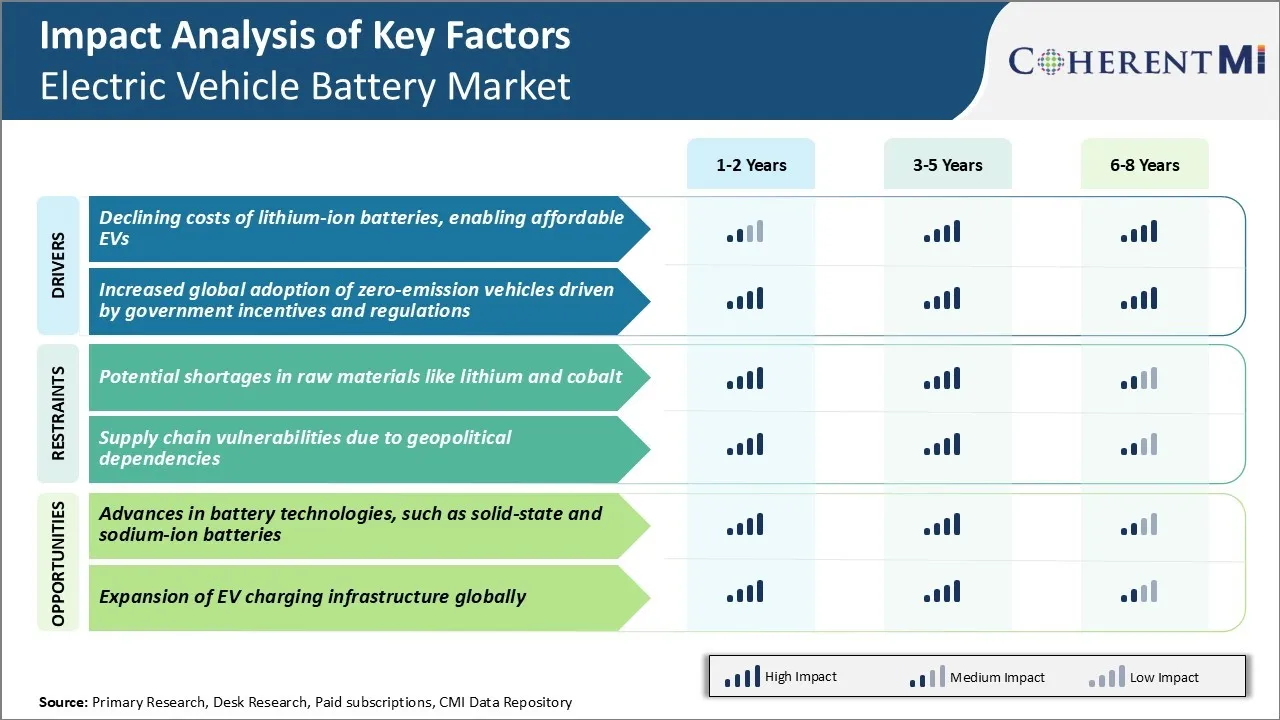

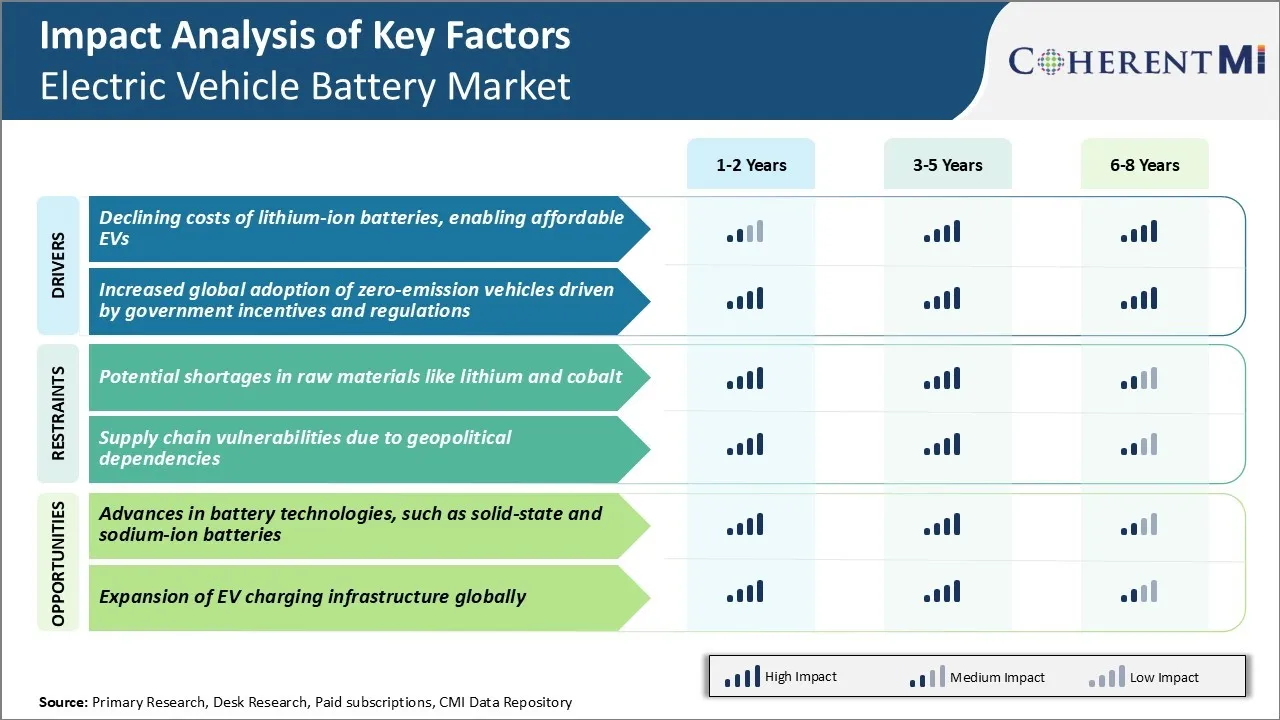

Market Driver - Declining Costs of Lithium-Ion Batteries, Enabling Affordable EVs

The declining costs of lithium-ion batteries has been one of the biggest drivers for the electric vehicle market in recent years. The costs of battery packs, which make up a large portion of an electric vehicle's overall costs, have decreased significantly over the past decade. This reduction in battery costs of over 85% has been transformational for the electric vehicle industry.

It is these lower battery costs that have finally made electric vehicles economically feasible for a mass market, as battery packs used to add tens of thousands of dollars to vehicle costs, making EVs too expensive for most consumers. Now as battery costs continue to decline, automakers are able to price electric vehicles more competitively without having to sell them at a loss just to push adoption.

With battery costs projected to fall below $100 per kWh within the next few years, price parity or even an economic advantage over gasoline vehicles is expected for a wider range of EVs. Lower upfront vehicle costs will be key in driving the electric vehicle battery market globally.

Market Driver - Increased Global Adoption of Zero-Emission Vehicles Driven by Government Incentives and Regulations

Growth in global government policies promoting zero-emission vehicles has also been an important driver of increased adoption of electric vehicles. This eventually influences sales of electric vehicle batteries. Many national and local governments have implemented purchase incentives and subsidies for electric vehicles buyers, as well as other initiatives like preferential access to HOV or carpool lanes, exemptions from tolls or road usage fees.

On the regulatory side, some countries and states/provinces have set future dates to phase out petrol and diesel-powered vehicle sales entirely. While others have implemented zero or low emission vehicle quotas that auto manufacturers must meet gradually over time.

Compliance will drive up automaker investment and production of electric vehicles, helping to make more models available to customers. Strict policies are making electric cars and trucks an increasingly mass market reality in those locations. This is expected to boost growth of the electric vehicle battery market.

Market Challenge - Potential Shortages in Raw Materials like Lithium and Cobalt

One of the major challenges faced by the electric vehicle battery market is the potential shortages in key raw materials required for lithium-ion batteries. Lithium and cobalt are two crucial materials used in current lithium-ion battery technologies and there are concerns about sustainable supplies of these materials as electric vehicle sales continue to rise sharply. Lithium reserves worldwide may not be adequate to meet the projected demand from electric vehicle batteries in the long run if battery chemistries and material efficiencies do not improve.

The heavy dependence on few countries and regions for these raw materials exposes the electric vehicle battery market to supply disruption risks. Higher material costs from potential shortages also threaten the target cost points required for mass adoption of electric vehicle batteries. Overall, uncertainty around long term availability of lithium and cobalt at affordable prices poses a significant challenge for the growth of the electric vehicle battery market.

Market Opportunity - Advances in Battery Technologies

The electric vehicle battery market is poised to benefit tremendously from ongoing advances in battery technologies. One such promising development is solid-state batteries which have the potential to replace liquid lithium-ion batteries currently used in most electric vehicles. Solid-state batteries offer higher energy density, better safety, and lower costs of production compared to liquid lithium-ion batteries.

Ongoing battery R&D is also working on improvements to lithium-ion battery chemistries using alternative anode and cathode materials to boost energy density while lowering dependency on costly raw materials like cobalt. Such advances in electric vehicle battery technologies have the potential to overcome challenges around raw material availability. It also accelerates the mass adoption of electric vehicles. This provides a huge opportunity for companies in the electric vehicle battery market to invest and capitalize on these new battery solutions.

The declining costs of lithium-ion batteries has been one of the biggest drivers for the electric vehicle market in recent years.

The costs of battery packs, which make up a large portion of an electric vehicle's overall costs, have decreased significantly over the past decade.

This reduction in battery costs of over 85% has been transformational for the electric vehicle industry.

It is these lower battery costs that have finally made electric vehicles economically feasible for a mass market, as battery packs used to add tens of thousands of dollars to vehicle costs, making EVs too expensive for most consumers.

Now as battery costs continue to decline, automakers are able to price electric vehicles more competitively without having to sell them at a loss just to push adoption.

With battery costs projected to fall below $100 per kWh within the next few years, price parity or even an economic advantage over gasoline vehicles is expected for a wider range of EVs.

Lower upfront vehicle costs will be key in driving the electric vehicle battery market globally.

Growth in global government policies promoting zero-emission vehicles has also been an important driver of increased adoption of electric vehicles.

This eventually influences sales of electric vehicle batteries.

Many national and local governments have implemented purchase incentives and subsidies for electric vehicles buyers, as well as other initiatives like preferential access to HOV or carpool lanes, exemptions from tolls or road usage fees.

On the regulatory side, some countries and states/provinces have set future dates to phase out petrol and diesel-powered vehicle sales entirely.

While others have implemented zero or low emission vehicle quotas that auto manufacturers must meet gradually over time.

Compliance will drive up automaker investment and production of electric vehicles, helping to make more models available to customers.

Strict policies are making electric cars and trucks an increasingly mass market reality in those locations.

This is expected to boost growth of the electric vehicle battery market.

One of the major challenges faced by the electric vehicle battery market is the potential shortages in key raw materials required for lithium-ion batteries.

Lithium and cobalt are two crucial materials used in current lithium-ion battery technologies and there are concerns about sustainable supplies of these materials as electric vehicle sales continue to rise sharply.

Lithium reserves worldwide may not be adequate to meet the projected demand from electric vehicle batteries in the long run if battery chemistries and material efficiencies do not improve.

The heavy dependence on few countries and regions for these raw materials exposes the electric vehicle battery market to supply disruption risks.

Higher material costs from potential shortages also threaten the target cost points required for mass adoption of electric vehicle batteries.

Overall, uncertainty around long term availability of lithium and cobalt at affordable prices poses a significant challenge for the growth of the electric vehicle battery market.

The electric vehicle battery market is poised to benefit tremendously from ongoing advances in battery technologies.

One such promising development is solid-state batteries which have the potential to replace liquid lithium-ion batteries currently used in most electric vehicles.

Solid-state batteries offer higher energy density, better safety, and lower costs of production compared to liquid lithium-ion batteries.

Ongoing battery R&D is also working on improvements to lithium-ion battery chemistries using alternative anode and cathode materials to boost energy density while lowering dependency on costly raw materials like cobalt.

Such advances in electric vehicle battery technologies have the potential to overcome challenges around raw material availability.

It also accelerates the mass adoption of electric vehicles.

This provides a huge opportunity for companies in the electric vehicle battery market to invest and capitalize on these new battery solutions.

Key winning strategies adopted by key players of Electric Vehicle Battery Market

Strategic Partnerships and Vertical Integration: Developing strategic partnerships and integrating vertically has helped companies secure supply of critical raw materials as well as capture more value in the electric vehicle battery supply chain.

Technology Innovation: Aggressive investment in battery technology R&D and bringing new and advanced battery chemistries to market faster than competitors provided an edge. For example, development of solid-state batteries have become a key focus area, with Toyota planning pilot production in early 2020s.

Cost Leadership: Achieving much lower battery pack costs through innovations in cell design/pack assembly, negotiating long-term supply contracts and achieving economy of scale gave companies a competitive advantage.

Strategic Partnerships and Vertical Integration: Developing strategic partnerships and integrating vertically has helped companies secure supply of critical raw materials as well as capture more value in the electric vehicle battery supply chain.

Technology Innovation: Aggressive investment in battery technology R&D and bringing new and advanced battery chemistries to market faster than competitors provided an edge.

For example, development of solid-state batteries have become a key focus area, with Toyota planning pilot production in early 2020s.

Cost Leadership: Achieving much lower battery pack costs through innovations in cell design/pack assembly, negotiating long-term supply contracts and achieving economy of scale gave companies a competitive advantage.

Segmental Analysis of Electric Vehicle Battery Market

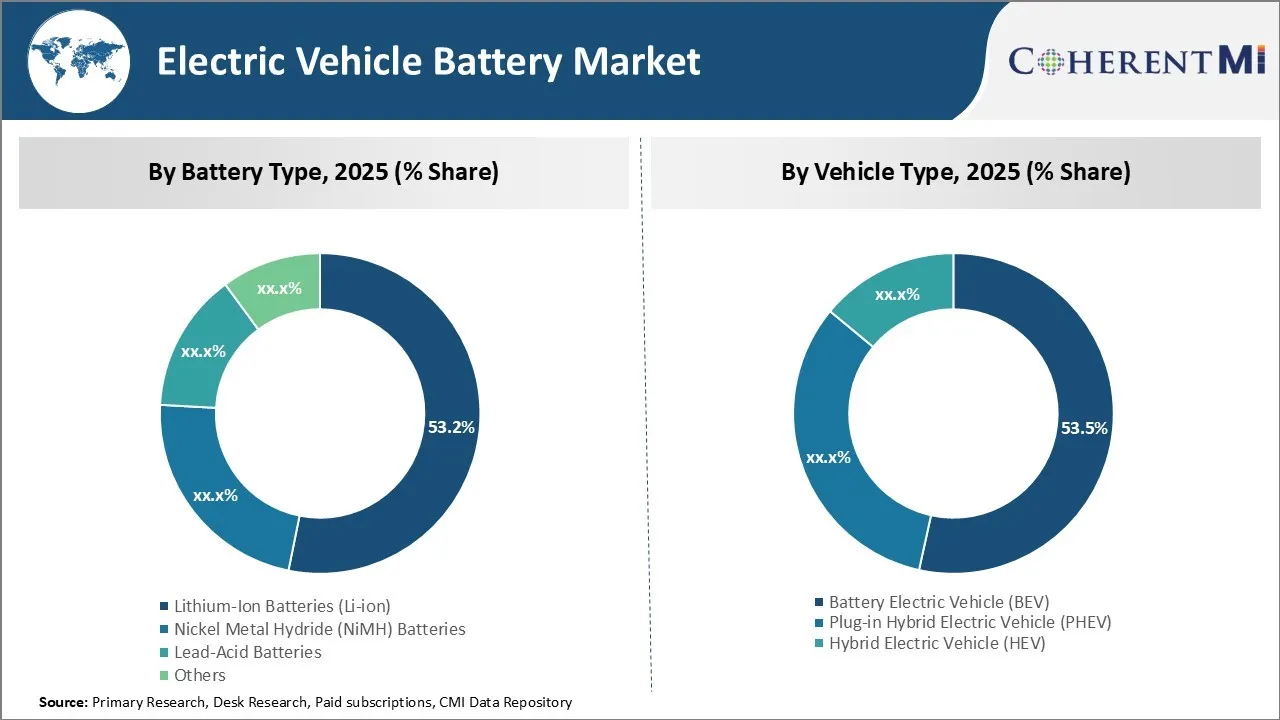

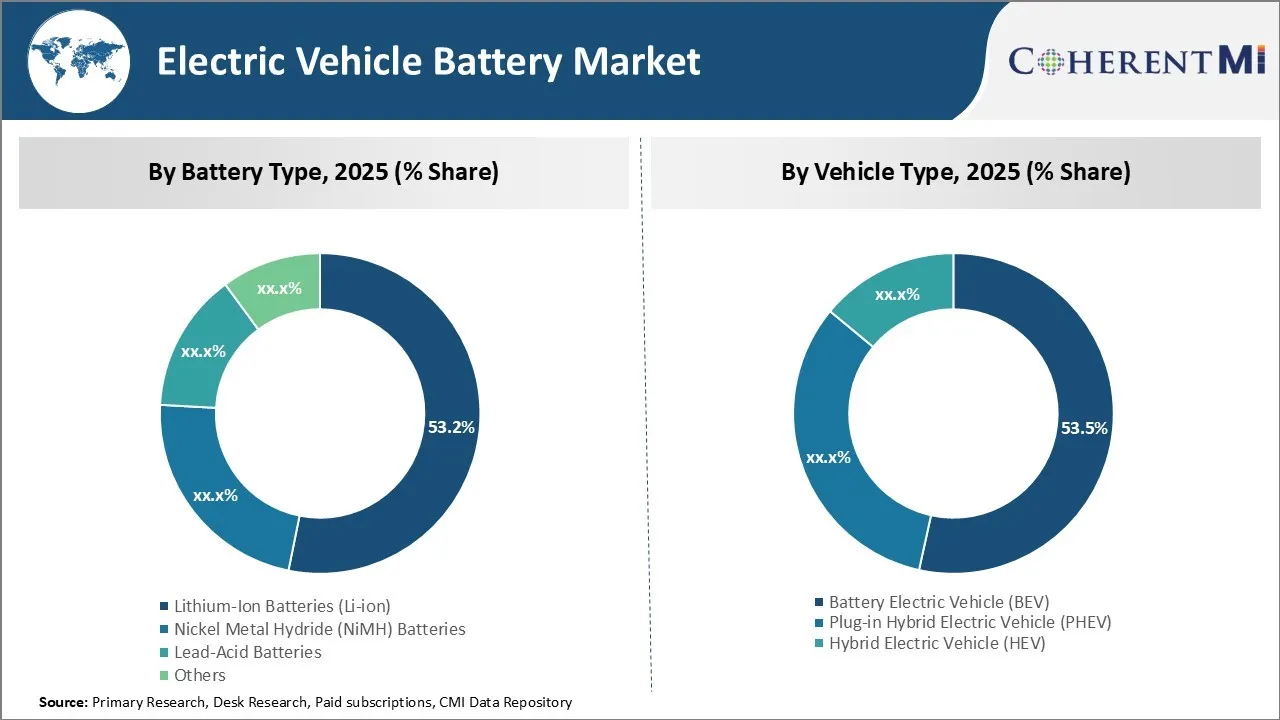

Insights, By Battery Type: >Lithium-Ion Batteries (Li-ion) Provide Energy Density and Rechargeability

In terms of battery type, lithium-ion batteries (Li-ion) are projected to account for 53.2% share of the electric vehicle battery market in 2025. This can be attributed to their higher energy density compared to other battery technologies. A key demand driver for electric vehicles has been improved driving range per charge, which is directly influenced by the energy density of the electric vehicle battery.

In addition, Lithium-ion batteries have a faster recharge time and undergo little battery memory effect compared to lead-acid and nickel-metal hydride batteries. This makes Li-ion an ideal choice for continuously recharging applications such as electric vehicles that require frequent recharging.

The high rechargeability of Li-ion batteries means electric vehicles can be quickly juiced up enough to enable further usage, reducing range anxiety among drivers. Lithium-ion's ability to rapidly recharge without significant loss of capacity over time contributes strongly to its widespread adoption in the electric vehicle battery market.

Insights, By Vehicle Type: Battery Electric Vehicles (BEV) Witness High Demand due to Regulatory Support and Improving Charging Infrastructure

Battery electric vehicles are projected to hold 53.5% share in the electric vehicle market in 2025, owing to supportive government policies and investments made towards developing charging infrastructure. Several countries and states/provinces have introduced purchase incentives and subsidies exclusively for BEVs to promote pure electric mobility. Major global markets like China, Europe, and California have implemented regulations phasing out sales of new internal combustion engines in the near future, driving up demand for zero-emissions BEVs.

Furthermore, investments by both private and public entities have led to enhancements in public charging networks, addressing range anxiety among customers considering BEVs. The increasing ubiquity of convenient fast charging stations is bolstering customer confidence in the practicality of owning a BEV. With regulatory tailwinds and infrastructure addressing some of their accessibility limitations, battery electric vehicles are expected to rise as the dominant electric vehicle battery market.

In terms of battery type, lithium-ion batteries (Li-ion) are projected to account for 53.2% share of the electric vehicle battery market in 2025.

This can be attributed to their higher energy density compared to other battery technologies.

A key demand driver for electric vehicles has been improved driving range per charge, which is directly influenced by the energy density of the electric vehicle battery.

In addition, Lithium-ion batteries have a faster recharge time and undergo little battery memory effect compared to lead-acid and nickel-metal hydride batteries.

This makes Li-ion an ideal choice for continuously recharging applications such as electric vehicles that require frequent recharging.

The high rechargeability of Li-ion batteries means electric vehicles can be quickly juiced up enough to enable further usage, reducing range anxiety among drivers.

Lithium-ion's ability to rapidly recharge without significant loss of capacity over time contributes strongly to its widespread adoption in the electric vehicle battery market.

Battery electric vehicles are projected to hold 53.5% share in the electric vehicle market in 2025, owing to supportive government policies and investments made towards developing charging infrastructure.

Several countries and states/provinces have introduced purchase incentives and subsidies exclusively for BEVs to promote pure electric mobility.

Major global markets like China, Europe, and California have implemented regulations phasing out sales of new internal combustion engines in the near future, driving up demand for zero-emissions BEVs.

Furthermore, investments by both private and public entities have led to enhancements in public charging networks, addressing range anxiety among customers considering BEVs.

The increasing ubiquity of convenient fast charging stations is bolstering customer confidence in the practicality of owning a BEV.

With regulatory tailwinds and infrastructure addressing some of their accessibility limitations, battery electric vehicles are expected to rise as the dominant electric vehicle battery market.

Additional Insights of Electric Vehicle Battery Market

- Battery Cost Parity: The report indicates that the electric vehicle battery market is on track to achieve a battery pack cost of around USD 100/kWh by the mid-2020s, which is widely considered the tipping point for cost competitiveness with internal combustion engine vehicles.

- Regional Adoption: China accounts for the largest chunk of global electric vehicle sales, contributing significantly to the demand for advanced electric vehicle battery solutions. Europe follows closely behind, driven by strict emission norms and progressive EV policies.

- Supply Chain Localization: An increasing trend toward localizing EV battery supply chains is prominent, as companies aim to reduce transportation costs, mitigate supply bottlenecks, and benefit from regional incentives.

- It further notes government initiatives such as tax incentives, grants, and subsidies that directly influence consumer adoption of electric vehicles, thereby driving demand for large-scale battery manufacturing.

- Technological partnerships are highlighted, where major electronics and chemical companies team up to develop new electric vehicle battery chemistries, ensuring improvements in energy density, charge cycles, and safety.

- Battery Cost Parity: The report indicates that the electric vehicle battery market is on track to achieve a battery pack cost of around USD 100/kWh by the mid-2020s, which is widely considered the tipping point for cost competitiveness with internal combustion engine vehicles.

- Regional Adoption: China accounts for the largest chunk of global electric vehicle sales, contributing significantly to the demand for advanced electric vehicle battery solutions. Europe follows closely behind, driven by strict emission norms and progressive EV policies.

- Supply Chain Localization: An increasing trend toward localizing EV battery supply chains is prominent, as companies aim to reduce transportation costs, mitigate supply bottlenecks, and benefit from regional incentives.

- It further notes government initiatives such as tax incentives, grants, and subsidies that directly influence consumer adoption of electric vehicles, thereby driving demand for large-scale battery manufacturing.

- Technological partnerships are highlighted, where major electronics and chemical companies team up to develop new electric vehicle battery chemistries, ensuring improvements in energy density, charge cycles, and safety.

Competitive overview of Electric Vehicle Battery Market

The major players operating in the electric vehicle battery market include Panasonic Corporation, LG Chem (LG Energy Solution), BYD Company Ltd., Contemporary Amperex Technology Co., Limited (CATL), Samsung SDI Co., Ltd., A123 Systems, LLC, TOSHIBA Corporation, Johnson Controls International plc, Hitachi, Ltd., Wanxiang Group Corporation, and Beijing Pride Power.

The major players operating in the electric vehicle battery market include Panasonic Corporation, LG Chem (LG Energy Solution), BYD Company Ltd., Contemporary Amperex Technology Co., Limited (CATL), Samsung SDI Co., Ltd., A123 Systems, LLC, TOSHIBA Corporation, Johnson Controls International plc, Hitachi, Ltd., Wanxiang Group Corporation, and Beijing Pride Power.

Electric Vehicle Battery Market Leaders

- Panasonic Corporation

- LG Chem (LG Energy Solution)

- BYD Company Ltd.

- Contemporary Amperex Technology Co., Limited (CATL)

- Samsung SDI Co., Ltd.

- Panasonic Corporation

- LG Chem (LG Energy Solution)

- BYD Company Ltd.

- Contemporary Amperex Technology Co., Limited (CATL)

- Samsung SDI Co., Ltd.

Recent Developments in Electric Vehicle Battery Market

- In 2023, Samsung SDI and its partners (e.g., Stellantis, GM) announced multi-billion-dollar factory deals in the U.S. to produce various EV battery technologies. However, most of these announcements refer to manufacturing expansions rather than discrete R&D funding.

- In May 2023, Nouveau Monde Graphite (NMG) and Panasonic Energy announced a framework agreement or binding offtake arrangement. Publicly reported details reference a multi-year supply arrangement—often cited at up to 10 years—rather than exactly 7 years.

- In July 2022, Panasonic announced a USD 4 billion investment in a new U.S.-based lithium-ion cell manufacturing facility. The expansion underscores Panasonic’s commitment to supporting domestic EV production, lowering supply chain risks, and accelerating electric vehicle battery output to meet surging North American demand.

- In 2023, Samsung SDI and its partners (e.g., Stellantis, GM) announced multi-billion-dollar factory deals in the U.S. to produce various EV battery technologies. However, most of these announcements refer to manufacturing expansions rather than discrete R&D funding.

- In May 2023, Nouveau Monde Graphite (NMG) and Panasonic Energy announced a framework agreement or binding offtake arrangement. Publicly reported details reference a multi-year supply arrangement—often cited at up to 10 years—rather than exactly 7 years.

- In July 2022, Panasonic announced a USD 4 billion investment in a new U.S.-based lithium-ion cell manufacturing facility. The expansion underscores Panasonic’s commitment to supporting domestic EV production, lowering supply chain risks, and accelerating electric vehicle battery output to meet surging North American demand.

Electric Vehicle Battery Market Segmentation

- By Battery Type

- Lithium-Ion Batteries (Li-ion)

- Nickel Metal Hydride (NiMH) Batteries

- Lead-Acid Batteries

- Others

- By Vehicle Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- By Battery Type

- Lithium-Ion Batteries (Li-ion)

- Nickel Metal Hydride (NiMH) Batteries

- Lead-Acid Batteries

- Others

- By Vehicle Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

Would you like to explore the option of buying individual sections of this report?

Gautam Mahajan is a Research Consultant with 5+ years of experience in market research and consulting. He excels in analyzing market engineering, market trends, competitive landscapes, and technological developments. He specializes in both primary and secondary research, as well as strategic consulting across diverse sectors.

Gautam Mahajan is a Research Consultant with 5+ years of experience in market research and consulting.

He excels in analyzing market engineering, market trends, competitive landscapes, and technological developments.

He specializes in both primary and secondary research, as well as strategic consulting across diverse sectors.