Aircraft Seating Market Size - Analysis

The aircraft seating market is estimated to be valued at USD 7.77 Bn in 2025 and is expected to reach USD 11.68 Bn by 2032. It is projected to grow at a compound annual growth rate (CAGR) of 6.00% from 2025 to 2032. The aircraft seating market is primarily driven by the growth of this market is the increasing international and domestic air passenger traffic across the globe.

Market Size in USD Bn

CAGR6.00%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.00% |

| Market Concentration | High |

| Major Players | Collins Aerospace, RECARO Aircraft Seating GmbH & Co. KG, Safran SA, Geven S.p.a., Lufthansa Technik AG and Among Others |

please let us know !

Aircraft Seating Market Trends

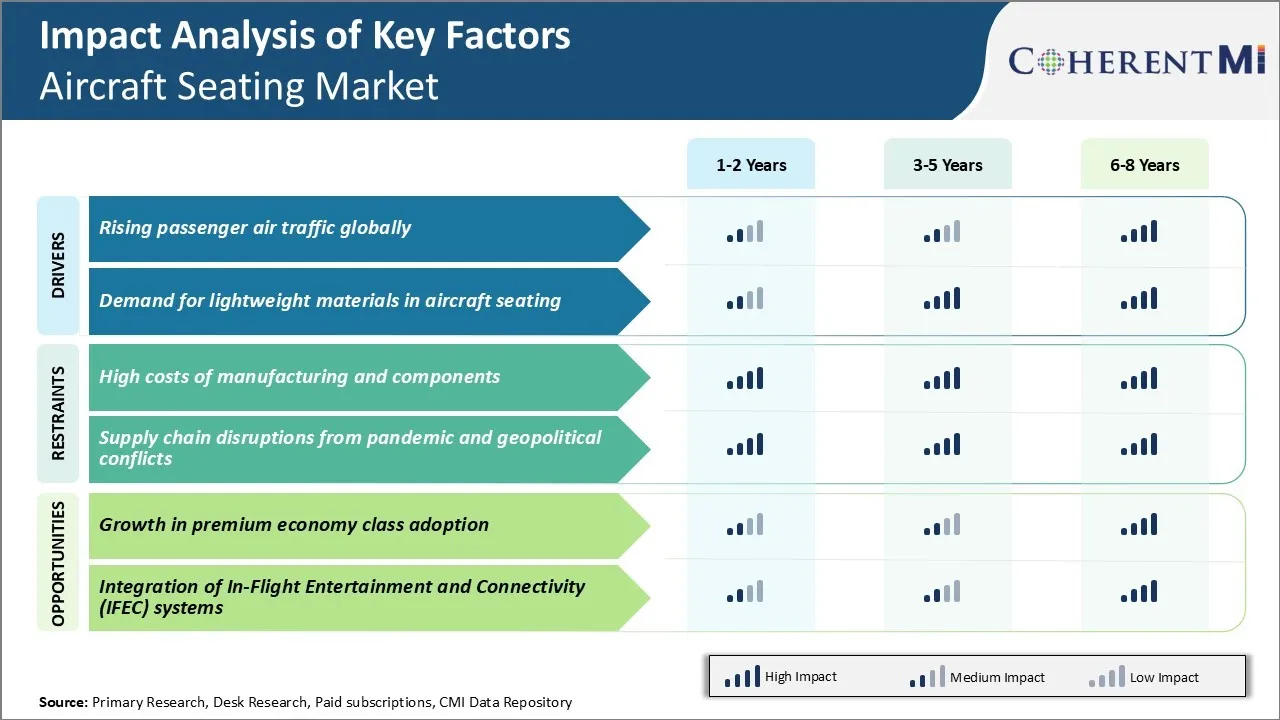

Market Driver - Rising Passenger Air Traffic Globally

As globalization continues at full pace, international travel has become much more frequent for both business and leisure purposes. Airlines around the world have expanded fleet sizes and increased flight frequencies on popular international routes to cater to this growing demand.

Major aircraft seating manufacturers will face substantial opportunities to not just fulfill demand for new aircraft deliveries but also participate in retrofitting programs for existing airline fleets. Constantly evolving consumer preferences also necessitate quicker refreshes of aircraft cabin interiors, further stimulating the aircraft seating market. New entrant airlines especially in emerging regions of Asia and Africa pose another notable source of demand.

Overall, the airline industry's ambition to connect people across the globe like never before ensures a busy era ahead for seat manufacturers. Sustained international cooperation on liberalizing air traffic rights bodes well for continued passenger growth momentum. This driver of rising global passenger volumes is likely to remain a primary catalyst propelling the aircraft seating market in the foreseeable future.

Market Driver - Demand for Lightweight Materials in Aircraft Seating

One of the top priorities of both airplane manufacturers as well as airlines is to reduce operating costs. This has led to a heightened focus on maximizing fuel efficiency of aircraft operations. Aircraft seat weight is a major contributor to the overall weight of an aircraft cabin interiors setup. This has shone the spotlight on developing lighter seating structures and components.

Lighter seats translating to lower overall aircraft operating empty weight in turn results in improved fuel efficiency especially on longer flight stages. Several latest aircraft seat models are incorporating composite structural panels, plastic trims, and carbon fiber reinforced plastics.

Significant resources are being dedicated industry-wide to certify novel lightweight materials for commercial aviation use. Such product and technology advances ensure the requirements for ever lighter seats remain a defining driver propping the aircraft seating market in the coming years.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - High Costs of Manufacturing and Components

One of the key challenges currently being faced in the aircraft seating market is the high costs associated with manufacturing and components. Aircraft seating involves the use of durable, lightweight and flame-retardant materials to ensure passenger safety. However, these specialized materials come at a significant cost.

Extensive certification and testing requirements by aviation regulatory bodies also contribute to lengthy development cycles and design validation procedures, inflating overall costs. Tighter profit margins in the commercial aviation industry have reduced airline willingness to spend on premium aircraft seating upgrades, demanding even lower prices from suppliers. This cost pressure acts as a deterrent for investments in new seating technologies, limiting innovation.

OEMs will need to explore innovative engineering and design approaches as well as material substitutes to help lower costs while maintaining strict quality and safety standards. Close collaboration with suppliers down the supply chain can also help attain procurement efficiencies in the aircraft seating market.

Market Opportunity - Growth in Premium Economy Class Adoption

One major opportunity being presented in the aircraft seating market is the rise in popularity of the premium economy class offering by airlines. This intermediate cabin class positioned between regular economy and business class promises additional legroom, seat width and in-flight amenities compared to mainstream economy, but at a lower price point versus business.

Seating manufacturers can capitalize on this trend with new product innovations tailored for this class such as modular comfort features, ergonomic designs and integrated in-seat entertainment systems. Development of multi-use platforms capable of configuration in standard economy or premium economy settings also open up more sales prospects. With strong anticipated long-term growth, premium economy represents a lucrative segment in the aircraft seating market.

Key winning strategies adopted by key players of Aircraft Seating Market

Key players have focused on product innovation to gain a competitive edge. Another strategy is expanding through strategic partnerships and acquisitions. In 2020, BE Aerospace acquired 100% of the interiors business of EnCore to strengthen its position in aftermarket commercial aircraft seating. This gave BE Aerospace access to EnCore's wide supplier network and enhanced its presence globally.

Customizing seat offerings based on customer needs and feedback has also helped players succeed. Opting for sustainable practices is another winning strategy. In 2021, Aviointeriors partnered with Sapiens to make seats with a recyclable 3D knitted material that uses recycled polyester yarns. This helped airlines lower carbon footprint and boosted Aviointeriors' green credentials.

Segmental Analysis of Aircraft Seating Market

To learn more about this report, Download Free Sample Copy

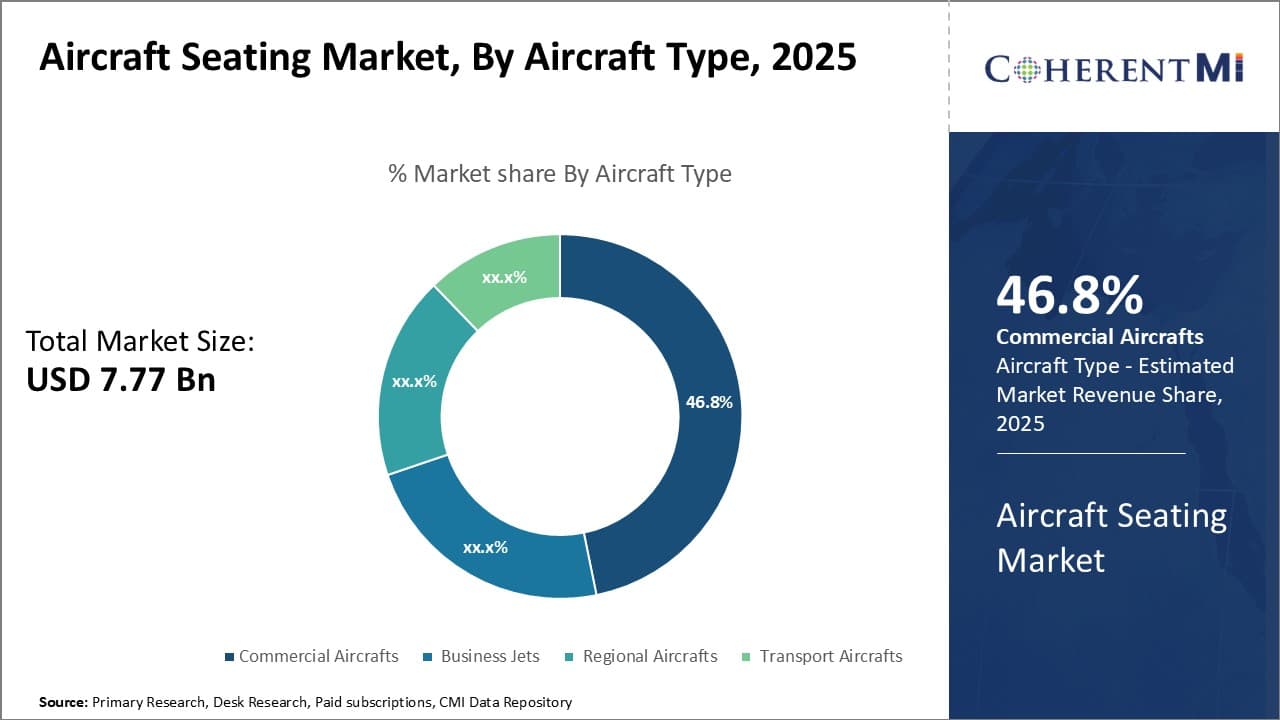

Insights, By Aircraft Type: Rising international and domestic air travel fuel commercial aircraft demand

To learn more about this report, Download Free Sample Copy

Insights, By Aircraft Type: Rising international and domestic air travel fuel commercial aircraft demand

In terms of aircraft type, commercial aircrafts contribute 46.8% share of the aircraft seating market in 2025. This is owning to the rising demand for air travel both internationally and domestically. Commercial aircraft see the highest volumes as they ferry passengers and cargo across regions and countries on daily routes. The liberalization of aviation policies by governments worldwide has led to increased competition among airlines, driving down ticket prices and making air travel affordable for more travelers.

Additionally, the rising middle class in emerging economies has greater disposable incomes to spend on leisure and business trips via air. Low cost carriers have further catalyzed air travel growth with their affordable fares. To meet this surging demand, airlines are expanding their fleets with new commercial aircraft deliveries, benefitting aircraft OEMs and aircraft seating market players.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

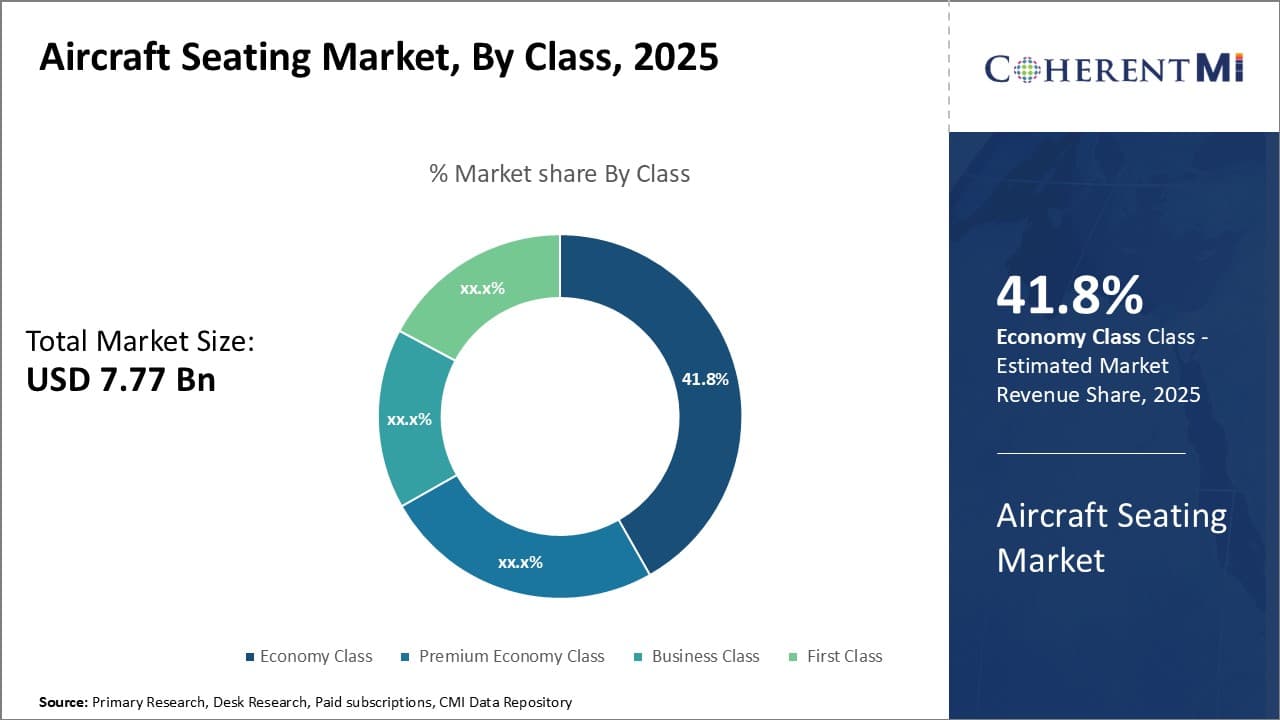

Insights, By Class: Economy Class Dominates Owing to Cost-sensitive Flyers

In terms of class, economy class contributes 41.8% share of the aircraft seating market owing to its appeal among cost-sensitive flyers. Economy seating makes up the bulk of any commercial aircraft's capacity and is favored by passengers seeking good value for money. Low ticket prices in this segment have made flying accessible to the mass market versus niche premium segments.

With budgets tight amid uncertain economic conditions, most travelers opt for economy over premium cabins if the journey duration permits. Furthermore, economy cabins on low cost carriers entirely drive their business models centered around low fares. This sustains solid demand for economy aircraft seating from airlines negotiating bulk purchase contracts. This will influence upcoming trends in the aircraft seating market.

Insights, By Component: Actuators See Most Use with Rising Installed Base of Advanced Seating

In terms of component, actuators contributes the highest share of the aircraft seating market owing to their proliferation with the rising installed base of advanced seating featuring recline, leg and headrest motion capabilities. Contemporary aircraft interiors demand compact, lightweight and reliable actuators to empower these ergonomic functions. As airlines upgrade aging fleets or expand with new aircraft, manufacturers fit these with technologically superior aircraft seating incorporating the latest actuations.

Additionally, an actuator is a high-value individual part priced higher than foam and structure pieces. With aircraft seat design leaning towards enhanced passenger experience and wellness, actuated recline and movement will remain an essential selling point driving actuator demand in the aircraft seating market.

Additional Insights of Aircraft Seating Market

- Enhanced Cabin Layouts: Several aircraft manufacturers are working closely with seat suppliers to introduce innovative cabin layouts with premium comfort, personal space, and integrated in-flight amenities such as power outlets and touchscreen controls. These layouts aim to improve the traveler’s flight experience while also maximizing passenger capacity for airlines.

- Post-Pandemic Recovery Plans: Airlines worldwide are rushing to modernize their fleets after the pandemic-induced slowdown. This involves reconfiguring existing cabins with newer aircraft seating designs that balance cost-efficiency with passenger expectations of cleanliness, comfort, and technological access.

- Regional Analysis: North America reportedly holds a significant share of the global aircraft seating market, driven by major OEM assembly lines (Boeing and others) and a large domestic airline sector. Meanwhile, Asia-Pacific is expected to witness the fastest growth in global aircraft seating market due to burgeoning passenger travel, new airline startups, and fleet expansions.

- Technology Outlook: Ongoing R&D efforts are leading to more advanced aircraft seat actuators, lighter seat frames, and integrated connectivity modules that cater to evolving traveler preferences such as wireless charging, full-flat seats in business cabins, and data-driven aircraft seat monitoring.

- Sustainability Initiatives: Manufacturers and airlines are increasingly emphasizing carbon footprint reduction by using recyclable seat materials, optimizing seat density for better fuel efficiency, and adopting life-cycle assessment (LCA) practices to measure and mitigate environmental impact.

Competitive overview of Aircraft Seating Market

The major players operating in the aircraft seating market include Collins Aerospace, RECARO Aircraft Seating GmbH & Co. KG, Safran SA, Geven S.p.a., Lufthansa Technik AG, Thompson Aero Seating, Adient Aerospace, Stelia Aerospace, Jamco Corporation, ZIM Aircraft Seating, Aviointeriors S.p.A., Panasonic Avionics, and Acro Aircraft Seating.

Aircraft Seating Market Leaders

- Collins Aerospace

- RECARO Aircraft Seating GmbH & Co. KG

- Safran SA

- Geven S.p.a.

- Lufthansa Technik AG

Recent Developments in Aircraft Seating Market

- In February 2024, Air India selected RECARO Aircraft Seating as its premium economy and economy seating partner for widebody aircraft. This collaboration involves installing over 22,000 RECARO seats through both line-fit and retrofit programs over the next five to six years.

- In November 2023, Emirates announced a series of contracts with Safran worth over US$1.2 billion. This includes a US$1 billion deal for the latest generation of Safran seats for Emirates' new Airbus A350 and Boeing 777X-9 fleets, as well as existing Boeing 777-300 aircraft.

- In June 2023, Recaro Aircraft Seating and Embraer announced a collaboration to develop a Supplier Furnished Equipment (SFE) catalogue for E1 and E2 aircraft. This catalogue will feature Recaro's BL3710 and SL3710 economy class seats, known for their ergonomic design, reliability, and lightweight construction, aimed at enhancing passenger comfort and operational efficiency.

Aircraft Seating Market Segmentation

- By Aircraft Type

- Commercial Aircrafts

- Business Jets

- Regional Aircrafts

- Transport Aircrafts

- By Class

- Economy Class

- Premium Economy Class

- Business Class

- First Class

- By Component

- Actuators

- Structure

- Foams

- Electrical Fittings

- Others

- By Seat Type

- 9G Seats

- 16G Seats

- 21G Seats

Would you like to explore the option of buying individual sections of this report?

Gautam Mahajan is a Research Consultant with 5+ years of experience in market research and consulting. He excels in analyzing market engineering, market trends, competitive landscapes, and technological developments. He specializes in both primary and secondary research, as well as strategic consulting across diverse sectors.